- CookBook

- Posts

- Optimistic mindset, defensive positioning

Optimistic mindset, defensive positioning

Plus, remember this pattern

In today’s edition we have:

Magus — Optimistic mindset, defensive positioning

Doc — Remember this pattern

Charlie — Alts are dying, with two exceptions

Stoic — Bias stays short until this changes

Mercury — Why I might skip the $75k long

Magus | Optimistic mindset, defensive positioning |

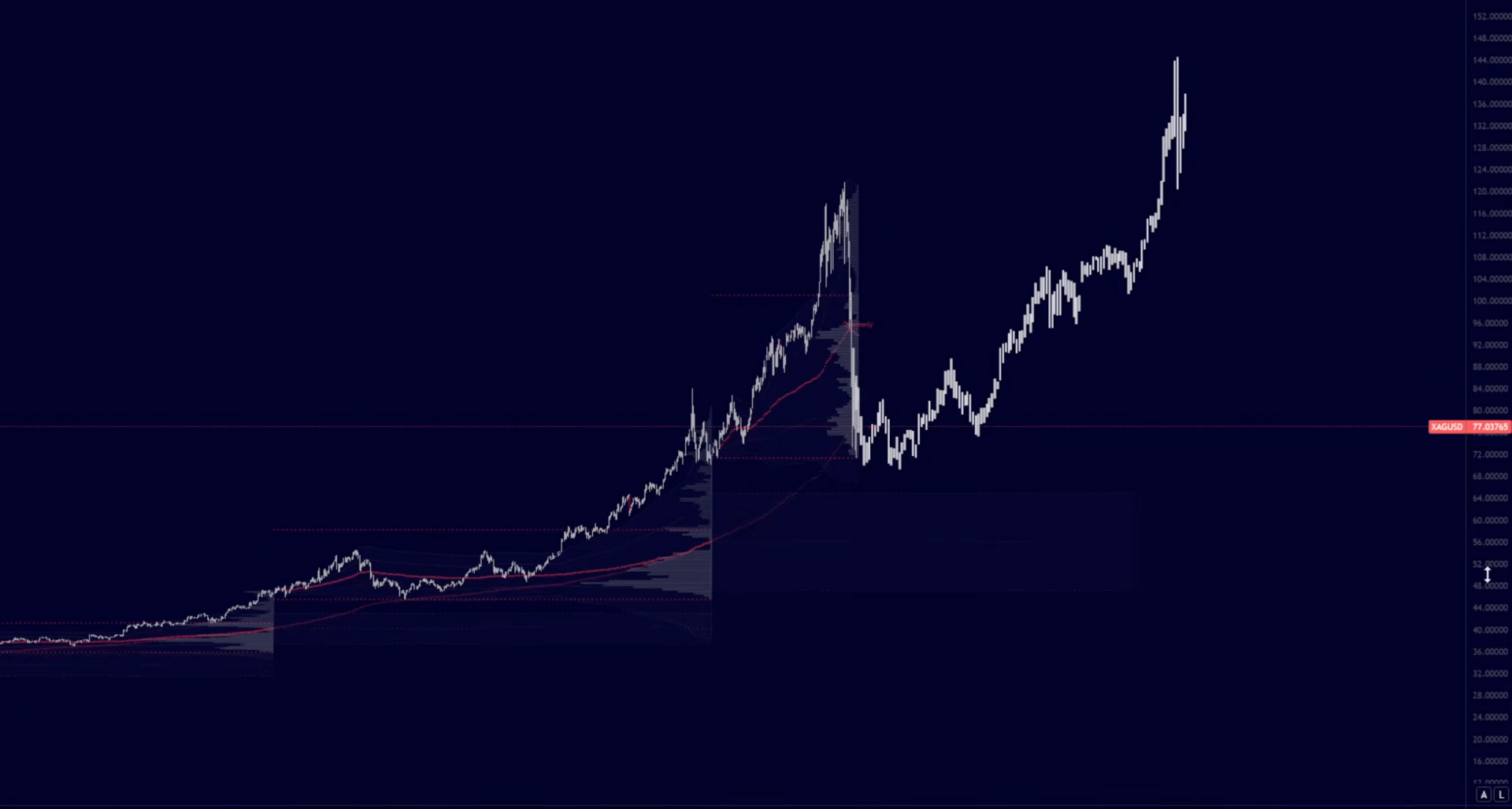

Metals

Historic puke came through on silver, down 40% in a day.

Overconfidence + leverage = massive blow outs.

I sold off a huge chunk of my silver before the final blowoff and am contemplating buying it back, but honestly I'm more interested in gold.

I think gold trades a little lower into the 4,400-4,500 range, and that's where I'd look to start a long-term position.

For higher timeframe plays I don't really care if I'm buying at 4800 or 4200, I just want to get the position started when I think the dust has settled.

I expect a bit more sell pressure followed by a range, then eventually the uptrend resumes. Could take weeks, maybe months.

Equities

Same thesis: S&P goes down, I buy.

I’m treating this like a savings account. Not expecting gross outperformance, but it likely beats inflation.

I have exposure to the S&P and the NASDAQ but I'm much more optimistic on energy and rare earths than tech right now.

This volatility is shaking things up and will create opportunities in the coming months. Stay locked in.

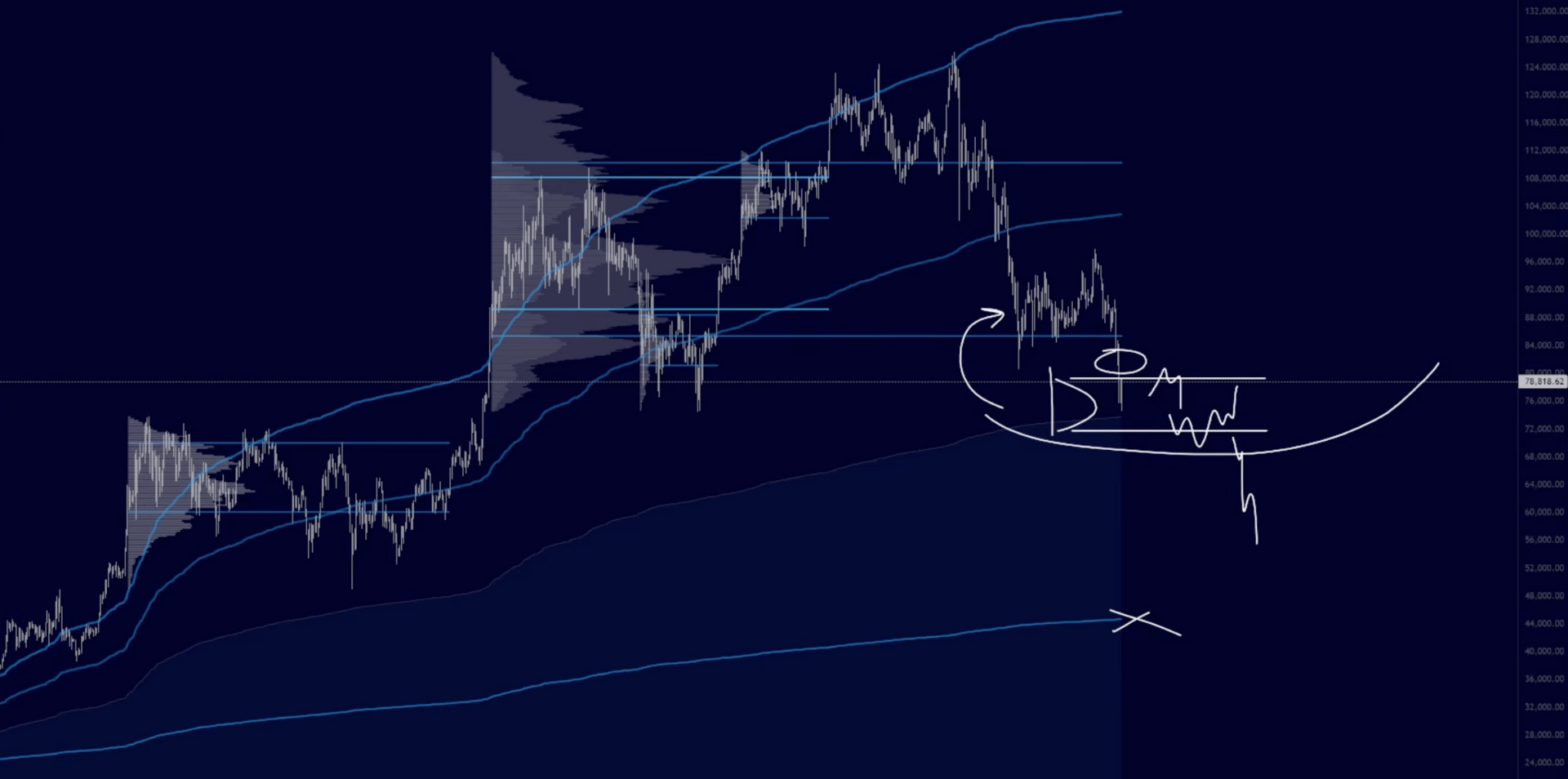

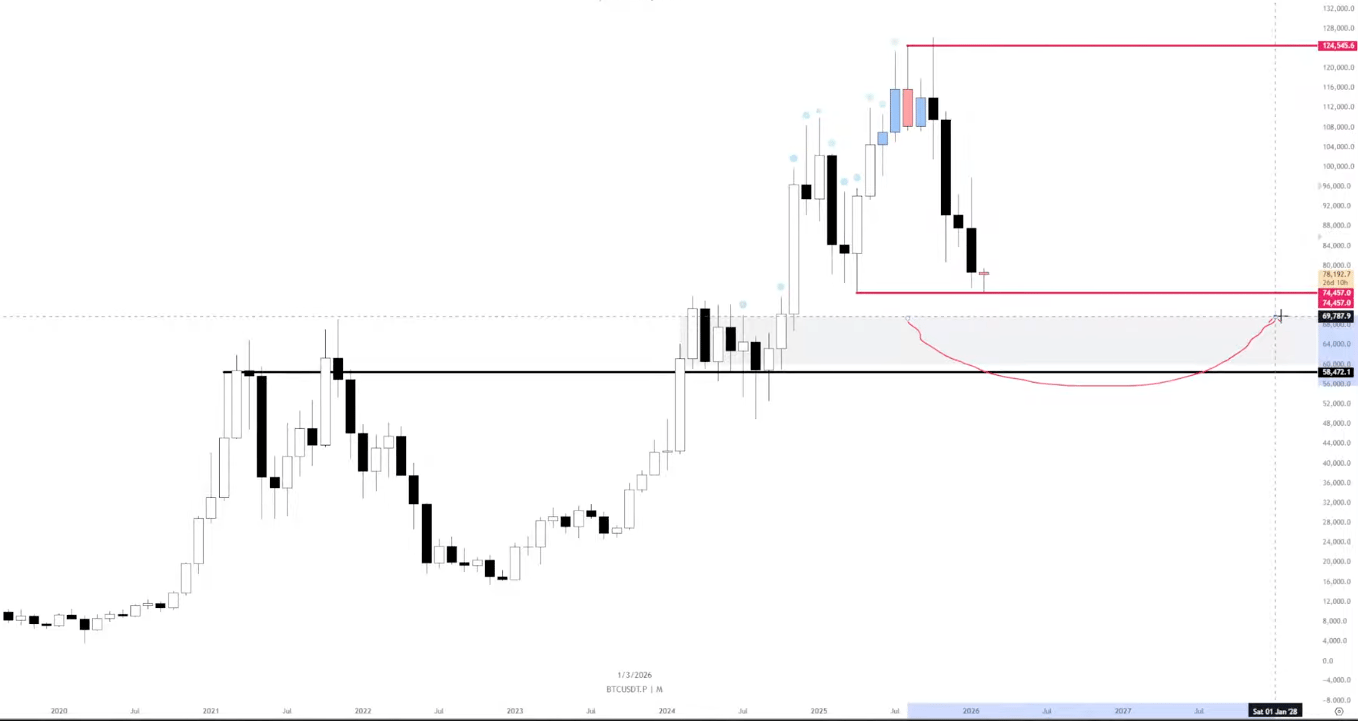

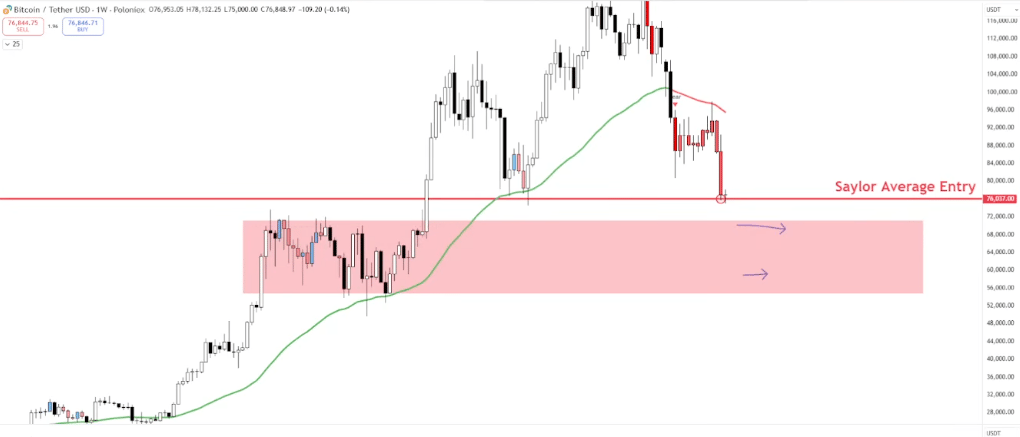

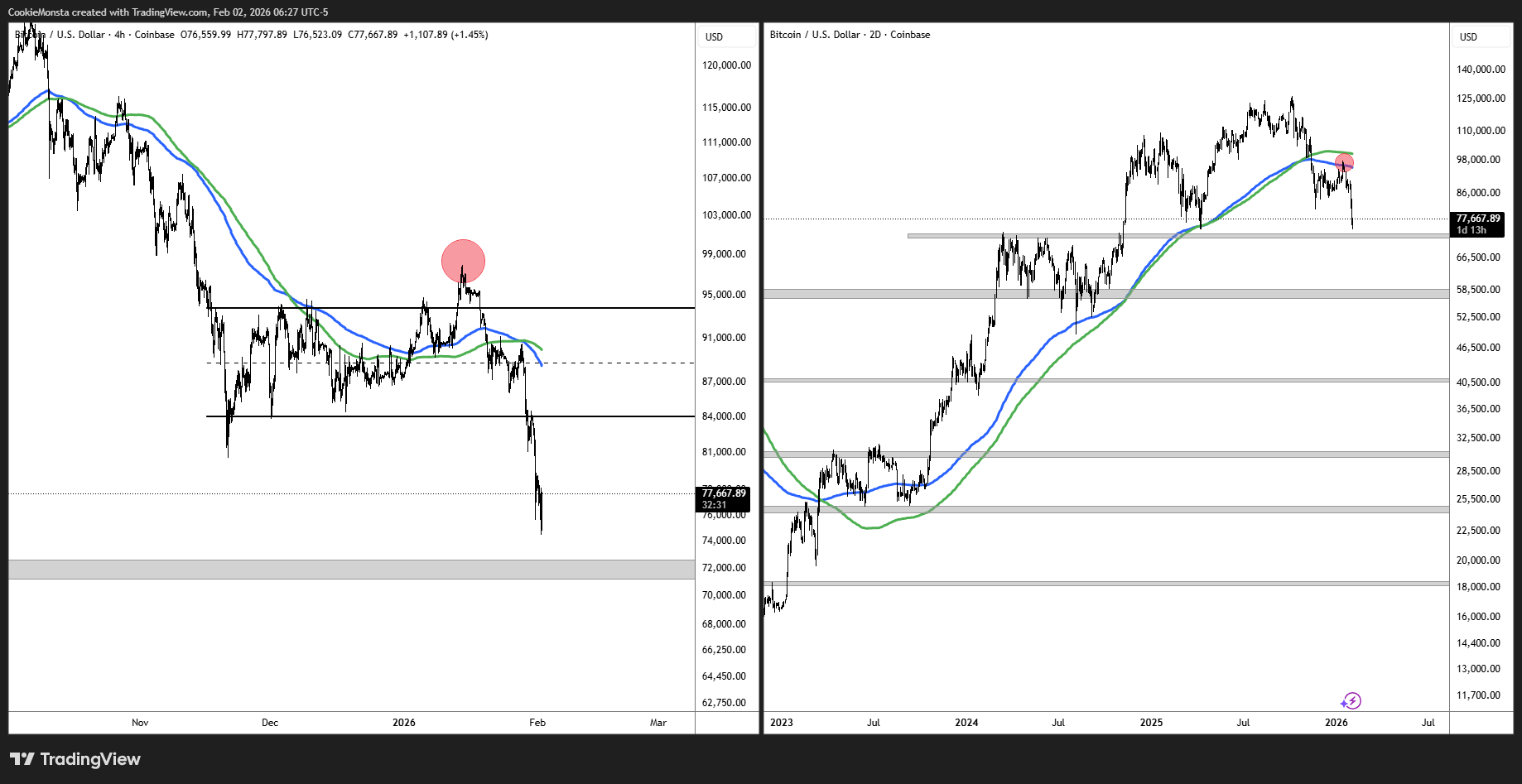

Bitcoin high timeframe

Anything below 80k feels cheap on the macro timeframe, and 70k looks like a really strong value buy.

There's a lot of confluence in this 70k region (2024 composite plus the very high-timeframe anchored VWAP).

Lose 70k? Then yeah, 40s. But I don't think that's coming.

We're in the later stages of giving up and despair. Big players have been distributing for six months and at some point they start to re-accumulate.

Wash out the filth. New uptrend begins.

Bitcoin medium timeframe

If I had to spitball, 80k caps the upside, 70k caps the downside. Simple $10k range getting built out.

Looking for downside momentum loss and a range to develop.

If you want to be bullish, you're looking for the rolling VWAPs to get flipped starting with the 7-day, then the 30-day. Same stuff we yapped about during the last range.

Short-term, I expect BTC to get rejected if it trades into the 80s. But on the macro time horizon I think sub-80k prices will get bought up eventually.

Job's not finished, but there's a lot of opportunity ahead of us.

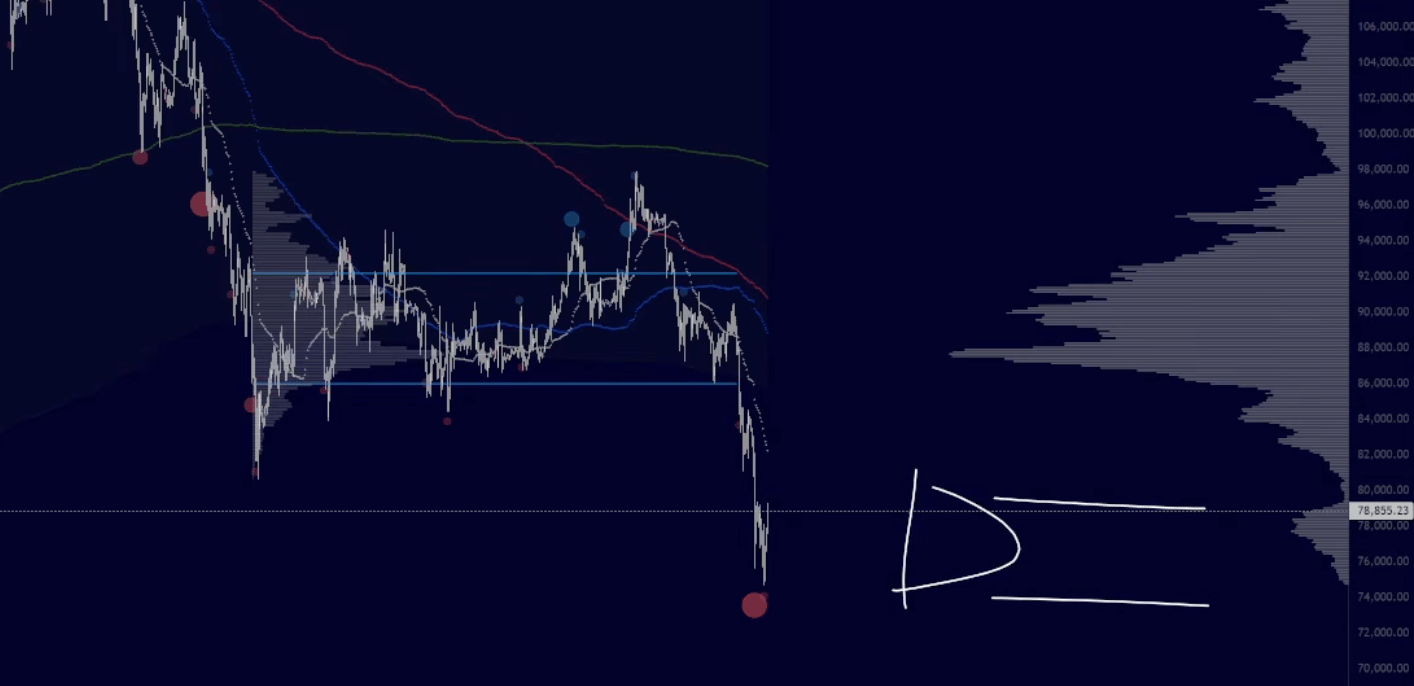

Doc | Remember this pattern |

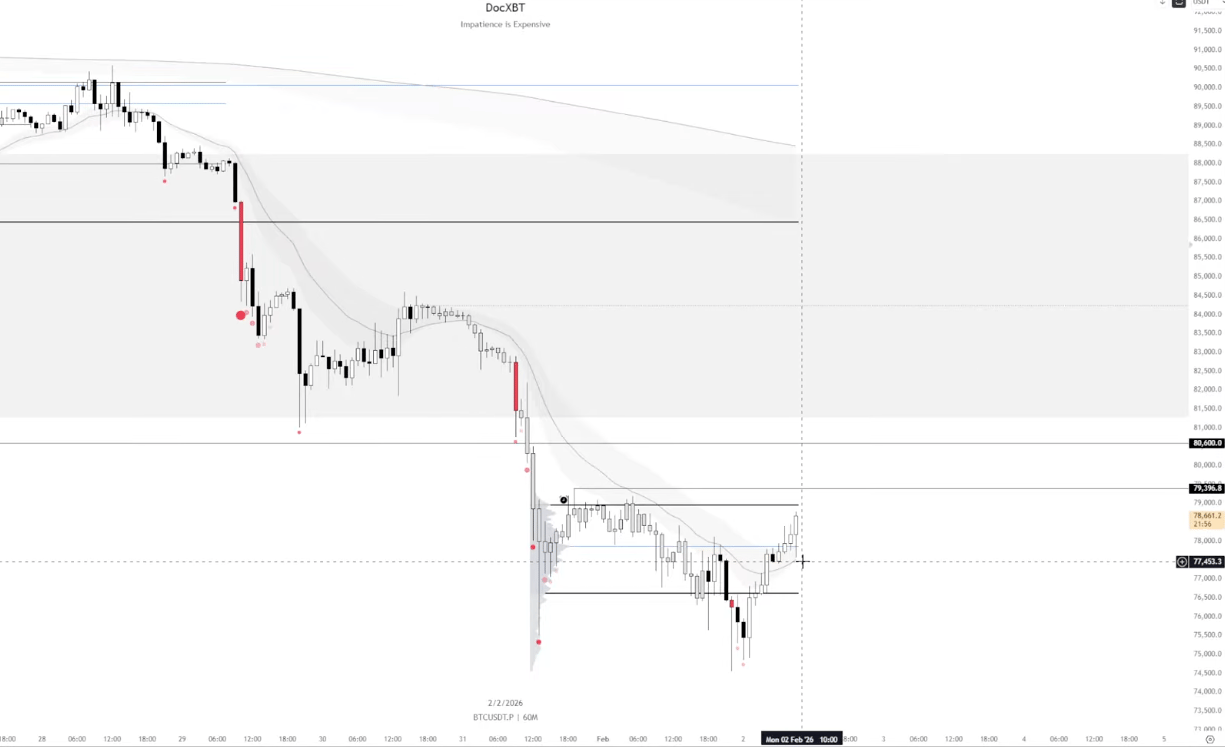

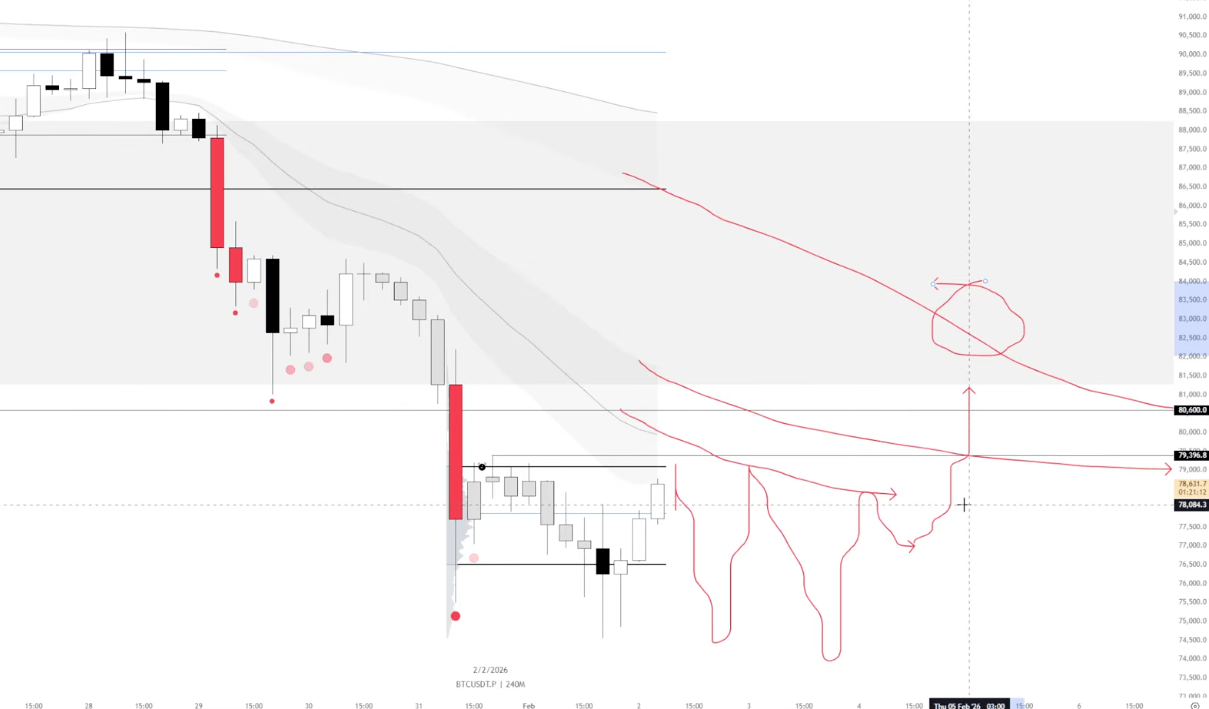

We broke down from a two-month range on high volume, which led to a straight 7K bleeder with no bounce to short.

Remember this pattern for breakouts and breakdowns: unless there’s a quick reclaim of the high volume candle, expect continuation.

The big picture

Things get interesting on the monthly chart.

We're trading back toward the $60k-70k demand zone that we flipped from resistance to support.

We got an expansionary leg up, momentum exhaustion at the highs, failed to close above, and now we're rotating back into demand. This is pretty much textbook price action 101.

The bottom zone

I’m looking for BTC round off anywhere between 78K and 58K.

(This assumes no generational FUD like a Luna or an FTX, some stock market blowup or record-high inflation.)

I’m not expecting an 80% drawdown like previous cycles because we built value the whole way up with multi-month ranges throughout.

Also, we've had a transfer from old holders in huge profits to new buyers who have higher cost basis.

The next trade

The H1 hourly trend just broke after carrying us down 15%.

That means range now, somewhere between here and 79K composite value high.

If we can break the 4-hour trend, maybe we get a shot at the daily trend and a CME gap fill.

But I wouldn't be shocked if we just ping pong between 70K and 82K for a while, filling out this lower volume node.

TLDR

Low timeframe: Looking for H1, H4 trend compression break trades

High timeframe: If Bitcoin trades into the 56-60K zone, I'm stacking. It probably won't be comfy and I'll probably feel stupid, but that's when I want to counter-trade my own fear.

Charlie | Alts are dying, with two exceptions |

I'm not sure it's such a good morning, but good morning anyway.

Bitcoin

BTC is sitting at Saylor's average entry, and $72k is the start of my ginormous demand zone, so I’d expect at least a lower timeframe bullish reaction there.

So while I’m not rushing to buy anything until I see some strength from BTC, this isn't where I’m going to get bearish.

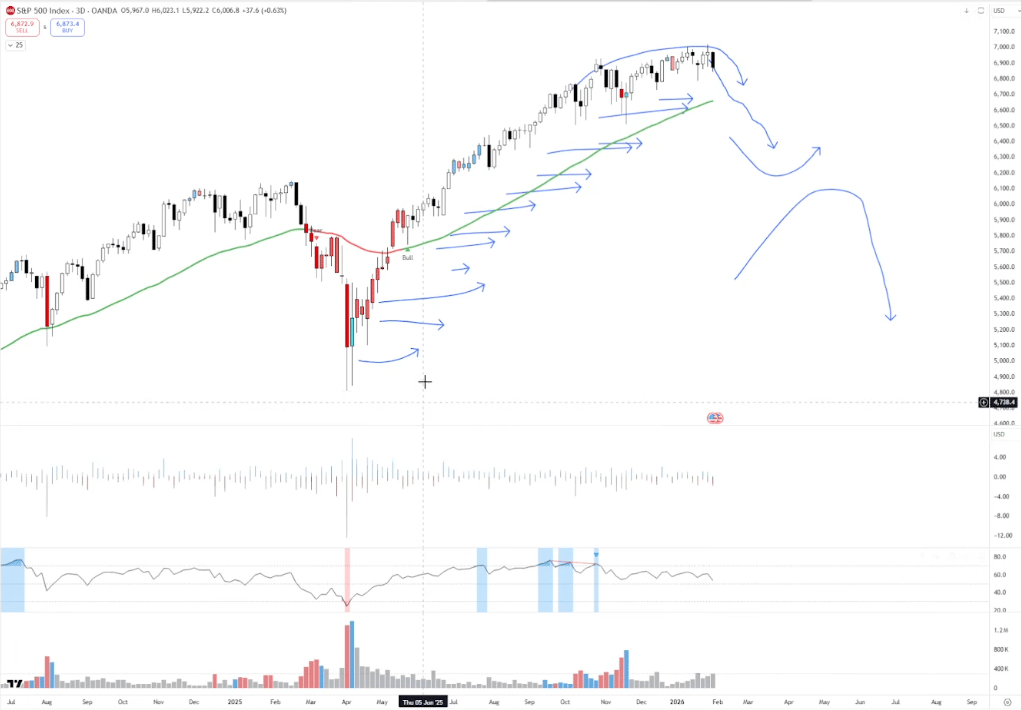

S&P 500

If I was going to short something, I’d look at equities.

Momentum on the 3-day RSI is clearly dying off.

I haven't shorted this, but it’s a much better short candidate than crypto at these levels.

Altcoin picks

ETH is absolutely dying from its consolidation and SOL lost its key level, but I do see some opportunity in the below coins.

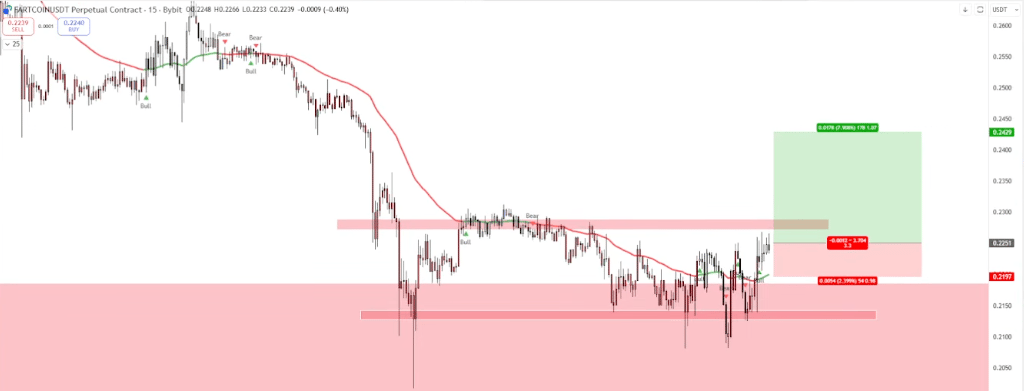

FARTCOIN is my primary focus.

It’s massively oversold and high beta, which makes it a good candidate for a reversion long. We just need to see some strength from BTC.

There's a range high forming around $0.22-0.23, and once we break that level with the lows getting defended, that's when the probability shifts in our favor. I might just chunk a little bit in for a rotation.

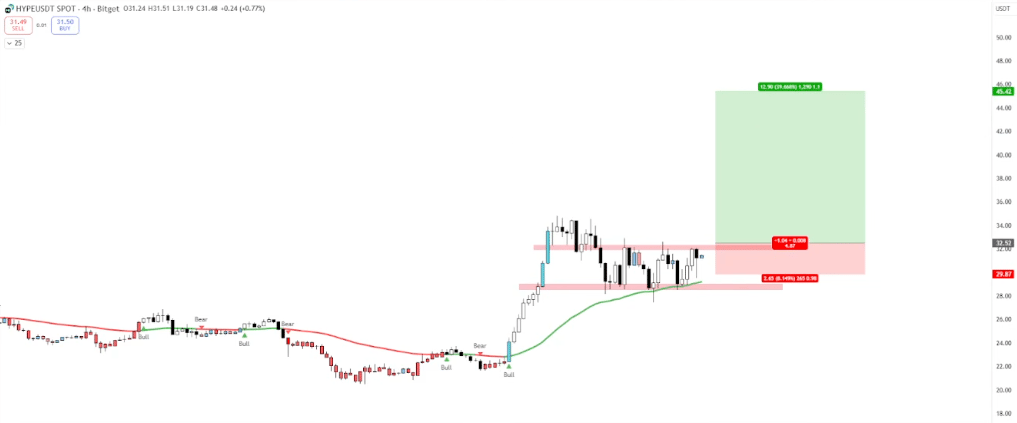

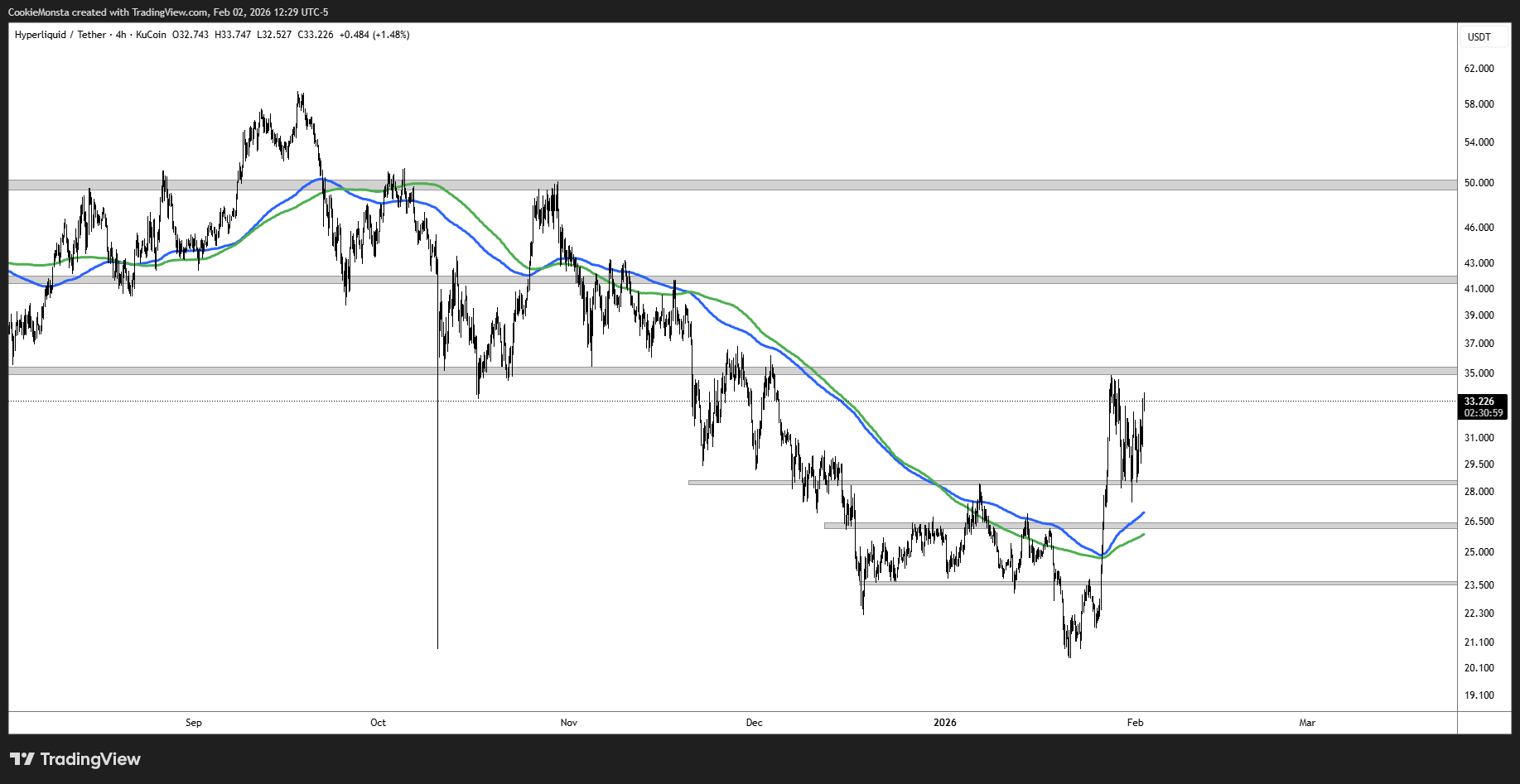

HYPE is another one showing decent strength.

We've broken the downtrend and now we're ranging.

There's narrative around people boycotting Binance and going to Hyperliquid, so potentially a genuine play there. Maybe a buy a spot bag and let it play out kind of trade.

TLDR

Waiting to see some strength from BTC and relative strength in alts.

Until then, sitting in cash and being careful with size.

On that bombshell, love you and leave you.

Stoic | Bias stays short until this changes |

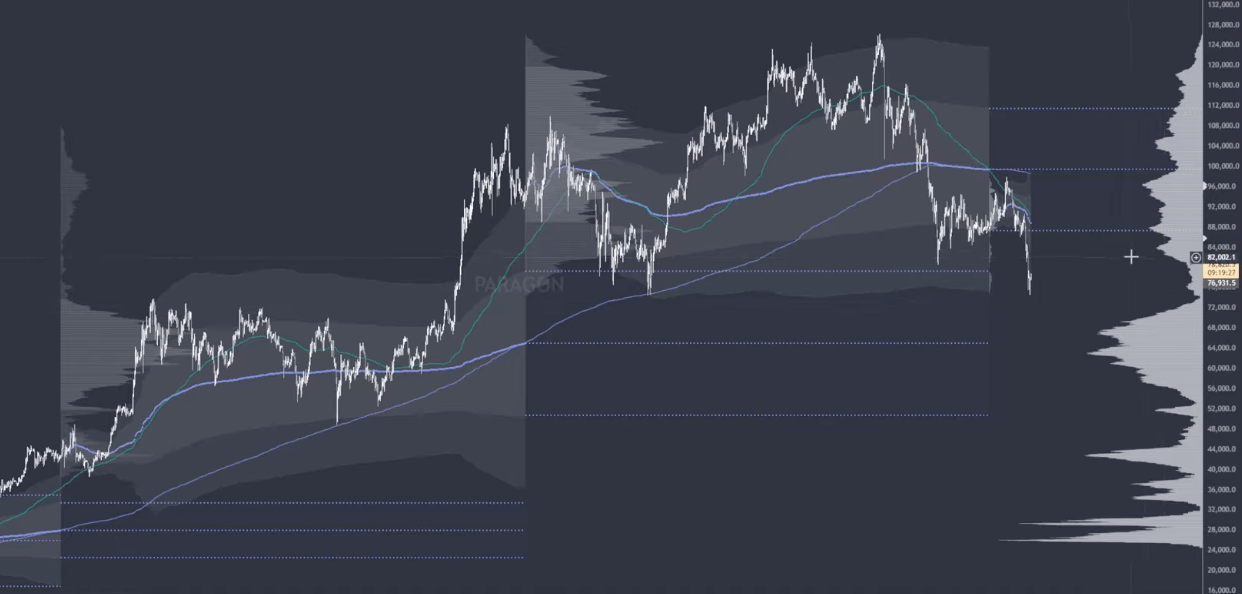

The composite I mentioned last week is what I used to set my bias in both directions.

Rejection from point of control and then loss of about two months of value development led to reflexivity to the downside, both scenarios I mentioned last week.

Pivot points

The current drift higher has been supported by Coinbase buying this session.

80-82 is the interim pivot, meaning a clear rejection points toward more chop whereas a reclaim could point to some more upside into the mid 80s.

There’s a lot of work to do to get there, so I'm just taking things level to level, observing spot and perps behavior and letting that inform my decisions.

Mode of operation

It's evident that the trend has remained strong in the down direction, which is why my bias has been more towards shorts, and I’m only taking longs for temporary mean reversion.

Until this environment changes, this will be the mode I operate in.

HYPE strength remains an outlier so this is one of the few other assets I'm paying close attention to currently.

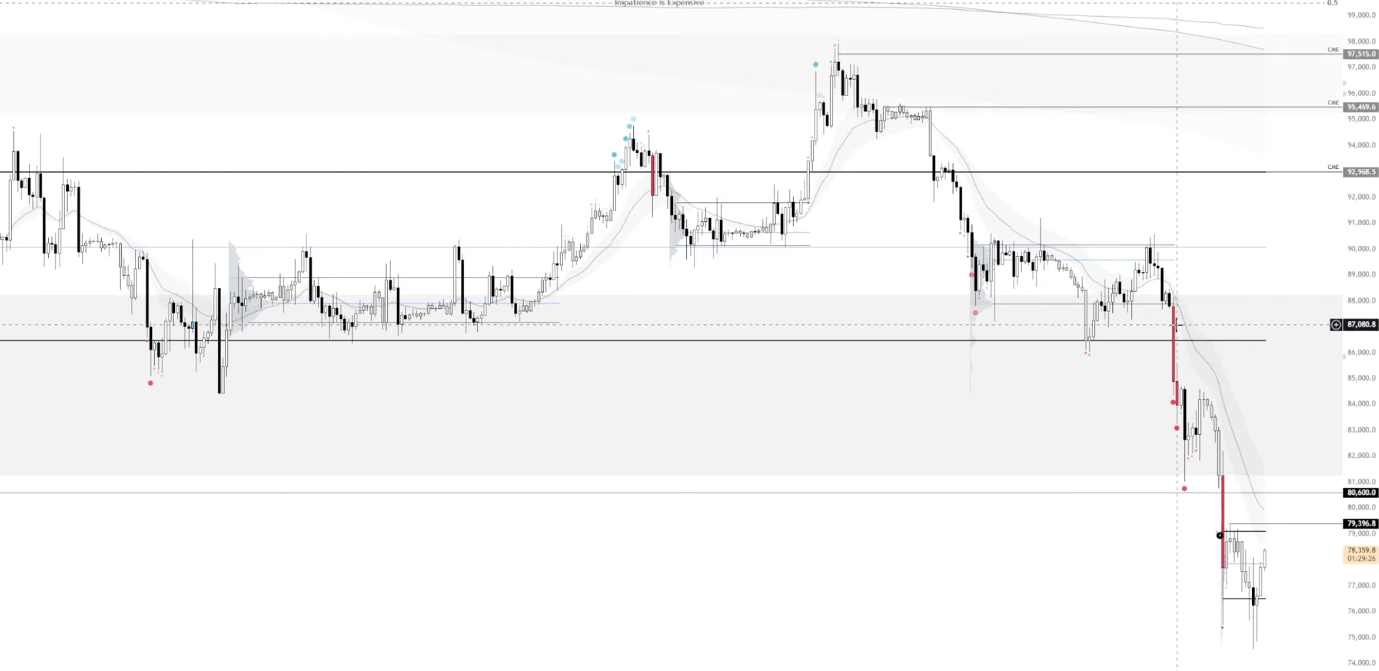

Mercury | Why I might skip the $75k long |

The assumption that Bitcoin remained bearish on higher timeframes, regardless of local strength, was proven correct.

Price has now broken down from a 2-month range, and we're seeing a higher volatility selloff toward the next support level around $75k.

This is clearly a key level, but I'm cautious of a muted reaction if price gets there. Bitcoin is notorious for blowing through or frontrunning obvious support levels.

If we see perp long positions opening without spot support it could lead to another cascade down.

I will be watching for elevated open interest as price approaches that region, and checking spot/perps premiums.

If there’s a premium on perps (i.e. perp price > spot price), this implies degenerates are buying the dip rather than chad spot buyers, who are less likely to puke in an instant.

Depending on how things shape up when the time comes, forgoing the long at the $75k retest altogether may be best.

HYPE relative strength

After the initial breakout at around $26 that sparked the impulse higher, HYPE has managed to maintain the same key bullish arguments that allowed for that rally.

This is a massive discrepancy in strength when correlated to the rest of the market.

HYPE is above a 2-month range, has reclaimed a key trend, and shows bullish market structure on the daily for the first time in 4 months.

Compare this to other coins right now, and there's essentially no contest. Most things are creating lower lows, breaking down below multi-month ranges, or making new all-time lows.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.