- CookBook

- Posts

- Hitting the ground running

Hitting the ground running

Plus, is altcoin Charlie back?

In today’s edition we have:

Magus — Hitting the ground running

Doc — Watching this trend

Charlie — Altcoin Charlie back?

Stoic — VWAP compression called the move

Mercury — Context is key

Magus | Hitting the ground running |

First outlook of 2026.

I’ve been locked in working since New Year's Eve because I want to be in a rhythm before the shift happens.

Remember, you want to be early in preparation, not necessarily in positioning.

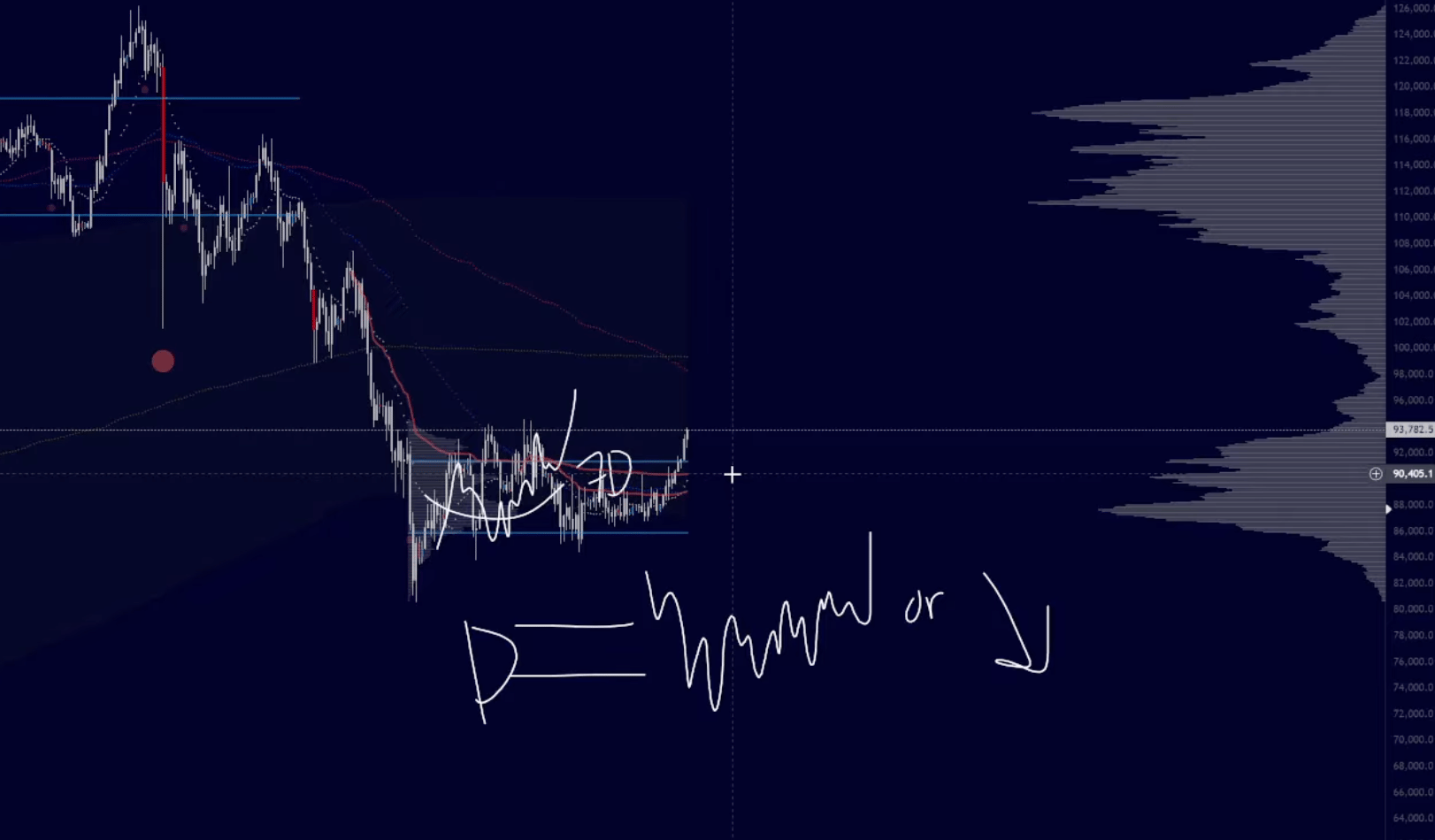

Bitcoin: Bullish, but I want a wipeout to long

BTC built out a range and has started flipping the rolling 7D and 30D VWAPs.

I'm holding spot and looking to send perps on any move down where existing longs get pressured.

The exact price is less important than the flows (e.g. seeing perp longs close is a classic entry signal).

In my entire 10+ year trading career I can only remember Bitcoin trading straight up off the quarterly open once, Q1 2023.

Every other quarter you get some kind of move in the opposite direction of the open, and that's when I buy.

Everyone wants to long the below setup, which means we’ll probably have to long intraday pukes higher to get on board.

If we get a 5-6k pullback I’m buying that. Otherwise our best chances are intraday pullbacks. I don't expect a 10k drawdown.

The question you’re probably all wondering

Do we get a dead cat bounce to a macro lower high or send to 150k.

Either way, I think we're trading up, but I think treating it like a dead cat and de-risking around 105k ± a few thousand gives you the highest expected value.

If it trades up more, we adjust.

Levels

80K: Most important support, don't want to see this lost.

90K: Resistance

92K: Hold above this convincingly, we rip higher

105-110K: Target zone

If Bitcoin can't run in Q1 while equities and metals are bullish, that's going to cook the Bitcoin thesis for a while. This quarter matters.

But technicals and balls tingling say up.

TradFi: equities, metals and indexes

The S&P is my largest holding apart from BTC, and I’m keeping it very simple: It dips, I buy more.

I have cash ready to go from some recent sells (see below). Otherwise I’m just letting the game run its course.

I'm also eyeing the rare earth metals and energy sector. Talked about the tickers on my Friday stream but haven't bought any yet.

Over the next few weeks I'm probably going to start dipping my toes in with smaller size, definitely less than BTC and equities exposure.

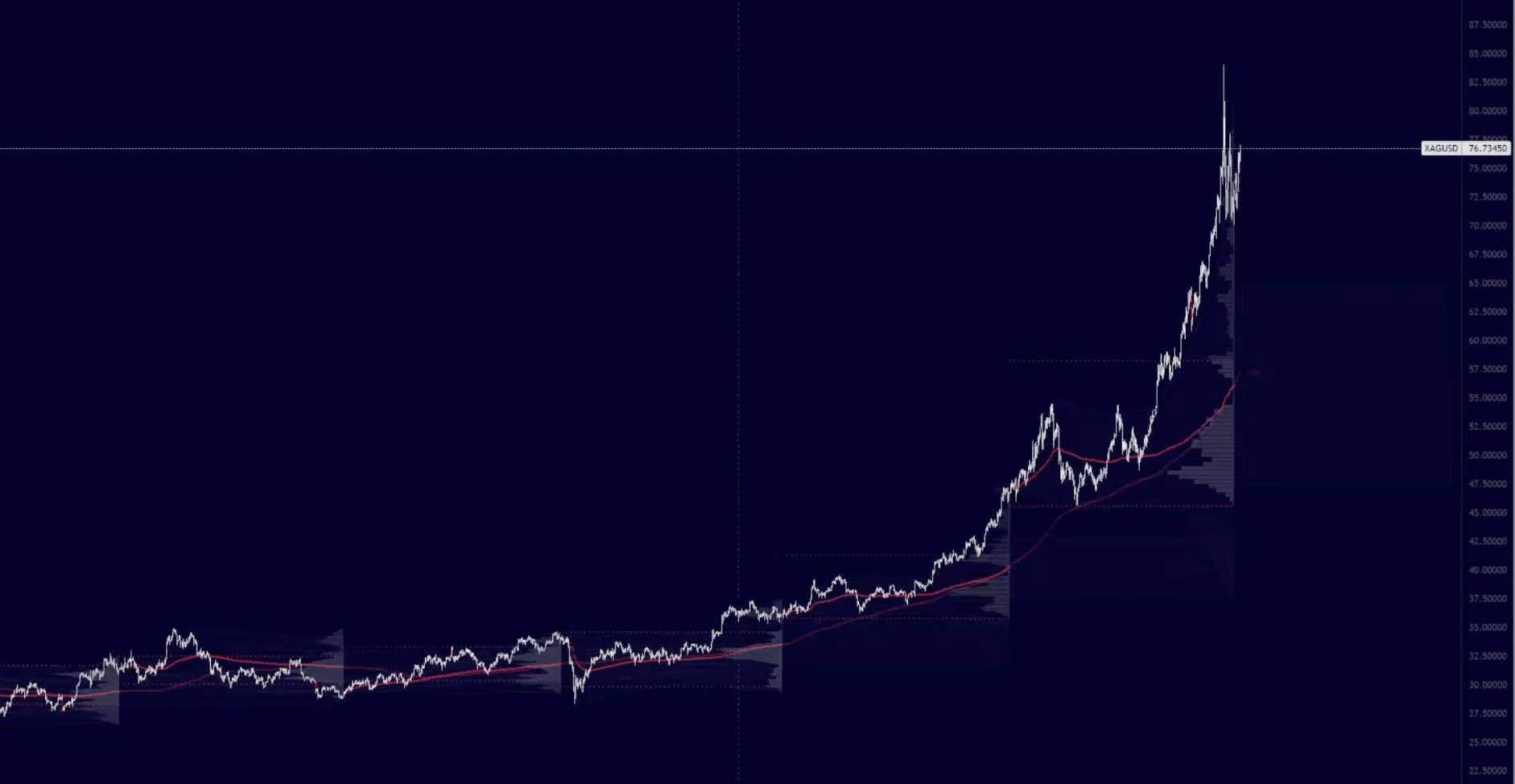

Update: I sold my silver

I was a silver surfer for a 300% move. Sold 75% of my exposure.

This probably keeps going up, but it was a good play for me and I wanted more cash ready.

Also, been saying for months I don't like having zero gold exposure. Maybe I buy some with the cash on a dip.

Doc | Watching this trend |

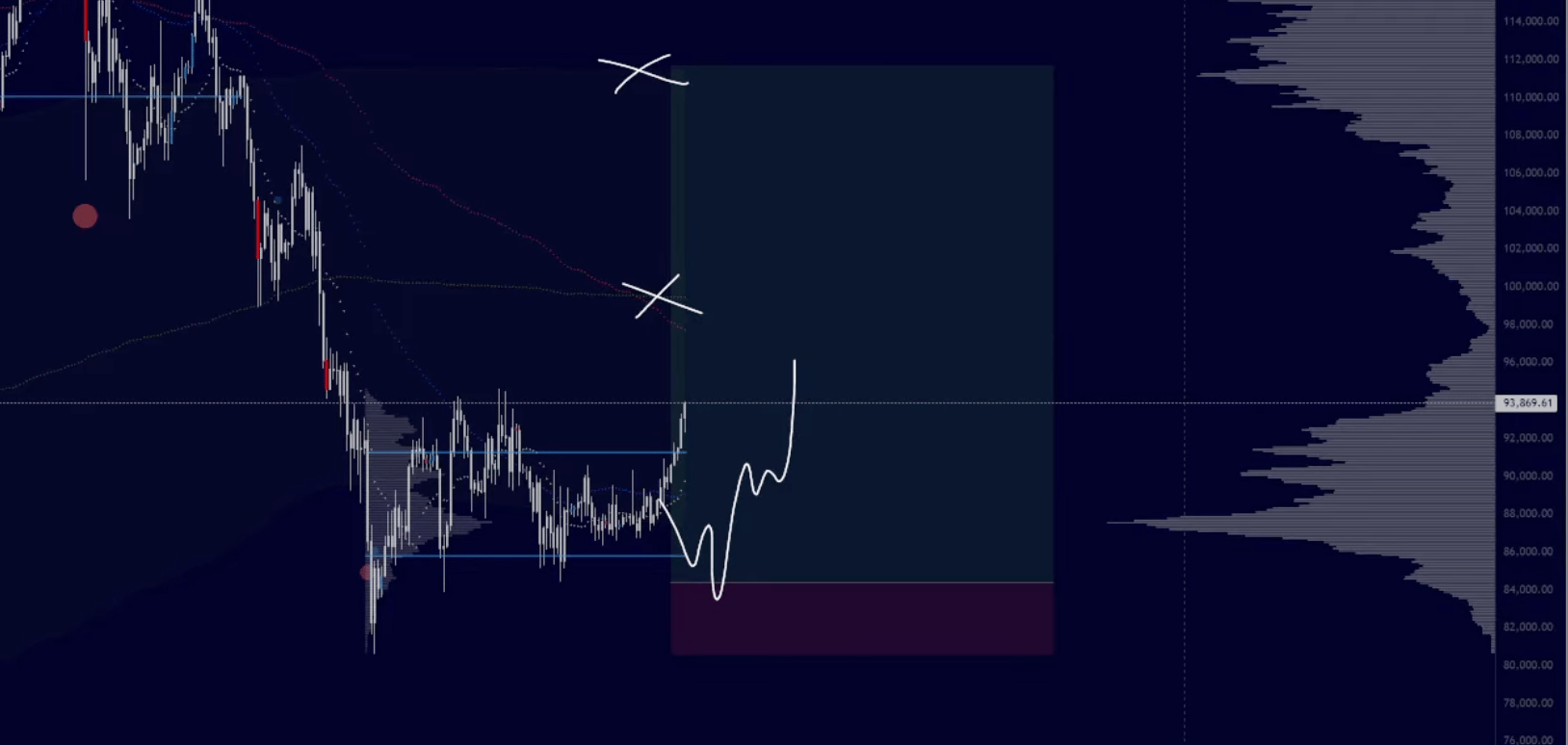

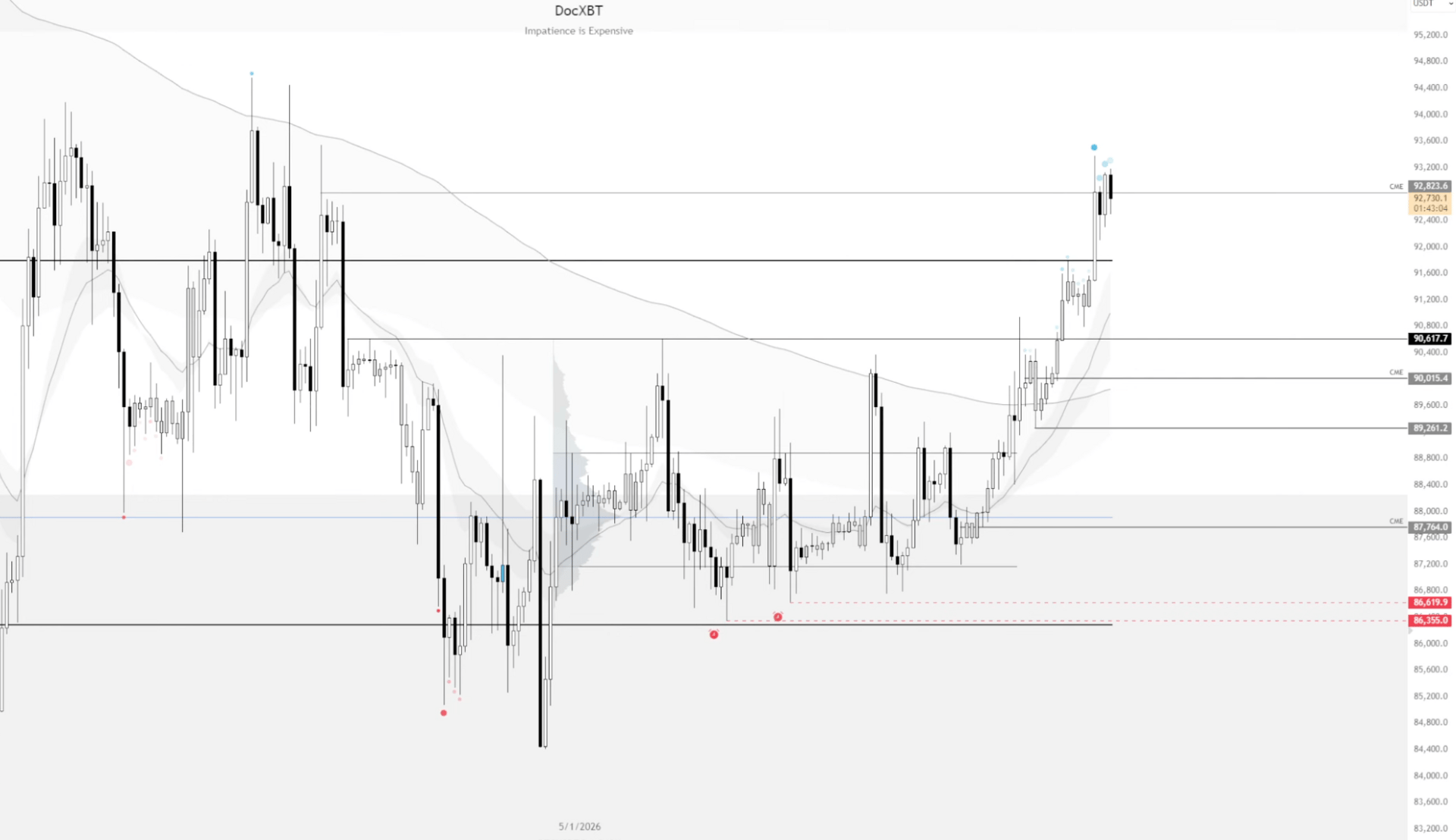

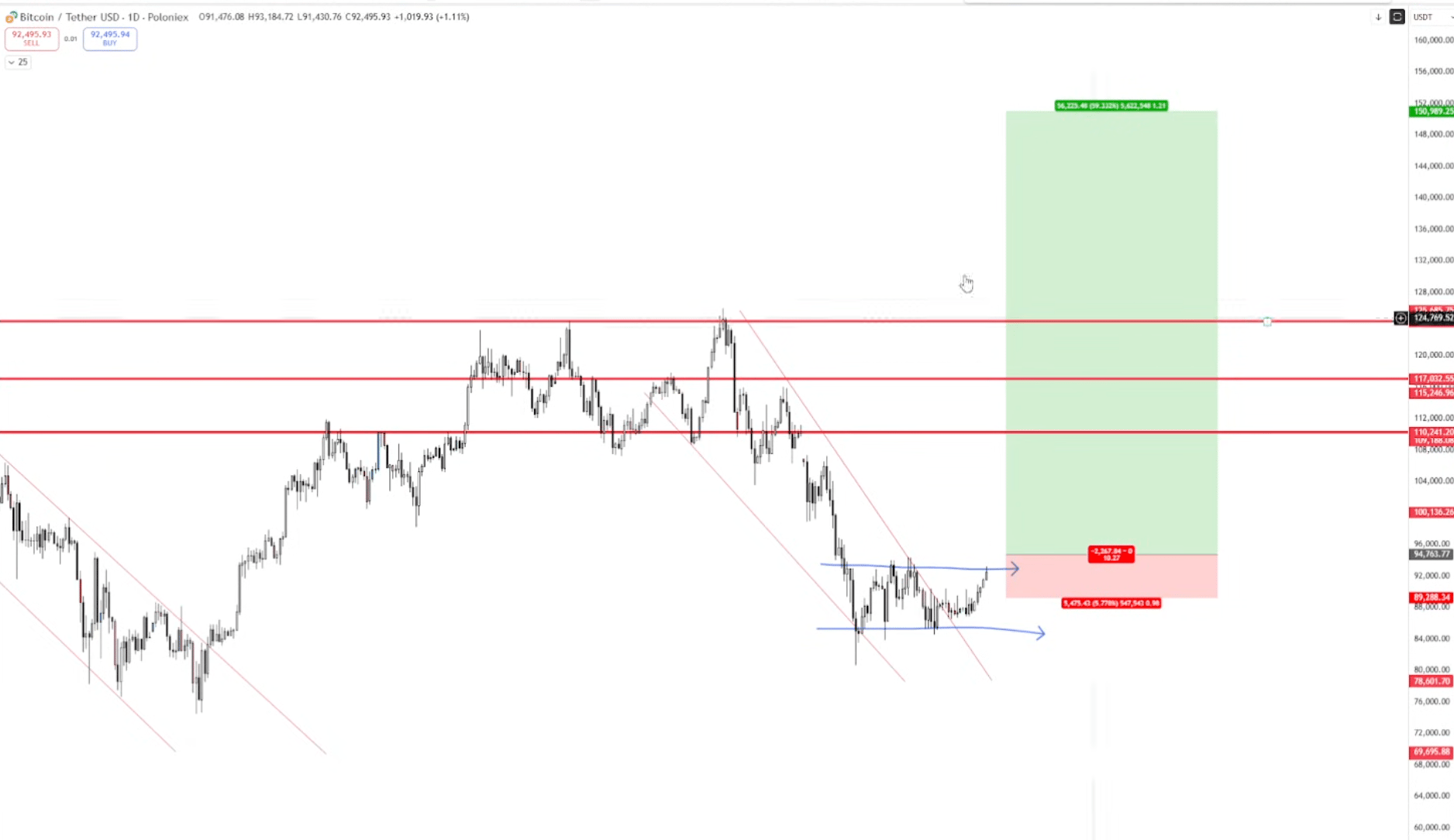

The game plan from November is playing out: range for longer than people can stand, they get chopped or check out, then we expand.

Now it looks like we got that compression under the daily, with a gap fill to the weekly shaping up.

My current read

Perp longs are taking profits into the NY open, large ask walls above, orderbook skews very negative.

This is the inverse of what we saw at the lows in November: shorts closing, spot buying coming in later. Here it's longs closing, maybe spot selling later.

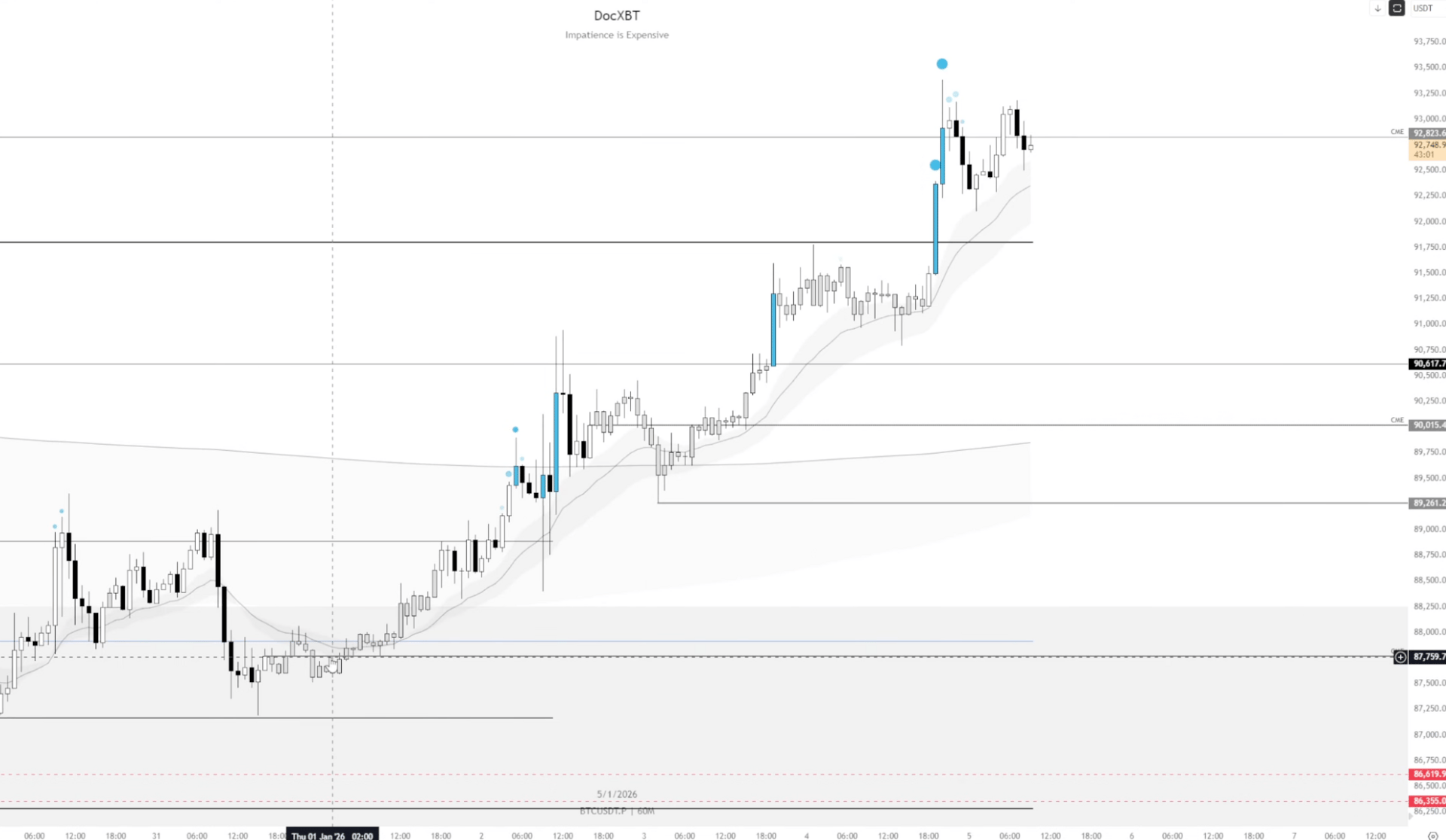

The hourly (H1) trend

The hourly has been immaculate with many retests and clean continuation.

Bulls on spot and perps are finally showing aggression, eating through asks instead of just taking you to resistance and folding, which is different from the ping-pong price action we had the last few weeks.

If we get a shallow dip and hold this hourly, I'm looking for continuation. If we lose it, I'm expecting a stronger reset toward the CME gaps.

CME gaps

The 100% fill rate continues with the recent 92.8k fill.

But we left fresh ones below: 90k from this weekend and 87k from earlier. Those will probably get cleaned up at some point.

If we rally to 108 or 110, I'll take that as a de-risk or swing short opportunity.

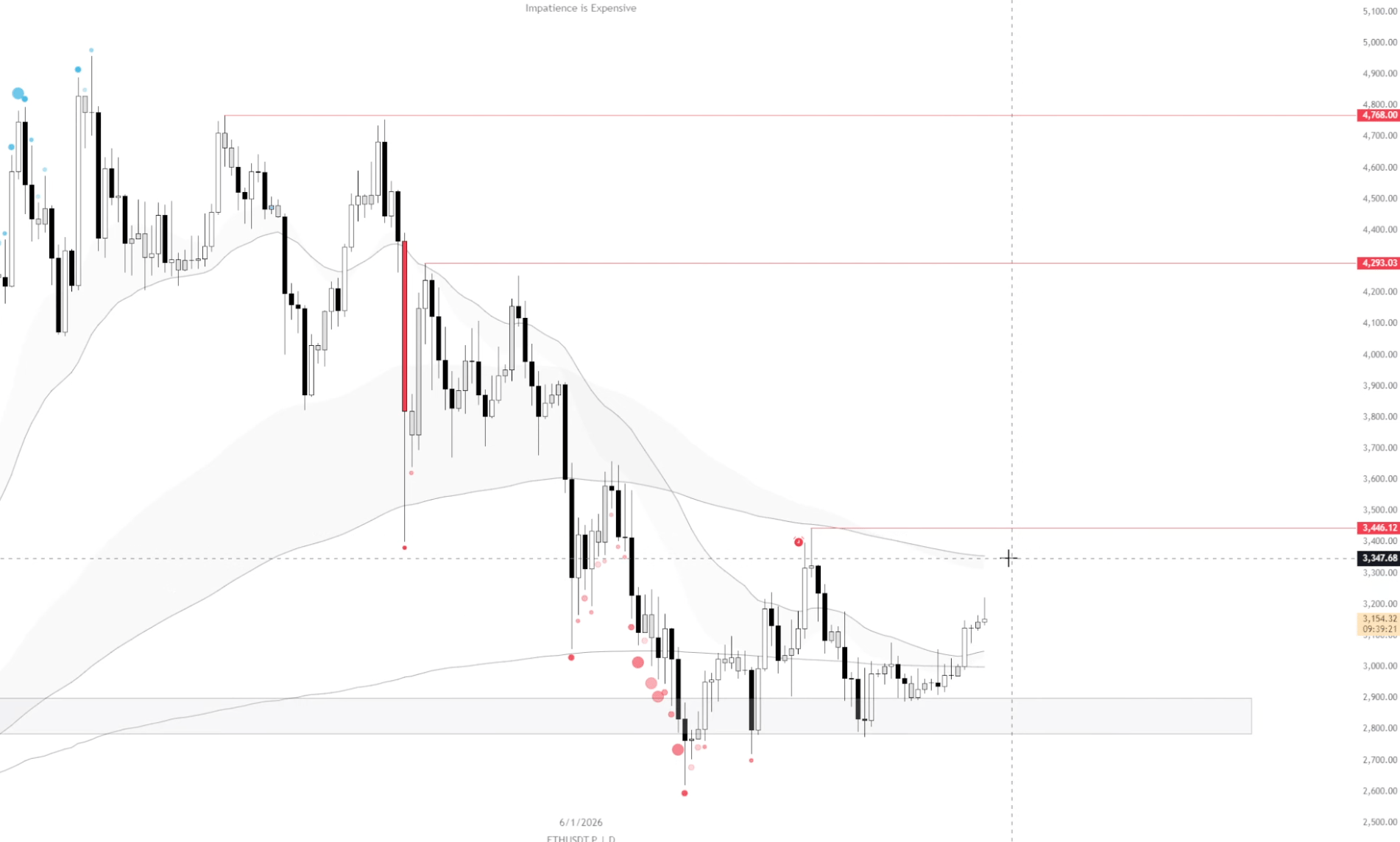

Alts looking like HTF distribution

ETH is stuck in no-man's land between the daily and weekly trends.

Quarterly VWAP, yearly VWAP, and 2024 value area high are all stacked above around $3500.

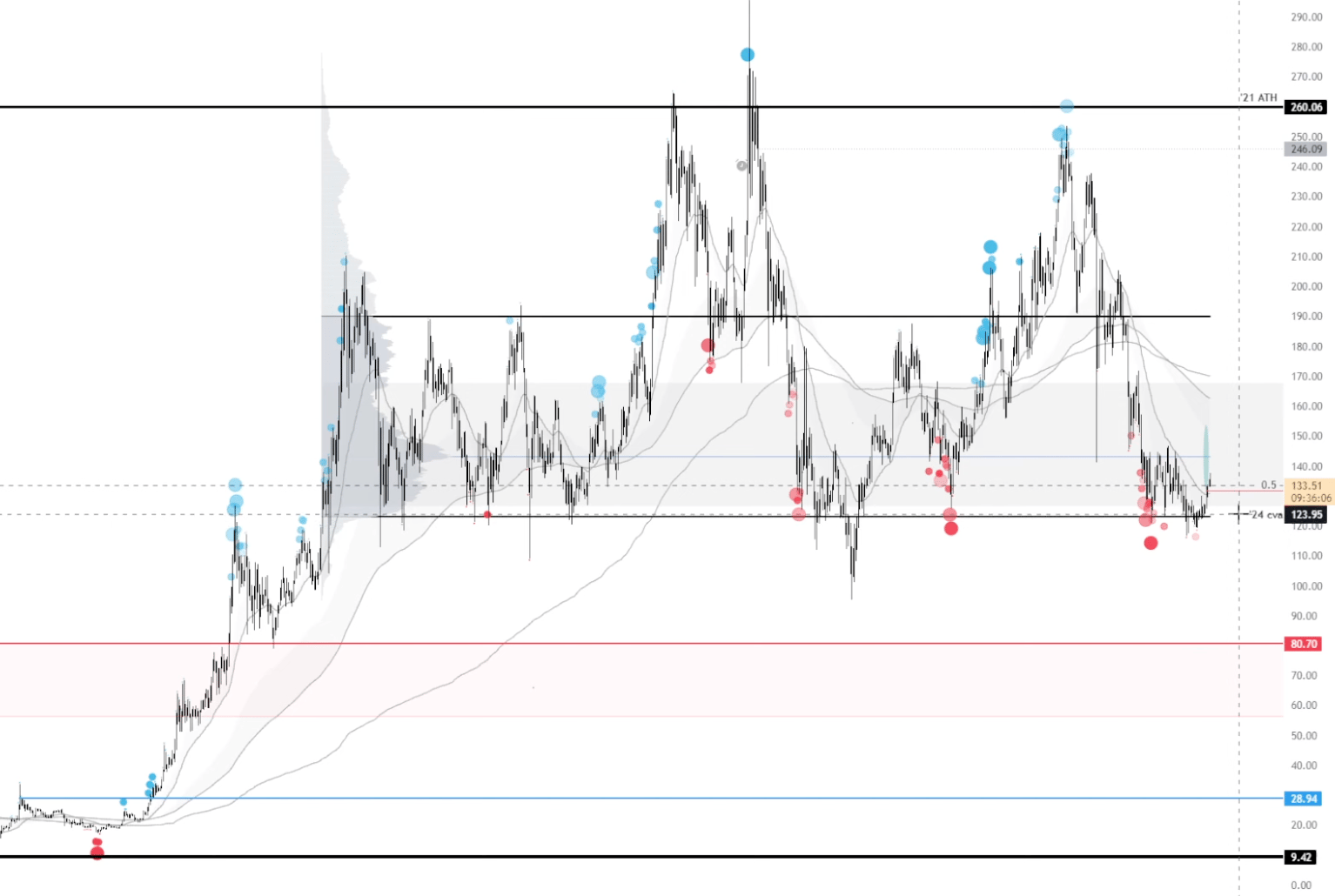

SOL is a similar story: weekly trend above is the target for de-risking longs or taking swing shorts. If it loses $123 the next downside target is $80-60.

My base case hasn't changed

This is a relief rally and I think we go below November lows before new all-time highs.

Why?

We lost a multi-year weekly uptrend and momentum has been waning on both a trend and price action basis.

If we hold 80k as support for months, maybe I reconsider.

TLDR; HTF remains bearish, but that doesn’t mean we won’t have opportunities to trade in the meantime.

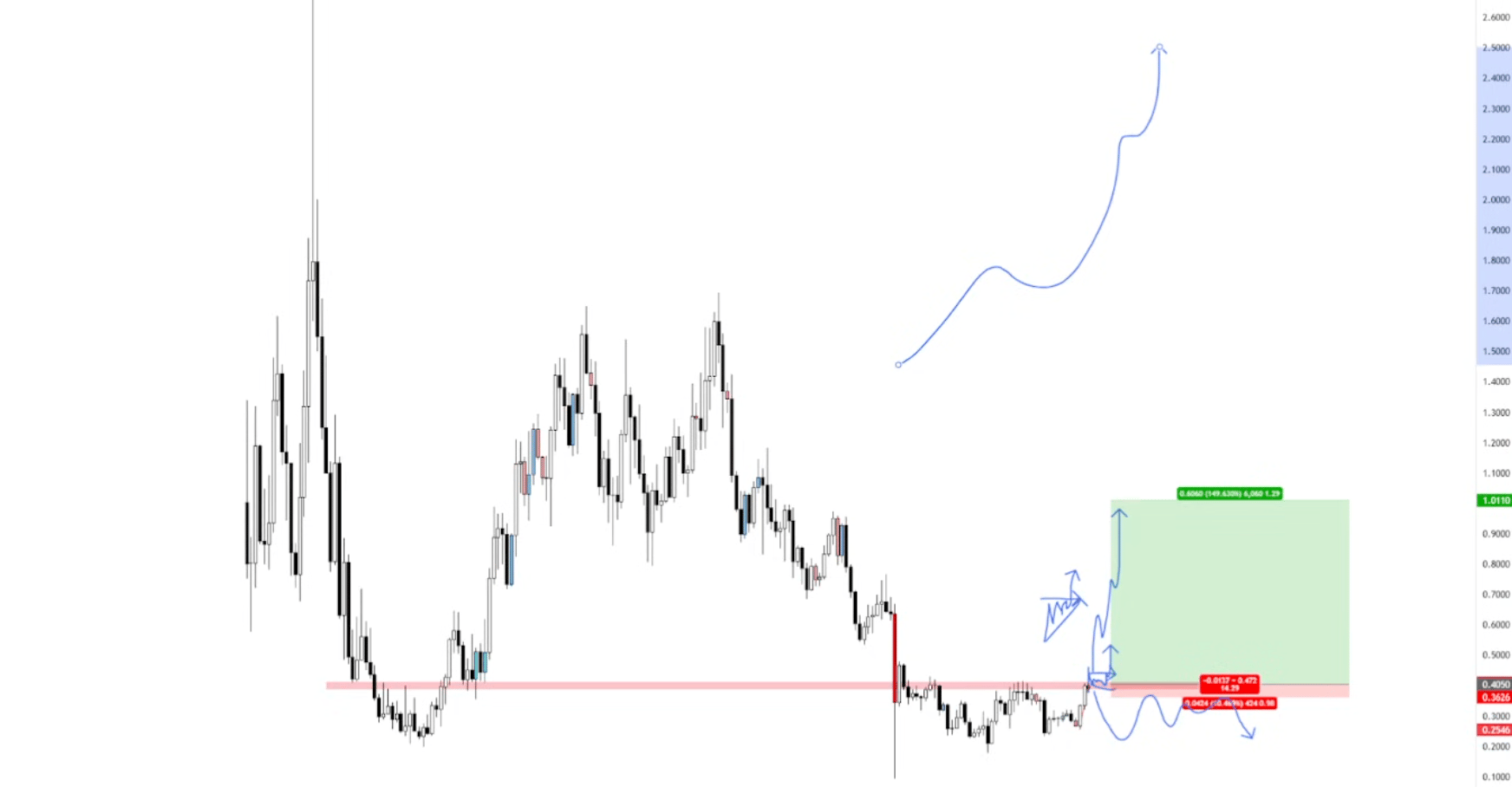

Charlie | Altcoin Charlie back? |

Memes are showing some life to start 2026 .

But they’re going to have to show a little bit more strength for these not to look like dead cat bounces.

And that requires BTC looking good.

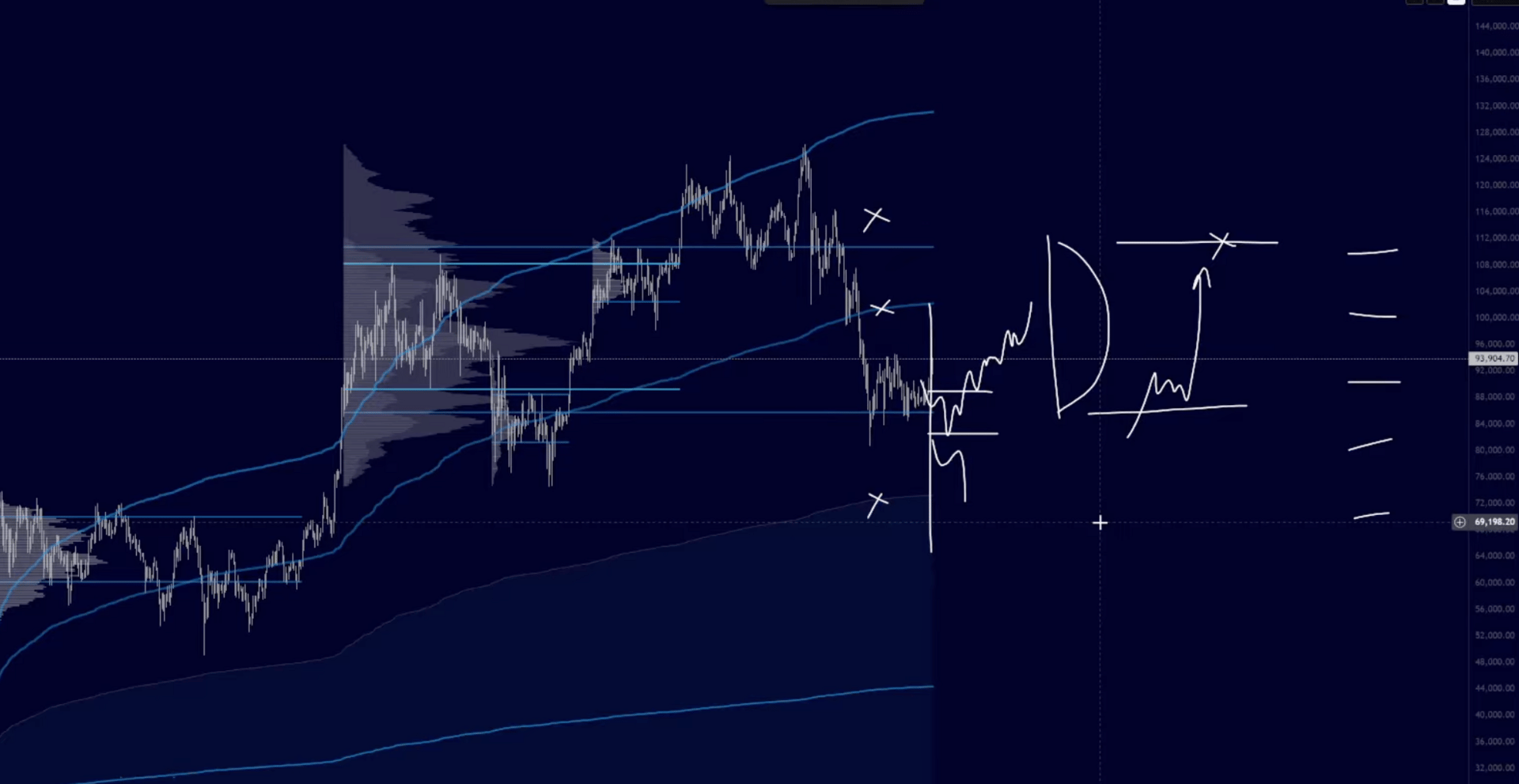

Bitcoin Setup

I'm watching for a long above 94-94.5k.

We've broken the previous downtrend, we're in consolidation, and this is a much better EV setup than trying to catch falling knives in the chop.

Targets are the three red lines: 110k area, previous support/resistance, former highs.

If we fail to reclaim any of them with strong momentum (all wicks getting bought, no pullbacks) I'm taking profit with no hesitation.

Alt & Meme Plays

ETH is meh. ETHBTC has no strength and oversized returns come from memes.

Pippin's got my attention. Redonkulous negative funding, massive disparity between spot and perps.

For triggers, I’m looking for demand indicated by meme triangle pattern.

FARTCOIN: Break above 40 resistance and we could get a decent move.

If it happens I expect it breaks out, gets everyone turbo bullish, pull it back massively, screw everyone over, then run (likely to a macro lower high).

Classic.

Coins on my radar: PIPPIN, FARTCOIN, JELLYJELLY, USELESS, TRUMP

Looking for the same thing on all of these: very high or low on spaghetti (high beta), at points of interest (breaking out or retesting levels), demand shown in the price action (meme triangle with series of higher lows)

The COIN indicator

COIN often acts as a canary in the coal mine for crypto, preempting moves.

Reclaiming 274 would signal crypto's back on the menu.

If we don't see that risk-on signal soon, it could be no man's land for months.

TLDR; I’m only taking on risk where breakouts make sense. Otherwise I’m just waiting.

Stoic | VWAP compression called the move |

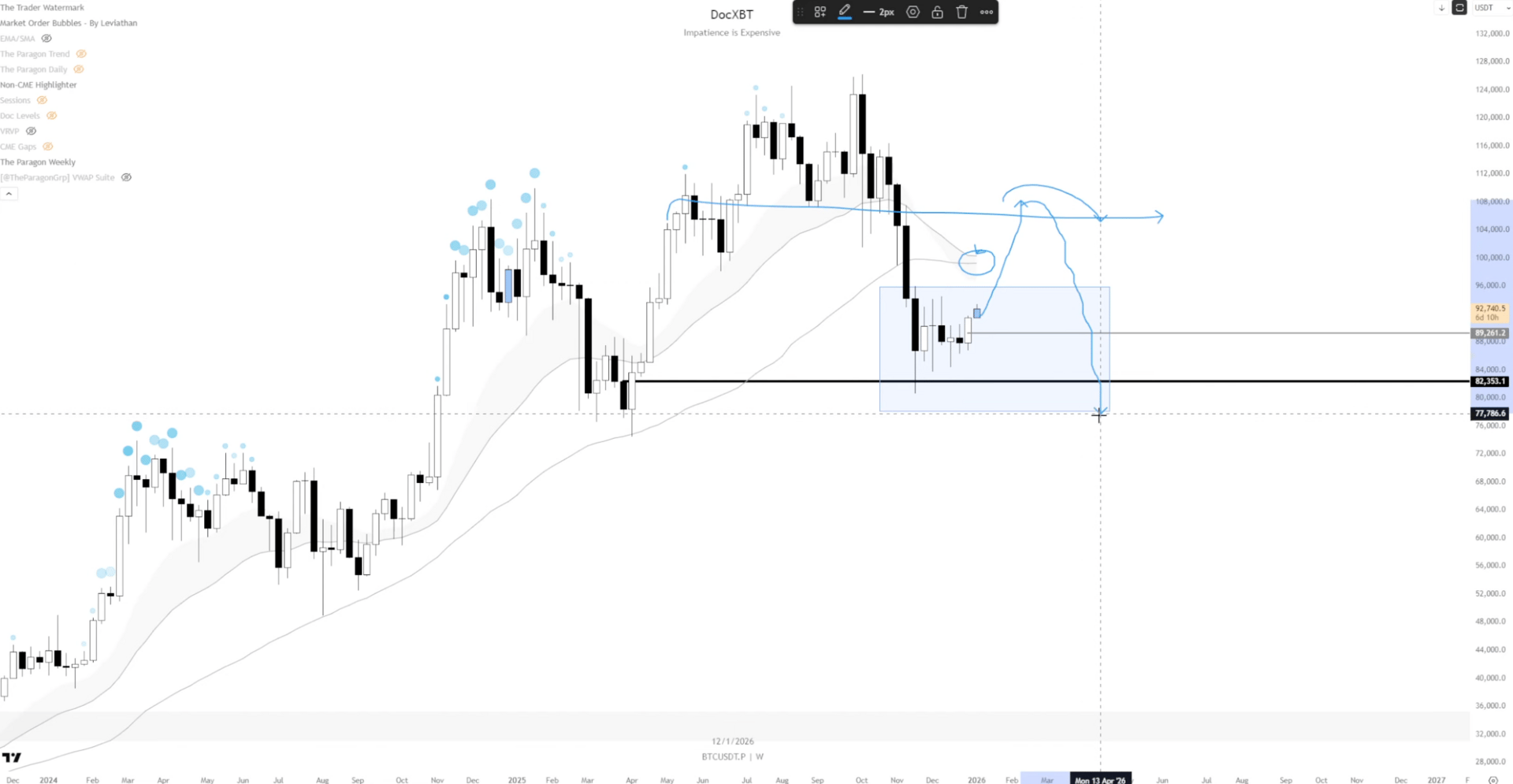

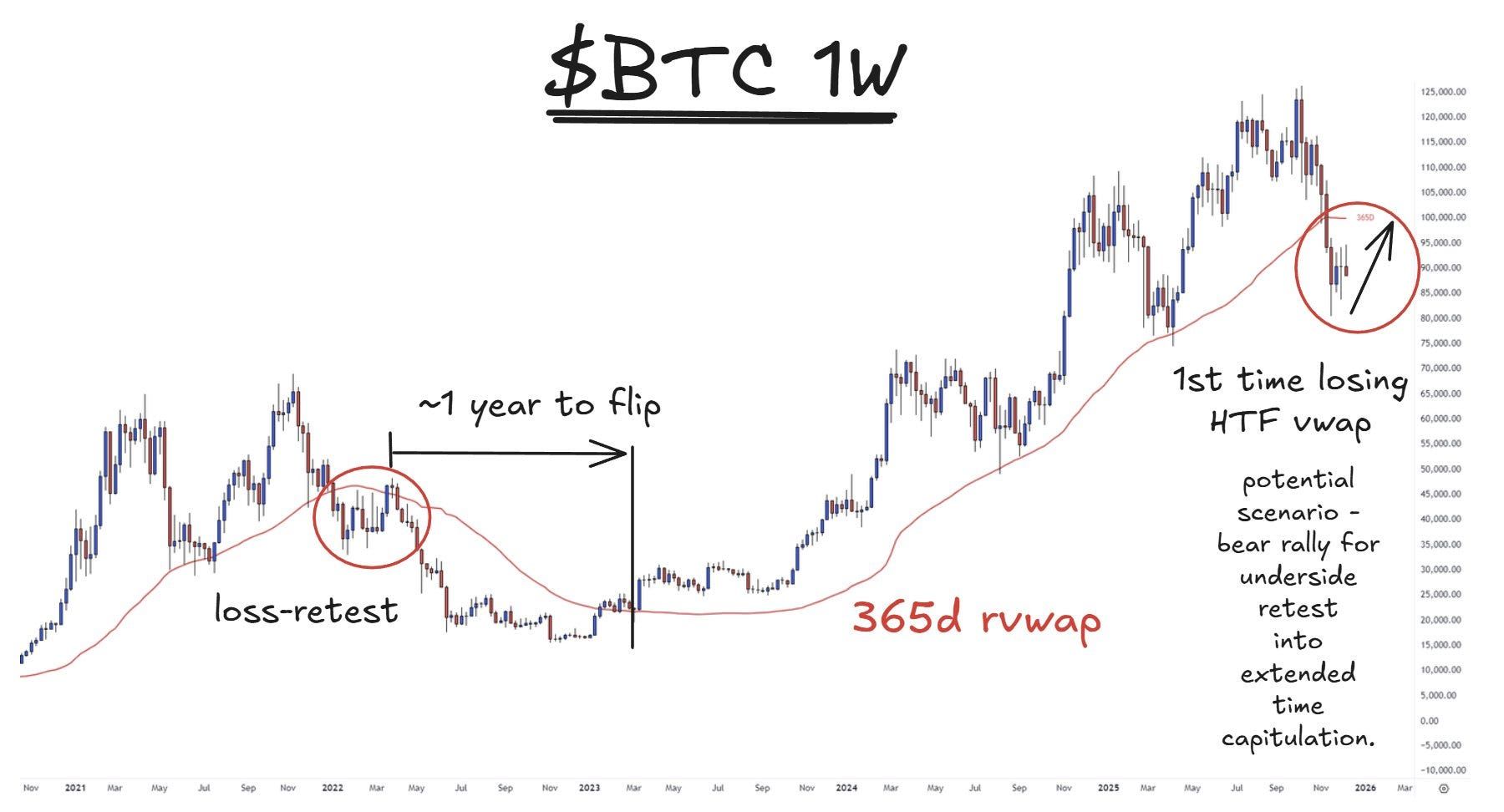

Going back to this visual I posted on Dec 14, I’m still expecting this to be a temporary relief rally unless BTC reclaims the 90D and 365D rolling VWAPs around 100k.

November was a strong downtrending month while December remained rangebound.

If BTC breaks above the current value area high around 92k, I expect a quick move up.

But I’m not betting on an extended rally unless new information invalidates this idea.

As long as the previous months’ value is held and the flow remains positive (spot lead), I’m holding my longs that built up over the entire lull period when people were clowning the price action.

The 7D and 30D rolling VWAPs were compressing, indicating a reflexive move.

If price trades back down inside the previous month’s value I will cut and reassess.

P.S. If you want a quick overview of how I use VWAPs (like in this compression setup) check out my explanation in this previous edition.

Mercury | Context is key |

Bitcoin has reclaimed the 4H 200 MAs inside the range, so I’m assuming that we will see an expansive push above the range in the medium term.

Unfortunately, the context remains unfavorable on higher timeframes, so I have to frame this rally as 'relief'.

The 12H 200 MAs, which have supported the few rallies we’ve seen during this multi-year uptrend, sit at $98k.

And the 2D 200 MAs, which represent the highest timeframe and were support during a three-year bull market, reside at ~$100k.

While context is favorable in the short-term, I imagine upside is limited until BTC reclaims these higher timeframe trends.

What to look for in the altcoin market

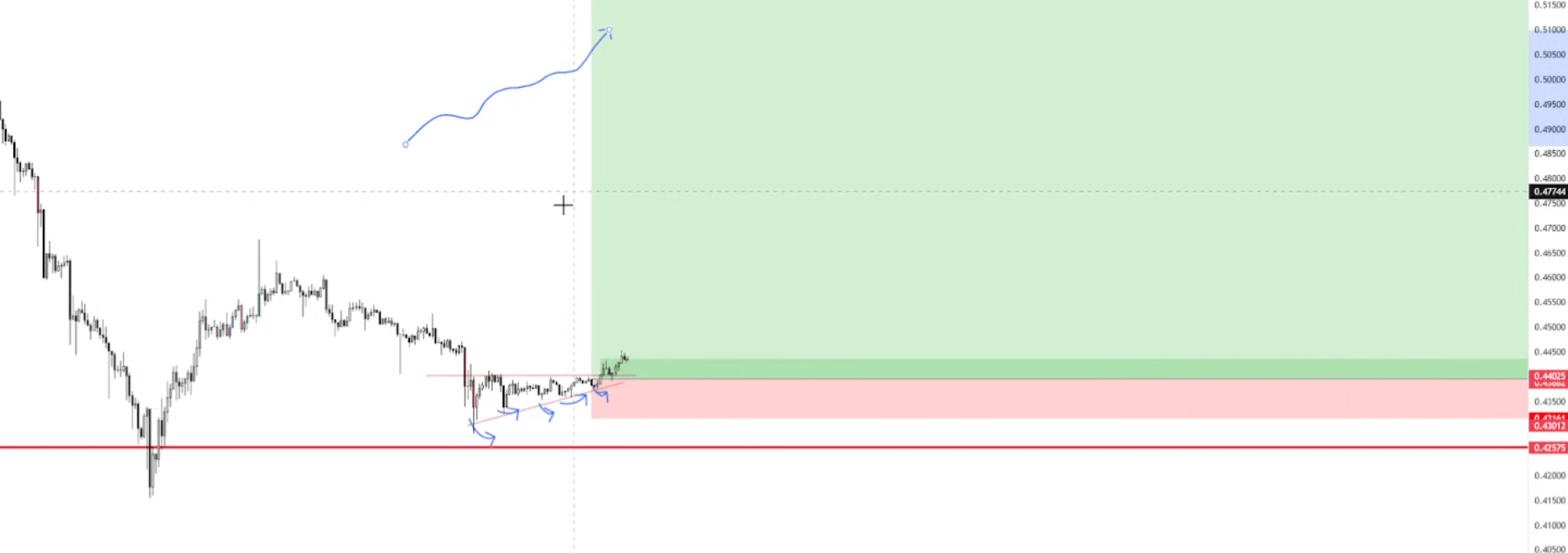

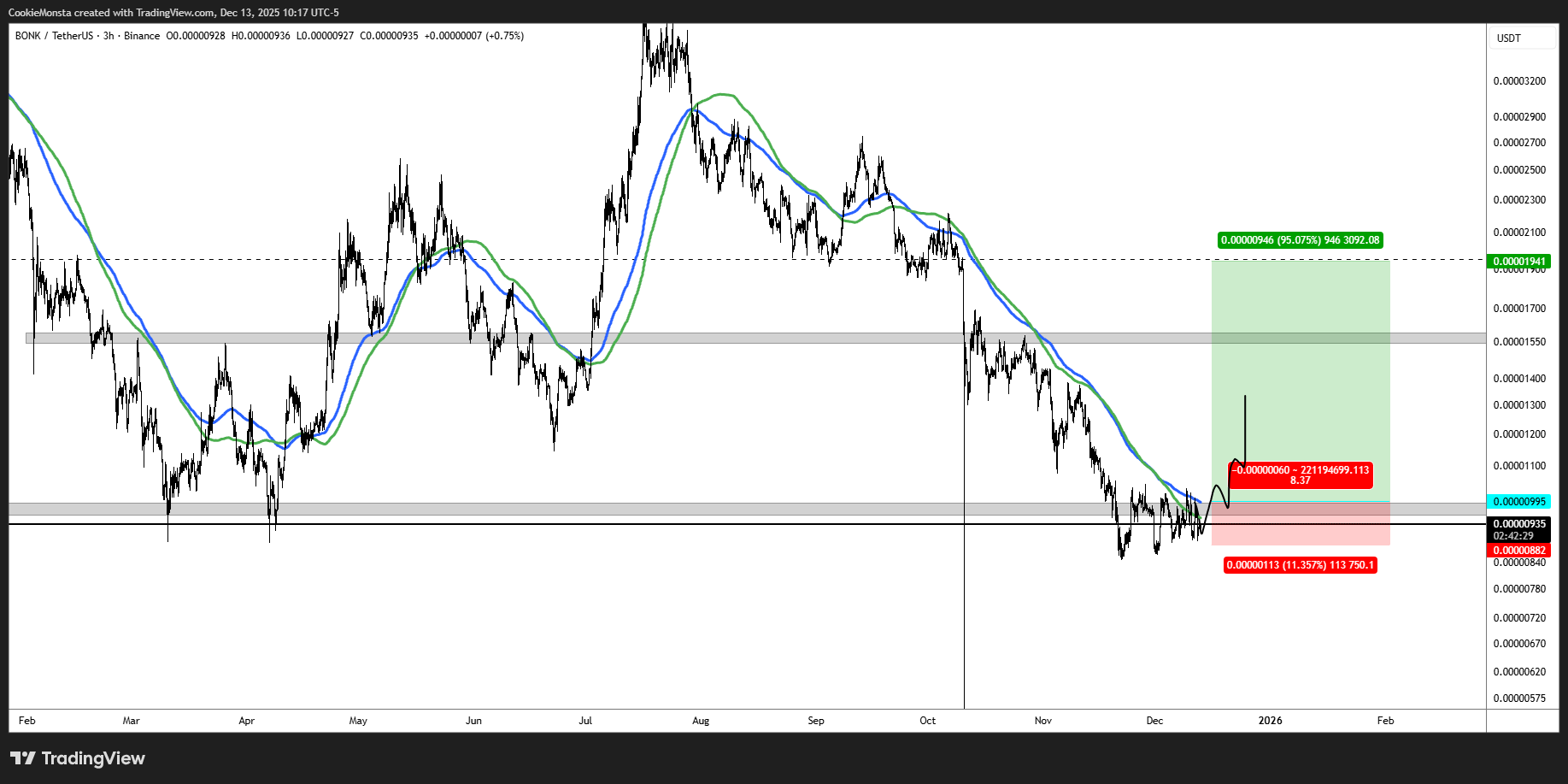

Coins like BONK or PEPE are great recent examples of what to look for in the altcoin market.

Assets that have downtrended an egregious amount, but have reclaimed key trends for the first time in months.

Violent moves down often mean violent moves up (and vice versa).

And we’re finally getting triggers for that shift.

The BONK setup below is an example of the kind of trade I've been looking for with the mantra, "No trigger, no trade".

Just waiting patiently for the downtrend to exhaust before making my move.

When reclaims like this occur, it's logical to aim bigger.

50-100% moves are not so farfetched, as the previous selloff was -90% for many of these alts.

In addition to the initial breakout trade on alts like BONK and PEPE, which have already triggered, continuation setups are perfectly valid, assuming we pull back enough for them to trigger.

Even if those pullbacks don't come, I imagine we'll see similar setups on other coins in the coming weeks.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.

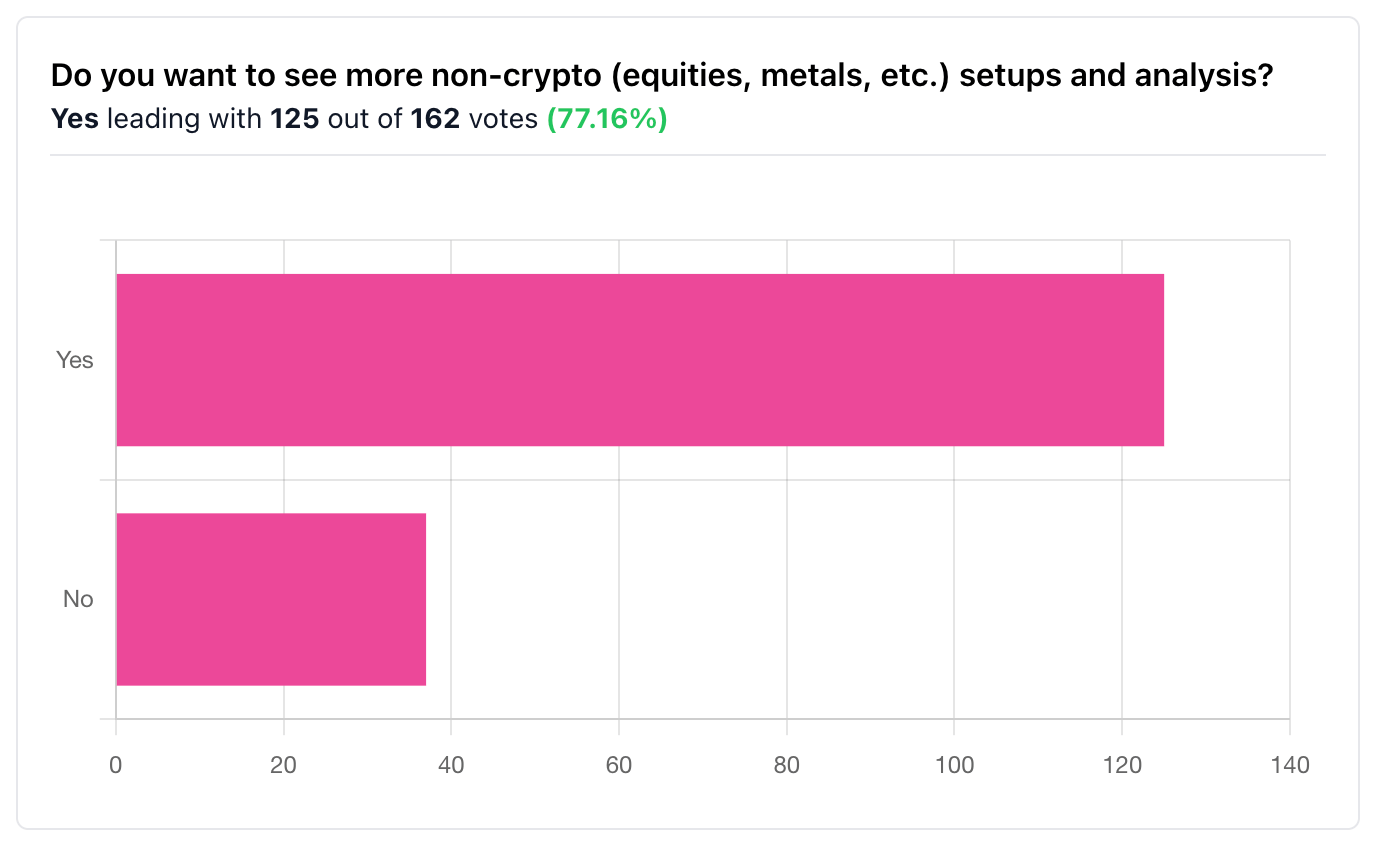

P.P.S. Thanks for participating in last edition’s poll. You’ll be the first to know if the guys cook up some TradFi setups (stocks, metals, etc).

What some of you said:

“I never leave feedback but this is the only 'newsletter' that has retained my attention over an extended period. I find the succinct format coupled with multiple viewpoints/opinions, each supported by differing strategies, very informative. Very much enjoy it. Great work!”

“I love the simplicity of cookbook, but more markets mean more options when crypto has zero volume.”