- CookBook

- Posts

- the most consensus trade ever

the most consensus trade ever

alt rotations print, BTC chops

In today’s edition we have:

Magus — Praying for the catchup trade

Doc — The most consensus trade ever

Charlie — Alt rotations printing

Stoic — Orderflow plans at 108k

Mercury — Clear triggers set

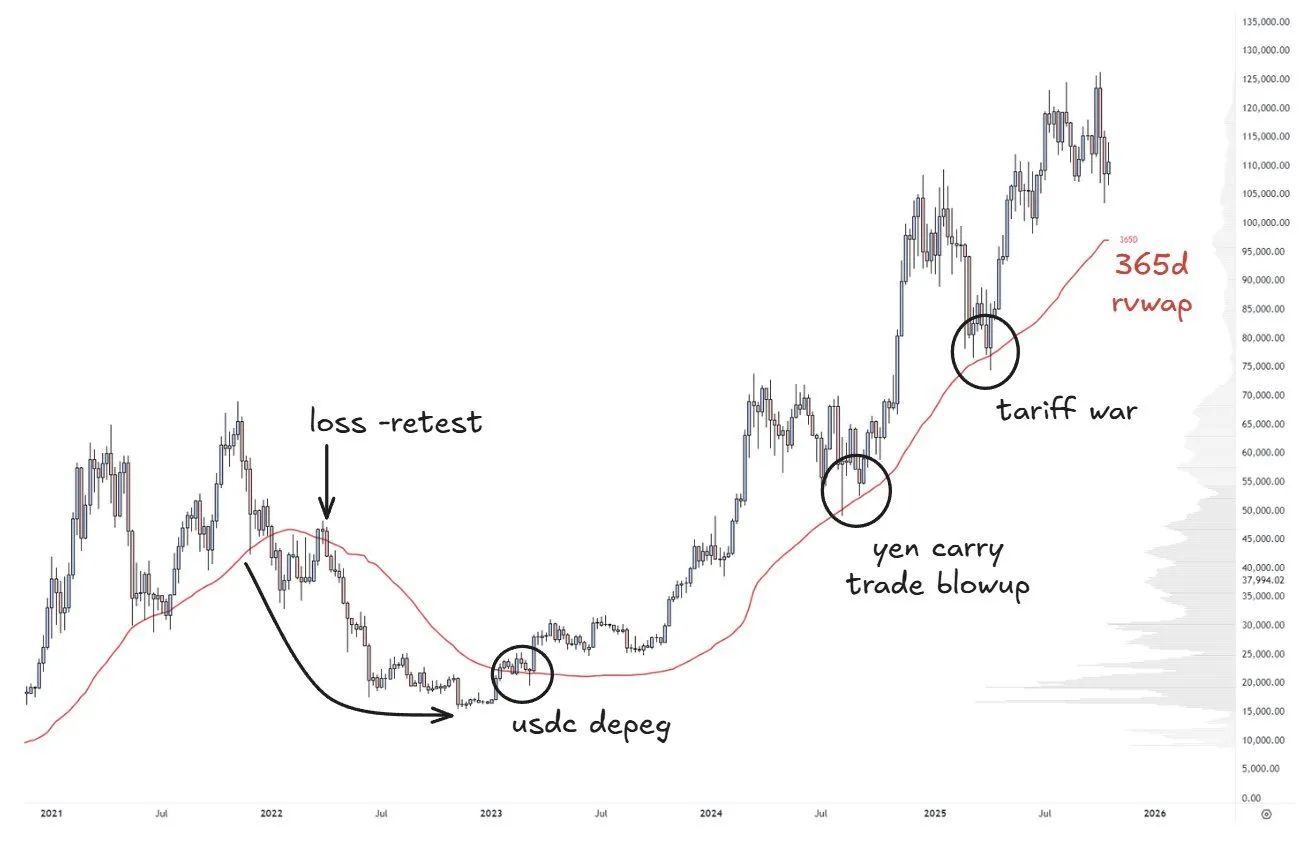

Magus | Praying for the catchup trade |

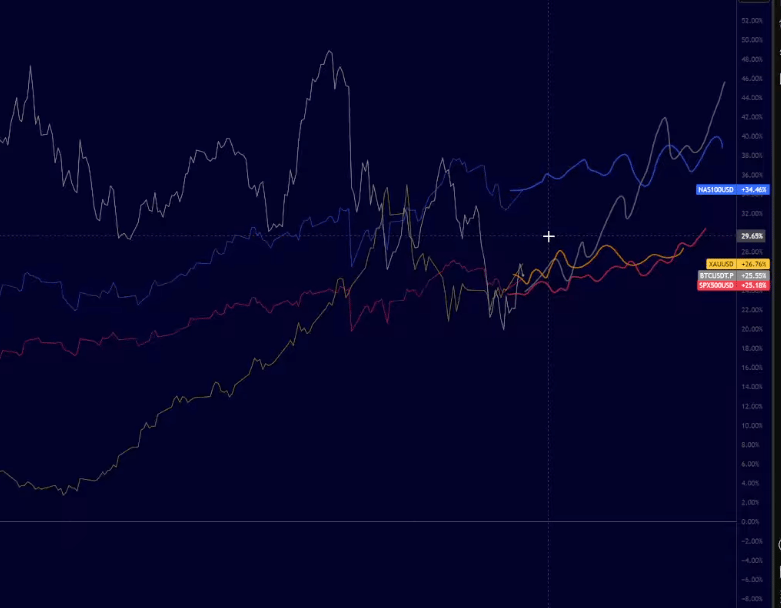

BTC has underperformed equities and gold since the April tariff lows, with a lot that underperformance happening since the 10/10 nuke.

My low IQ take is the that all these assets will trade up again with BTC ending up as the fastest horse.

If that doesn’t happen in by Q1 then we’ll have to reevaluate BTC.

Boomers like me who have been around a while know that BTC commonly puts pressure on people by chopping them up for longer then they can handle, they quit, then it puts in a god candle.

TLDR: Core macro thesis is still in tact. BTC is still in an uptrend, even though it’s been painful lately.

Levels

106k: local resistance

104k: local support

110k: most important level to reclaim; re-acceptance back into range

100k: macro support

TLDR

Don’t let the sentiment flip-flopping you see get to you. Remain optimistic.

Building a watchlist. Being patient on alts until I see bullish reclaims by BTC.

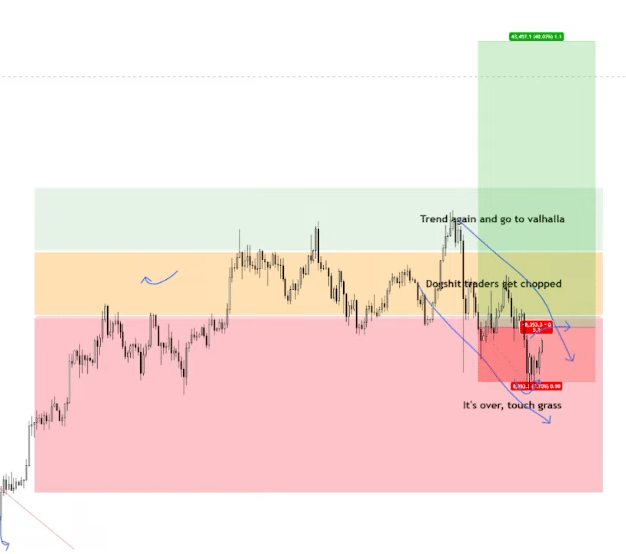

Doc | The most consensus trade ever |

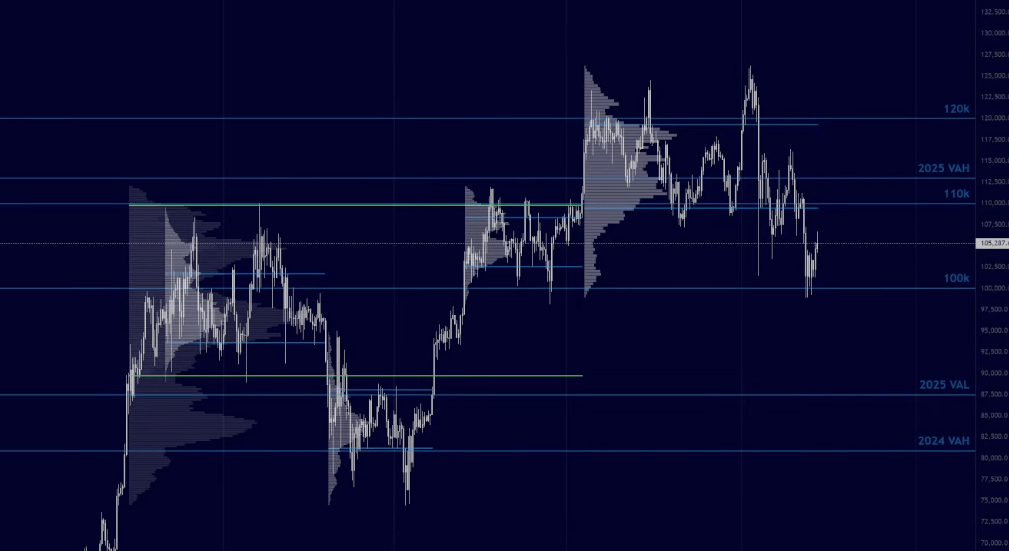

The one positive that 10/10 brought us is the return of volatility on Bitcoin, but it left us with one question…

Will the 100k lows hold?

This is probably the most consensus trade idea I've ever seen on CT (you read it here first). You even have Scotty Pippen posting the same line now.

So will we all be able to hold hands and ride to Valhalla together, or will people get shaken out along the way?

I think we deviate below to shake people out, but it doesn't mean that holding 100k can't happen. Maybe BTC is tradfi enough now that CT consensus doesn’t matter as much.

Clean lines in the sand

107-109 region = daily trend, weekly trend, monthly VWAP, previous composite high, previous all-time high, CME H4 trend

This is where I’ll be looking to hedge out my 99k longs for a dip before (hopefully) more up.

Here's the simple game plan

Down first means we look for longs.

Up first means we look for shorts.

Going up in a straight line and blasting through 108k with no pullbacks doesn’t seem that likely, which makes that a decent place to look to lock in some profits, hedge some of your bags if you bought the lows with me, or even look for some shorter-term shorts.

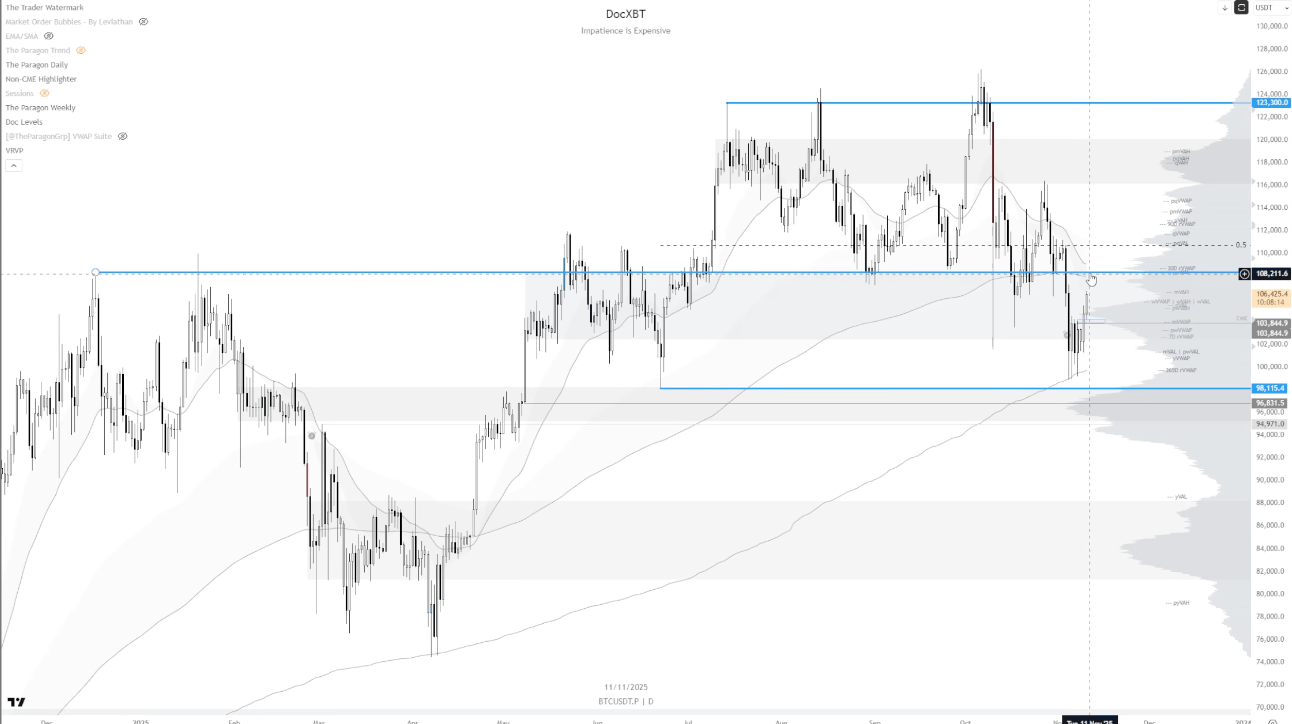

ETH

Same plans on ETH as BTC:

down first, look for longs

up first, look for shorts.

Because ETHBTC has been getting bullied by the daily trend, it may make sense to take any short positions on ETH rather than BTC.

Anything in the 3650 to 3800 would be a reasonable area to look for those.

My plan in a perfect world

Rejection here, run the equal lows around 99k to really make people sweat, remove the hedge, and then we could look for the next leg up from there.

Charlie | Alt rotations printing |

The rotations on alts have just been insane.

But that doesn’t mean we throw risk management out the window. Here’s how I did that recently on a…

ZEC short

I got in as the parabola broke, set stop above highs, watched for long triggers to get out (click image to see my thoughts on the chart).

I’m always asking:

Is my trade thesis in tact?

Does the coin still have relative strength?

Where am I wrong on this idea?

Where is my hard stop?

Should I be moving my TP's and stops up based on PA?

Not super bullish, not super bearish on BTC

We're still in this downtrending channel, so nothing to get too excited about.

TLDR

Alt rotations are the play for now.

Don't do what a lot of people do and run the P&L curve up, then give it all back by throwing out risk management.

There will be a bunch of pumps on alts to hunt. Spaghetti is your friend.

Eventually we’ll lose but make 10%, make 10%, lose 2%, lose 1% sounds like a good tradeoff to me.

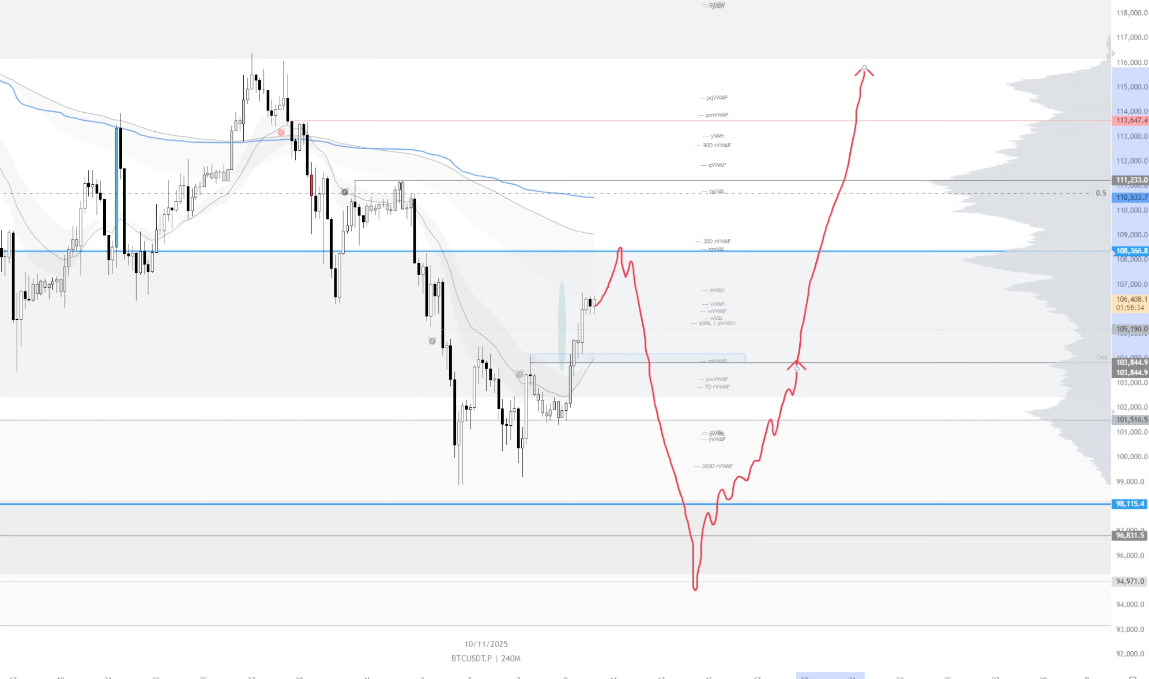

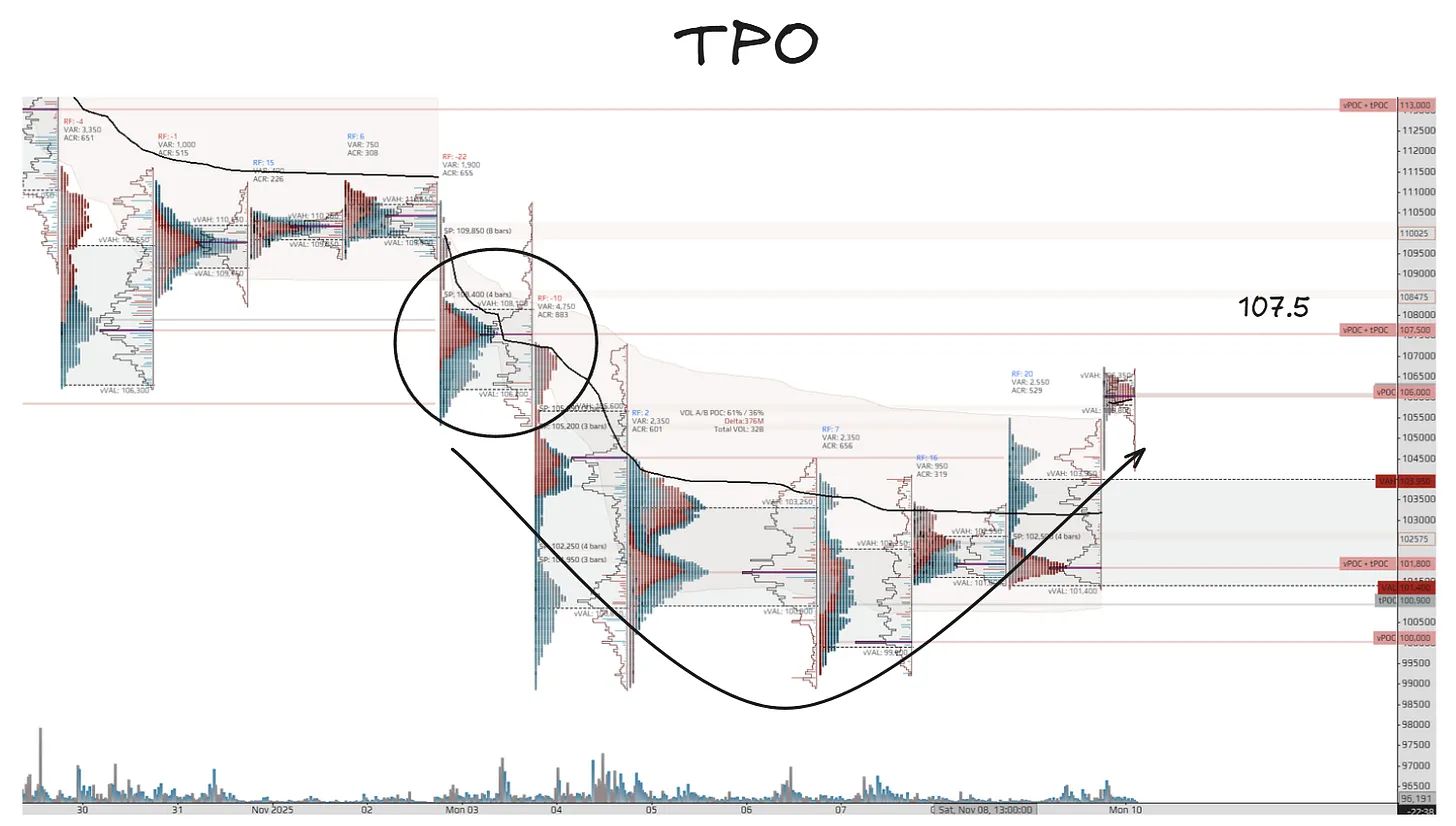

Stoic | Orderflow plans at 108k |

Here’s the BTC weekly chart I posted in the October 27th issue of cookbook with the big red line everyone is talking about now:

We’re accepting back into the May/June composite and rotating toward the high side of value with Binance spot leading.

When price is inside a composite I assume rotational, rangebound price action.

I’ll be watching spot vs perp flows around the composite highs at 108k.

If price grinds through it with spot support, I’ll look for the continued upside.

If perps get aggressive on the buy side with price and spot buying stalling, it makes sense to look for the for the reversion back down to composite lows.

The TPO also shows the 108k region as a key pivot point – it was the session before the unravel.

TLDR

Watching spot and perp flows around the 108k pivot point.

Mercury | Clear triggers set |

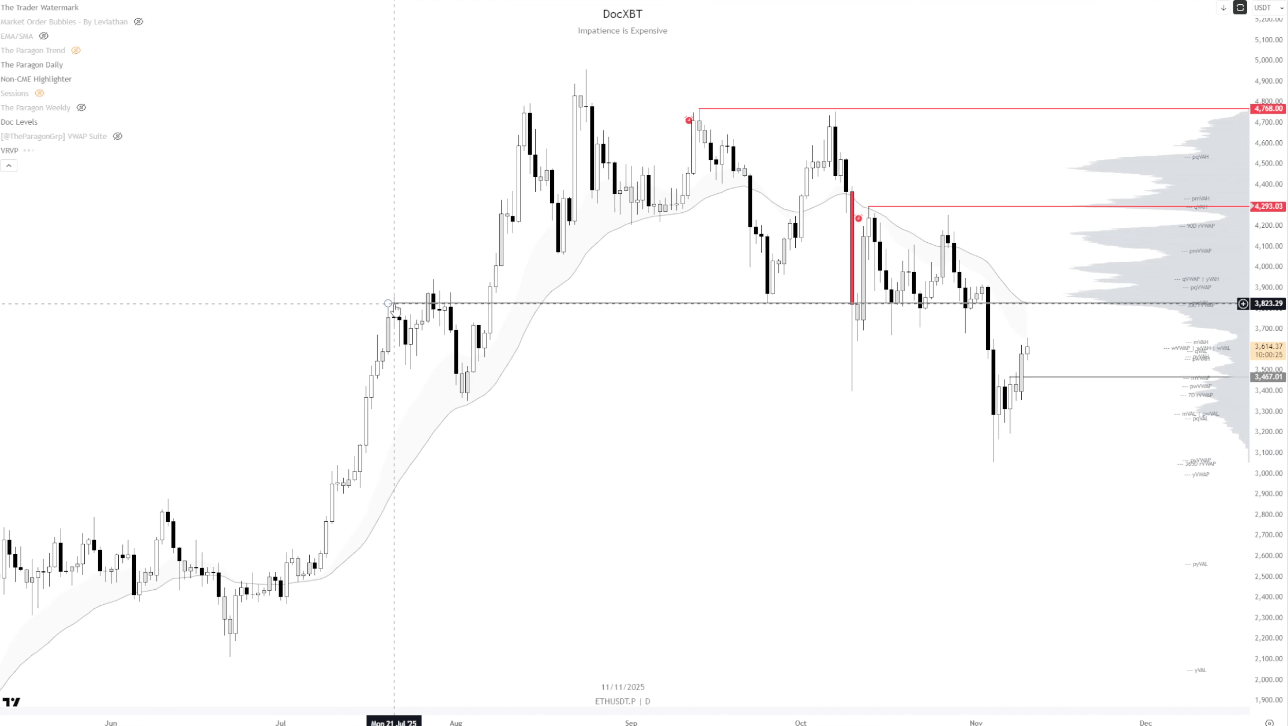

BTC bounced nicely from the D2 200 MAs, the same trend that marked major bottoms throughout this cycle and tops in 2022.

I want to see a deviation back inside the previous 3-month range around $110k to begin scaling into the assumption that the macro bottom is in and momentum favors uptrends across all timeframes once again.

We saw a similar trigger for compounding momentum in April.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.