- CookBook

- Posts

- 100k or 70k?

100k or 70k?

Plans & setups on BTC and alts

In today’s edition we have:

Magus — Patient and clicking buttons

Doc — My line in the sand

Charlie — S-tier setups only

Stoic — Observing this level

Mercury — Watching for a snowball of strength

Magus | Patient and clicking buttons |

All right, my friends, here’s the quick TLDR:

I still think the macro uptrend is intact, but the next few weeks will be telling.

We've set our local low at 80k and are now likely building a range between 88k and 80k.

Below 80k takes us to 71k.

Above 88k opens up 100k, then 110k, etc.

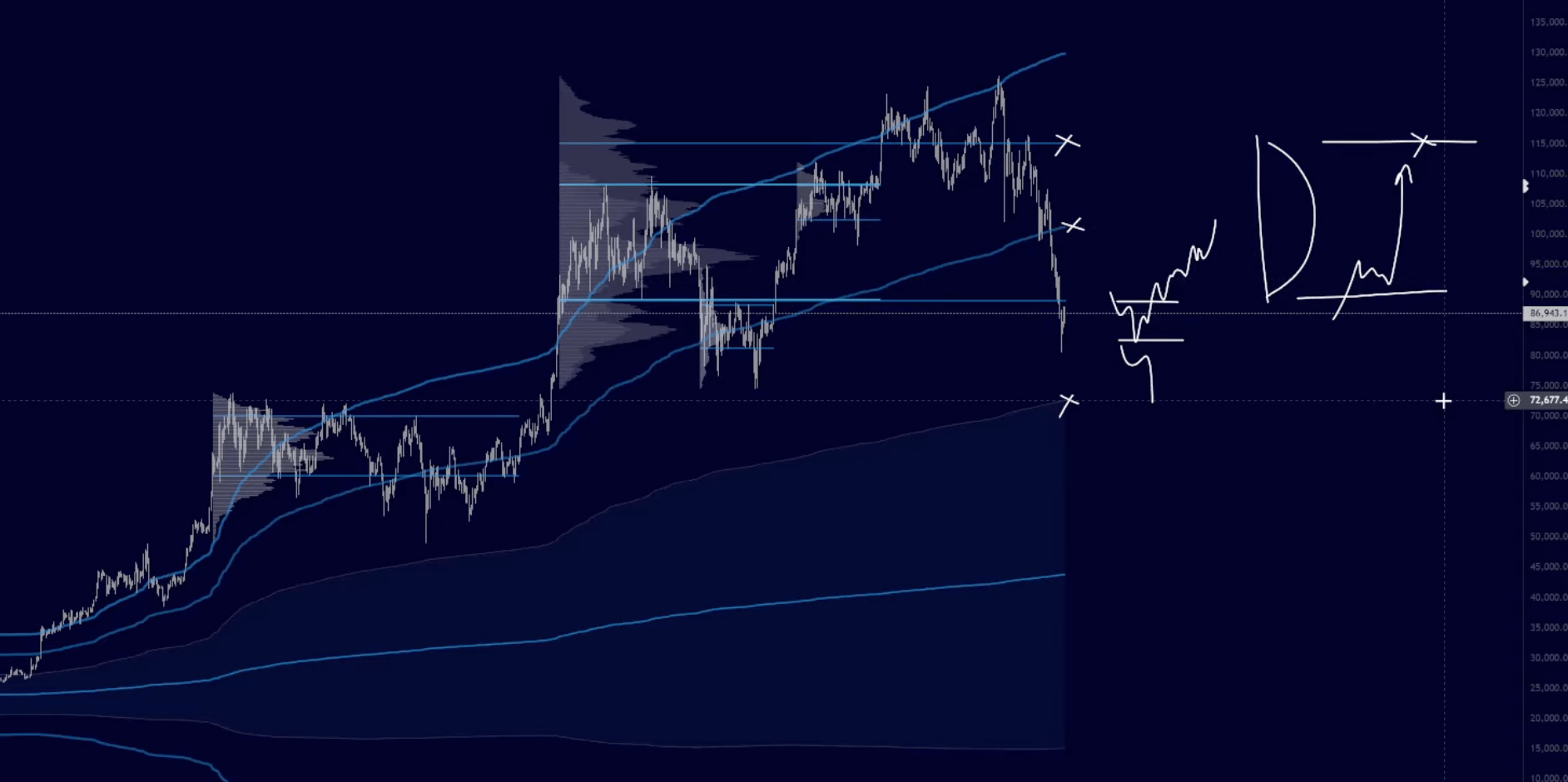

Medium timeframe

After a high volatility move like we just had, sideways usually follows. Then we either break up from 88k or down from 80k.

Maintaining patience. No FOMO.

I'm fine clicking buttons on intraday until better opportunities come.

TLDR

still believe macro uptrend intact despite extreme pullback

all VWAPs bearish, waiting for structural shift

expect 80k-88k range

below 80k → 71k target

above 88k → 90k, 100k, 110k, 120k path (round numbers)

waiting game to see if we reclaim range or accept below

Accumulate chips. Play the long game.

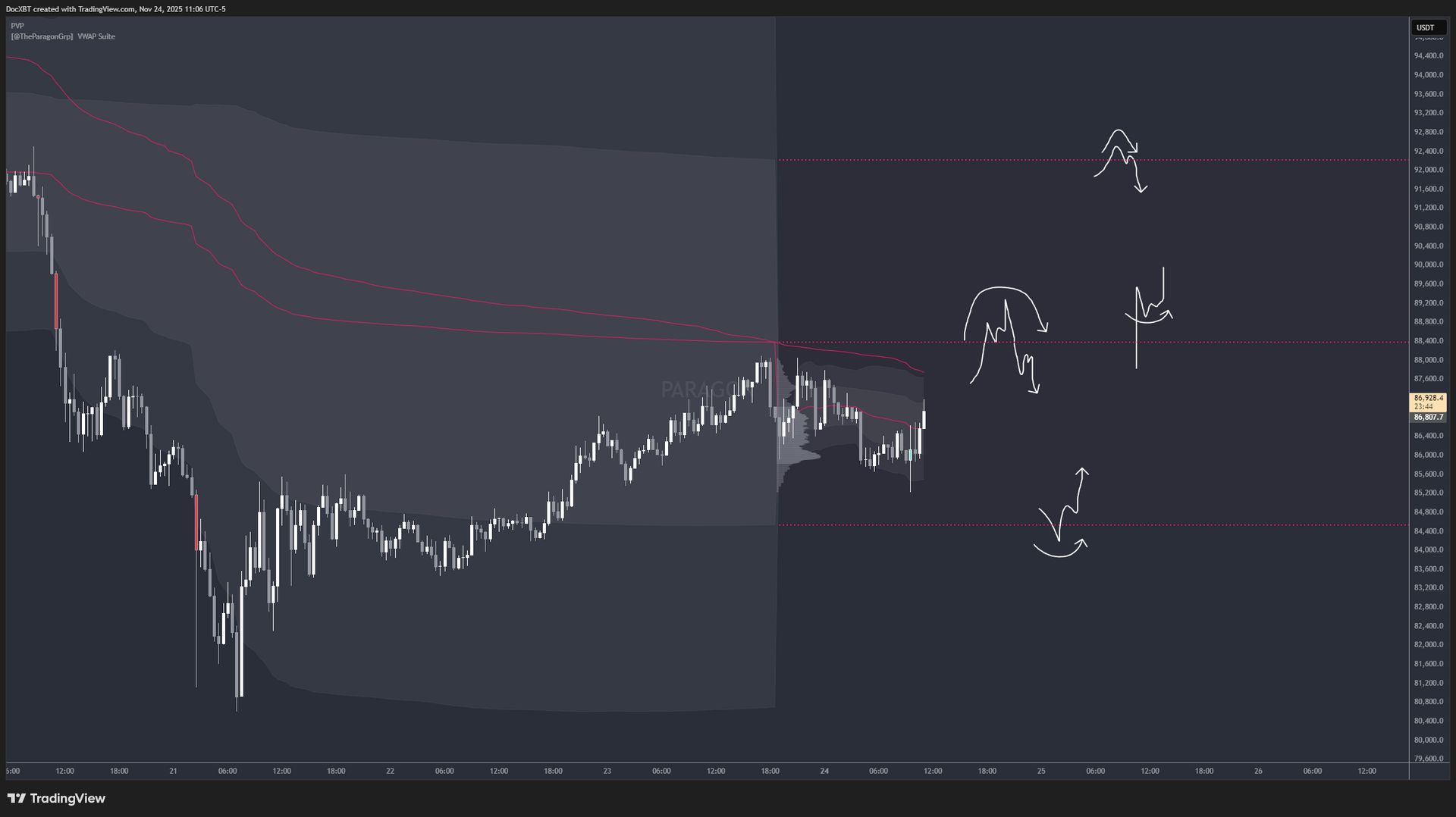

Doc | My line in the sand |

We had a good bounce over the weekend.

Here are the levels and plans I’m working with going into this week…

Week plans

88k is a massive level for a lot of reasons:

Top of our composite value (i.e. range) from March and April

Yearly value area low

Monthly value area low

Previous week's VWAP

H4 trend

My plans are built around this level and the previous week’s VWAP & value area. Here are the setups I’m looking to take.

If we reject from 88k, I’ll look to long prev. week VAL around 84.5k

If we get above the 88k VWAP but accept back below, I’ll look to short

If we get strong clearance above 88k I’ll look to long a shallow retrace

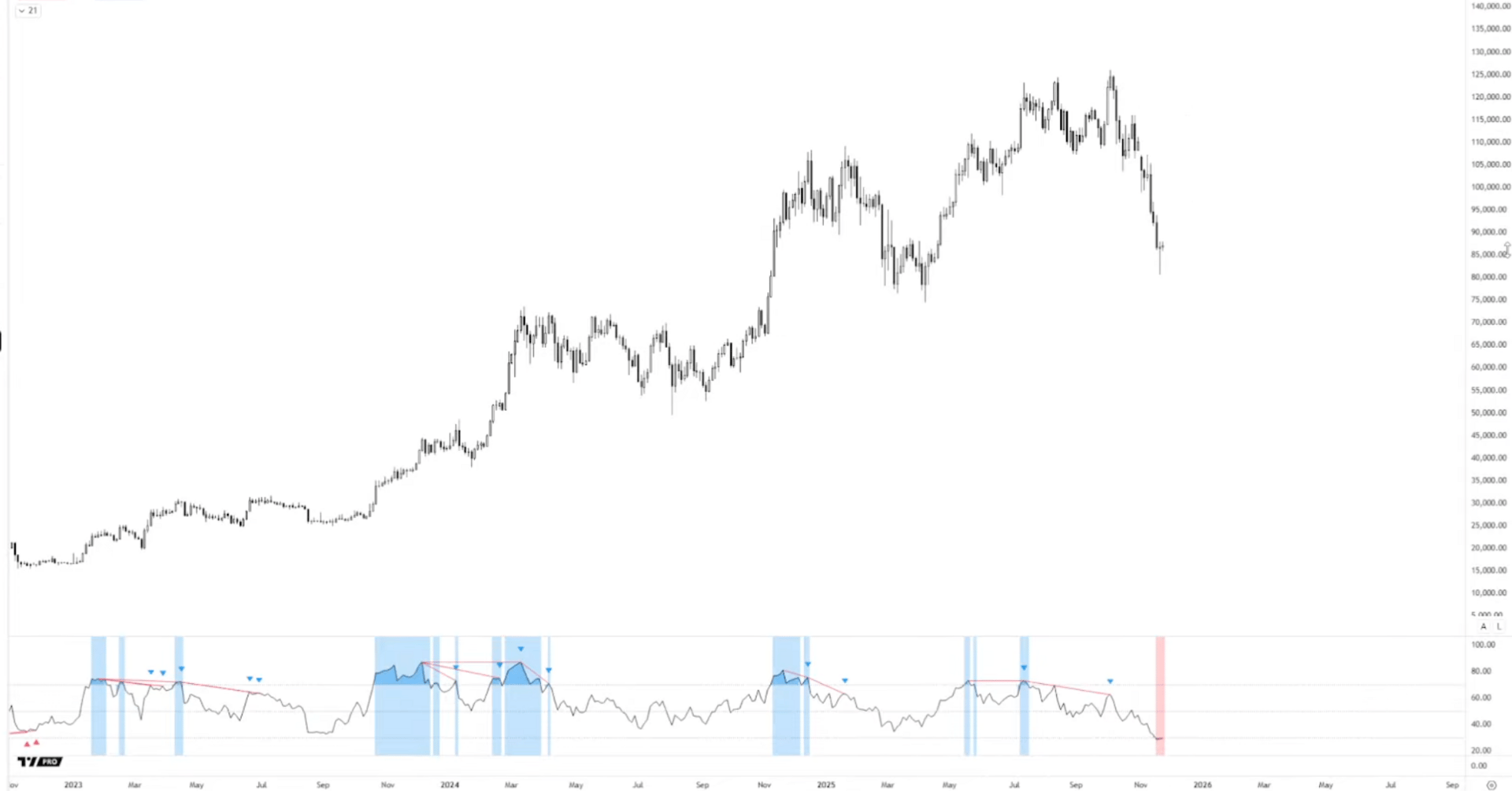

High timeframe plans & expectations

The same pattern on the high timeframe keeps repeating: short bouts of high volatility followed by range-bound conditions for months.

Rinse and repeat.

It sounds simple, but a lot of participants have not adapted.

If you can maintain discipline, you can be on the right side of these trades by simply buying at a discount and selling at a premium of the range.

And now that Bitcoin's daily RSI has hit the low 20s, which indicates high volatility, and has not happened often in Bitcoin's history, what do you expect price action to be like?

Rangebound.

Likely for months, followed by another break of value.

Make your plans accordingly.

Charlie | S-tier setups only |

While I think the majority of the down move is done, I'm fairly cautious and only looking to take the best setups for quick rotations. Not interested in holding big swings.

BTC tagged extreme lows on 2-day, 3-day RSI. After moves like this you usually get volatility compression afterwards, so I'm not expecting us to just insta bounce. Ranging is more likely.

That said, alts are down so bad that sentiment shift could produce strong rotations. Here’s what I’m looking at.

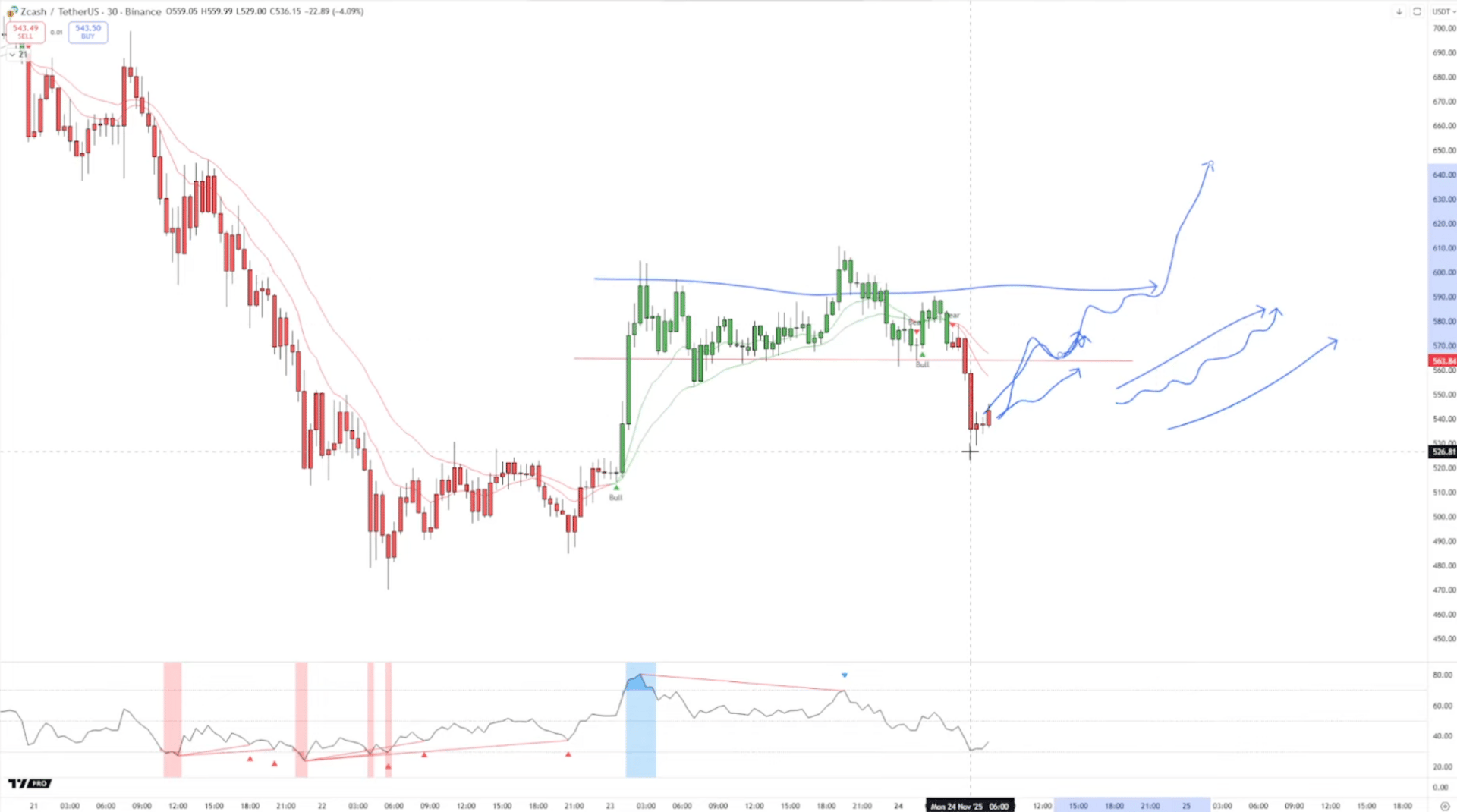

ZEC

ZEC remains one of the most interesting assets, which isn’t that hard when most coins look like hot garbage.

I’d be looking for a reclaim or breakout of this recent consolidation to long.

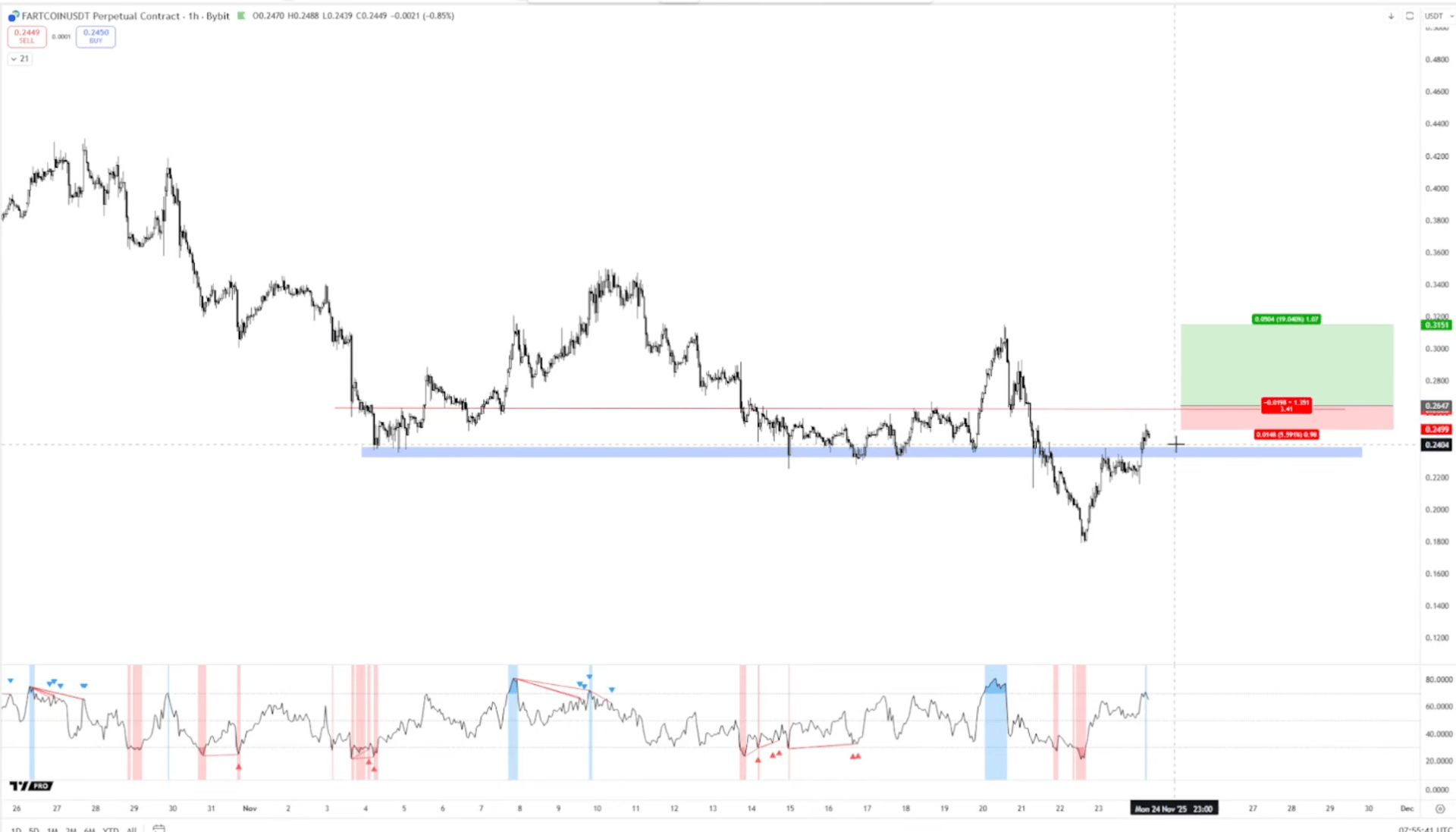

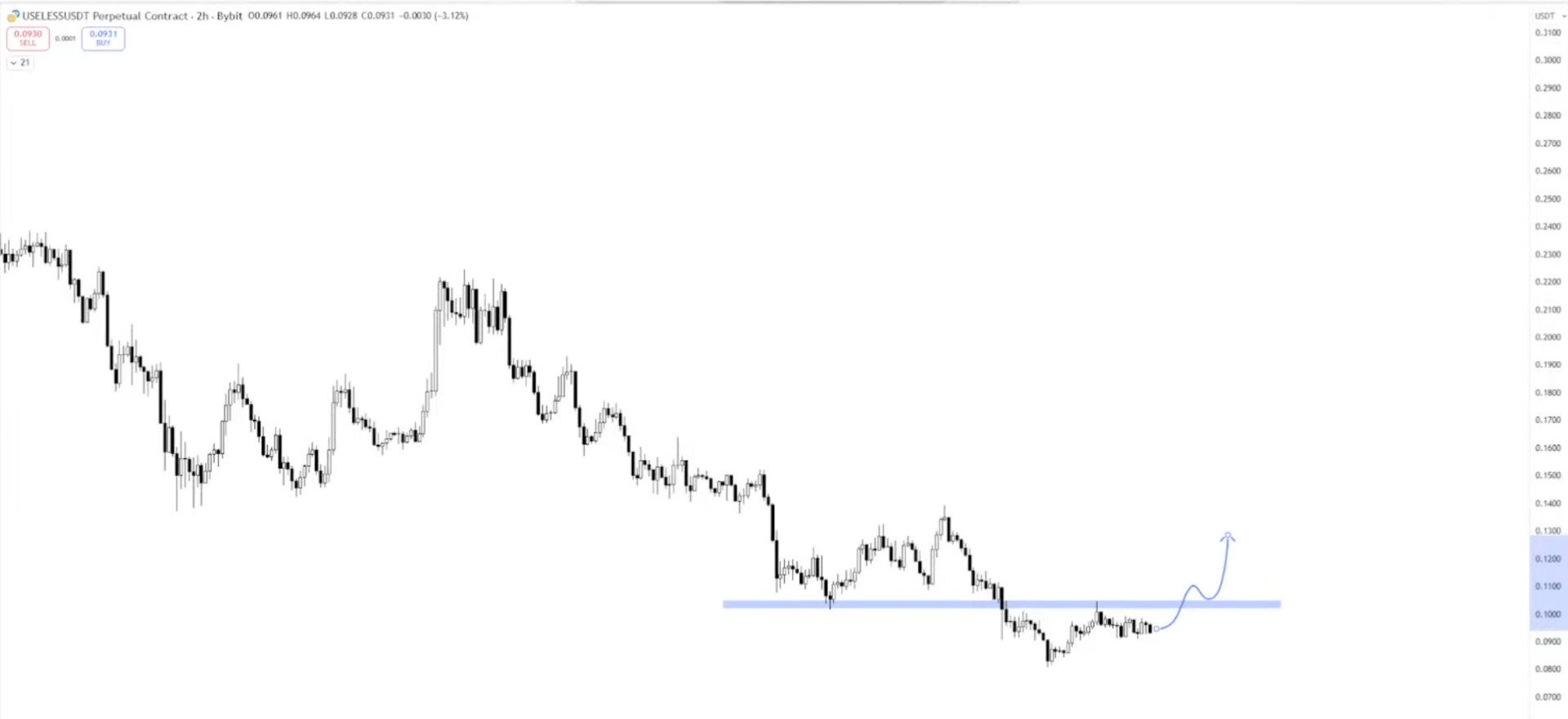

FARTCOIN & USELESS

These are good risk-on signals for rotations.

They’ve probably already moved by the time this newsletter is out but it’s worth keeping these on your spaghetti as a proxy for risk rotations.

TLDR

Expecting ranging/consolidation after RSI extremes, not V-reversal

Being selective; S-tier setups only

Focusing on rotations, not swings, quick in/out, taking profits fast

Alts down so bad that sentiment shift could produce strong rotations

Stoic | Observing this level |

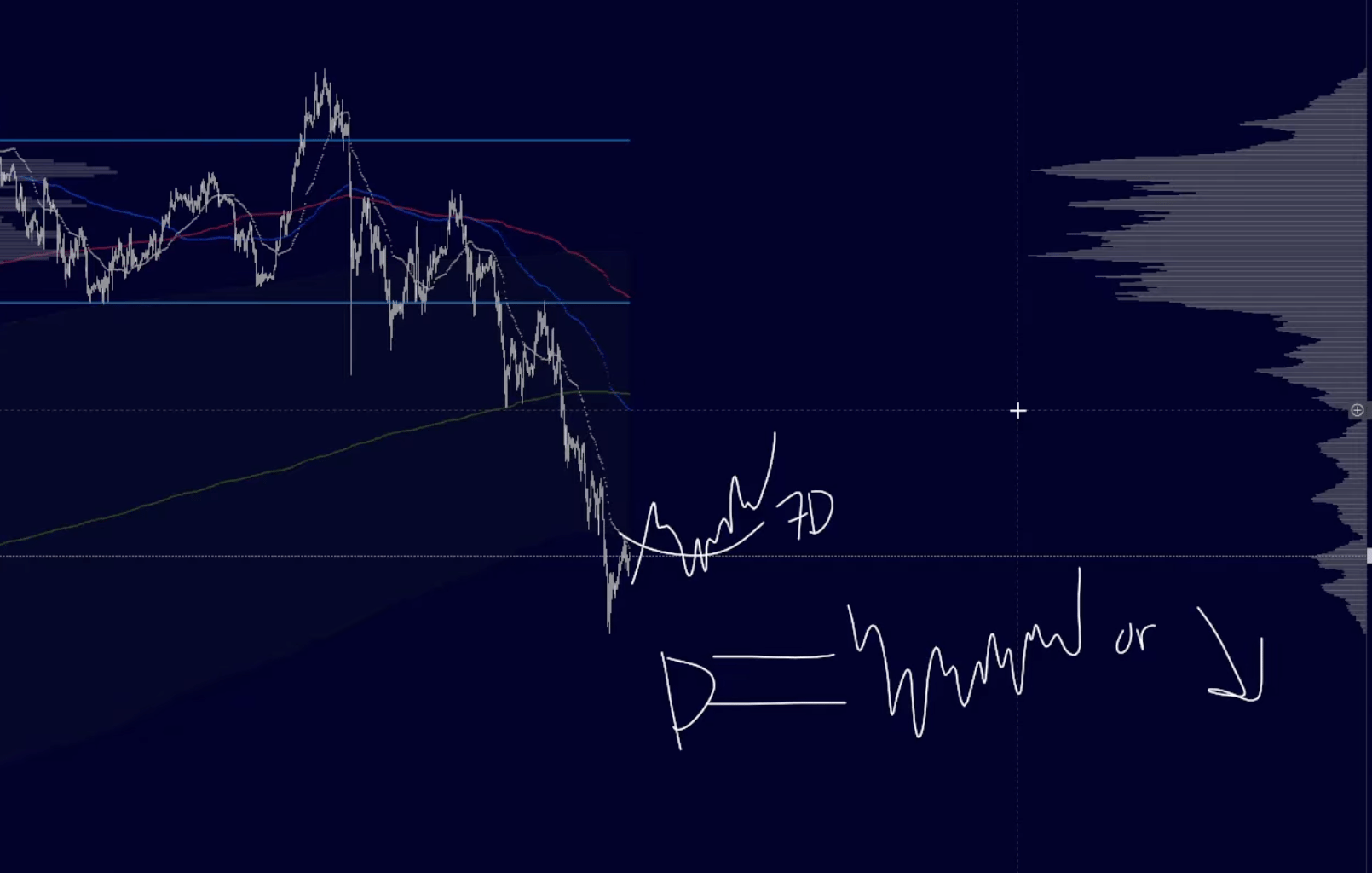

High timeframe

BTC has decisively lost the trend on the D3 chart.

It’s currently trading into the composite that sparked the initiation to all-time highs, which is why this area is pivotal.

This general area could set up for some interim reversion if the bottom is defended.

Below here, I’d expect price to trade back towards the 8-month value developed in 2024 in the 70k-60k region.

Medium timeframe

The H4 trend has been a reliable indicator for the current downtrend. Since its loss in early October BTC has failed to reclaim it decisively.

BTC has to break it for any chance of further upside. So far, spot has been selling into it relentlessly.

Lower timeframe

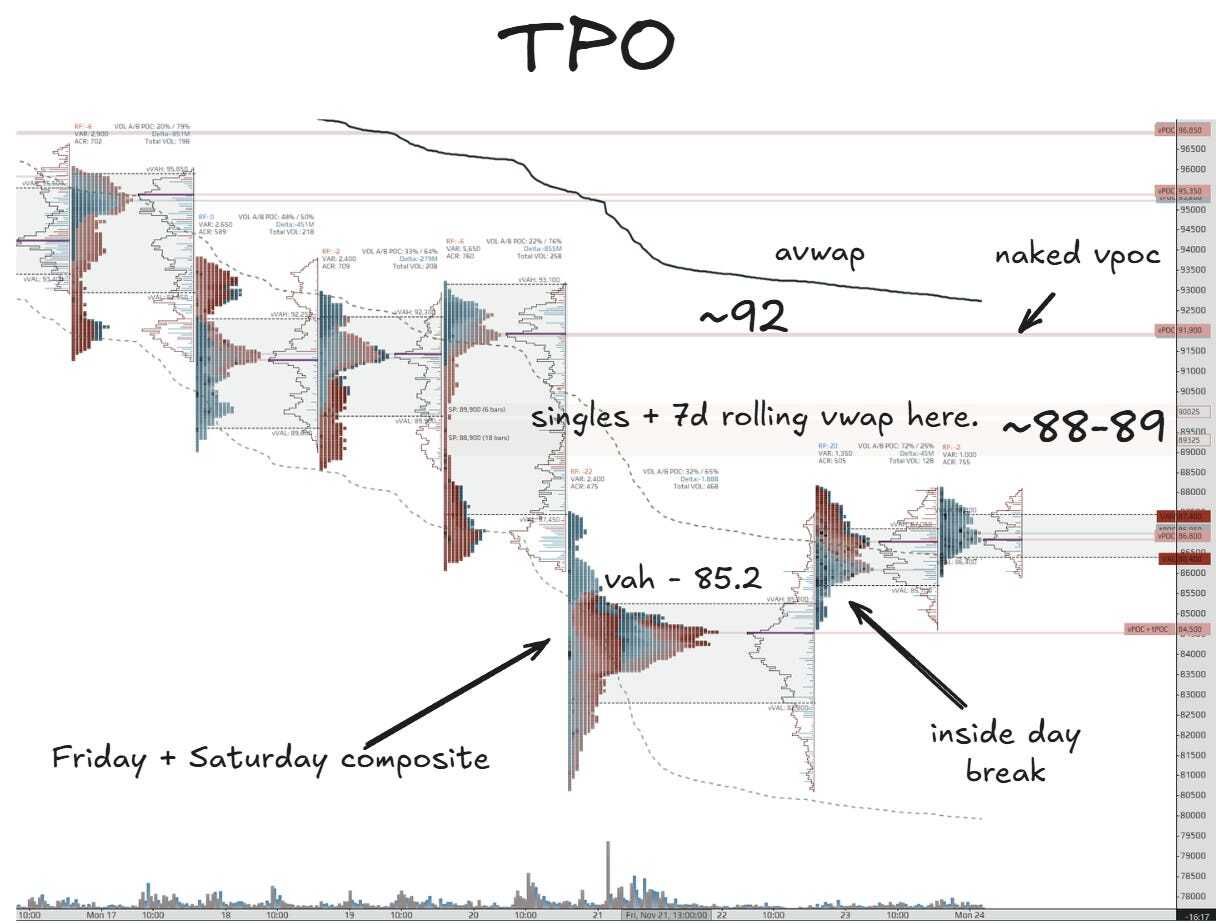

Zooming in, the TPO shows BTC breaking from the Friday + Saturday composite VAH at 85.2k during Sunday’s session.

The first area to look for acceptance or rejection are the high 80s, which has several overlapping confluences: singles, 7d rolling VWAP and prior consolidation value area high.

TLDR

BTC is in a downtrend

If 85k holds: watching for a bounce to fade (short opportunity)

Break above high 80s could open low-mid 90s

Need real spot buying for any bounce to last

Otherwise: expect drift back down to find buyers

Mercury | Watching for a snowball of strength |

I’ve been using the 30m 200 MAs to gauge the market on a more actionable scale, and we can see BTC coiling up right around them.

This is the same trend I’ve used throughout the past 3 months to get a deeper understanding of the local context, so reclaiming it would be the first signal of true strength.

I’m watching this region for a convincing reclaim to justify a larger relief rally toward 92k.

If that occurs, and 92k resistance is flipped into support, I can look for that same rally to extend further, toward the H4 200 MAs around 100k.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.