- CookBook

- Posts

- hunting the next knockout long

hunting the next knockout long

wen bottom?

In today’s edition we have:

Magus — Next leg loading at 105k?

Doc — Hunting my knockout long

Charlie — Too late to long, too early to short

Stoic — $110k: rally or rejection?

Mercury — Did alts just bottom or top?

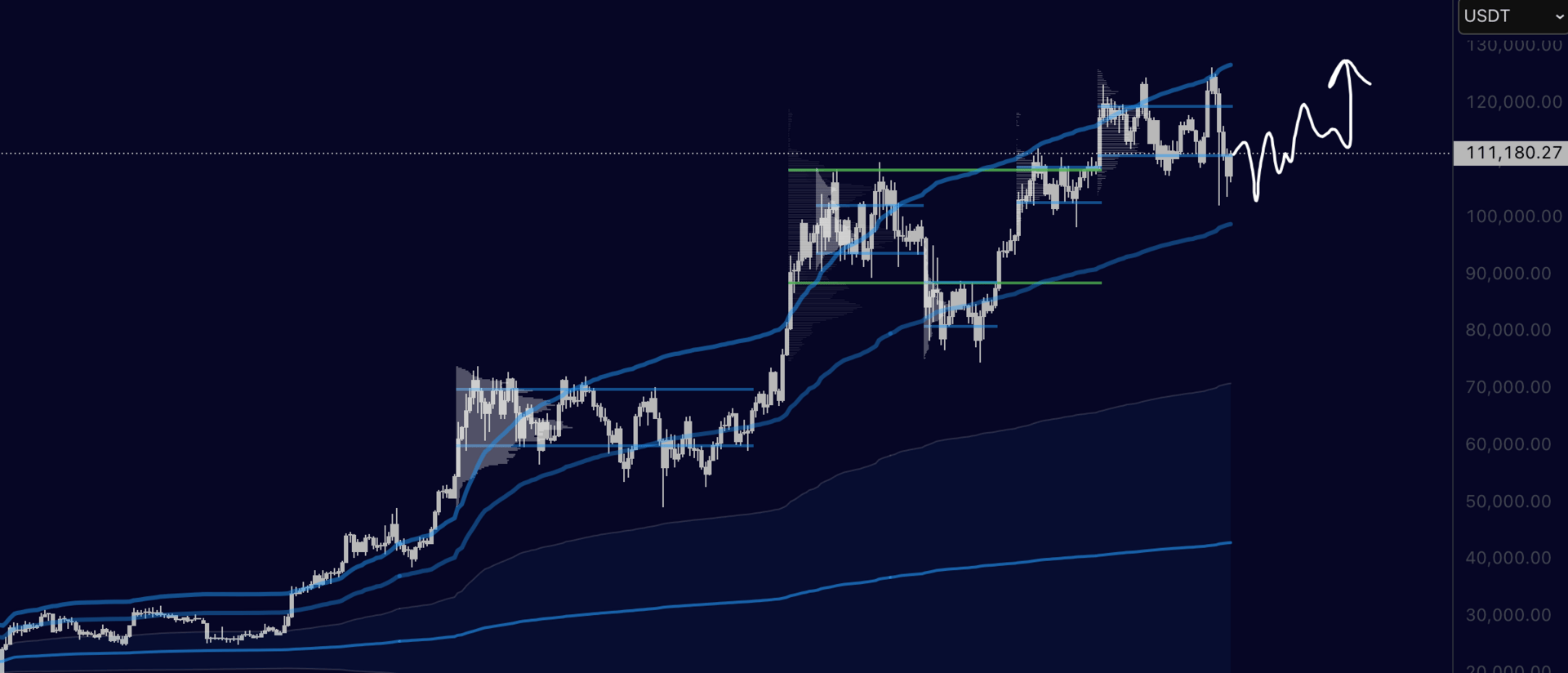

Magus | Next leg loading at 105k? |

The macro trend is very much intact.

We've got slight momentum loss, but I'm still expecting continuation.

Medium term, we either reclaim $112k or range between $110k-$100k.

If we pullback again toward the local lows around $105k, that's likely a very strong swing long setup for November and December.

My hope is Bitcoin has a strong Q4 and we end the year as the fastest horse compared to stocks.

If BTC has a poor quarter, we'll have to reassess Bitcoin versus equities.

I recently added to my BTC stack. Zero interest in adding or starting alt bags right now.

If Bitcoin follows my original plan, alts will follow, but we don't want to be early to alts. Better to be late on them

A lot of people want to bid $100k, so I think we either frontrun them or trade lower. The consensus is too strong at that level.

Cheers my friends.

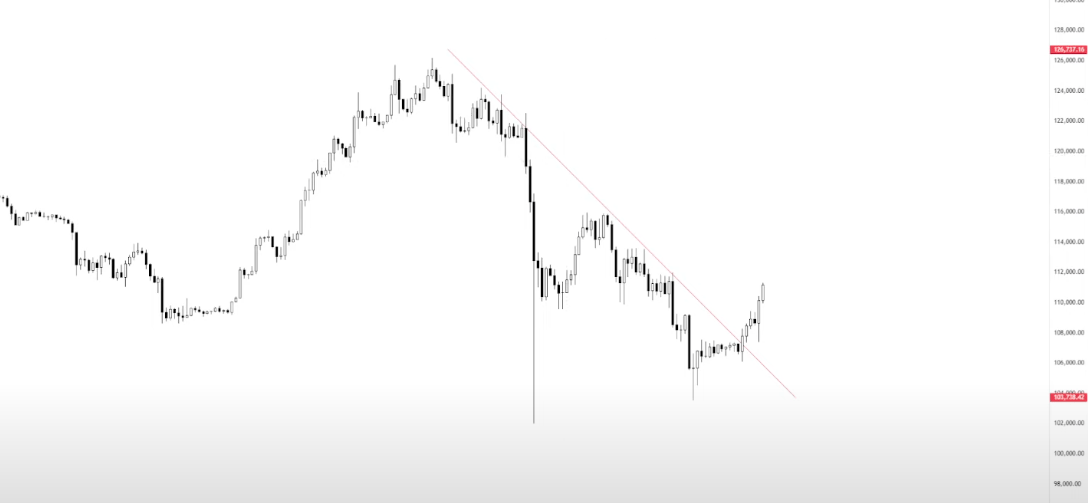

Doc | Hunting my knockout long |

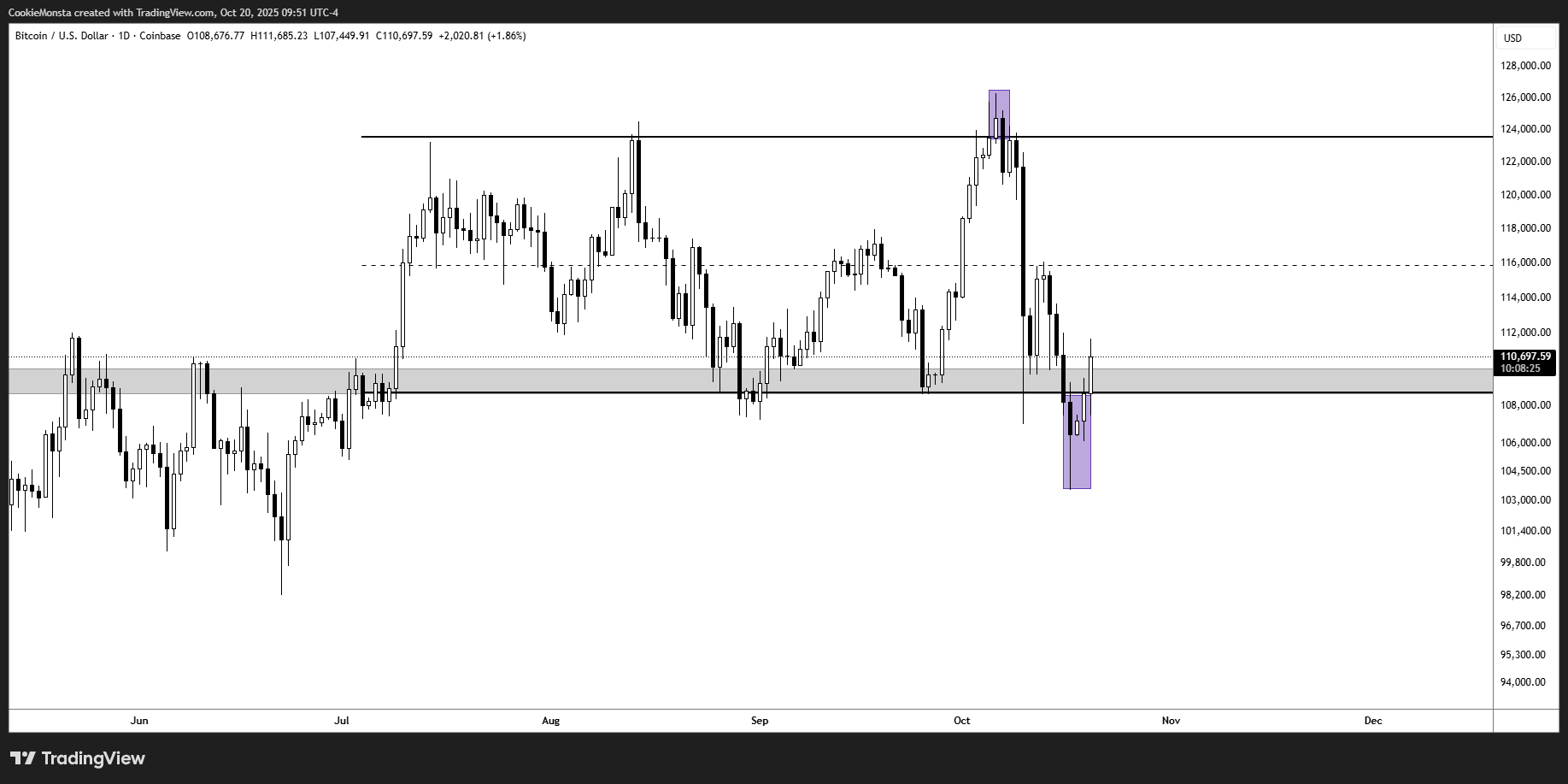

Is the bull market cooked?

I'm fighting the FUD and defying the 4-year cycle top narrative.

My bull market line in the sand, the CME daily 200 and 365-day rolling VWAP, held perfectly, so I'm staying optimistic until this breaks.

But I don’t expect an immediate V-shaped recovery to new all-time highs.

Big nukes have taken multiple weeks or even months to recover, just look at August 2023, August 2024 and the tariff reset in April.

These periods give Bitcoin time to build a solid base before launching.

Trade plans

Locally, I think we reject 115k on this first push and fill the fill the CME gap toward 106k.

Higher timeframe I'm betting we test the yearly VWAP around 100k one more time.

That's where CME weekly trend, 365-day rolling VWAP, and yearly VWAP all converge and is the best risk-defined, highest-EV swing long setup for all-time highs.

I'm spot long BTC and ETH, using hedges to lock in some volatility and stay calm.

If you're hunting the next big swing, be patient.

The 100k setup is coming.

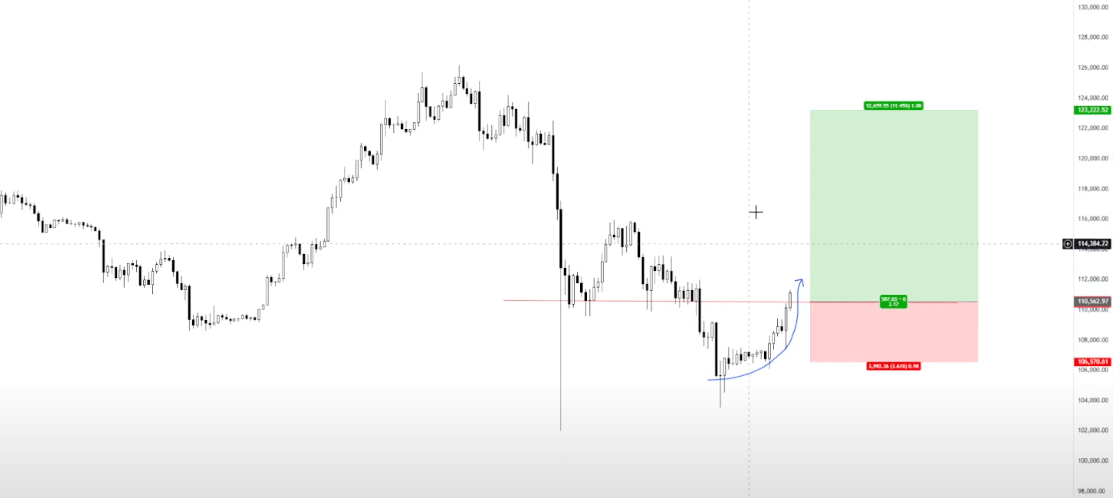

Charlie | Too late to long, too early to short |

BTC

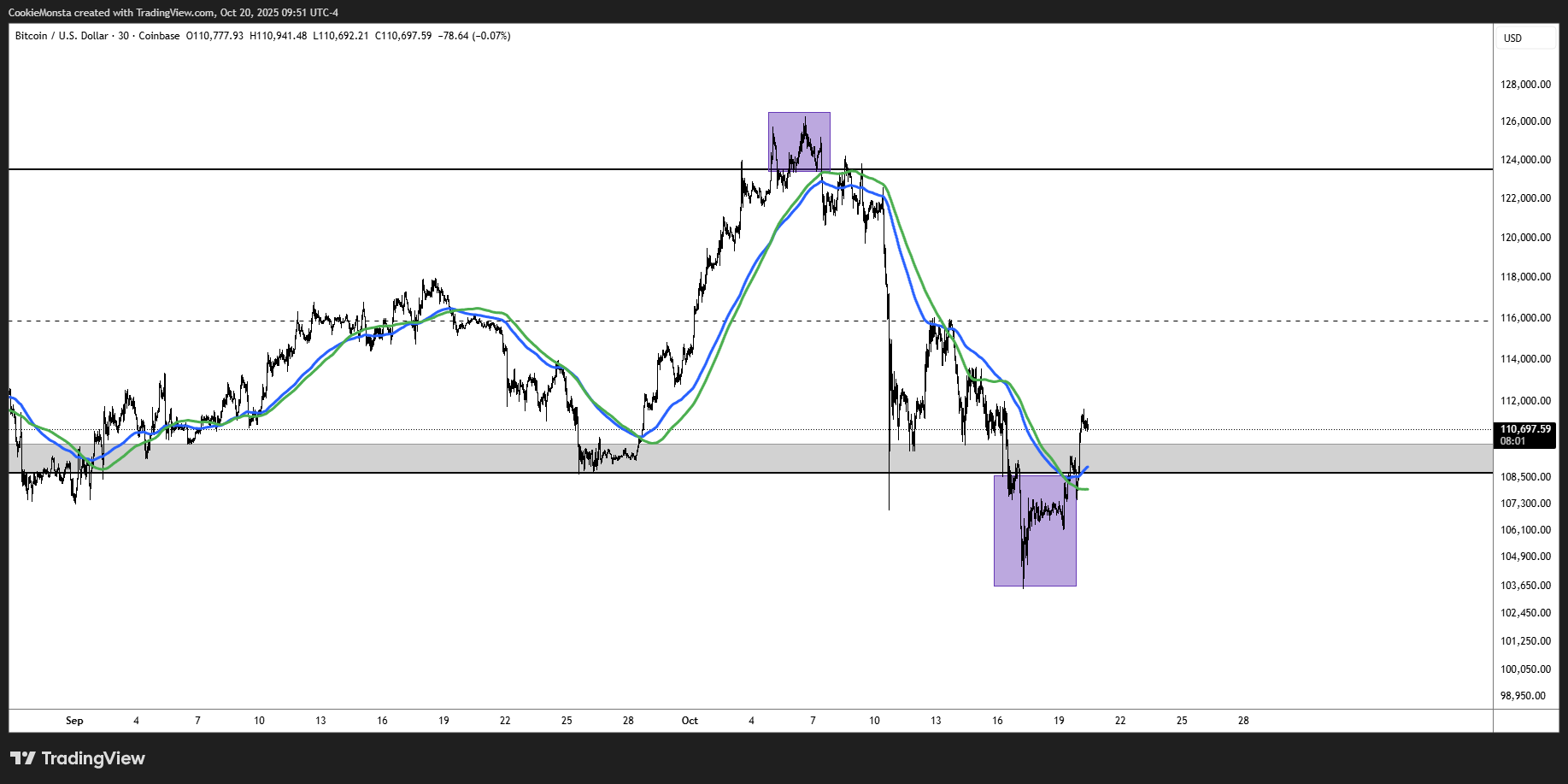

Bitcoin got a nice bounce from the lows breaking the H4 downtrend.

But a lot of coins already ran 20% early Monday morning, so I’m being patient on alt rotations for now.

110k and 106k are pivotal levels for me so my setups are based around those (I already have enough spot BTC so not looking to add for now).

Alts

ETH is above $4k and showing a higher low on the daily with a diagonal break. I may be interested if we reclaim $4071 and get a pullback to long.

USELESS, ASTER, PENGU

These are all on my radar for rotational plays, but I need to see either a consolidation with a low-timeframe breakout or a pullback to better levels.

Stoic | $110k: rally or rejection? |

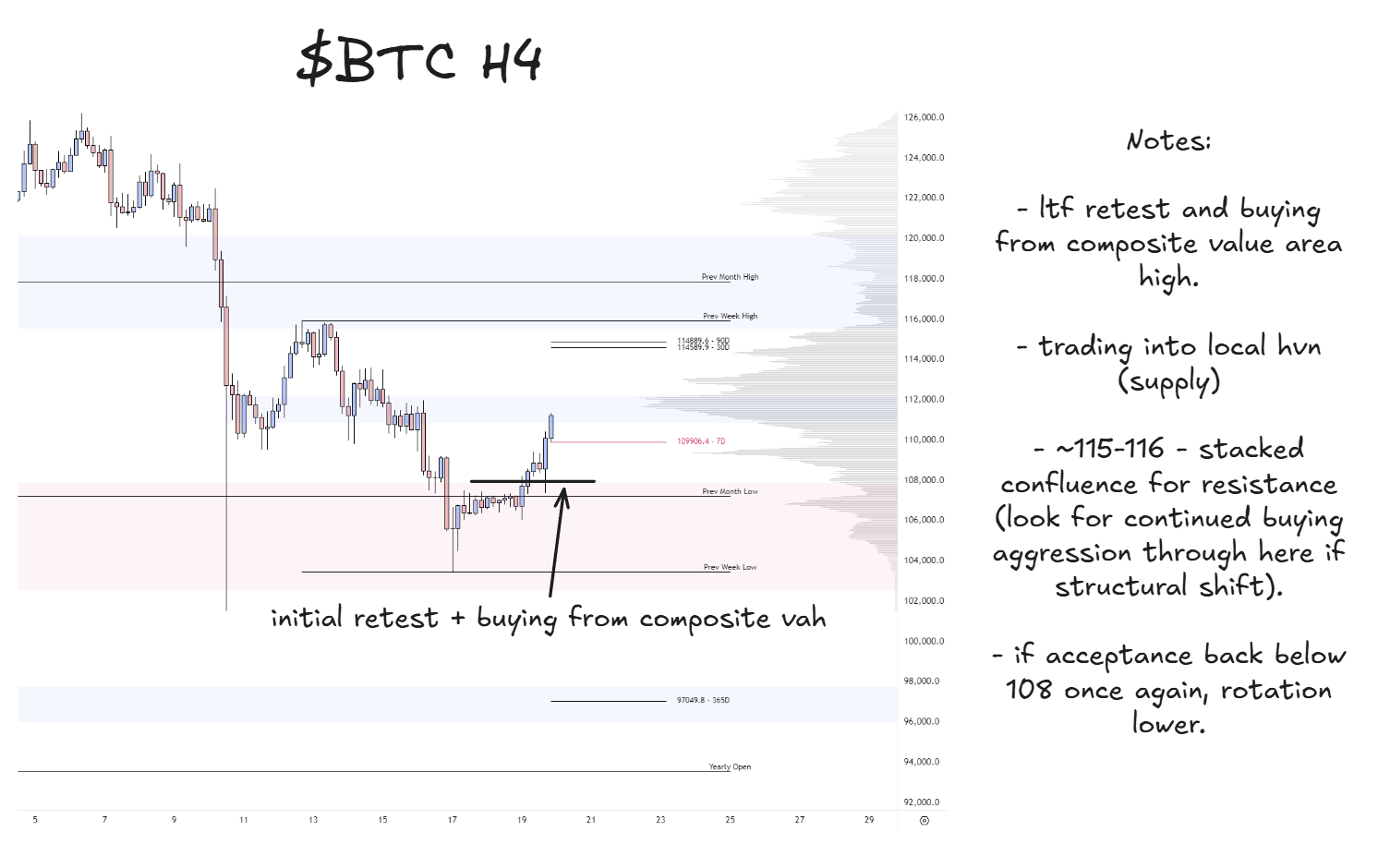

Bitcoin has lost the daily trend and is currently trading above the 7-day rolling VWAP with a clean retest of the lower balance value on the break.

As long as $108k holds, there's potential for rotating higher into the $114-116k range.

Zooming in, we're currently trading into a local high volume node, which is potential resistance.

On lower timeframes, if $110k holds, I'm looking for a rotation into the 30-day and 90-day rolling VWAP with the potential of taking out the previous week's high.

This area between the two areas of balance lends itself well to choppy price action, especially after a massive liquidation event.

A potential scenario is mean reversion into rejection, but staying agile in this environment is key. Strong convictions loosely held is the goal.

I'll be observing Monday's range development as a reference to trade the rest of the week.

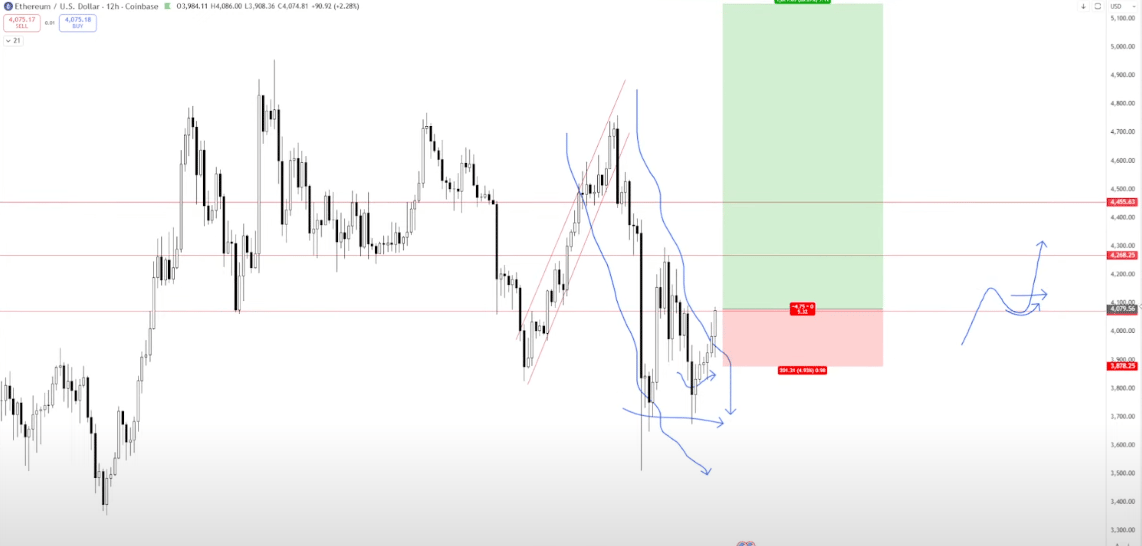

Mercury | Did alts just bottom or top? |

BTC

Last week's analysis held up perfectly.

As long as Bitcoin stayed below the intra-range 30m 200 MAs, any pops were relief bounces, not rallies.

That framework helped us avoid most of the selloff, as the local trend kept getting rejected and eventually led us to break down below the range entirely.

But within the past 24 hours, not only have we reclaimed the 30m 200 MAs, we've also deviated back inside of the range

Range deviations typically result in a push to mid-range and eventually the other side of the range, similar to what we saw on the recent false breakout to the upside.

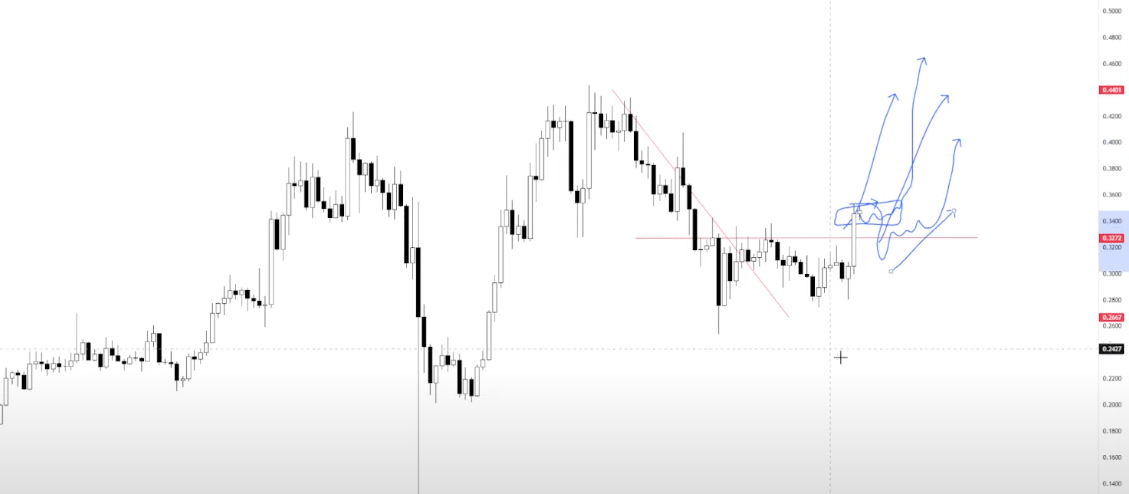

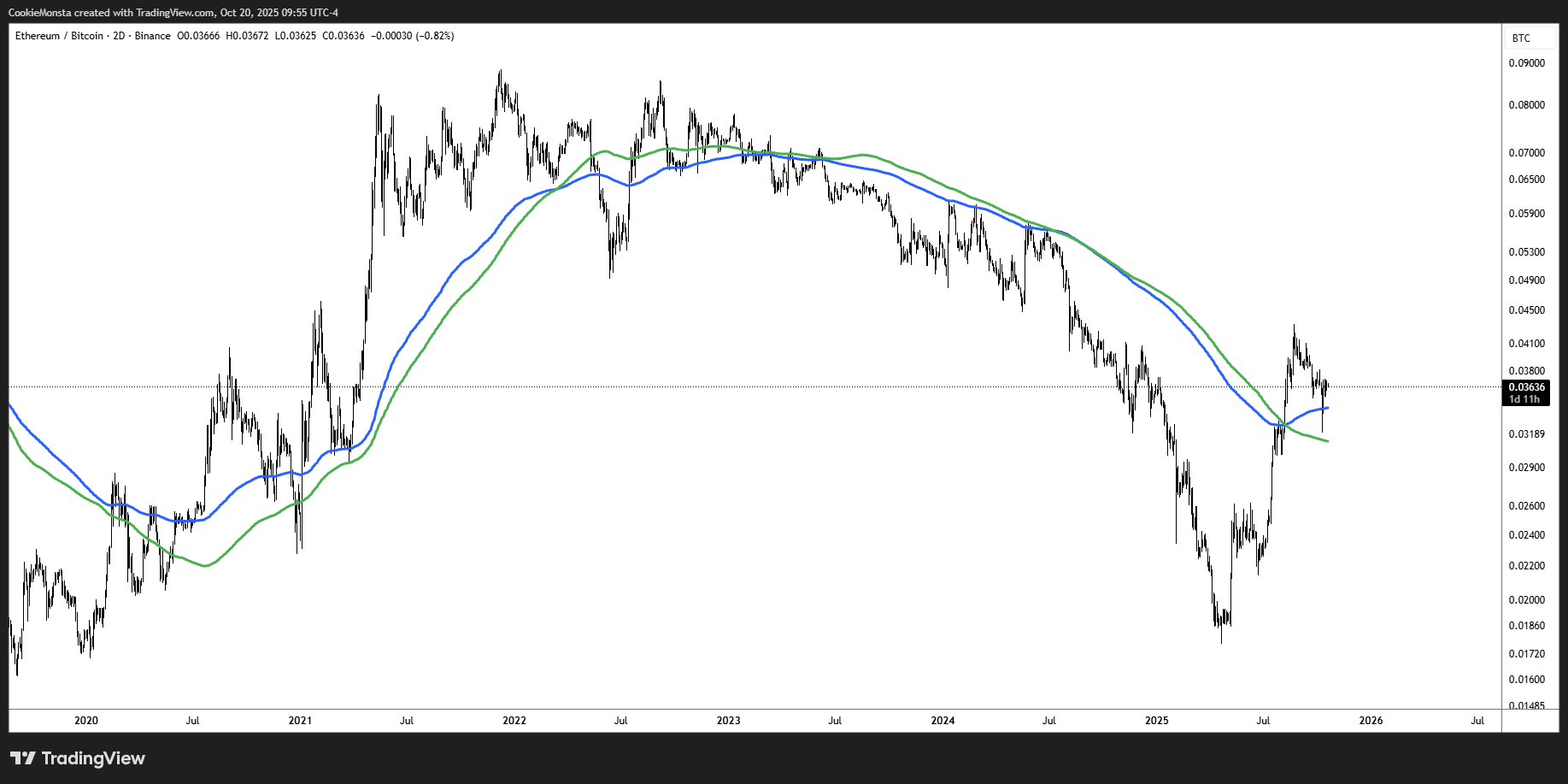

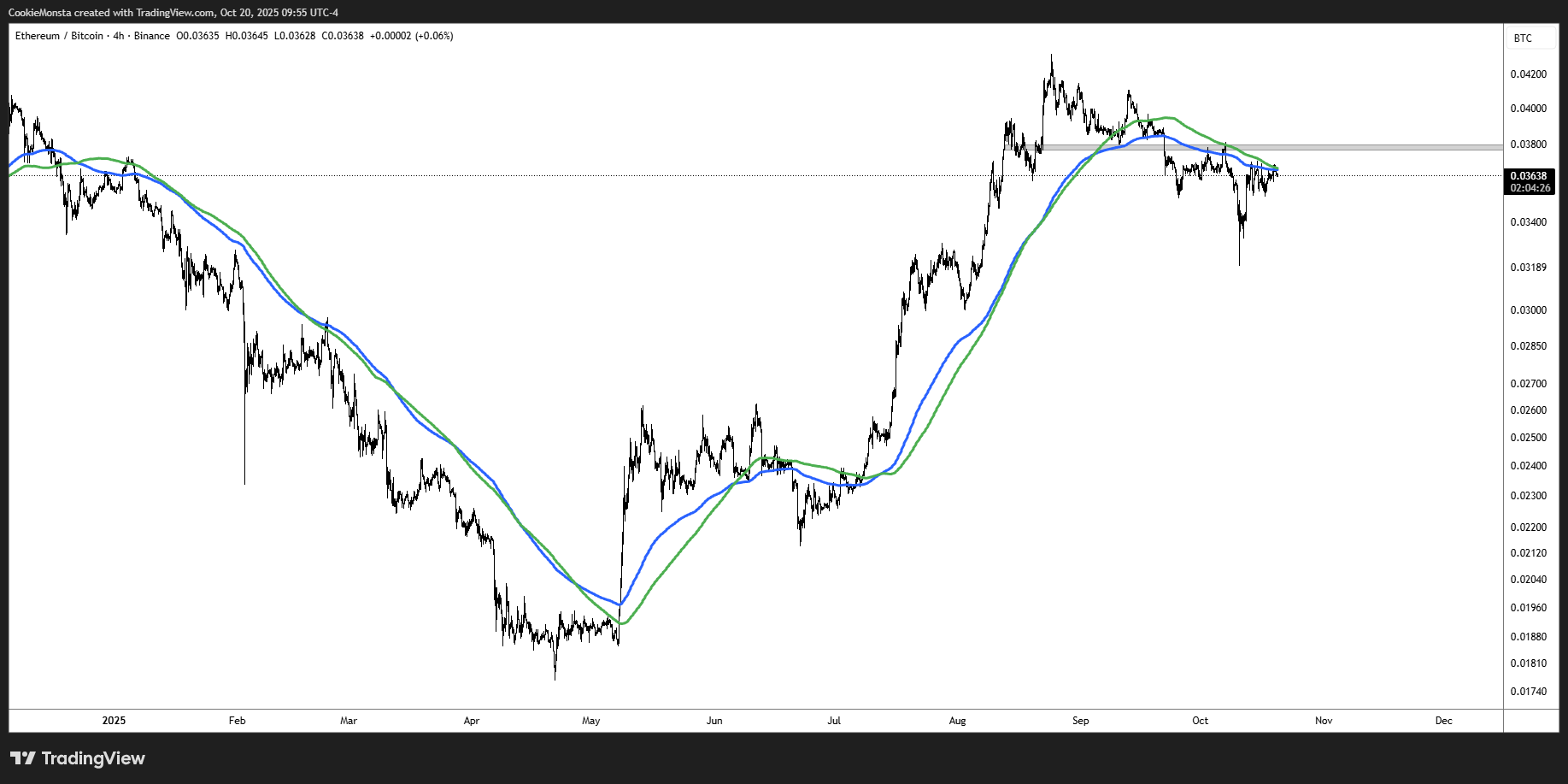

ETHBTC

Meanwhile, the ETHBTC chart remains sandwiched between a rock and a hard place.

The very high timeframe D2 200 MAs are being held as support.

But the H4 200 MAs have yet to be reclaimed.

This reflects current market sentiment perfectly.

Crypto traders are scratching their heads wondering whether the recent altcoin selloff was an opportunity to bid before the real rally begins, or if we've already seen the extent of the fun on alts.

I firmly believe ETHBTC is the best proxy for general altcoin market strength, as it has proven that thesis over the past three years.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.