- CookBook

- Posts

- My last outlook of the year

My last outlook of the year

Plus, the institutional tool you should know

In today’s edition we have:

Magus — My last outlook of the year

Doc — Key levels and what I’m watching

Charlie — Holiday time

Stoic — The institutional tool you should know

Mercury — When the range becomes a breakout

Do you want to see more non-crypto (equities, metals, etc.) setups and analysis?(click/tap below) |

Magus | My last outlook of the year |

I’m not planning on trading much this week, but I expect things to heat up in Q1, so get ready to work going into the new year next week.

Return of the Vol

BTC is chopping, the suits are on holiday and liquidity & volatility are flatlining.

Not a great intraday trading environment right now, but I’m confident that will all change soon.

Keeping it simple:

The year opens. People get horny to make money. When people want to trade, price moves. That gives us opportunity.

Because the year opens mid-week, I'll be paying attention to flows the days going into New Year's. That's when front-running could begin.

My ideal scenario

Drift upwards into year-end, sell off sometime in January, then long that dip.

I don’t want to see the year open and just go straight up. Those rallies rarely last (early 2023 was an exception).

I want to see early longs pressured, then buy into their selling.

Caveat: You don’t always get the ideal scenario, so we adjust.

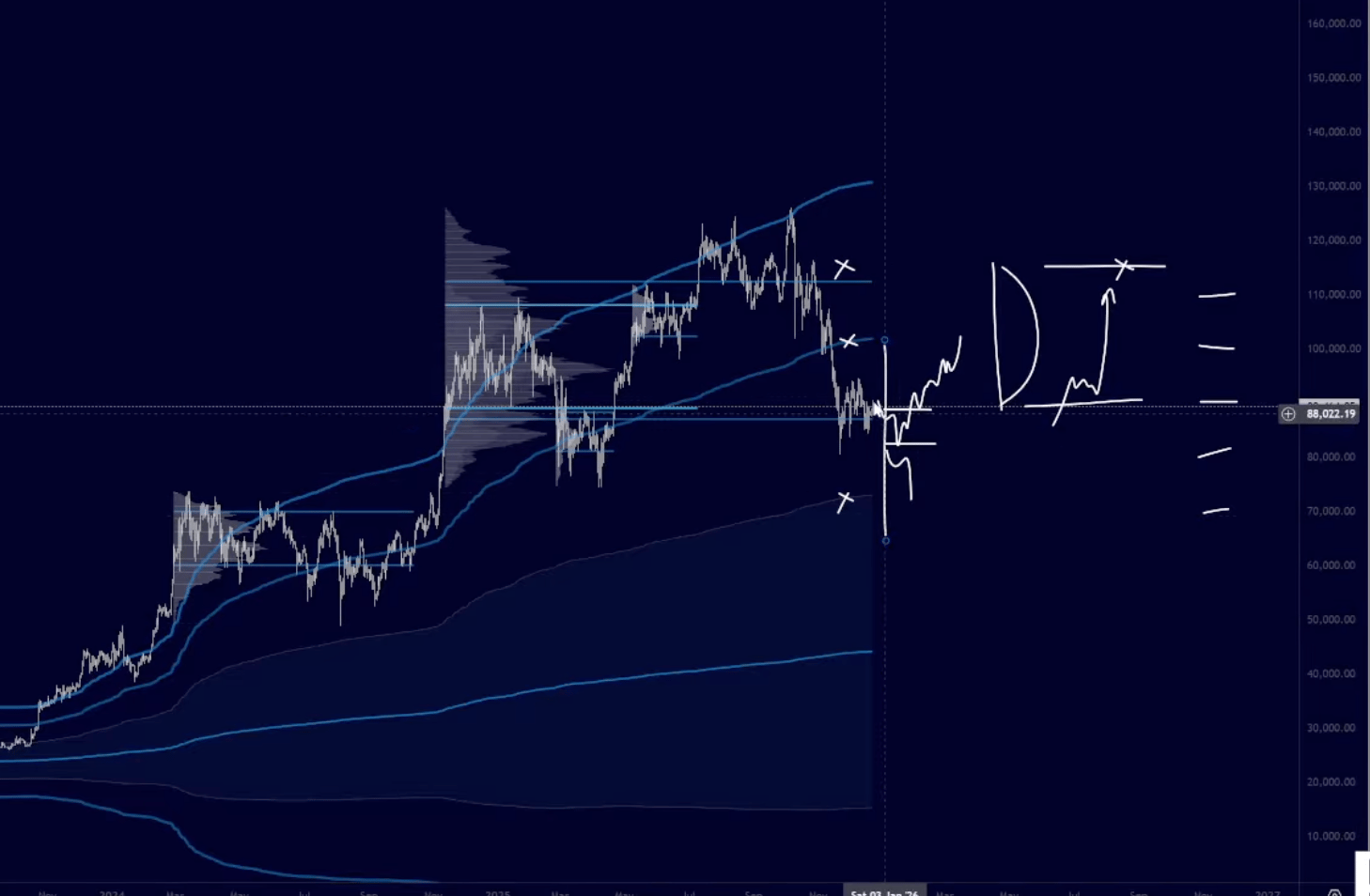

Medium timeframe

rolling VWAPs: yearly (green), quarterly (red), monthly (blue), weekly (white)

The local range came in higher than I expected.

Thought the value area high would be around 88k, but it's showing more signs of life and it’s at 91.7k instead.

We're moving in the direction of flipping the 30-day VWAP, which has been great for trend recognition since 2023.

Quick TradFi scan

SPX looks insane. NAS same. Ridiculously overextended from the tariff lows, but politicians want this stuff up, so we dance while the music plays.

I’m looking to send some swings in TradFi in 2026 with precious and rare earth metals high on my watchlist.

TLDR

Not trading low liquidity holiday period

Volatility and momentum to return to Bitcoin in Q1

Watching flows going into New Year’s for signs of shift to momentum regime

Gun-to-head: more likely to resolve higher than lower from here, but highest ev is betting on deadcat (i.e. lower macro high)

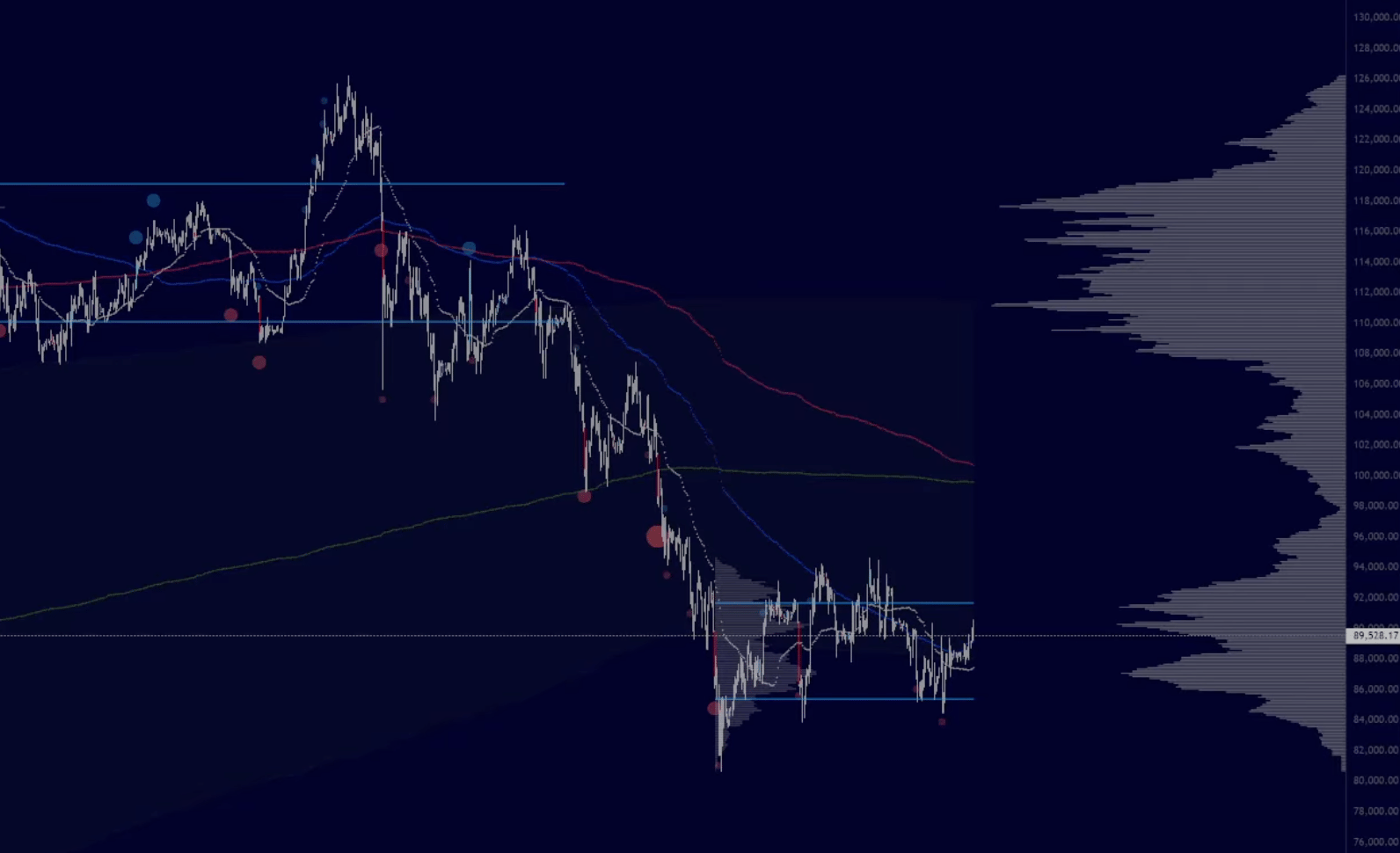

Doc | Key levels and what I’m watching |

I just got back from vacation and we have the holidays this week so I’m taking it slow.

Here’s what I’m watching

Exact same range that we mapped out almost a month ago still in play.

The 30d rolling VWAP is flattened out telling us we’re in a ranging regime (not trending).

90k is the key local level to accept above (previous week VAL).

Spot been heavy this morning over 89k with orderbook skews neutral/bearish.

We need active buyers to press us through ask walls and for effort to be rewarded to see continuation up.

CME gaps above an below price: 87.8k, 92.8k

Key levels

86k should be protected (comp VAL + pwVAL)

Acceptance over 90k should bring 94k (need active buyers to be rewarded in this region)

Acceptance over 94k should bring 100/102k (same thing)

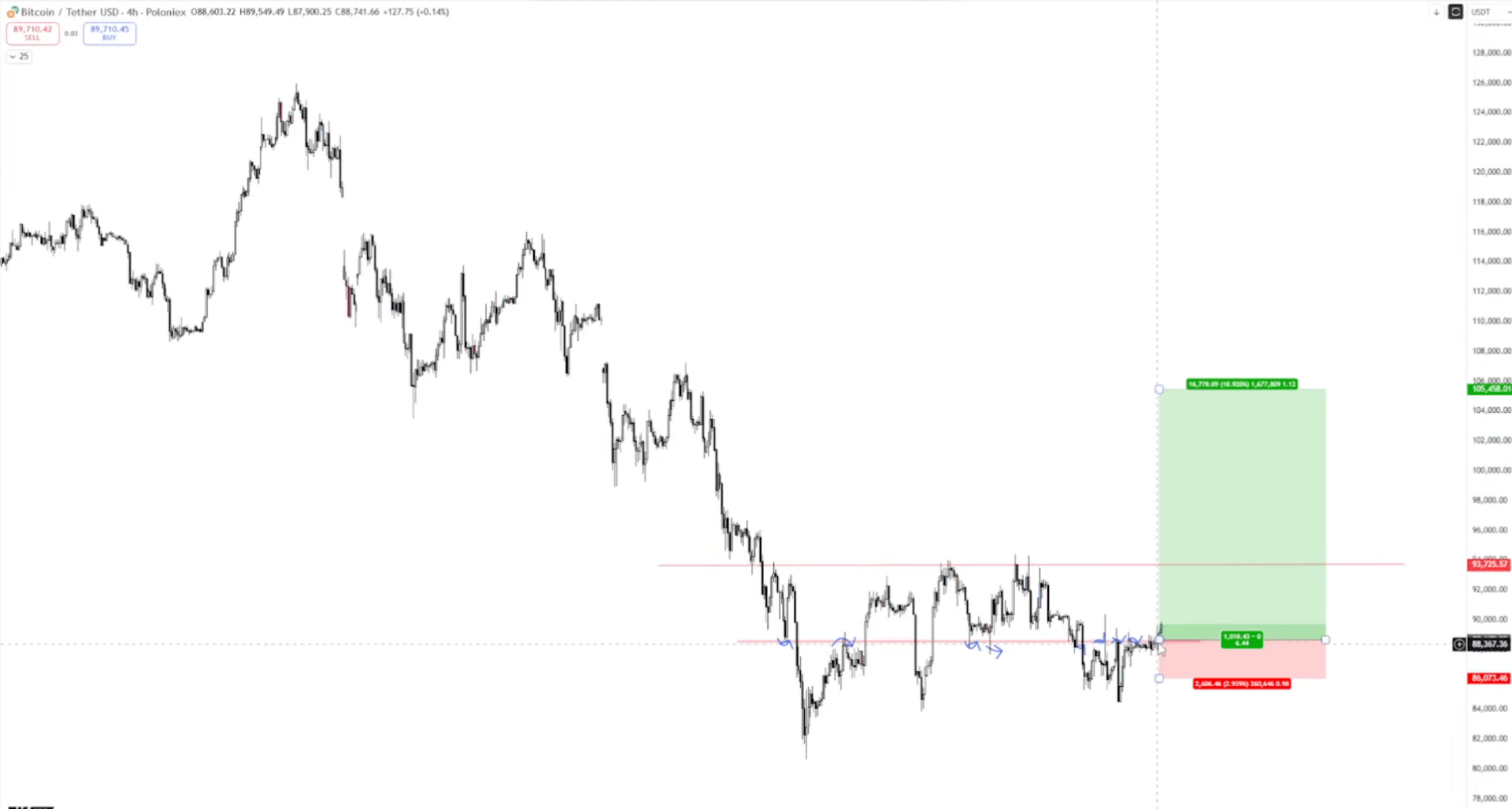

Charlie | Holiday time & the upcoming test |

Keeping this quick as the whole world is wound down for the holidays and there's not much to talk about.

BTC structure

All I see on Bitcoin is hopefully a higher low, but the real test is at 110k.

If we reject from there, game over. If we reclaim 110k, we head to Valhalla.

The 110k rejection is more likely, but we could still get some good rotations in the run-up to a lower macro high.

As for BTC, here’s a the setup I might take if I didn’t already have spot.

Intraday bias

As long as we're above 88.5k, I'm bullish intraday. Even a move up to local highs gives some decent rotations on alts.

But I'm unlikely to catch any of them as I’m wound down for Christmas and it’s hard to justify sitting at the PC.

Alt setups

ZEC has a series of higher lows heading into support. Clean invalidation.

You can be aggressive and widen your stop for wiggle room, or play for the breakout. If you lose the diagonal, it's over.

FARTCOIN is stronger on this rotation, but the PA is slow and choppy.

Not getting big moves, and when you do break out it’s for a couple percent or retests your entry.

I don't feel like I'm missing anything, put it that way.

TLDR

It's just a boring market.

Until Bitcoin accelerates properly, there's not much to trade. I'll be looking at TradFi more in 2026 for better volatility.

Happy Christmas.

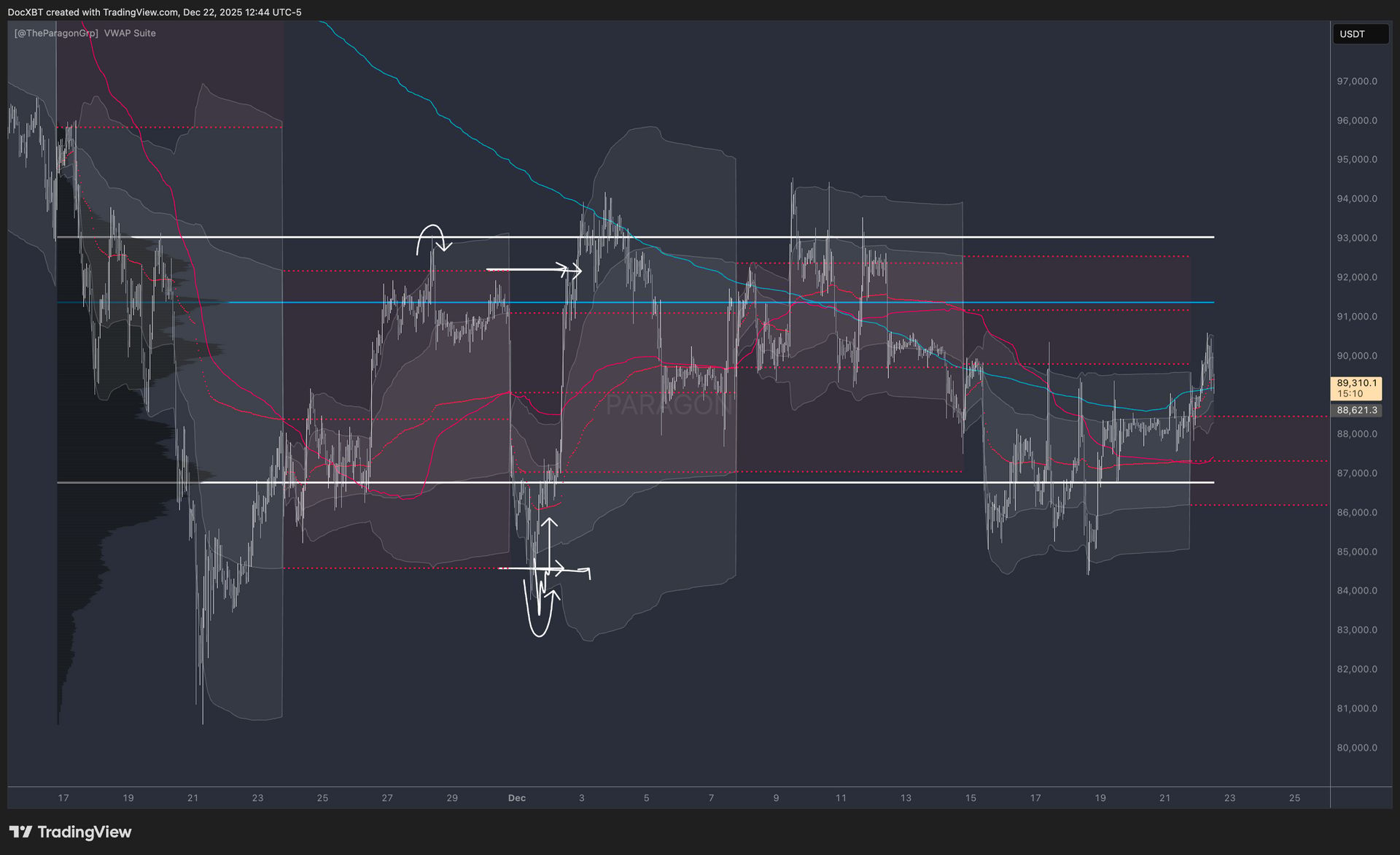

Stoic | The institutional tool you should know |

Stepping back from market structure this week to cover VWAPs, a foundational tool in my trading system.

VWAPs matter because they’re one of the preferred analysis tools for institutions, and they’re making up more and more of BTC flows.

Seeing who is in control

VWAP shows who's in control at any given time.

Price above = buyers/bulls in control

Price below = sellers/bears in control

Think of the VWAP as the front line of a battlefield.

In a sustained downtrend, an anchored VWAP is the line where buyers need to come in and overthrow sellers for a shift in power.

This is how you identify regime shifts from bear to bull.

Types of VWAPs

Anchored – Discretionary. You select the anchor point that you deem as significant turning point (e.g. swing highs/lows, start of trend, major news event, etc).

Time-Based – Resets on fixed periods (yearly, quarterly, monthly, weekly, daily).

Rolling – No reset. I use 7d and 30d rolling heavily for trend recognition and regime context.

Multi-timeframe approach

Look at VWAPs across timeframes to see who is in control on different time horizons. Good for quick scans and areas of interest.

Standard deviation bands are useful for trending assets. Observe reactions at these bands. With confluence, they present entries and potential exits.

TLDR

VWAPs determine who's in control and mark key areas on the battlefield.

Mercury | When the range becomes a breakout |

This isn't a reclaim yet, but it's getting interesting.

If we reclaim the 4H 200MAs, my bias shifts from "anticipating range, with possibility of breakout" to "anticipating breakout, with possibility of range."

Any push into local range highs from here would be more favorable for breakout than previous tests because we'd be above the HTF trend this time.

Previous tests came from below it.

The $100k Setup

If we break out of this range entirely, I'd be looking for a larger relief rally toward $100k.

That region is the key inflection point. The 2D 200MAs and 12H 200MAs converge there, which guide my HTF bias.

Above that zone, and I treat this like a bull market.

Below it, bear market rules apply.

It’s a simple framework, but it keeps me from fighting the trend.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.