- CookBook

- Posts

- The edge nobody builds

The edge nobody builds

Plans & outlooks from all 5 traders

In today’s edition we have:

Magus — The edge nobody builds

Doc — Traps to watch for

Charlie — No follow-through, no trades

Stoic — Looking for this shift

Mercury — First time in 3 years

Magus | The edge nobody builds |

Before I get into levels and technical fugazi, I want to talk about something more important.

These are the grinding days when you can build your base and separate yourself from others.

When others are quitting, you’re putting in the work.

And when brighter days return, you’ll be coming from a position of strength while others chase.

Now, onto the my plans…

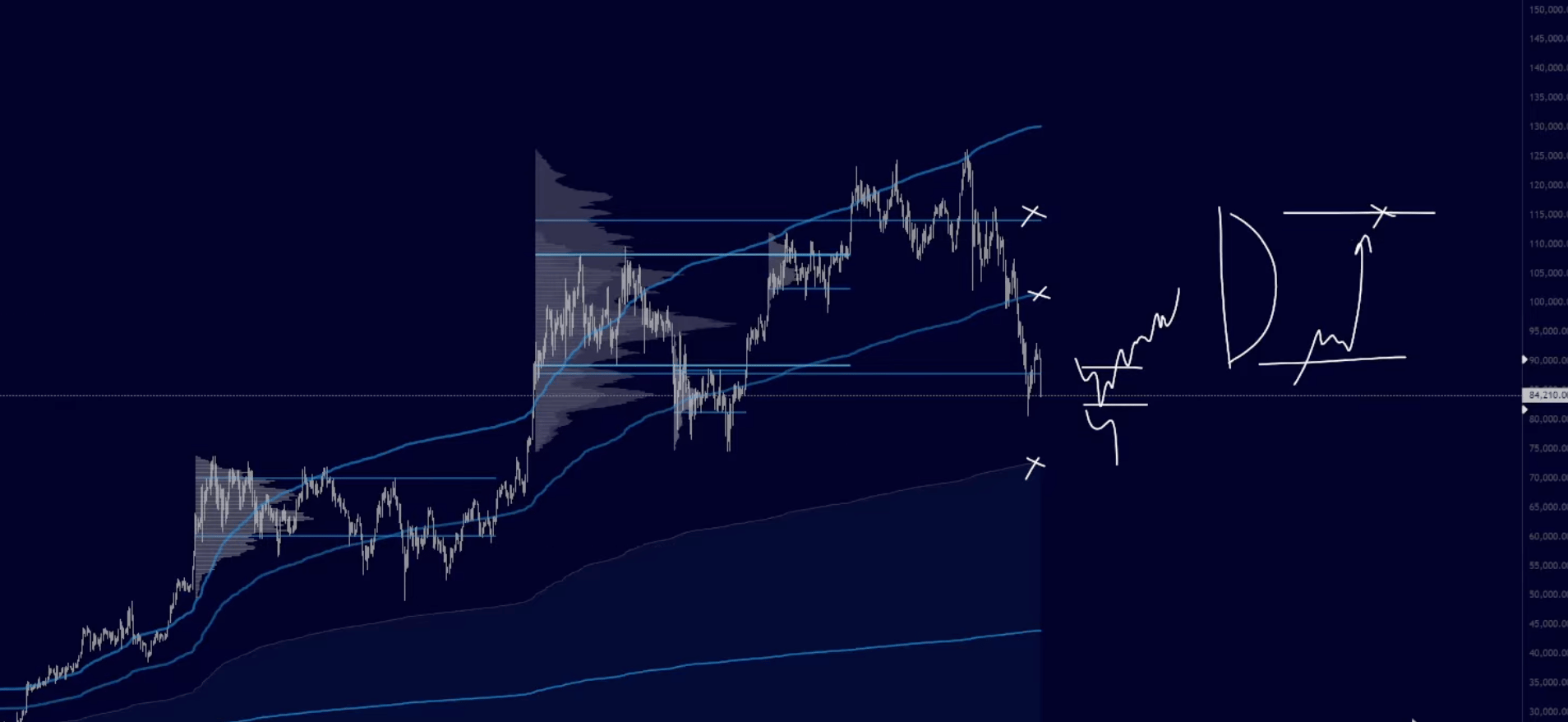

The macro uptrend is still intact but in trouble.

What happens here is really telling. As long as we stay inside this 80k-90k range, the trend is okay.

If accept below 80k, the HTF trend is over and we’ll have to look for a macro base to form lower. Can’t predict where.

Sticking with my adage, “being smart is for stupid people”, here are my major levels: 110k, 100k, 90k, 80k, 70k.

Medium term plans

Right now I think we’re building out the 80k-90k range.

I'm expecting us to trade down into 82k, maybe as low as 80k.

Important caveats:

I need confluence from flows, I don’t blindly buy levels

My whole front-run thesis around levels hasn't worked lately, we've been blasting through levels on this downtrend

So if 80k is my final buy zone, maybe we wick below that.

TLDR

I’m boomered up in Bitcoin, S&P, NASDAQ, silver

Zero interest in alts (unless trading them for short-term rotations like chad Charlie)

These are the grinding days where you can separate yourself from the pack

Doc | Traps to watch for |

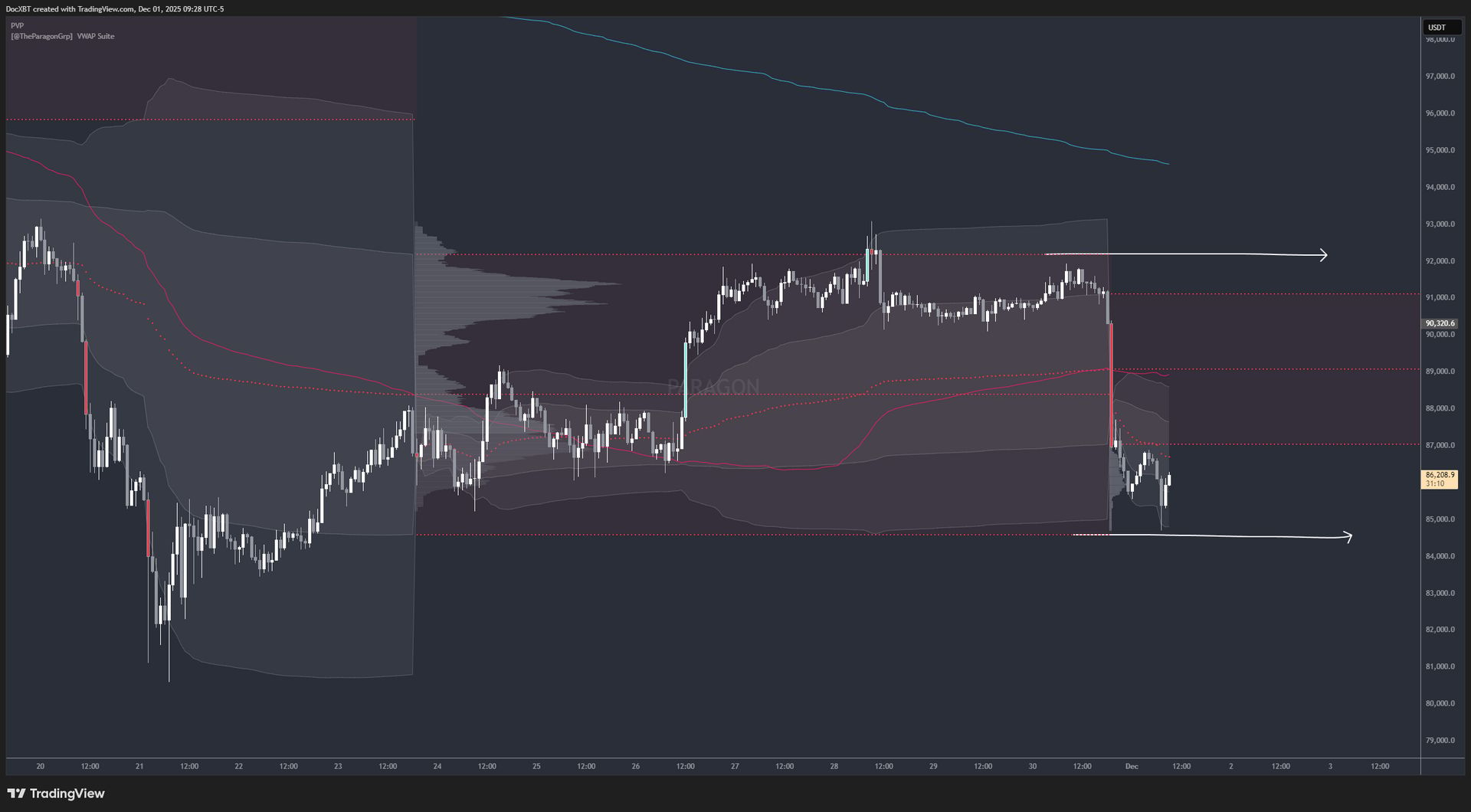

Last week I talked about 88k as a the key pivot for long/short bias.

It played out.

This week, I’m using the same thought process but with updated levels. Let’s get into it.

High timeframe

First, let’s acknowledge that all the high timeframe trends are broken — yearly VWAP, 365-day rolling, weekly trends, etc — so I can't make a trending argument anymore.

My base case is that we range between 80k and 100k for one to three months, which could set a perfect trap for both bears and bulls at the extremes.

Game theory speculation

Bulls on the fence see monthly structure holding higher lows and think we're going to new all-time highs.

Bears looking for immediate sharp continuation lower don't get it.

Result: Everyone fails to accept the reality that BTC ranges for months after big moves. They all get chopped up.

Whatever happens, I don't think price blows through everything in either direction.

Unlike previous cycles, we've had checkpoint after checkpoint on the way up.

So I'm not expecting an 80% drawdown, but I do think the next major relief rally fails and we make a lower macro low before a new ATH.

This week’s plans

Right now I'm trading the local range based on the Nov 16-23 weekly value area.

We opened this week with brutal selling and filled the CME gap.

I’m looking for longs in this region if I see a momentum loss pattern.

If we make a third drive lower with exhaustion, I'm looking for relief back to 90k, maybe even the monthly open at 93k.

My gut says we close the year green before more downside in the new year.

Charlie | No follow-through, no trades |

The best trade is no trade.

At least for me right now.

Sometimes it’s like that and I just have to adapt to the market conditions.

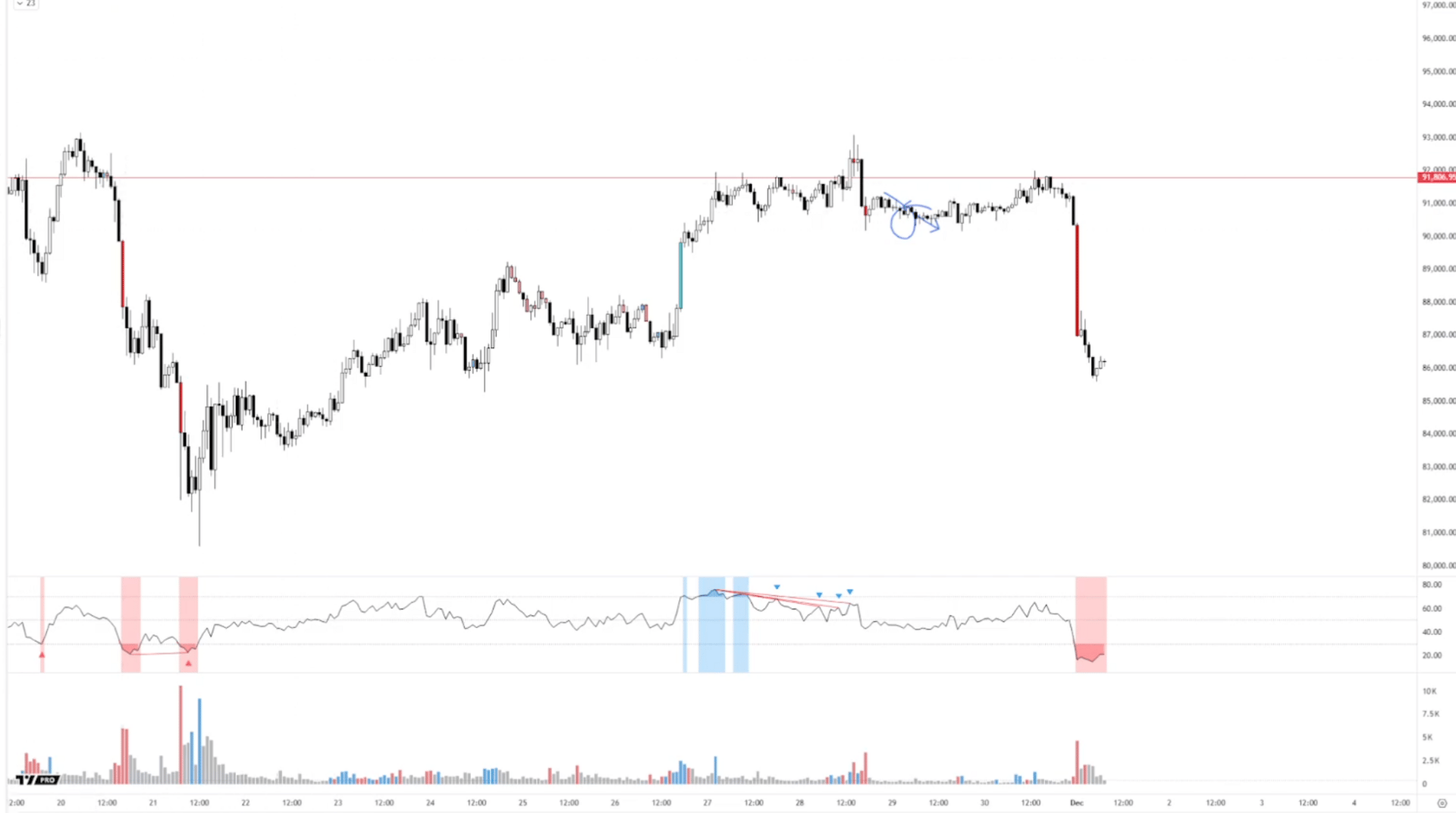

BTC literally ran it up, distributed, and sold off the entire move.

The play was shorting the failed breakout at the range high, but I wasn't around and didn't want to be aggressively short anyway.

Here's where I'm at

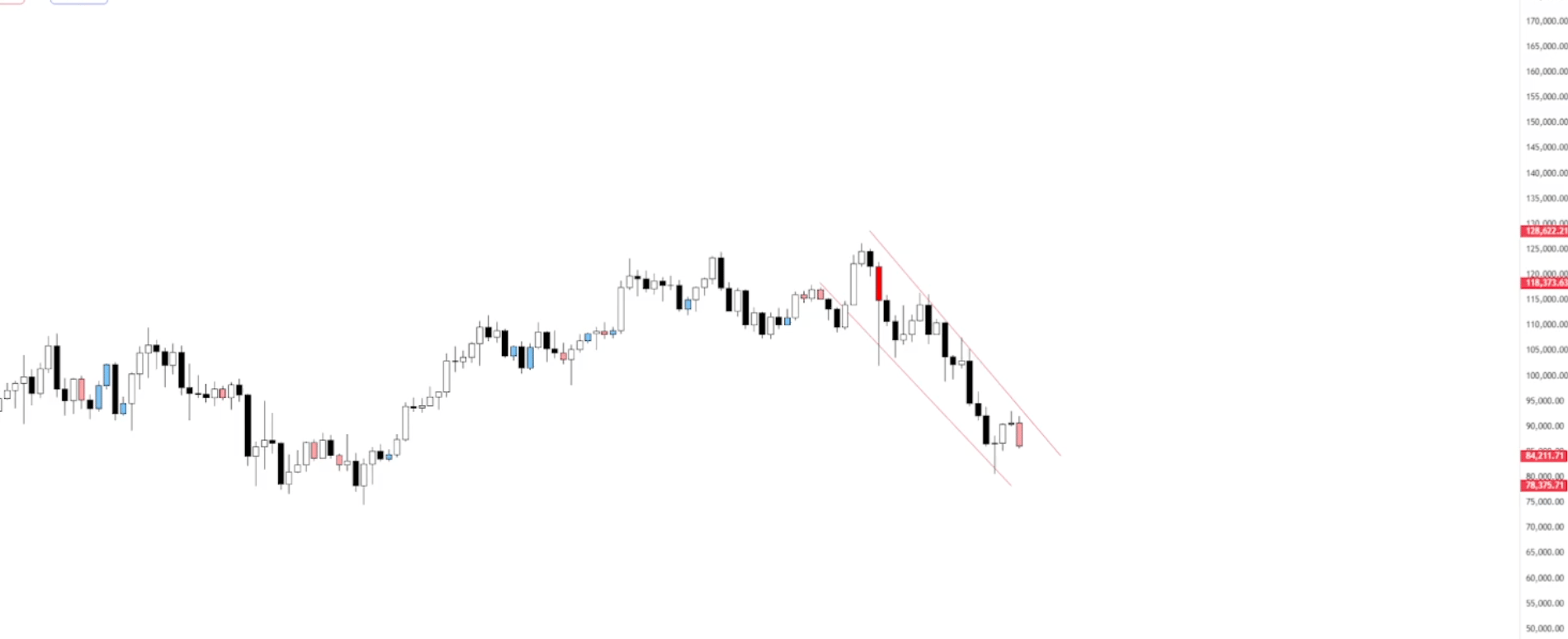

Bitcoin is in a strong downtrend, and until that breaks, I'm just not interested in taking aggressive longs.

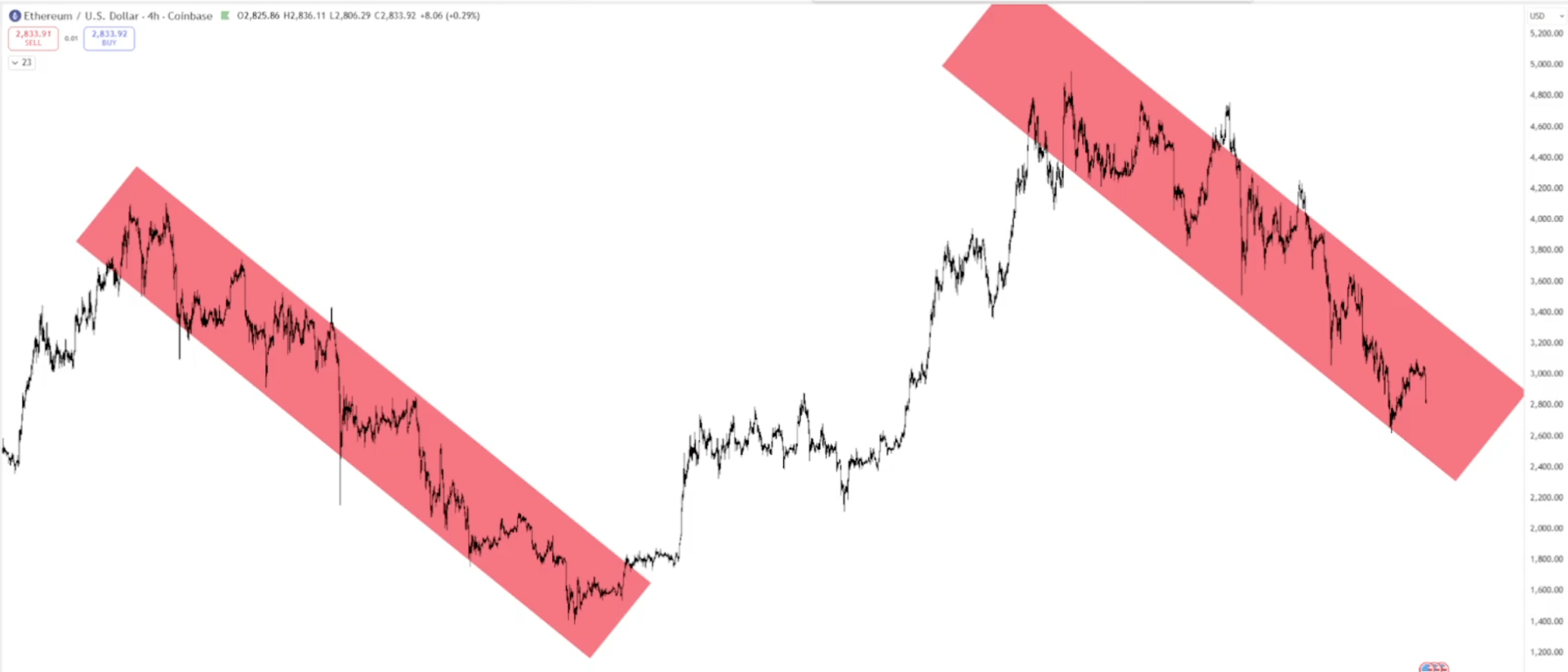

Same thing with ETH, I’m waiting for it to show me something different:

Alts

I took some hits on my equity curve even though the individual trade setups were valid. This is a sign that conditions just aren’t there at the moment.

When I caught breakouts recently, there was no follow-through.

Even ZEC, which has been one of my favorite coins to trade the past month, looks brutal with no relief.

TLDR

Why rush into positions when BTC & ETH are in strong downtrends and even the strongest alts are giving weak rotations?

Yes, I believe we do get risk rotations eventually but I can’t predict when.

When things break out of downtrends and start running again, easy mode will be back for at least a couple weeks.

Until then I'm (mostly) sitting on my hands.

Stoic | Looking for this shift |

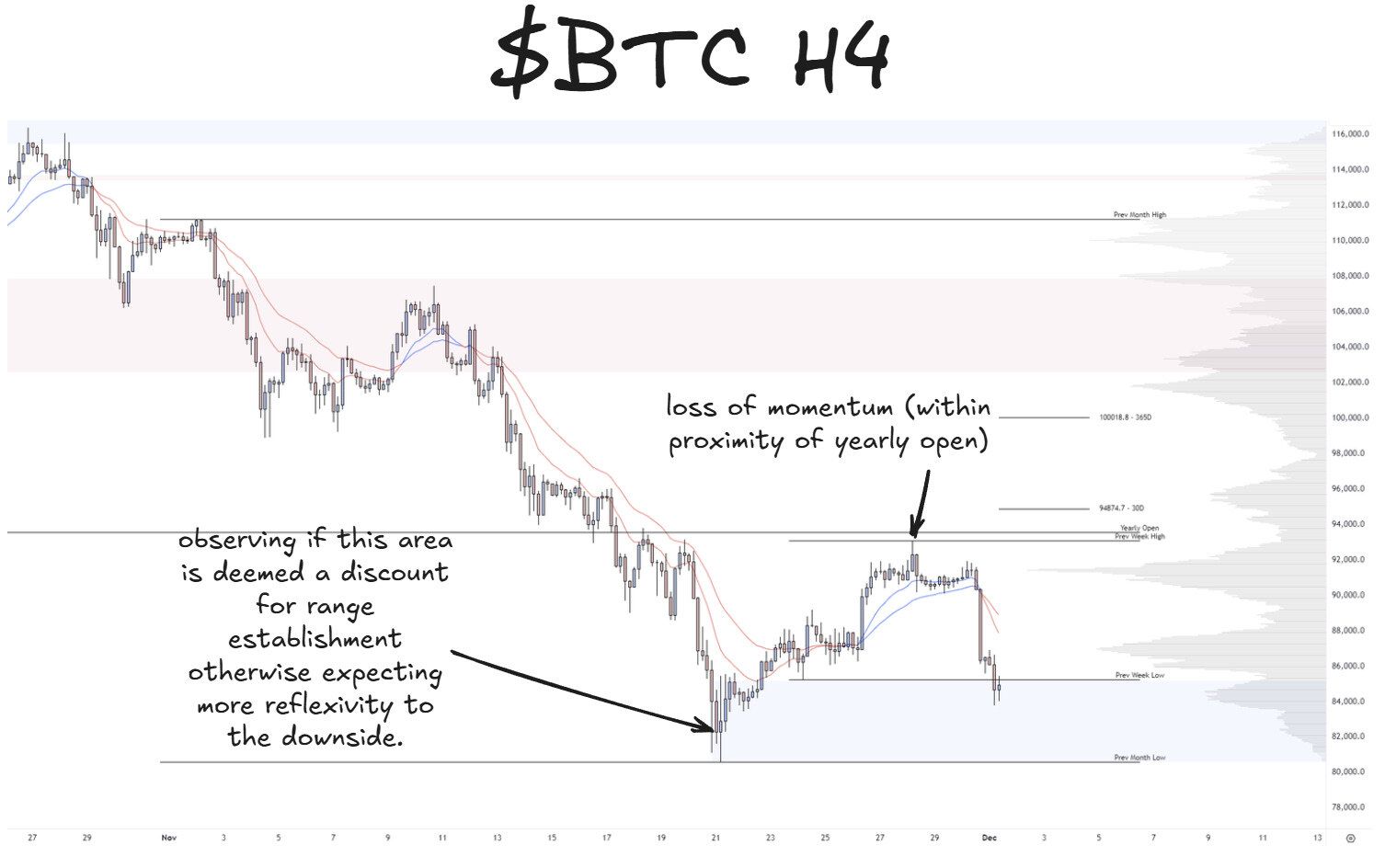

We lost momentum within 0.5% of the yearly open to mark the most recent local high.

Now we're trading back into the 80s and I’m looking for potential range development.

Supportive signs would include a pause in orderly spot selling or absorption into the local lows, especially after a sweep (trapped selling).

Overall, BTC is still in a downtrend, so my bias is downside continuation unless there is a clear change in behavior.

One of these shifts would be BTC finding some footing and starting to trade sideways.

For now, I’m remaining agile and only taking short-term trades in both directions.

Mercury | First time in 3 years |

The HTF outlook remains bearish with the loss of D2 200 MAs, a first in three years.

As mentioned last week, I'm still using the 30m 200 MAs as a gauge for LTF bias.

They did in fact provide a nice relief bounce, but after losing them again, downtrend continuation on all timeframes seems most likely, with sideways chop a less probable scenario.

It's the market's job to prove to me why I need to change my bias.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.