- CookBook

- Posts

- This will define BTC's path

This will define BTC's path

Where the volatility is right now

In today’s edition we have:

Magus — Q1 will define Bitcoin's path

Doc — What comes after____?

Charlie — Where the volatility is right now

Stoic — How to “make it”

Mercury — Yes, yes I am

Magus | Q1 will define Bitcoin's path |

This week I’ll be winding down a lot of my active trading to focus on year-end review and 2026 prep.

I know it's not easy to look back on tough years, but push through the pain of facing your mistakes. That's when you grow.

Let’s take a look at BTC.

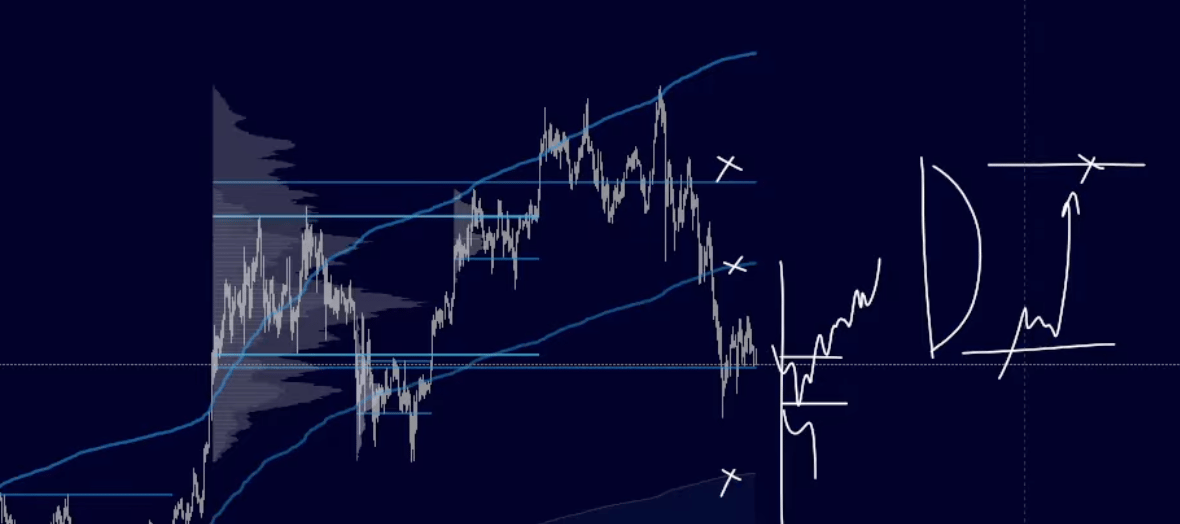

The macro range

We've been building out this 110k-88k range for over a year now, which by now shouldn’t seem strange to you.

Bitcoin goes sideways 85-90% of the time, then sends in short bursts.

I expect us to trade toward range lows, then fight to reclaim levels in Q1.

Q1 is going to be key

Bitcoin has underperformed other risk assets for the first time in years.

If we don't see some relative strength in Q1, allocators will rotate away and BTC will struggle for a while.

I don't need it to be the strongest asset, but I need to see buyers.

100k is the psychological level.

Above it brings faint optimism. Below it and everyone assumes a bear market.

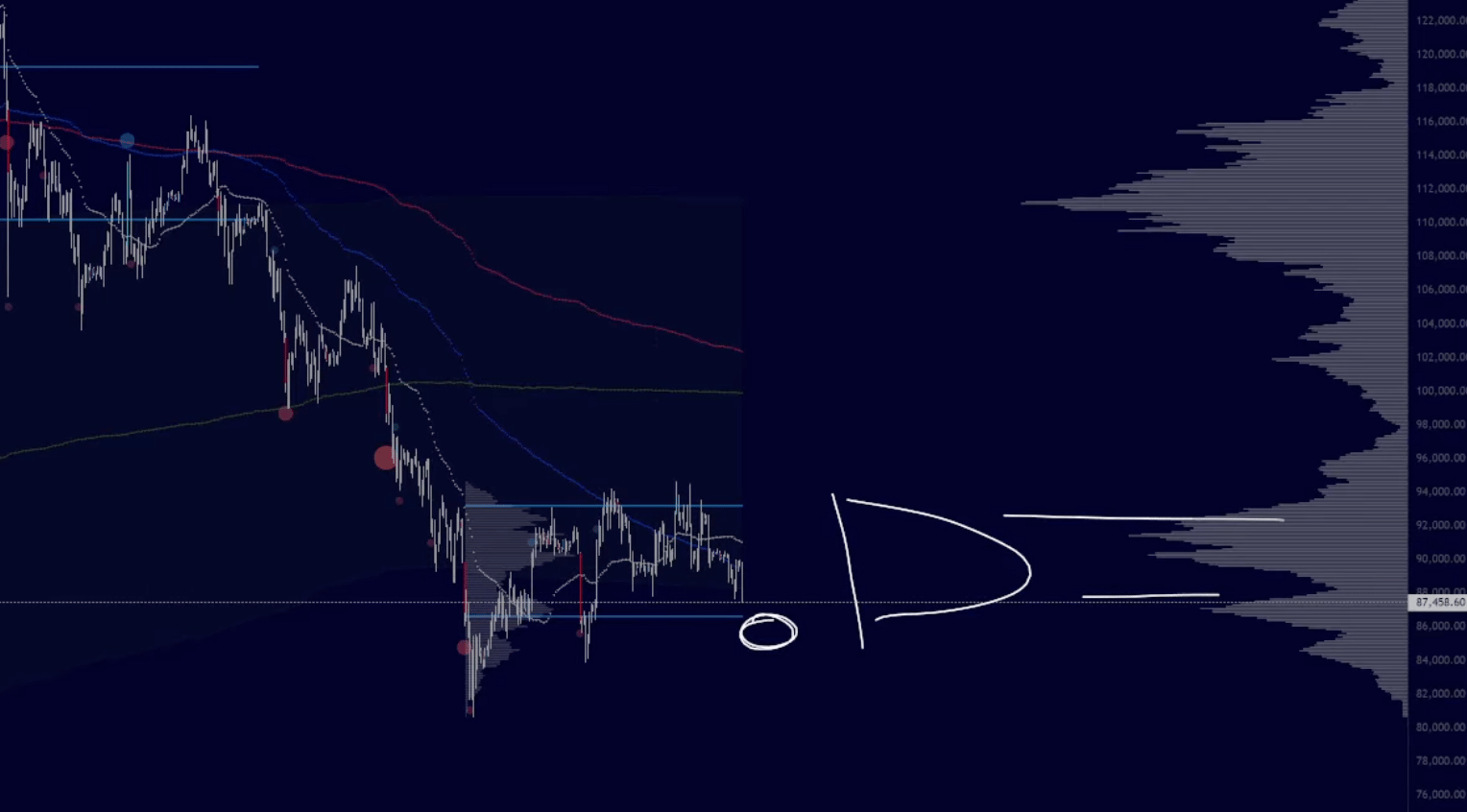

Medium timeframe

We’ve seen some momentum loss to the downside but it’s still not the bottoming structure I look for, that rounding out I always yap about.

I’m looking for another selloff toward 84-85k then a potential bounce toward 92k resistance.

So I expect more weakness, but I’m looking for reasons to get long. I just need to see the structure shift (and ideally a quick selloff).

Year-end & 2026 plans

I’m still positioned in Bitcoin, S&P, NASDAQ, silver.

Considering rebalancing toward gold, some rare earth metals and more equity index exposure.

Doing my year-end review (watch for it in the coming weeks).

Spending time with family and disconnecting a bit so I can hit Q1 hard from day one.

Doc | What comes after____? |

Guys, I said weeks ago that I expect rangebound price action for a while.

Journal about BTC’s behavior so you can adjust, avoid getting chopped, and even enjoy it.

Charlie | Where the volatility is right now |

If it were up to me, I'd take Christmas off and do nothing, but I'm trading for you guys.

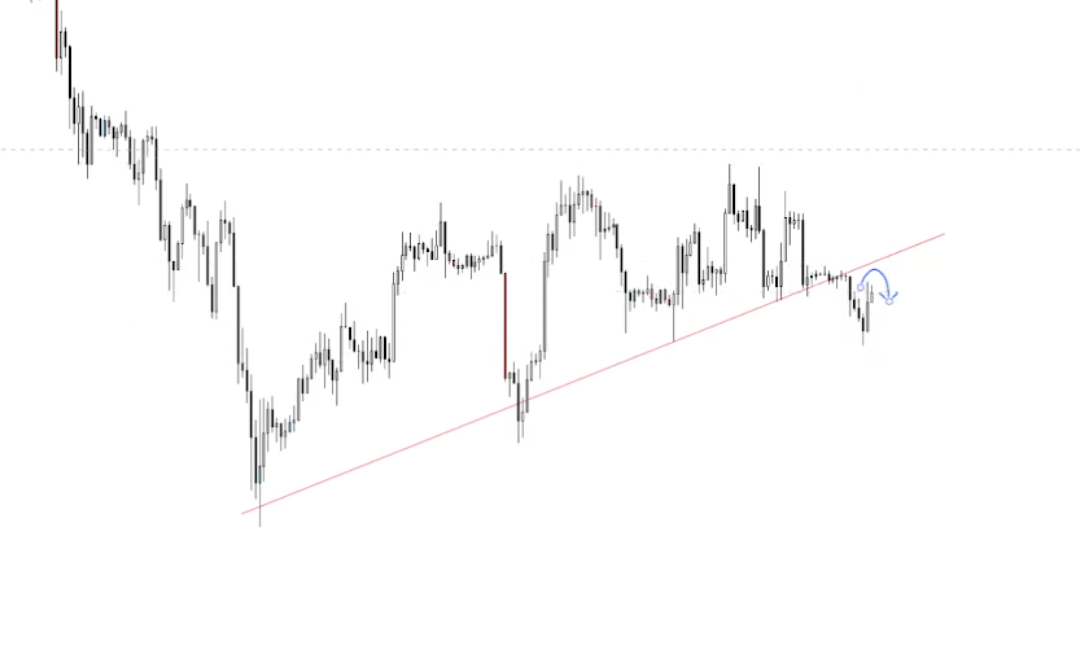

Bitcoin has been chopping around, and we just lost the local bull memeline setting a lower low.

So this looks like the bearish retest before a leg down.

TLDR; Things get interesting above 94k. Until then, chop.

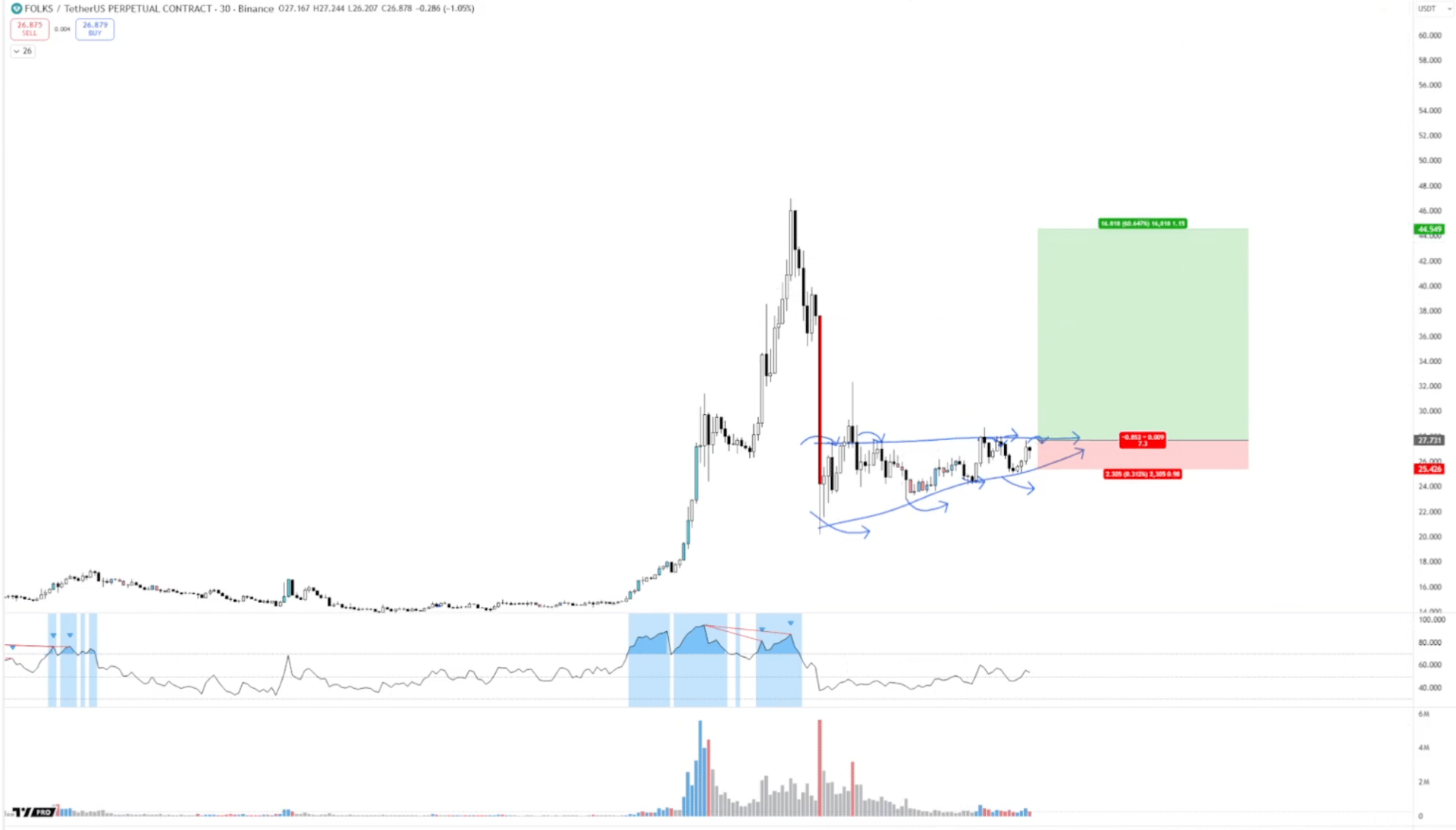

Finding volatility

When the market gets dull enough, the only volatility left is in heavily supply-controlled coins that can do 5% moves in a minute.

So trading these is playing with fire and I size accordingly (i.e. smaller).

PIPPIN

I’m looking for the same pattern over and over: meme triangle with higher lows compressing into resistance above.

I set an alert at the breakout trigger, then see if its strong on spaghetti.

But again, these are supply-controlled, which means minus 5% candles can happen in one minute. Small size only.

MYX

Similar setup PIPPIN.

These coins repeat this pattern of higher lows punching into support before a potential breakout.

FOLKS

Same process: find coins that are moving and are making a series of higher lows.

Then make your trade plan, set alerts and check for relative strength when they go off.

Stoic | How to “make it” |

Spoiler: You never do. The best are always improving.

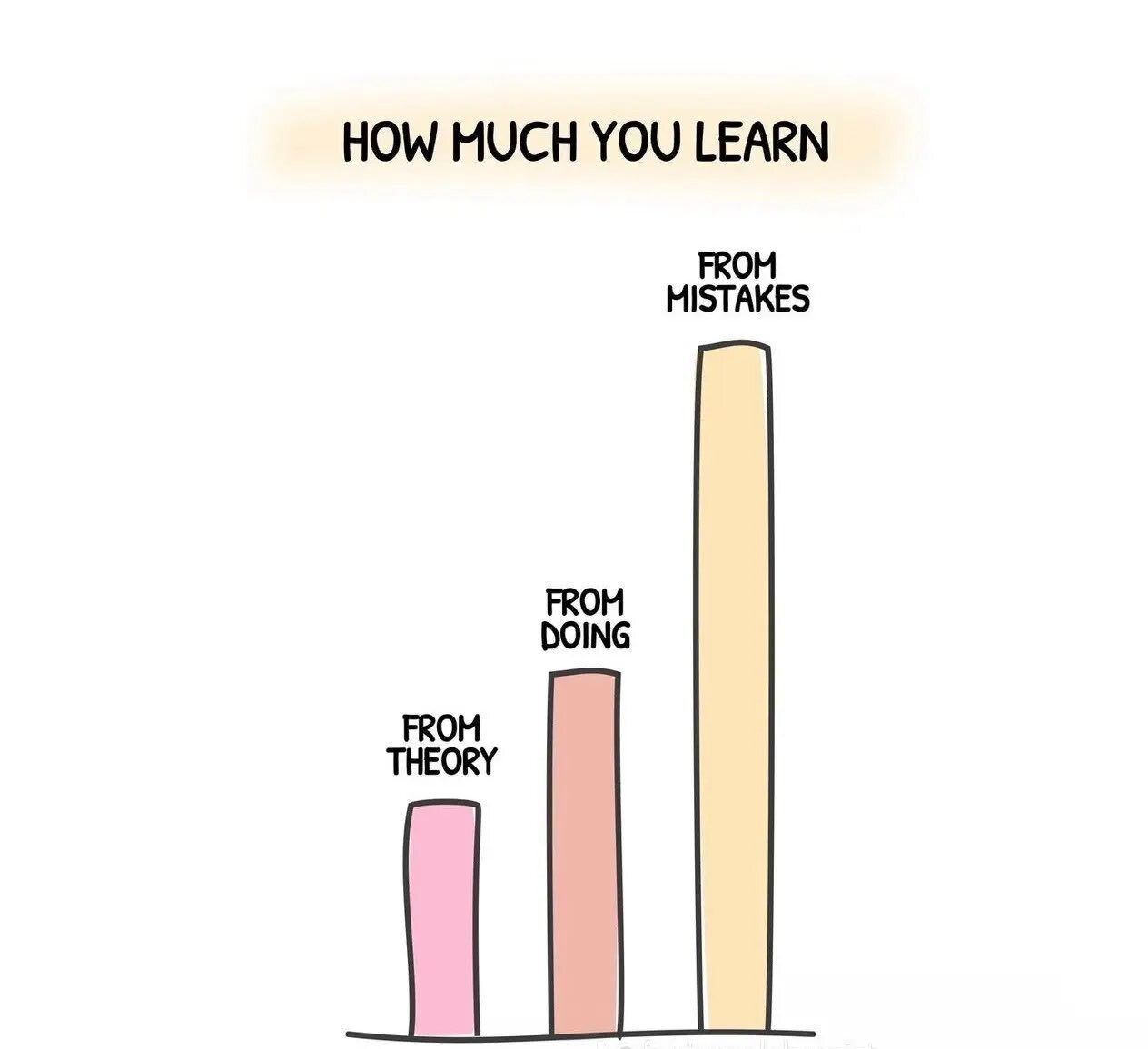

Level 1: READ (read trading analysis)

Level 2: DO (put trading education into action)

Level ∞: ADAPT (learn from your actions)

Nothing new here.

But another reminder to look at your trades and pain from the past year

To use it as fuel for the year to come.

Mercury | Yes, yes I am |

Sidelined.

We can debate what we think will happen, but we cannot debate what is happening.

The market has lost a key trend for the first time in 3 years.

The contextual shift represented by the 2D 200 MAs seems to be too much pressure for any larger rally to come into fruition.

On a more actionable scale, Bitcoin has chopped sideways for the past month, unable to break out of the range.

The 4H 200 MAs remain the key trend portrayal for BTC to reclaim, and thus far it’s failed.

The sidelines continue to be a comfortable place as we wait for better opportunities.

It's really that simple. I see no reason to overcomplicate things.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.