- CookBook

- Posts

- Shifting bullish

Shifting bullish

Waiting for these triggers

In today’s edition we have:

Magus — The market rewards the patient

Doc — I'd rather bet on up than down

Charlie — Waiting for these long triggers

Stoic — Fall down seven times, stand up eight

Mercury — “Bounce here or it’s…”

Magus | The market rewards the patient |

All right. CPI Tuesday, tariff decision Wednesday.

I'm not trying to guess how these play out, but they could create some really tradable moments to react to.

If we get some sort of scare around the tariff decision that’s probably a buy the dip opportunity for me.

Still waiting on that long

I've been presenting this swing long argument back up toward 100-110k for a while now, but haven’t taken it yet.

That patience is paying off, avoiding unnecessary losses and roundtrips.

To be clear, I’m spot long, waiting for derivative swing entries.

Anything below 90K is likely a strong buy the dip zone.

The best entry trigger will be some news-related spook (maybe this week), with supportive flows (e.g. perp longs closing and no follow-through down on price).

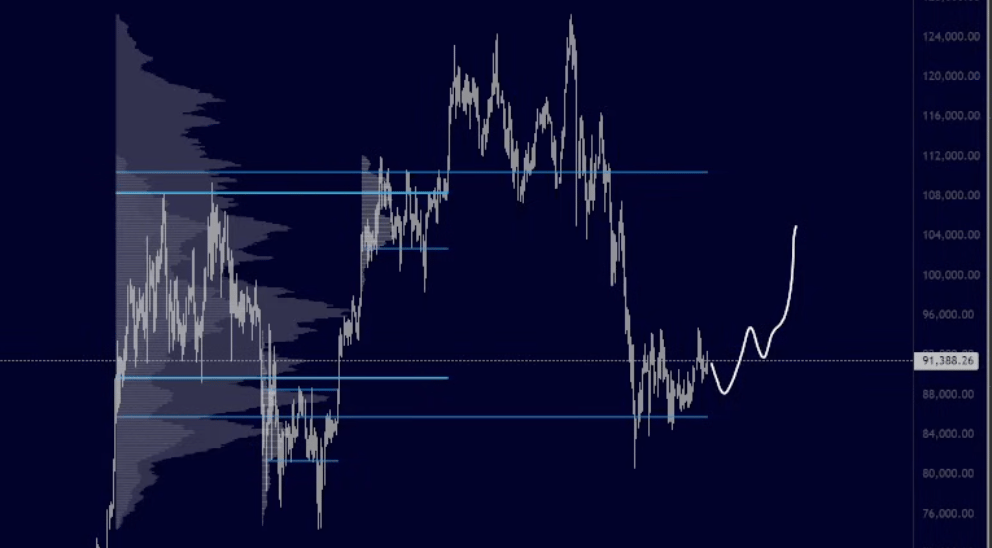

Bullish structure shift

We're finally getting that flip to a more bullish structure that I’ve been calling for since November.

Huge downside momentum after something like 10/10 doesn't just flip immediately. It's slow and painful.

And that's exactly what's happening: price & value is drifting up, we’re flipping the 30d rolling VWAP.

As usual, the difficult part isn’t recognizing what’s happening, it’s having the patience to see it play out and not get chopped up in the meantime.

Range right now: 92K high, 86K low.

Any dips into the lower ends of value are likely good expected value. Eventually, I think we defeat 92K. It just takes time.

Dead cat or 150K?

As a trader, I'm going to approach it like a dead cat and lock in profit on bounces 100k+. It’s the higher expected value play.

But I'm remaining optimistic from a spot and portfolio standpoint.

Q1 Reality Check

Look, if Bitcoin can't perform while equities and metals are this bullish, people are going to re-evaluate their longterm views.

Most people (including me) are buying Bitcoin for the performance.

So if Q1 is another dud like Q4, we'll have to adjust.

But even then, there’s always intraday BTC and bull opportunities in other markets. Like silver up another 6%.

Until then, I’m remaining optimistic and dipping my toes in other markets (rare earths, metals, energy, etc)

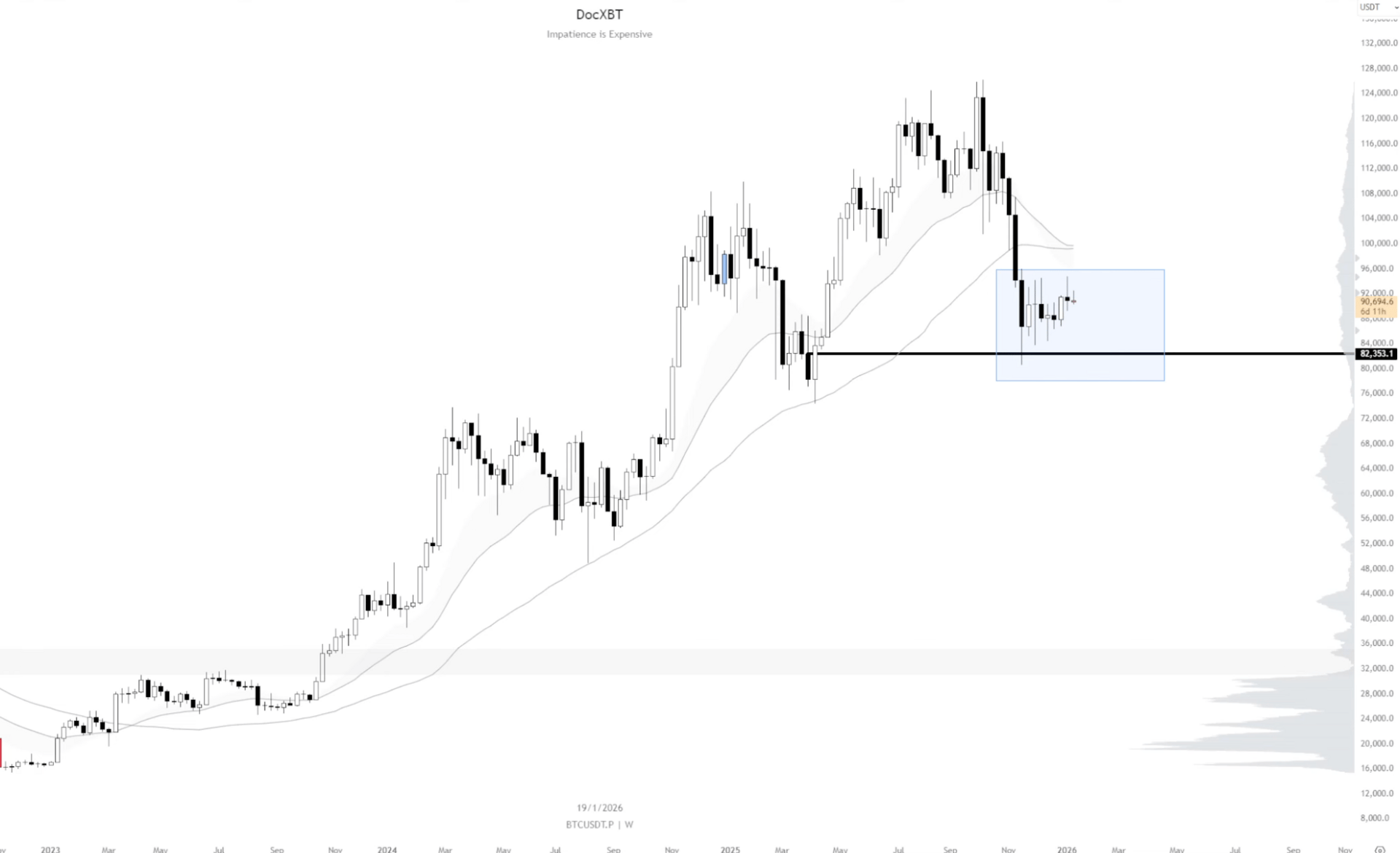

Doc | I'd rather bet on up than down |

We've been kind of ranging for almost 2 months now.

And value keeps drifting higher, which you can see on the weekly candles.

Here’s my thought process

The main shift I’m taking into account is that we're now holding over the daily trend after maybe 10 rejections.

Because of this, my bias is up – daily trend to weekly trend gap fill.

That’s the bullish view I’m taking: daily downtrend broken, maybe we're setting a higher low here for push toward 100k.

The bearish take is that we tried to break above this two-month range but failed and dropped back in. And failed breakouts often rotate to the other side (range lows).

Levels

If we drop into the local mini-composite value low around 90k and hold, that sets up intraday rotations back to 91.5k.

I'm fine taking $1000 moves, that's how I've been trading for the past year.

But the big daddy level is 93k.

Break that with strong spot flows, and we're looking at gap fill into the 96-97s, but really I’d expect a bigger push toward 100k.

Not going gigabull

Even if we get the breakout, I'd be looking for distribution to form.

My 2026 base case is pop up, get to levels that make people significantly bullish again, then we see what happens.

So the plan is to take profit into the strength. Don't worry about catching the generational long, that's how you roundtrip all these moves.

De-risk into highs, maybe leave some runners. Cherry on top if they hit.

TLDR

Bullish take - daily to weekly trend gap fill

Bearish take - rotated back within 8 week value, bearish POI (cme) at composite value area (range) low

I'm leaning bullish for a push over 94k to potentially 100k

Expectation is more local crab, looking for spot buyers to show similar strength as the yearly open rally

Still high-timeframe bearish, but medium-timeframe bullish

Execution triggers will be flow based: Are there spot buyers? Is price moving in the direction of aggressive/takers?

Charlie | Waiting for these long triggers |

Better price action than I expected to wake up to.

Consistent higher lows on BTC, so it's actually quite hard to be super bearish here.

But I'm not changing my high timeframe bias just yet as we've been pretty weak since 10/10.

If we see strength, I'll join it. Until then, I'm not just going to blindly bid.

94k is my trigger

If BTC breaks out from the 94k pivot, everyone will forget crypto's been heavy compared to stocks and we'll start trending on dog coins again.

Alt setups

Everything looks like a copy-paste setup right now waiting for one little injection of hope into the crypto markets.

Looking for level reclaims and relative strength on spaghetti.

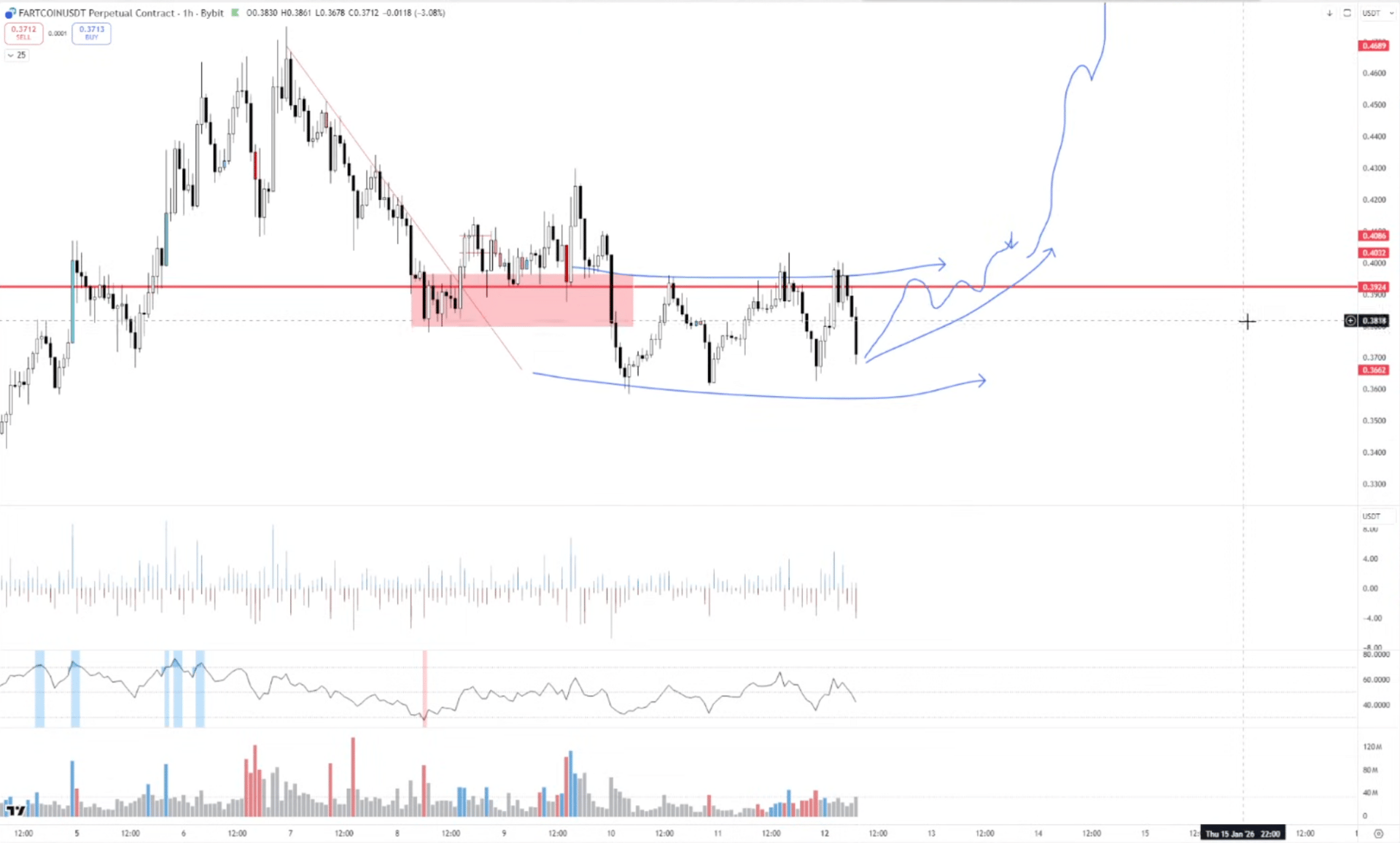

FARTCOIN — at a high timeframe pivot, consolidating after that downtrend failed to break down. If it breaks out into a trending move, we could see a 10-20% rotation.

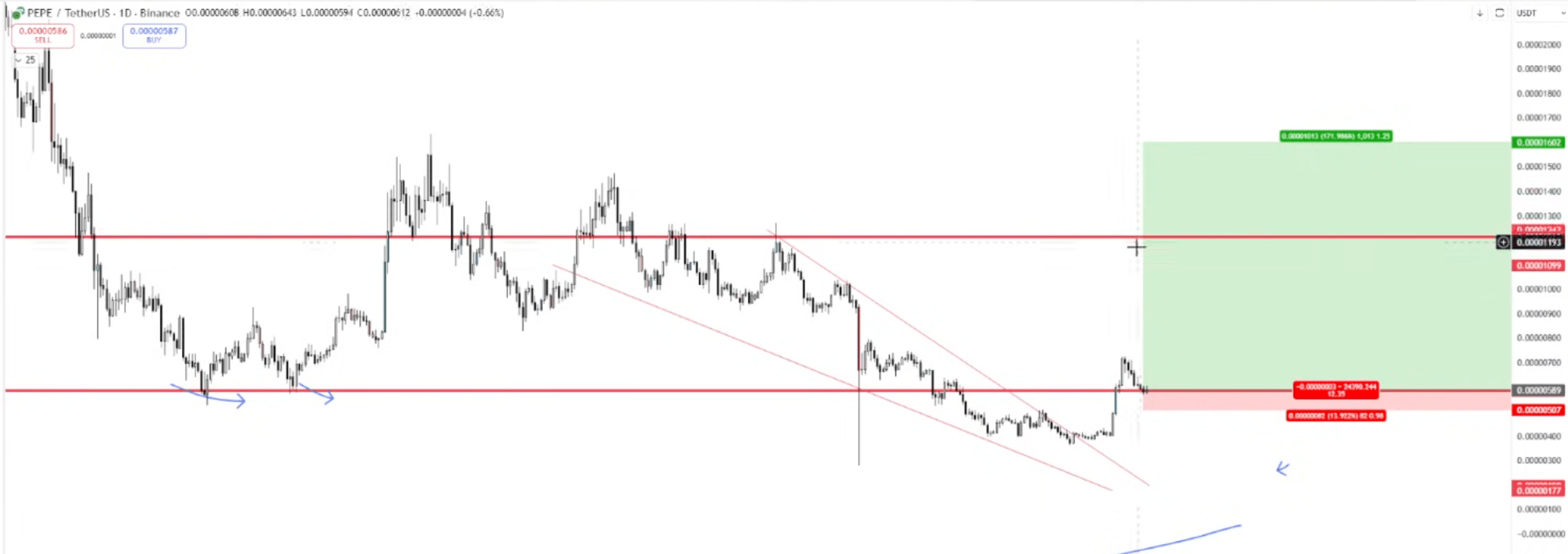

PEPE — the support on the daily is mental. Can't justify blind bidding it, but if it shows relative strength, could be a really good trade.

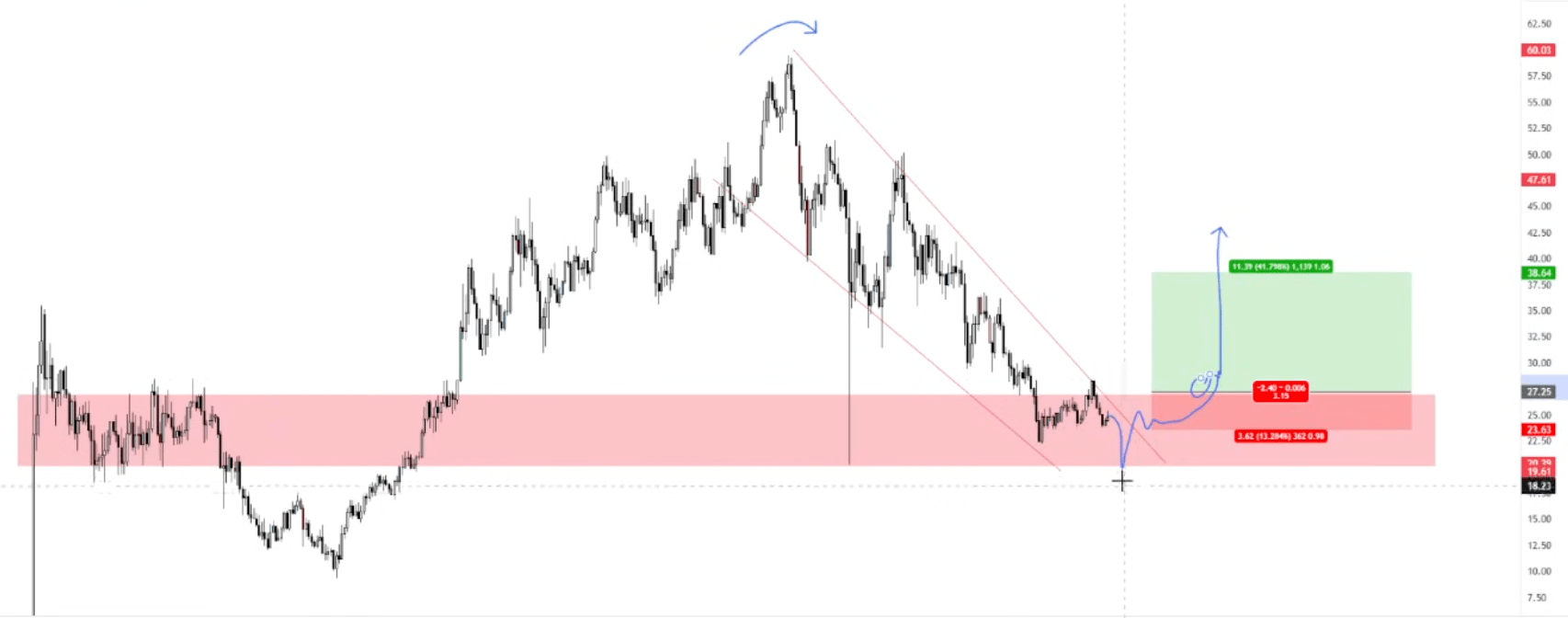

ZEC — relative strength earlier today, range reclaim potential, tends to move in brutally strong candles

PIPPIN — redonkulous volatility, massive dumps/pumps, good for small size only

HYPE — massive HT downtrend, looking for consolidation or reclaim at lower levels

The reality

I'm at this weird place where I want to be long several things, but it's just a little bit too early. I don't want to chop myself up in meh conditions.

As always, all I'm doing is looking for strength to join. And there's not much of that in the market at the minute.

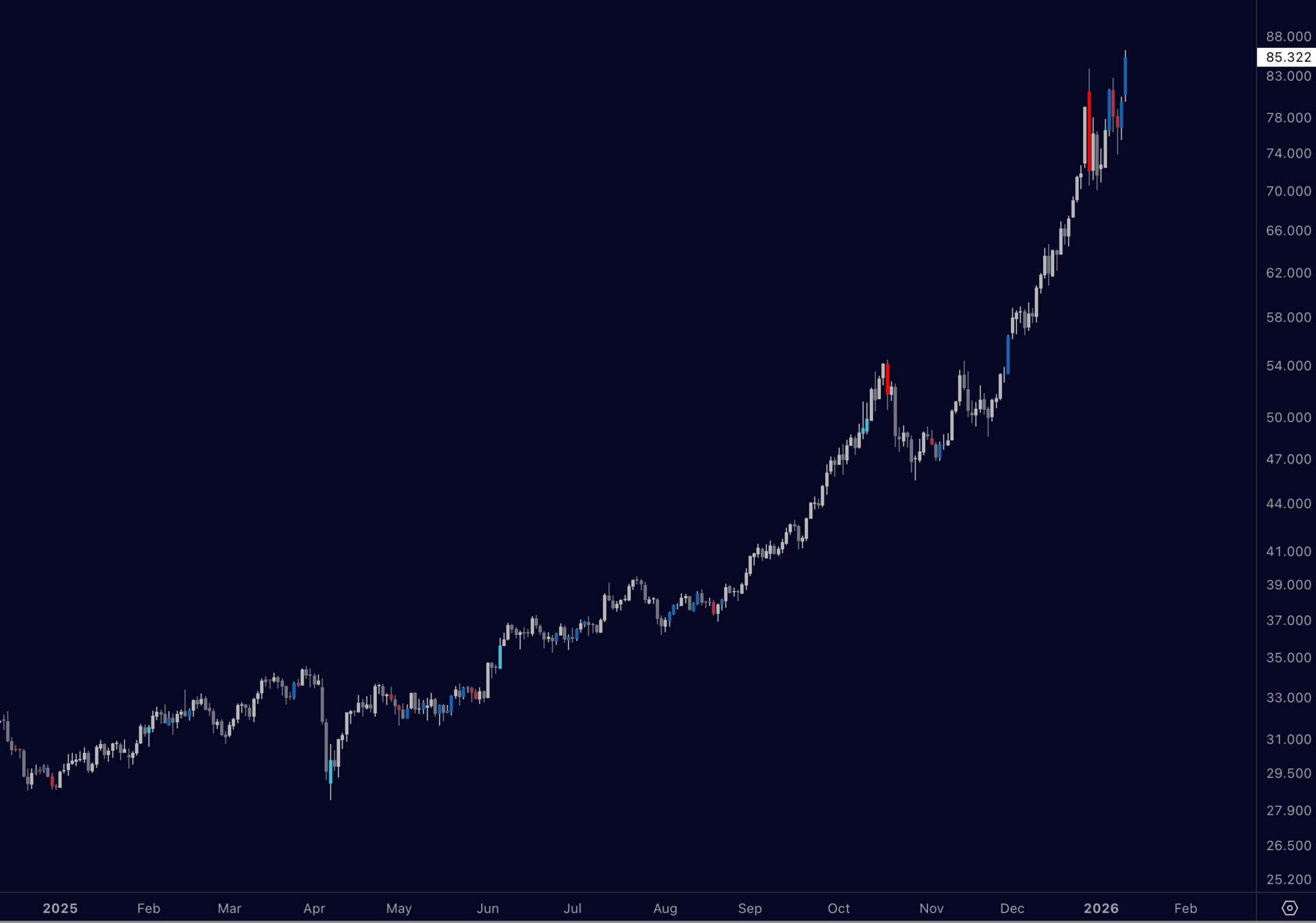

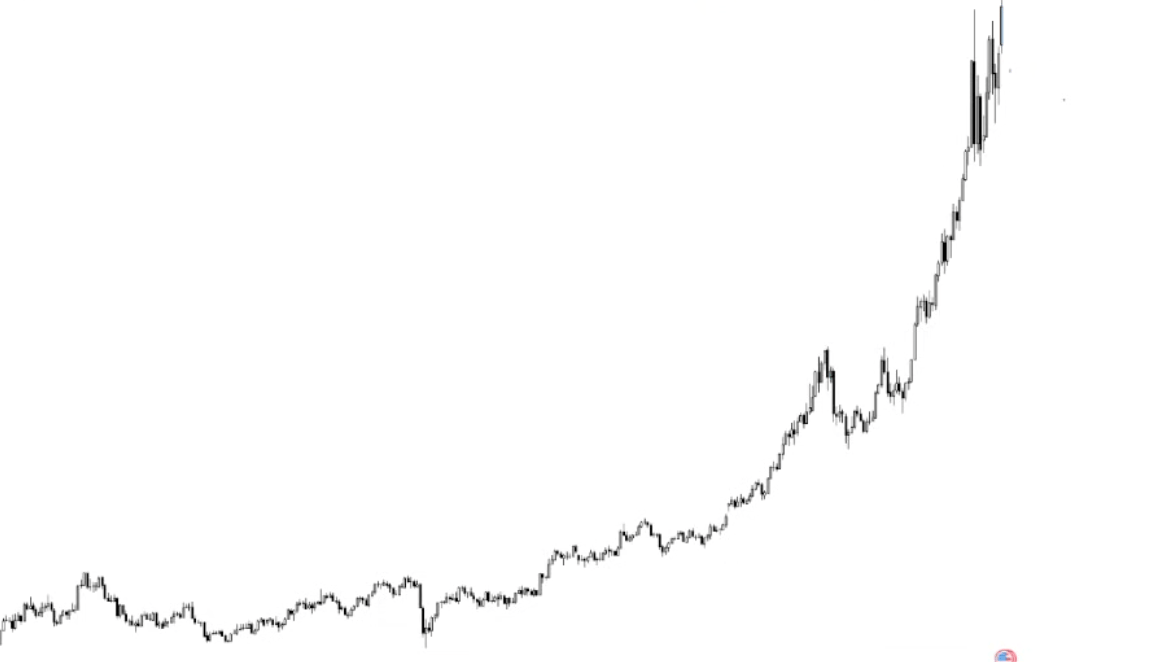

In other news, silver's hitting new highs.

Remember when crypto charts looked like this, boys?

Those times will come back. Patience.

Stoic | Fall down seven times, stand up eight |

Nobody posts the boring stuff.

The weeks where nothing sets up.

The months of grinding small wins.

The endless chart reviews that don't lead anywhere obvious.

But that's where the separation happens.

The thing standing between you and the trader you want to be isn't a strategy or a signal.

It's your willingness to do the tedious work.

Over and over.

When no one's watching.

And nothing feels like progress.

Fall down seven times, stand up eight.

That's the game.

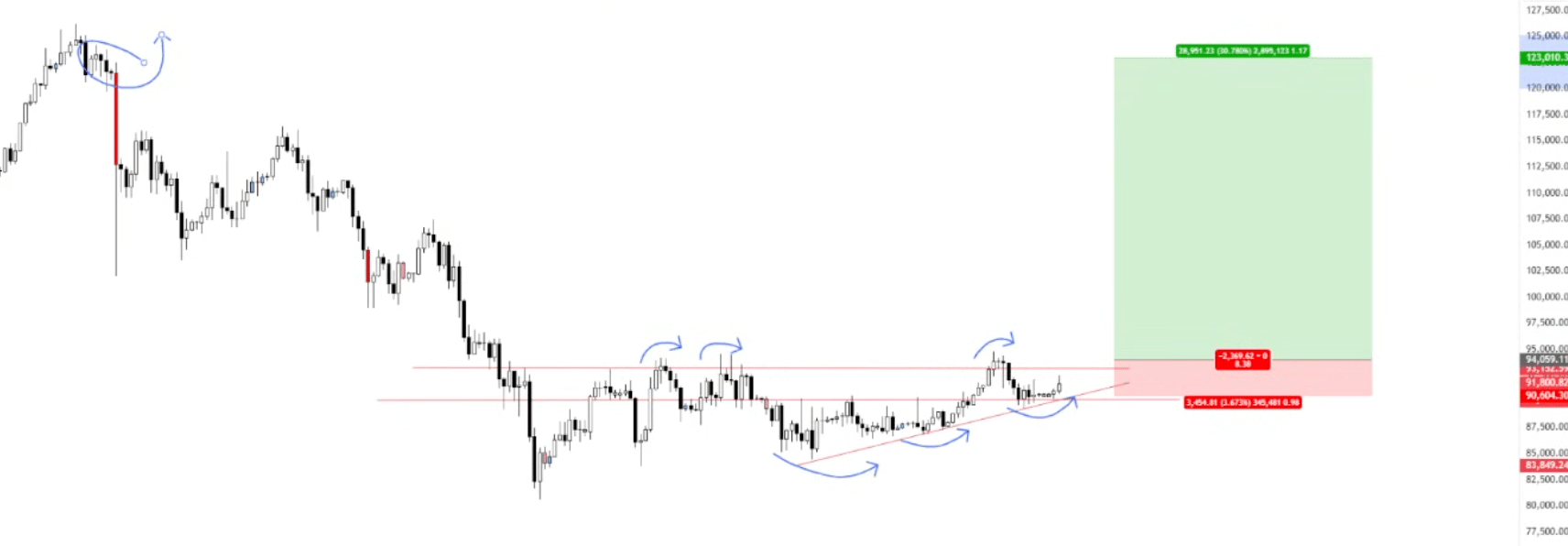

Mercury | “Bounce here or it’s…” |

Posted this a while ago, and my thoughts haven’t changed. We either bounce here.

Or the higher timeframe outlook takes precedence, and we continue down to range lows at best or threaten continuation down at worst.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.