- CookBook

- Posts

- 👀 where to buy the dip

👀 where to buy the dip

alts to watch

In today’s edition we have:

Magus — Q4 plans playing out

Doc — My next swing long setup

Charlie — Hunting new setups after 66% win rate

Stoic — Riding alts while BTC is above this level

Mercury — This reclaim hints at an incoming leg

📊 Quick Poll (5 seconds): What do you want to see more of?tap/click below |

Magus | Welcome to Q4 |

First, congratulations for surviving.

This is an infinite game, and most people lose by giving up or running out of money before the good times.

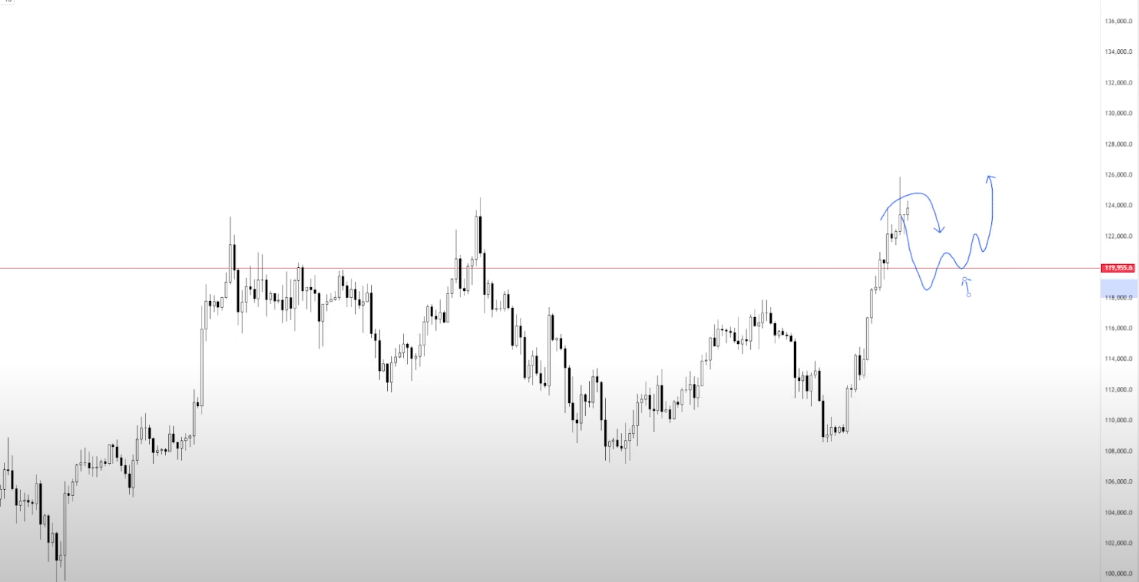

Medium timeframe structure has locked in a higher low and higher high. Price has flipped $120k to (hopefully) support.

If we get a dip to $119k-$118k, I will ape hard. Below $110k invalidates the risk-on thesis.

Alts

It's finally time to buy more spot alts for big swings.

Don't chase everything you see shilled on Twitter. Pick good coins and wait.

I like SOL more than ETH right now. XRP and LTC are my favorite boomer plays. Overall I’d be looking at memes and L1s.

Stay level-headed & optimistic

I only celebrate when I'm selling, not when things are going up.

If I'm right about this quarter, it's going to get way crazier than this so don’t get lost in the sauce on Twitter.

Remember: pessimists sound smart, optimists make money.

Lock in.

Doc | My next swing long setup |

Bitcoin has been on a tear since the monthly/quarterly open, holding the value area high with minimal pullbacks.

My bias simple: hold the monthly value high, continue aiming higher.

My two areas of interest to send swings are:

Monthly VWAP around 120-121k, which is also previous weekly resistance, a psychological level and the top of the July-August composite value high

Monthly value area low around 118k, which lines up with the previous quarterly value area high

Holding below 118k signals we’re still in a rangebound environment and not ready to trend immediately.

PUMP

I'm rebuilding my position at the monthly VWAP keeping risk disciplined.

Last week we talked about the importance of breaking through the monthly VWAP at 60.

We did and found ourselves all the way at the previous monthly VAH, which provided a very clean place to lock in profits.

It’s a new month and I think the previous monthly value area provides good context.

We want to flip previous monthly VWAP into support around 60 to play a continuation toward range highs.

Failure to do so would likely lead to a bleed back down to range lows.

XPL

Last week I warned that losing the listing anchored VWAP would lead to a range at best and a bleed at worst.

We got both.

Here are the bullish and bearish scenarios:

Accept above 95, and I’d aim for continuation toward the listing anchored VWAP around 1.1.

Expand below current range lows around 83 invalidates upside in the near-term.

Charlie | Hunting new setups after 66% win rate |

I'm not going to lie, this week's going to be harder than the last few.

We're around Bitcoin's all-time highs, which can can get choppy.

If we get a proper pullback to the $120s, I'll look for the next real trades.

At the start of this week I’ll most likely be risk-off on fresh perp trades.

That said, I’m not going to stop hunting new alt setups (I don’t have a gambling problem).

USELESS

Useless has had a bullish shift in structure, putting in a higher low on the daily.

I’d be looking for a continuation long if I see consolidation and relative strength around this pivot point

Keep in mind it's a nightmare to trade on perps because of the wicks, but the setup is clean.

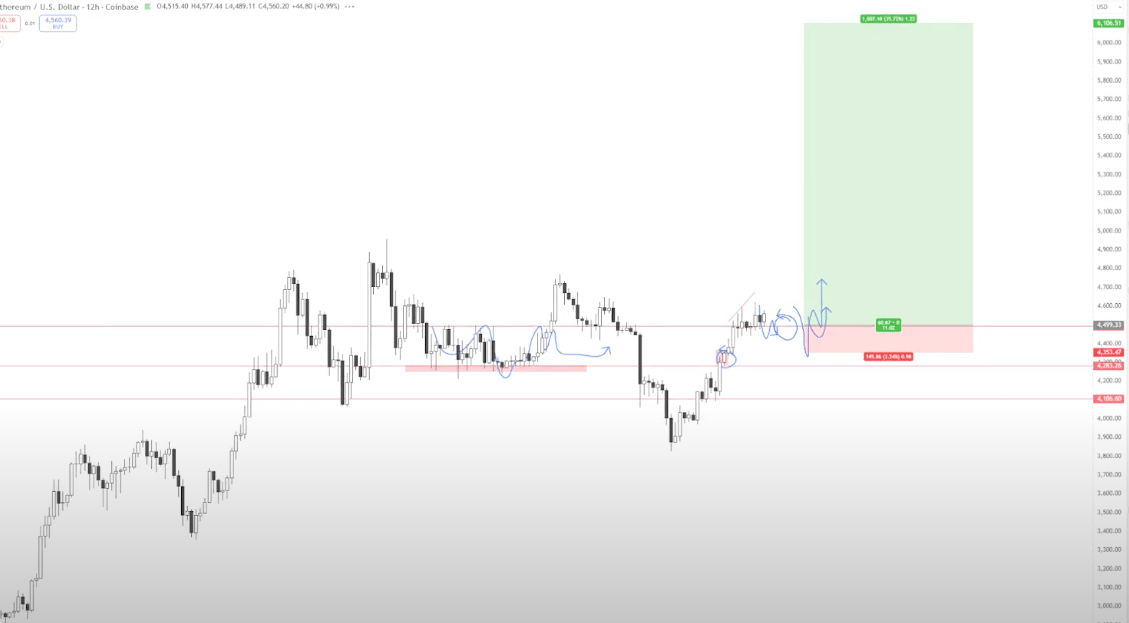

ETH

For ETH, this consolidation is exactly what we talked about.

A sell-off and reclaim is when I can get interested in a decent-sized bag for the next leg up.

TLDR; We're at the highs after a strong couple weeks. I'm scaling back some risk and waiting for the market to show me the next clean opportunity.

Stoic | Riding alts while BTC is above this level |

Keeping it simple.

BTC has broken from the upper balance on the daily chart and I’m looking for acceptance outside of value for continuation.

118-120k has overlapping confluence and is my area in the sand for a deeper pullback.

Zooming in, the H1 has been trending for about a week now. I'm tracking the trend with an anchored VWAP from the local low.

The 1 standard deviation band is holding fairly well, currently around $123K. I'm using this to measure strength and weakness on lower timeframes.

For alts, I'm keeping it simple: Bitcoin above $120K means I'm looking for alts that are showing strength and maintaining their trends.

I use a spaghetti template to track what's performing well.

I've been scalping longs on ASTER this past week, but I'm keeping my eye on any alts that demonstrate strength or bounce hard when Bitcoin dips.

Mercury | This reclaim hints at an incoming leg |

ETH

Ethereum's high-timeframe bullish retest of the 4-year range high has proven successful.

We’ve also finally reclaimed the 4H 200 MAs, which is significant because the previous two times ETH reclaimed this trend we saw major rallies.

Reclaim #1 delivered a 65% trending move over approximately 2 months.

Reclaim #2 gave us a 100% rally, also over roughly 2 months.

The most recent reclaim happened just days ago, and it's not unreasonable to expect similar directional movement.

I'm looking for a breakout of local range highs and continuation into price discovery in the coming weeks.

DOGE

DOGE has been coiling nicely along the 1D 200 MAs.

We've only seen this pattern twice in the past 2 years, and both times it delivered over 200% moves.

This chart has tested patience, retracing rallies but never invalidating the broader timeframe thesis.

Historically, DOGE has served as a strong proxy for the altcoin market.

The previous two rallies coincided with those rare moments when everything rallied together (the notorious "Alt SZN" traders fantasize about).

If DOGE confirms this breakout, it could signal the start of broader alt market strength.

What setups did you like today? Hit 'reply' to this email and let us know.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.