- CookBook

- Posts

- The FOMC edge

The FOMC edge

Ride the unwind

In today’s edition we have:

Magus — Fading other people's mistakes & new assets I’m watching

Doc — The FOMC edge

Charlie — It's alt season… just not in crypto

Stoic — How I’m playing a stacked week

Mercury — Every successful trader has this

Magus | Fading other people's mistakes & new assets I’m watching |

FOMC is Wednesday so I expect de-risking today and tomorrow and buying after the fact (setups and levels below).

TradFi = bullish

Equities still make up a huge chunk of my holdings.

My plan is simple: If blessed with dips, I buy. An FOMC dip can be both a long-term DCA or medium-term buy the dip opportunity.

Silver at $111 is wild. I sold most of mine at 77, 78, and 92. Still have a little left, but sold too early.

Most of my exposure has been in the big indexes like the S&P, but I’m looking to get more involved in thesis-driven rotational plays like rare earths, energy, defense, other metals, space tech, etc.

I’m more interested in owning the building blocks that feed these industries rather than the big companies themselves.

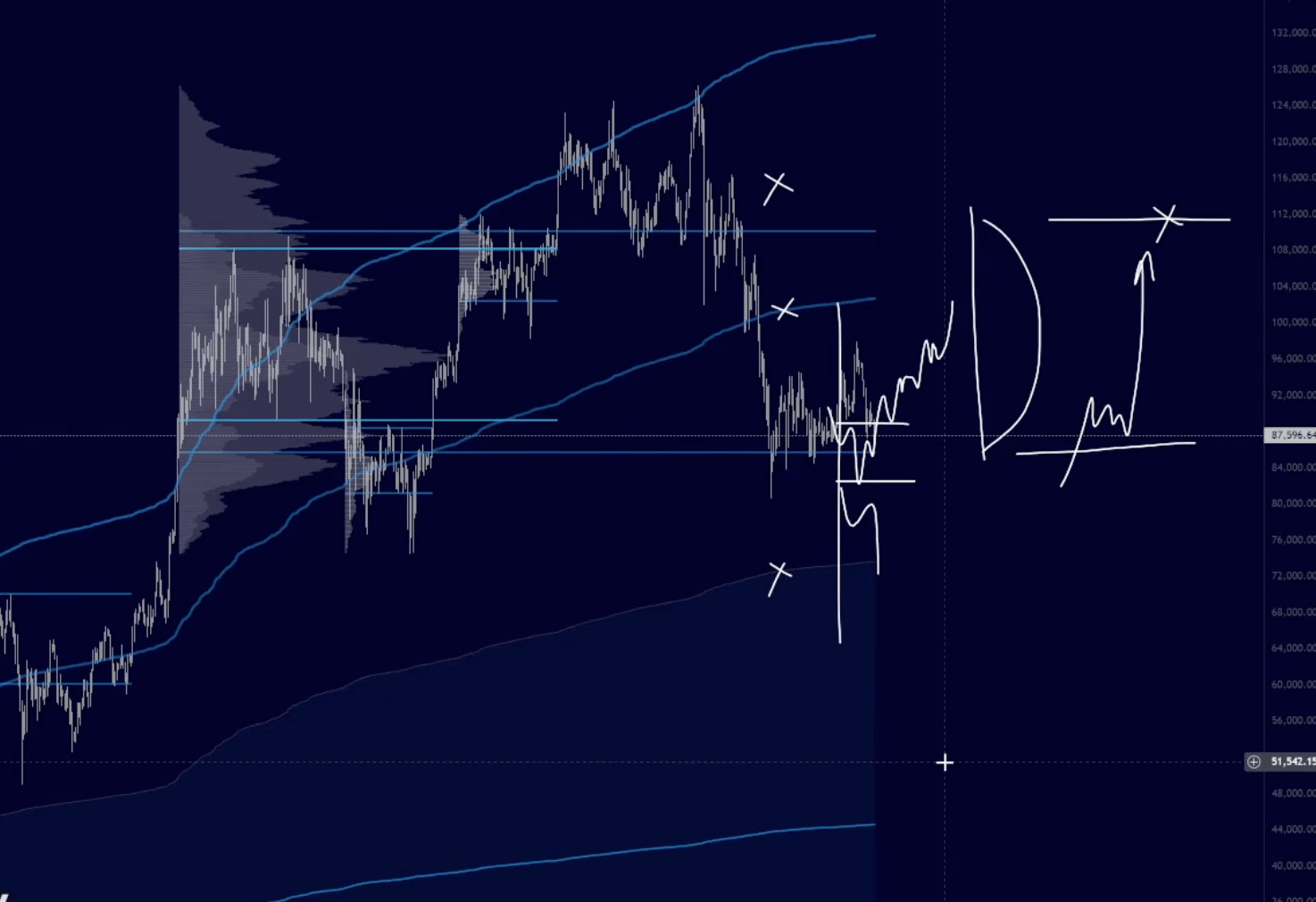

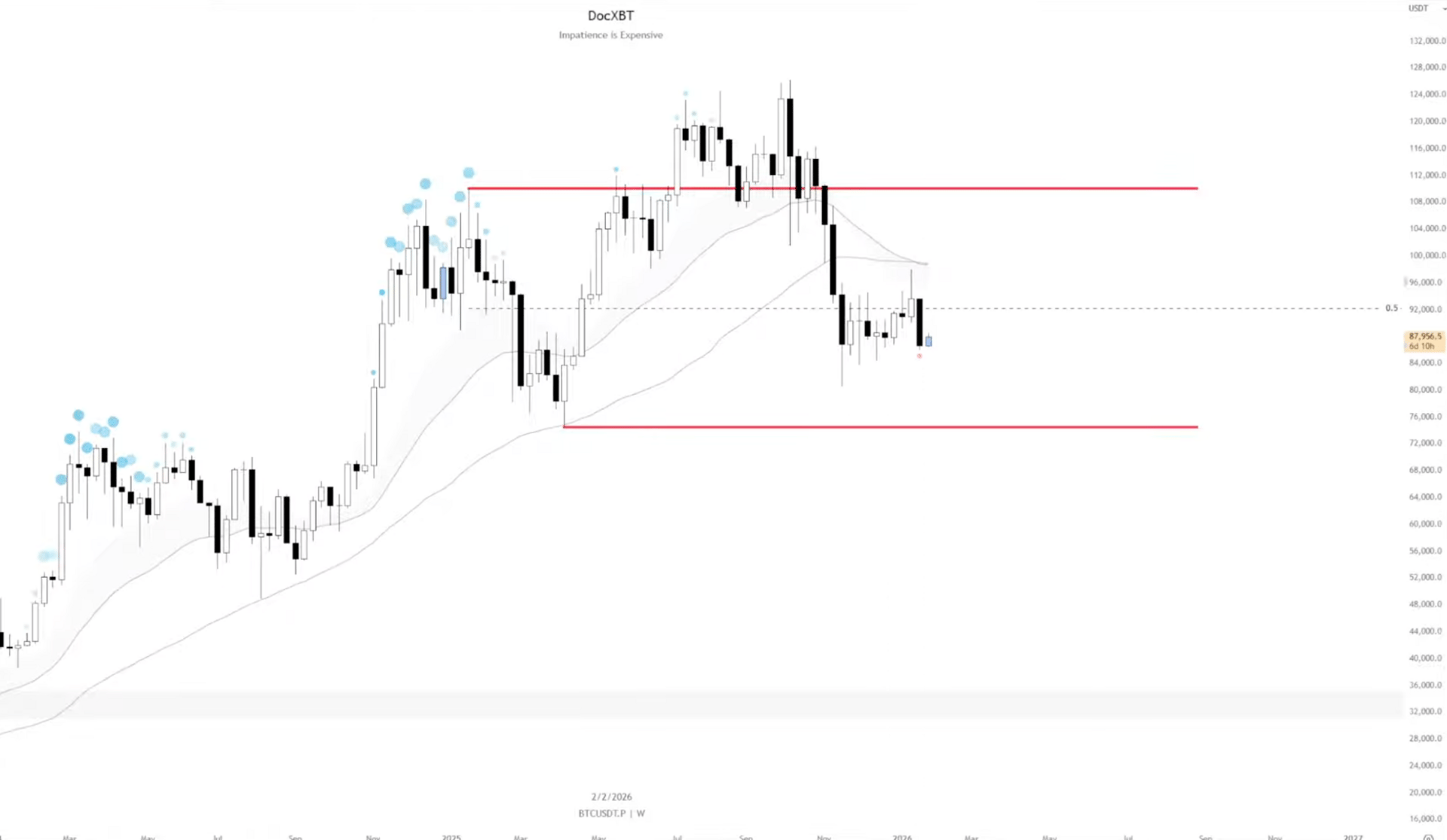

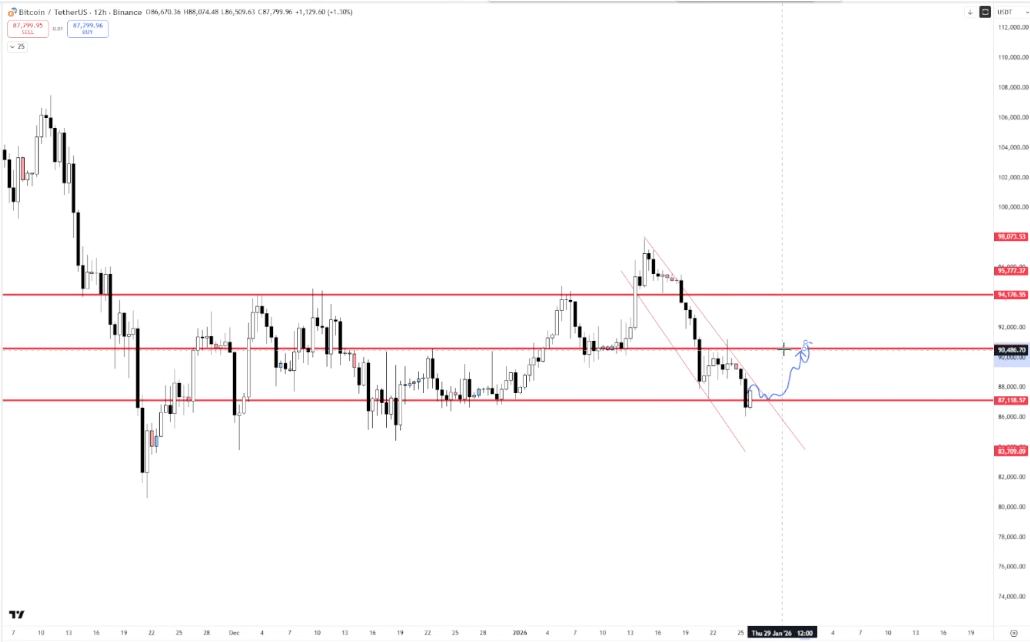

BTC macro: relatively weak but thesis still valid

Still holding the 14-month macro range low.

Price action feels similar to the tariff lows last year, but strength relative to other asset classes is the polar opposite.

I see zero reason to allocate more to Bitcoin right now. Eventually, that will likely change, but I’m not rushing.

Swing long

On the medium timeframe we're trading inside this 92k and 85k range.

The 80k to 85k zone is value to me, so I’d look to send longs around there if FOMC sell pressure comes through.

Intraday

I got 3 intraday trades in less than 4 hours this morning

In a rangebound reversion market, I fade the extremes and enter on other people’s mistakes (i.e. perps closing out).

Hedge

I also hedged out my BTC into the short squeeze today.

Yes, the location is terrible since I'm hedging near macro range lows, but I shorted into other people getting blown out on their shorts two days before FOMC, and that execution makes sense to me.

If we rip up I close the hedge and let spot ride, if we dump I'm protected.

That's pretty much it. Cheers.

Doc | The FOMC edge |

Back in 2022, I learned about the FOMC edge from Huss.

When you get heavy selling and hedging going into fearful events like FOMC, those hedges often unwind afterward. This unwinding causes buy pressure, which we can ride.

I’ll be looking for this confluent with the setup below.

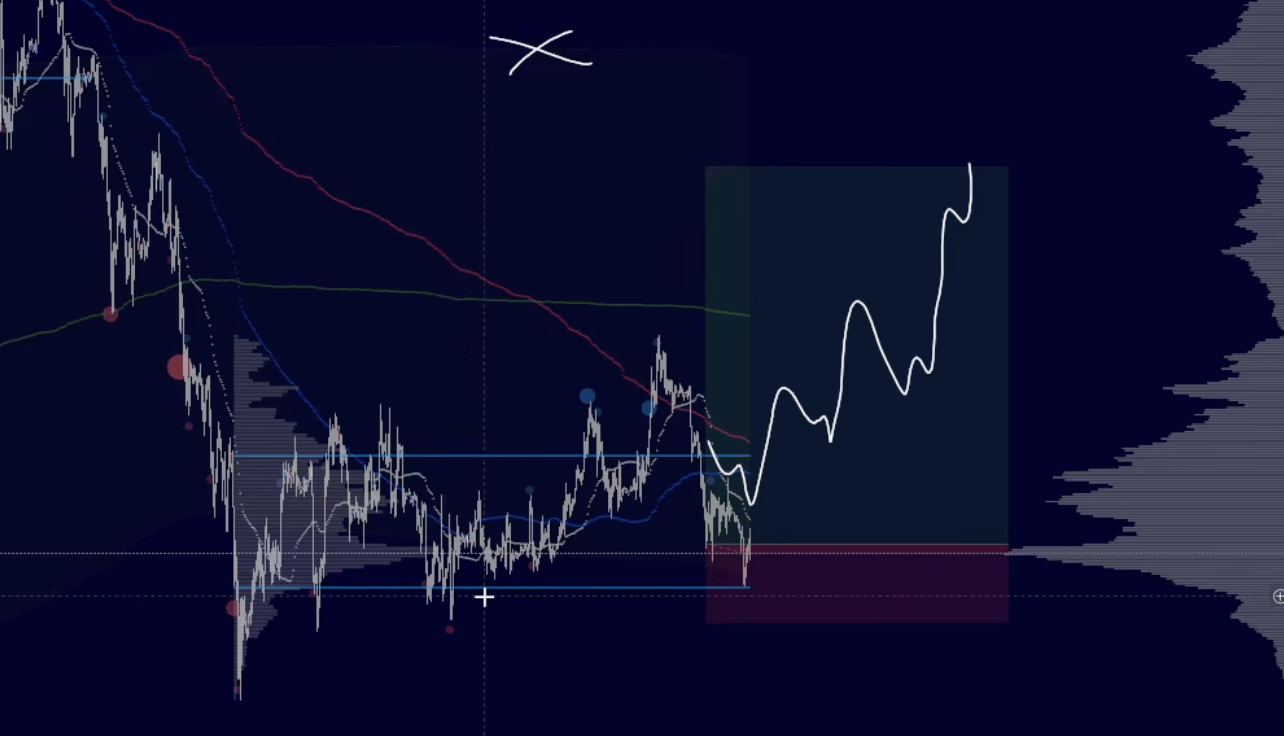

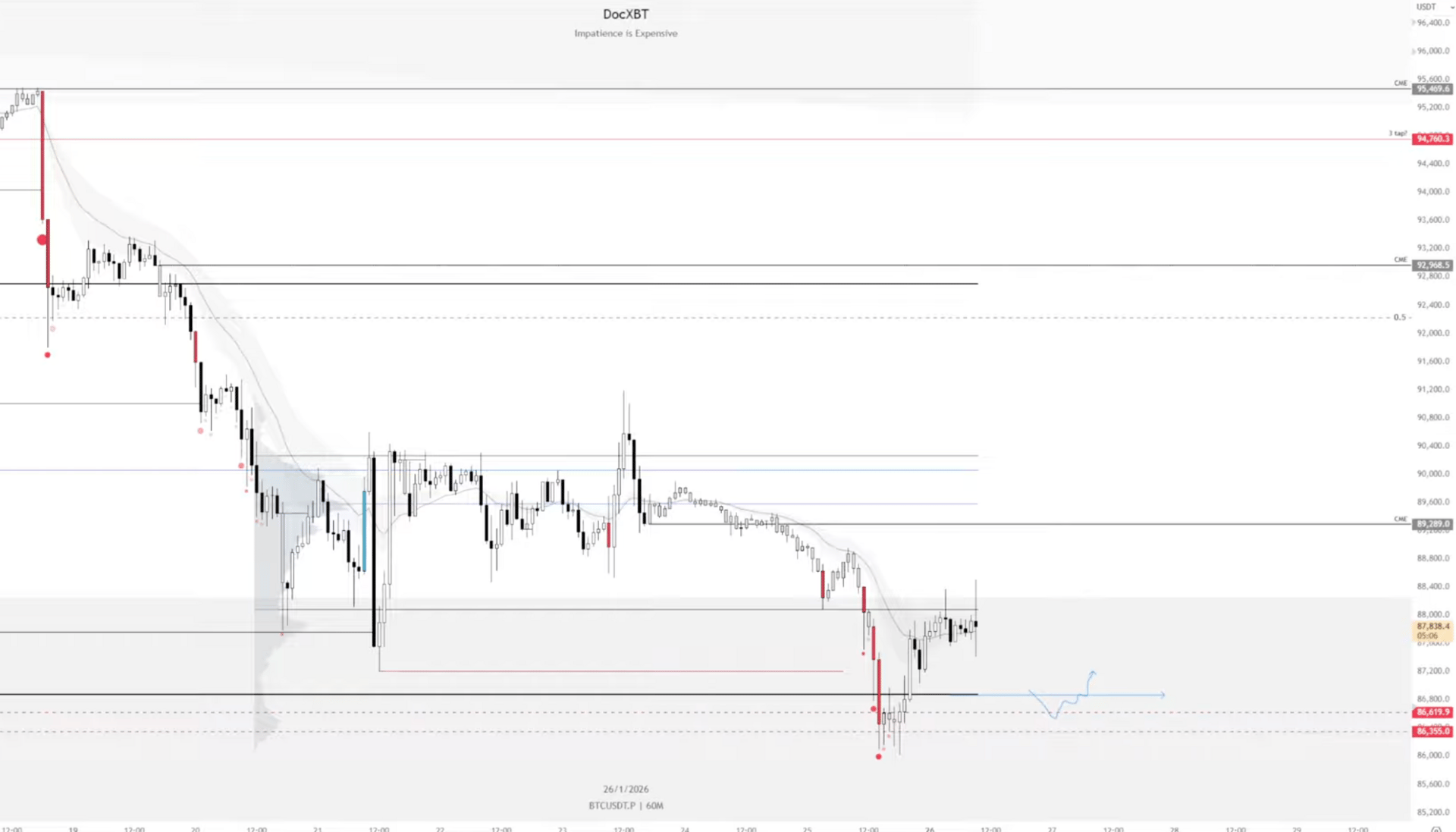

The setup I’m looking for

If we can get acceptance back above $88.3k (H4 trend + previous week range lows), I'm looking for rotation up into the 90s.

My first target is the local composite value high around 90k, but really I’d expect a bigger reversion because we have four CME gaps above, which is rare in one direction.

Also, we got a large deviation of the lows on Sunday, and large swings in one direction often result in similar moves the other way in rangebound regimes.

TLDR; Looking for a break of the 4-hour trend, and rotation to 90k-93k.

High-timeframe

We’ve been building out our local range for 10 weeks after losing a 1,000-day HTF uptrend

As a reminder, my expectations after trend loss in order of probability are:

Range

Continuation

Reclaim of previously lost trend

We’re getting the range now, so I’m playing the extremes of value, longing the lows and selling the highs.

Charlie | It's alt season… just not in crypto |

I'm leaning into this week more than the last two.

BTC is sat at range lows, and moves up can squeeze late shorts if we break this diagonal downtrend.

And that's when alts could get proper rotations, 8-10% in a short space of time.

Just be aware that we’re still in this local downtrend so be prepared if BTC rejects from it.

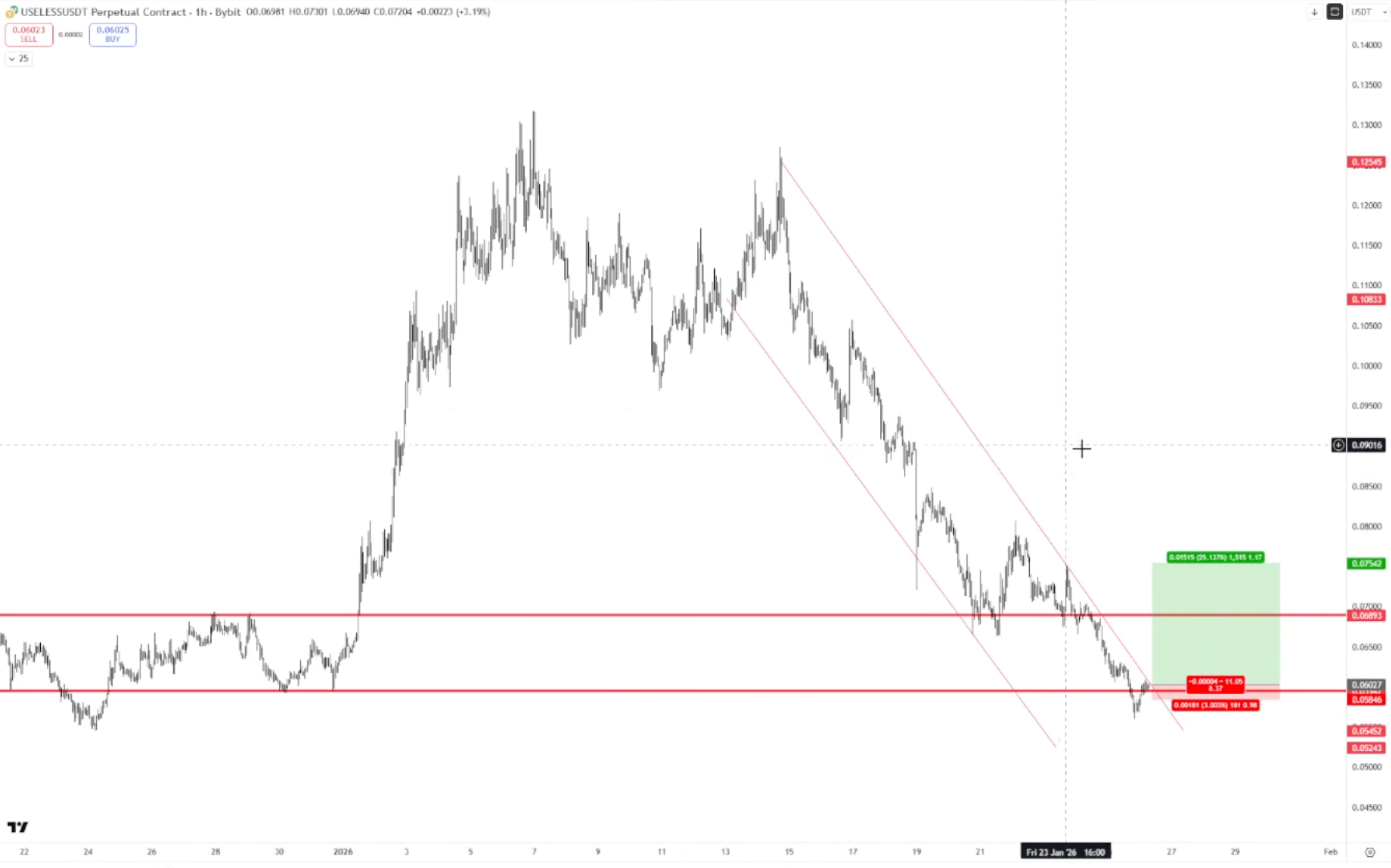

Already in USELESS

I've bought some USELESS on spot.

It’s had an absolute savage downtrend, but it’s deviated range lows, and shown consolidation across the bottom. That's a setup I like to play.

A few more alts

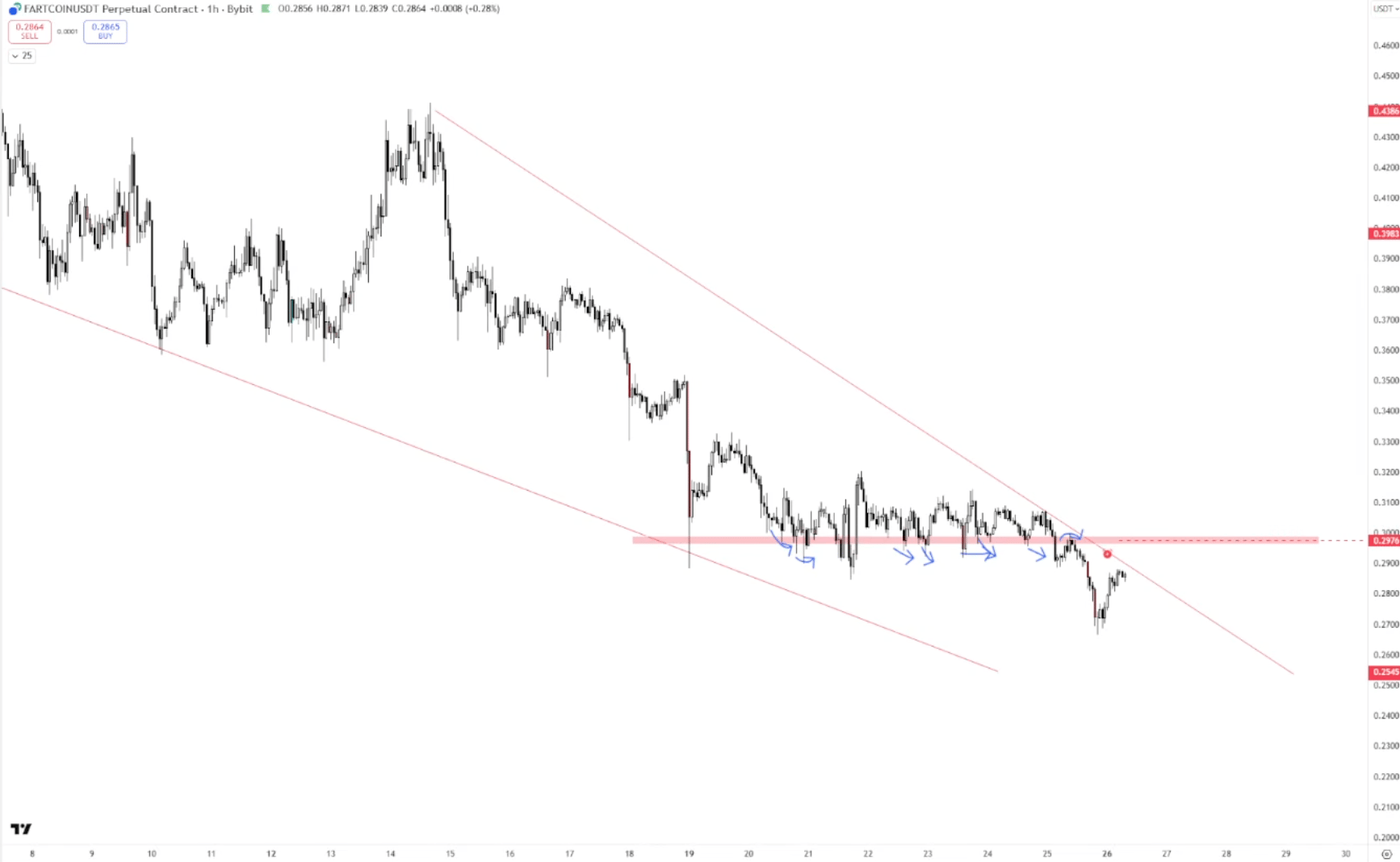

FARTCOIN has something similar setting up but I'm waiting.

Thirty cents is such a key level (previous support, multiple tests), and until we reclaim that, I'm not interested.

This is an example of letting trades come to me: Set alert. Do nothing. Check relative strength on spaghetti when alert goes off.

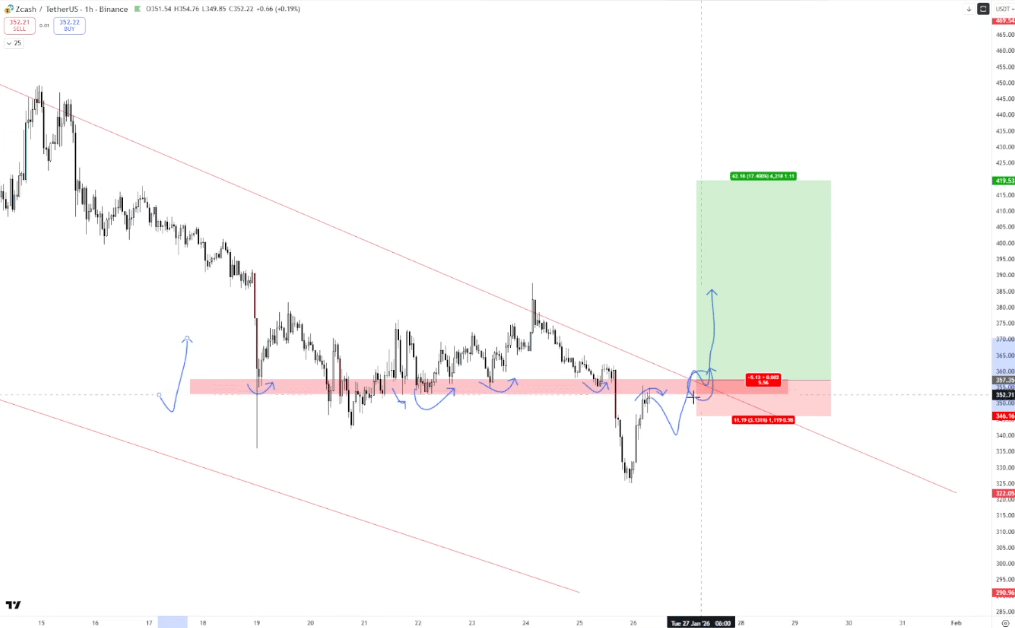

ZEC was one of the strongest liquid coins on Spaghetti early today.

That 355-360 area is key. I'm waiting for a diagonal break plus continued relative strength on spaghetti

I generally don’t buy the pullback before as you see drawn above. I’m just much better at entering once the rotation to the upside has already begun, so that’s where I do business.

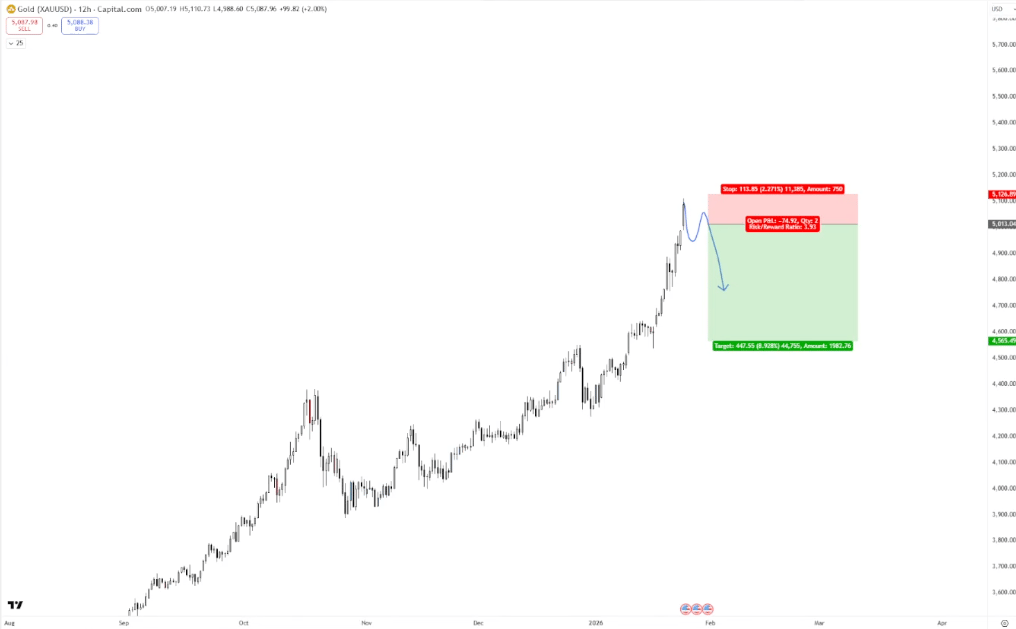

Gold is crushing it

The shiny rocks gold and silver are absolutely crushing it.

Another parabola forming. I don't short a parabola until it shows weakness, and it’s shown none so far (hypothetical setup below).

My one hope for crypto is that some of that gold money eventually rolls into crypto, but I don’t see any signs of that happening right now.

It's alt season. Just not in crypto.

Stoic | How I’m playing a stacked week |

There should be a bunch of short-term opportunities this week with all these volatility events:

FOMC Wednesday

GDP Thursday

PCE Friday

Four Mag7 earnings

The setup

BTC swept the range lows and is now trading near the lower end of value, so I’m looking for longs.

An early session push today could set up mean reversion higher if these lows hold. Confluence I’d be looking for: a passive spot bid and continued buying aggression on dips.

If BTC breaks down, and the low side of value becomes resistance, we could see a fast move down to take out lows like the previous month low.

TLDR

This week is a bit tricky with all the events. Markets can get thrown for a loop.

So I'm staying flexible and looking for short-term opportunities vs. trying to swing for the fences.

Mercury | Every successful trader has this |

Perpetual optimism isn’t: “My assets are only allowed to go up.” That’s delusion.

Perpetual optimism is: “Opportunities will fall into my lap once again.”

Optimism without delusion.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.