- CookBook

- Posts

- waiting for the spark

waiting for the spark

plus, doc on how to sharpen your edge

In today’s edition we have:

Magus — Waiting for the spark

Doc — Put the ball in the damn court

Charlie — Too late for waterproof sheets

Stoic — It’s all downstream

Mercury — Waiting for something to break

Magus | Waiting for the spark |

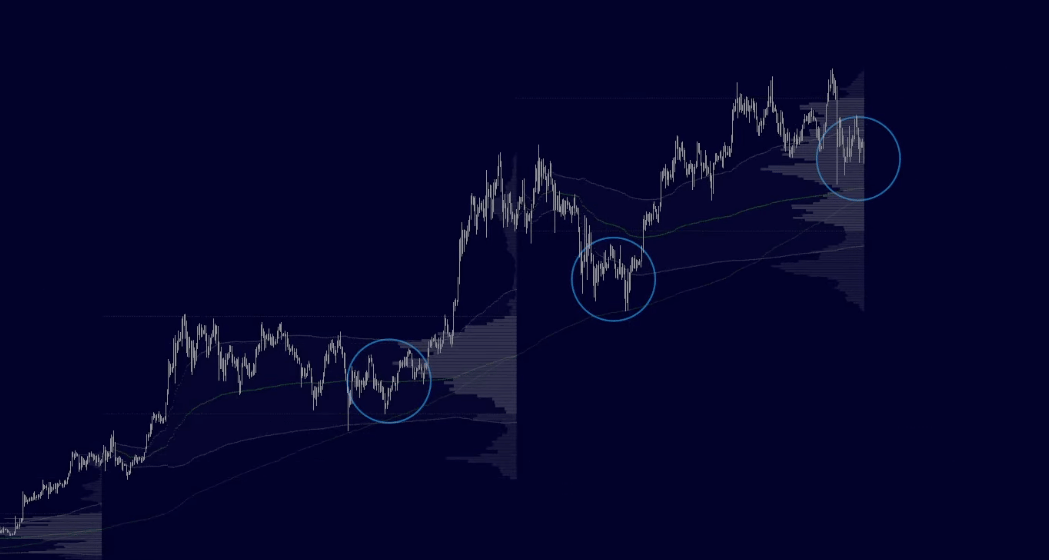

This is the first year in all my years of trading where we've seen BTC not crush other assets like equities when the path forward was clear.

The 10/10 liquidation event was much more painful than I expected, and I think Bitcoin would be trading higher right now if that didn’t happen.

That said, I'm still bullish and haven't changed any plans or any positioning. But I'm keeping the following in the back of my head.

If we don't see this bull trend start to spark in November, it means the Q4 thesis is pretty much dead.

Then the only bull hopium you can cling to is maybe it comes one quarter late in Q1 2026.

But if we get a month or two into Q1 2026 and Bitcoin's still just trading how it's been recently, then I'll start to abandon the optimism in favor of realism.

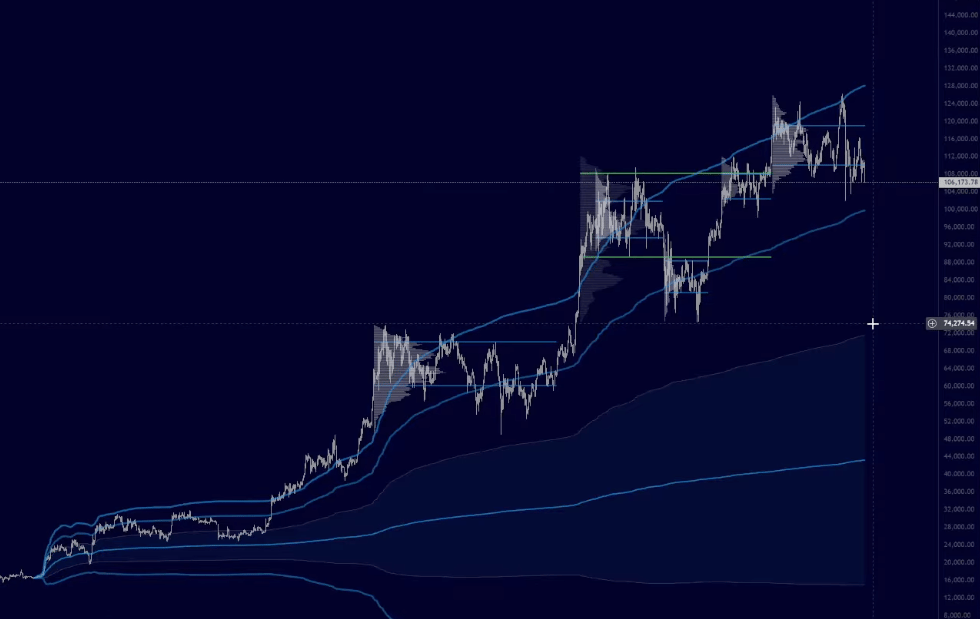

Medium timeframe and levels

As far as levels go, 110k is the level bulls need to reclaim, but I think Bitcoin's probably going to trade lower first.

The next major target is around 100k, plus or minus a few thousand.

Plans

I’m focused up on intraday right now, mostly looking to short pops as the short side is higher expected value right now.

Alts are for trading only. These past weeks have shown us again that we only want to have significant alt spot exposure when BTC is trending.

From a portfolio standpoint, I'm continuing to rebalance in the direction of benchmarks.

I plan on starting a gold bag and adding to NASDAQ and SPX if we get that deeper pullback in equities.

Doc | Put the ball in the damn court |

Breakeven trader?

Stuck in elo hell?

You don’t need new indicators or a new system.

The fastest route to profitability comes from…

Reducing unforced errors.

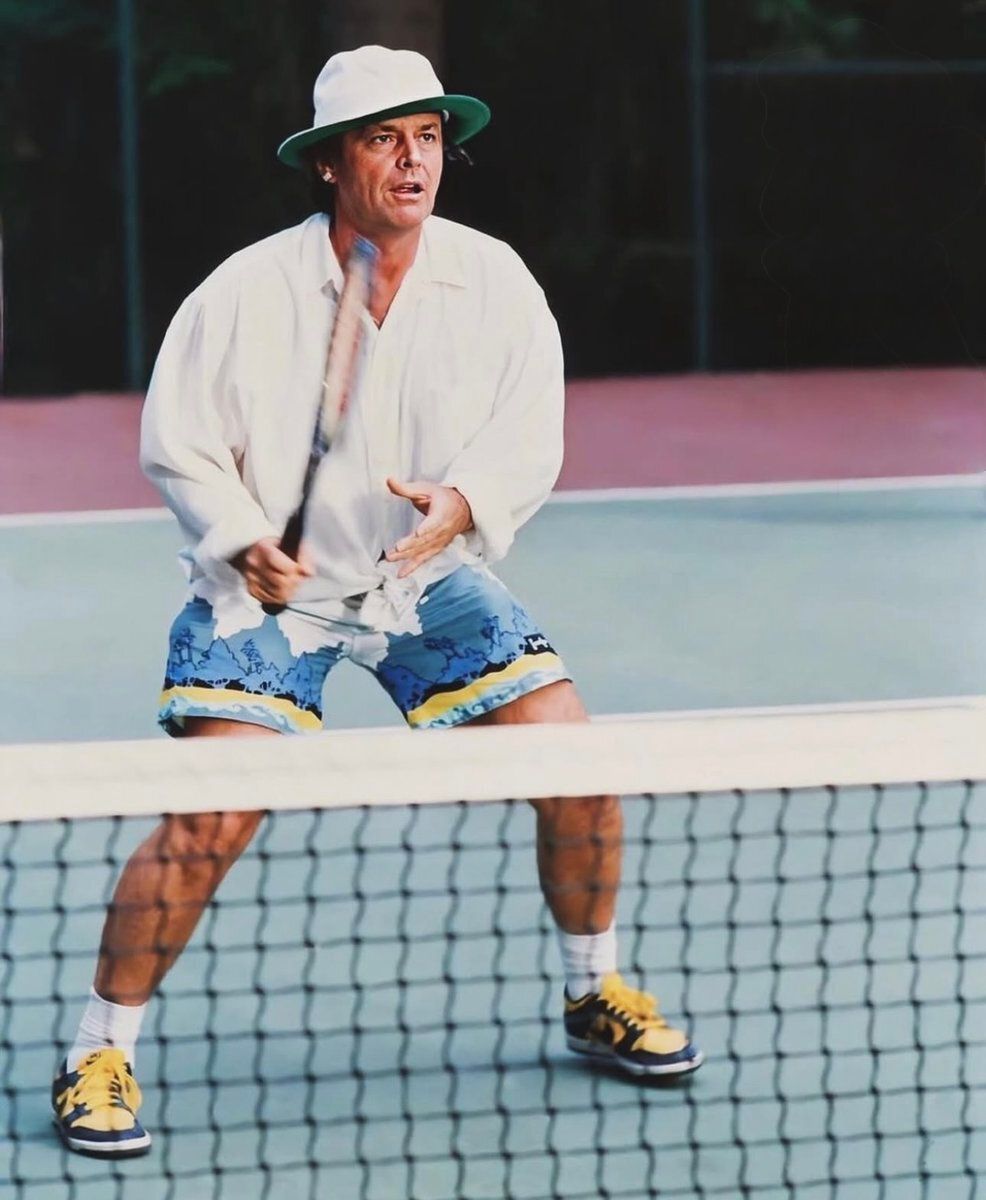

This is an idea I stole from tennis.

I used to wake up at 4 AM to make 530 AM practice when I was 11.

Bedtime was 730 pm.

I was ranked top 100 in the nation.

But before cracking those ranks I simply had to stay in the point without shooting myself in the foot.

Just avoid losing.

Nothing fancy. Win by screwing up less. This is your amateur’s mantra.

Markets are the same.

Just put the damn ball in the court.

Keep doing the boring stuff that let’s you win until you’ve earned the right to get fancy like a pro.

How to implement it

What’s the one setup or the one timeframe that intuitively comes to mind as your favorite?

Don’t know?

Then start by writing down everything you're bad at as a trader.

Every error. All of them.

entering too early

taking trades you didn’t plan

planning trades to don’t take

etc.

This is how you figure out what you might be good at.

And I promise you, even if you're on full tilt, you have something you can do well.

Gather some stats.

I bet you that you're over 50% win rate with it.

Take that one stupid setup again and again and again…

Ignore everything else.

Adding more setups too early will just lower your overall expected value.

Think of it like a video game: You don’t split points equally across every skill tree. You focus on one and build around it.

Is there one coin you trade better?

> Stick to it. Remove the rest from the watchlist.

Better at trading ranges?

> Stop trading trends.

Trade better on H1?

> Stop yourself from trading other timeframes.

The fewer the variables, the better.

TLDR

Your desire to learn it all and participate in everything is preventing you from consistently doing the one thing you can probably already do well.

Be a shameless amateur. Sharpen your knife on one thing.

Earn the right to play like a pro before you get fancy with size, flow and game theory.

Put the ball in the damn court.

Charlie | Too late for waterproof sheets |

I'm back from holiday but the market doesn't look like it's ready for me.

Memes, which are usually a good proxy for risk, look awful.

We're still feeling the pain from 10/10.

I think Bitcoin dominance is just going to be up and to the right for a while and alts continue to be piss poor.

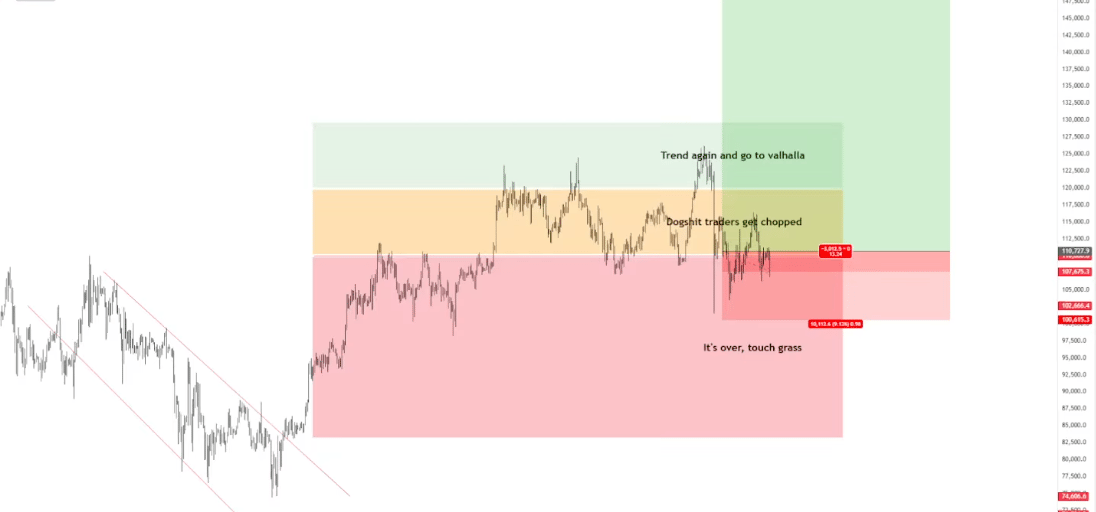

BTC bias

The only chart that really matters is Bitcoin.

We're at the bottom of this local range, and if it loses 107k, then I'm going to be like, yeah, we’re in a strong local downtrend.

But it's too late to short this low.

You don’t want to be shorting massively oversold hourly candles after the market's already shat the bed. You'd be putting down the waterproof sheets after the deed's done.

Do I want to be looking for aggressive longs at these lows? Not really. I’m looking for rotational plays to get in and out quickly on relatively strong coins while managing risk.

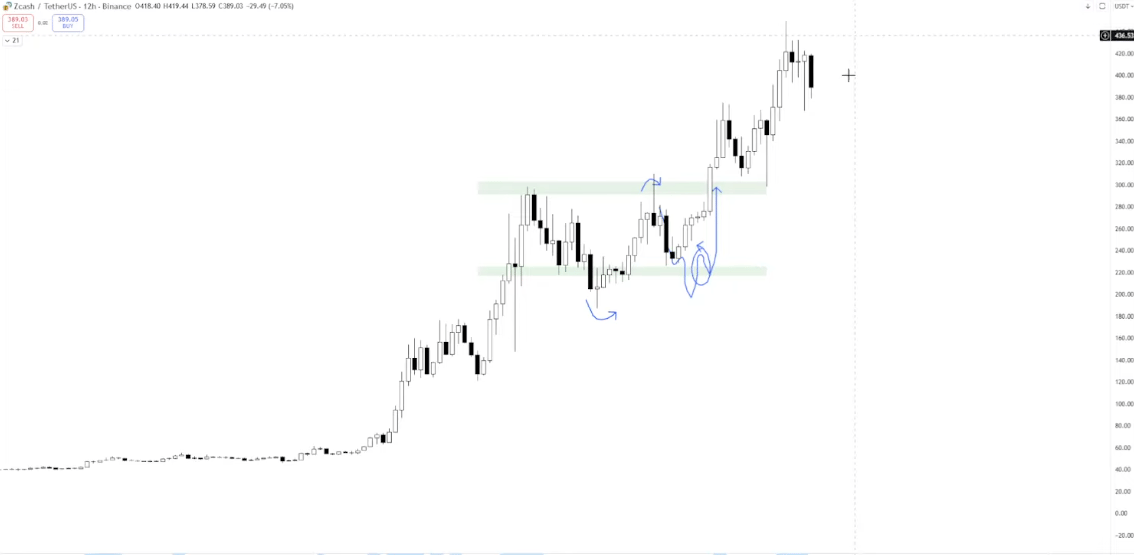

ZEC

Compare ZEC to pretty much anything and you can see it’s obviously different.

It's maintaining its strength, so if we get a strong rotation on a low time frame basis, I'll be happy to play it, but with sensible risk management… you know, not opening seven other alt longs with 100x leverage along side it.

Takeaway

I think Doc's prediction of like a 9-month range is kind of playing out. We're in it and everyone is just losing the will to live because it's not easy mode.

TLDR: Play some rotations if I see relative strength with sensible risk management on lower timeframes.

Stoic | It’s all downstream |

Instead of asking, “How can I make more money today?”

Ask, “How can I be more disciplined today?”

What you want is a byproduct of the basics.

Mercury | Waiting for something to break |

Bitcoin continues to show relative weakness compared to the stock market.

The S&P 500 threatens yet another new ATH, while BTC teeters on the edge of a cliff near 3-month range lows.

Bitcoin is higher volatility than stocks. Combine that with relative weakness and we can get high volatility in the wrong direction, down.

The same can be said for Altcoins pertaining to Bitcoin.

Alts bleed toward their October 10 wicks while Bitcoin goes sideways. If BTC sneezes, alts likely outperform to the downside.

This relationship can generally be depicted by the HTF weakness on the ETHBTC chart:

ETH is the king of altcoins, so it often portrays the general sentiment in the broader altcoin market.

Alts look to ETH, ETH to Bitcoin, Bitcoin to equities.

Right now, the higher risk assets are relatively weaker than the benchmarks they look up to.

The market will simply remain this way until something breaks, with sporadic opportunities scattered between (e.g. HYPE, ZEC recently).

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.