- CookBook

- Posts

- Two ways this bottoms

Two ways this bottoms

Plus, found one that might actually run

In today’s edition we have:

Magus — 2 bottom patterns to look for

Doc — Longing here if I get this

Charlie — Found one that might actually run

Stoic — The 2 levels I’m watching

Mercury — 3 charts shaping my view

Magus | 2 bottom patterns to look for |

Short and sweet this week since US markets are closed today.

Trump's speaking at Davos Wednesday, and we could get some wild tariff talk. Honestly, I'd love a non-event that creates a buy-the-dip opportunity.

TradFi: The opportunity I’ve been waiting for

I'd love to see SPX pull back another 200 points to 6,600. I'd shove pretty hard there.

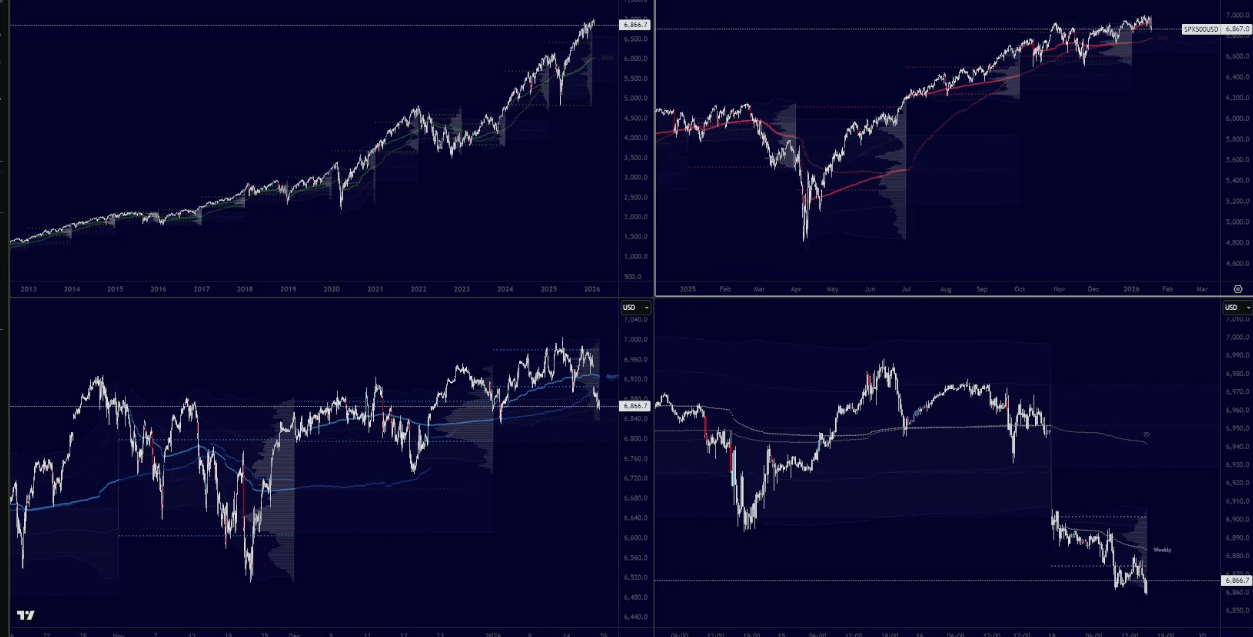

Yearly VWAP (top left), quarterly VWAP (top right), monthly VWAP (bottom left), weekly VWAP (bottom right)

But honestly, trying to pick exact levels isn't that wise. If I buy the lows, great. If I buy after it bounces, I'm okay with that too.

These aren't trades.

They're portfolio plays.

Precision doesn't matter as much.

General thesis: Bullish equities, metals, rare earths, energy, defense. Those are the areas I have exposure to or am looking to add to on a dip.

Silver's gone parabolic

Metals are in gigachad mode.

I've liquidated 90% of my Silver position at 350% gains. Maybe I sold a little early, but we lock in the W.

It's entering that truly parabolic stage, so if your taxi cab driver is asking if he should buy, maybe sell some.

Silver

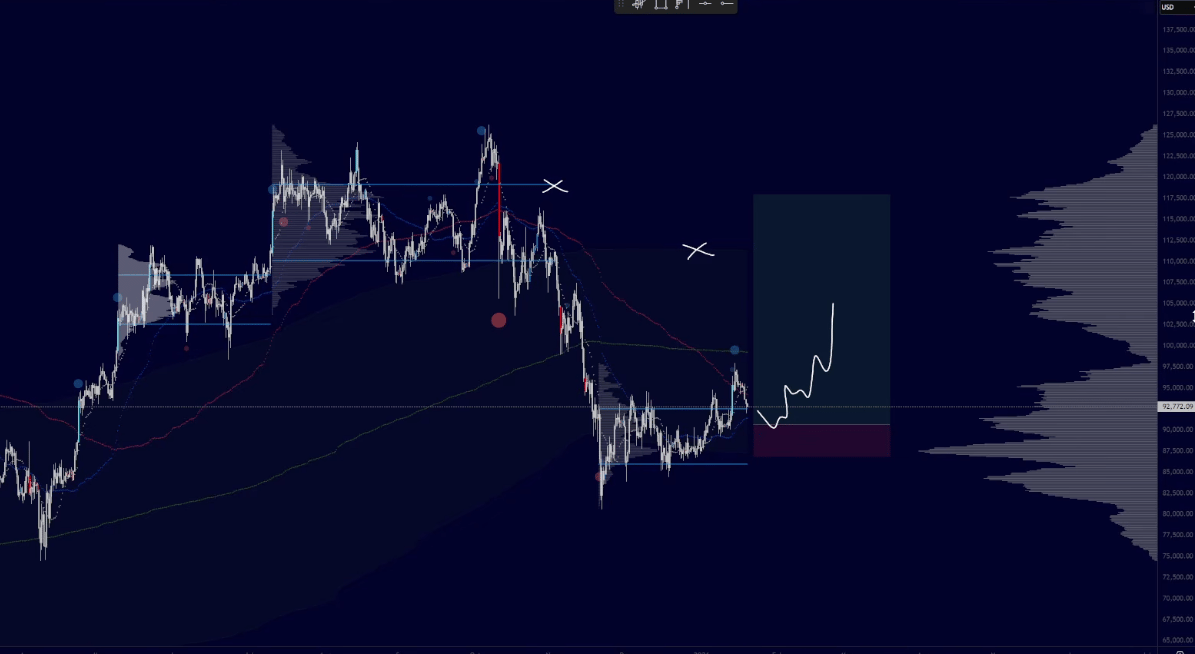

Bitcoin: 90k support, 110k resistance

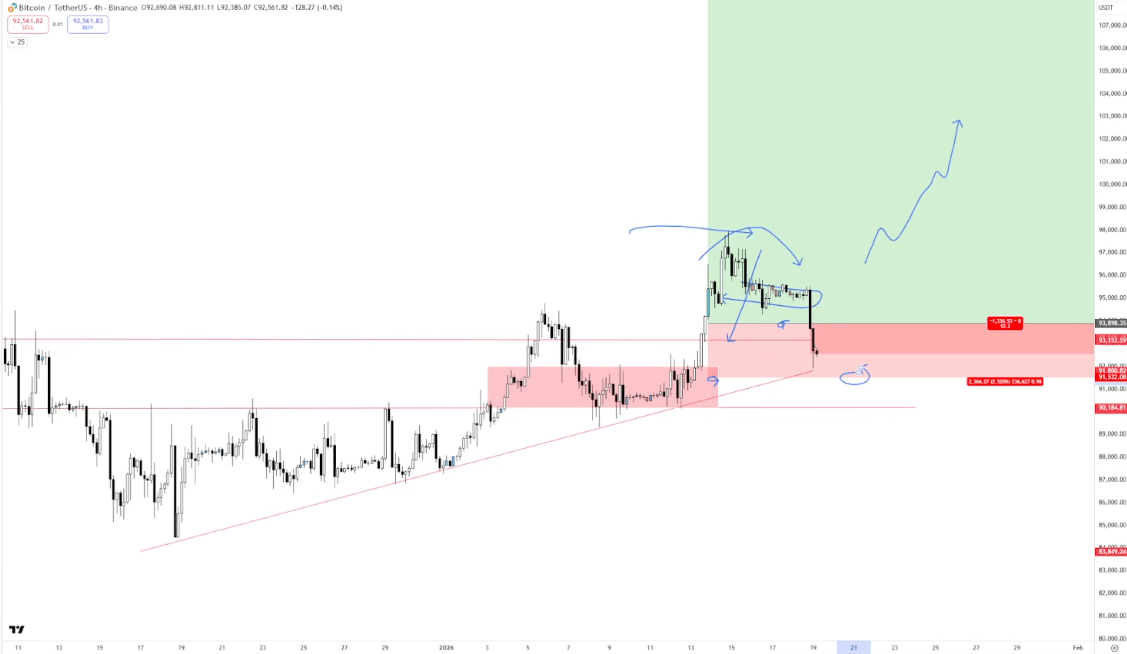

Don't overcomplicate it.

I’m longing anything sub 90k in the next week or so with a clean setup.

Targets: 105k first take profit, 110k final, maybe 120k if you get lucky.

Two ways it could set up:

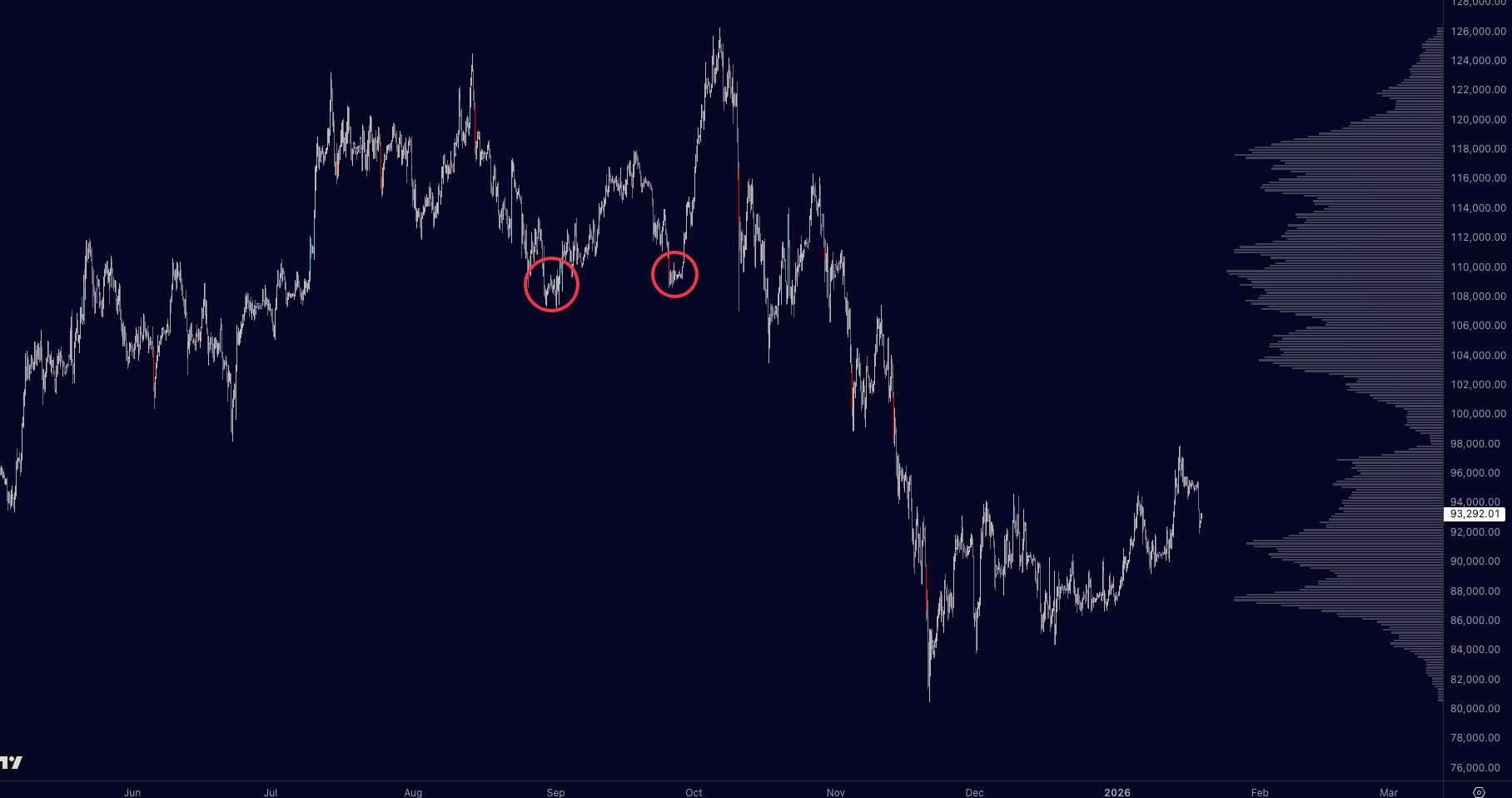

Violent and fast — Volume climax, OI swipe, panic selling. Done quickly.

Slow and grindy — Sellers exhaust, spot bid soaks any selling. Ugly bottom like we got at the end of Aug and Sept in 2025.

If it's grindy and bidders want 91k, that might be all you get. Don't be married to your levels.

Slow and grindy bottoms

TLDR

I’m still bullish on Bitcoin on the high timeframe, so I plan to hold spot longer than the above trade ideas.

That said, I'll hedge spot if I see weakness.

Probably not trading intraday today unless we get an inefficient squeeze to 93-95k.

Cheers.

Doc | Longing here if I get this |

Pretty simple plans this week.

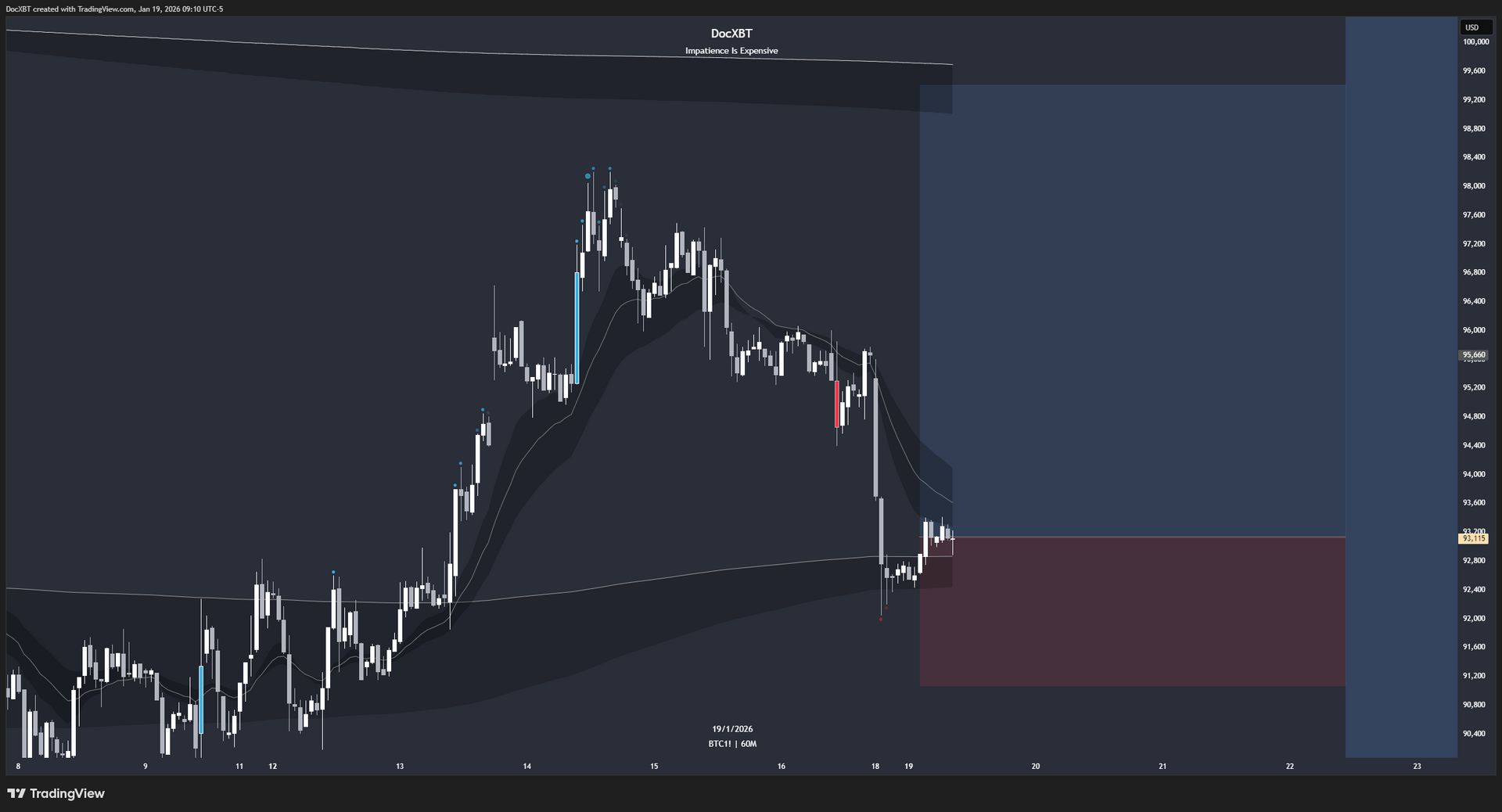

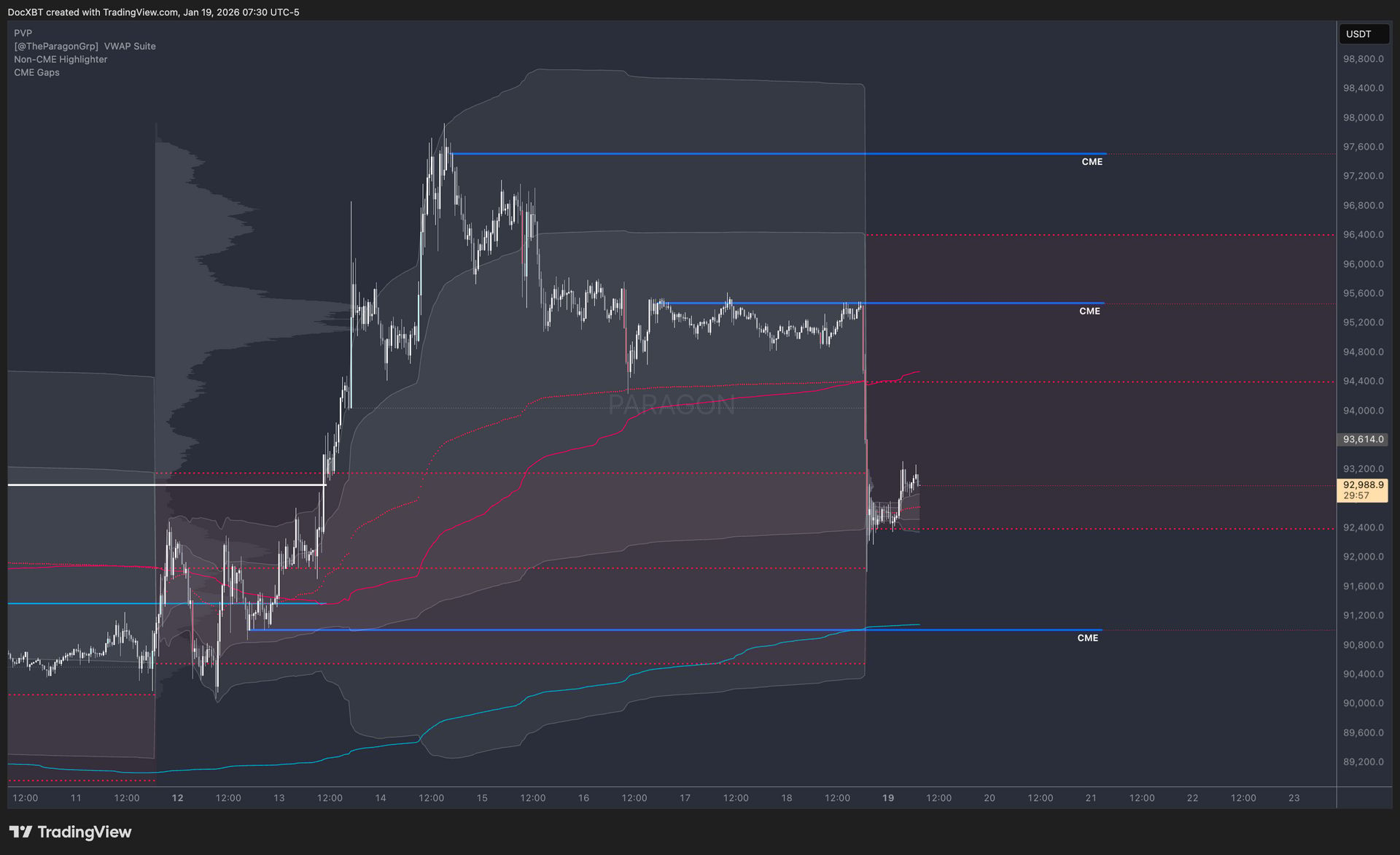

We nuked straight down off the CME open, but the selling lasted an hour then flatlined.

No immediate continuation down bodes well for the bulls given where we're trading.

The setup

We're sitting at the daily trend, which is the same level I was bullish at before. The argument is the same: if we hold here, we open up targets at the CME gaps above around 95.4k and 97.5k.

If we lose the daily trend then I'm targeting range lows and the CME gaps at 87k and 90k.

TLDR: (Unironically) hold here, or it's lights out. I'm looking for rounding at the Daily trend (92k) and eyeing the long side of the book.

Shortened week bias

US markets are closed today, and shortened weeks tend to stay rangebound rather than trend.

So don’t be surprised if we ping pong between 80k and 100k for another month. Bitcoin's no stranger to that.

Charlie | Found one that might actually run |

Not going to lie, this is a shit start to the week.

Bitcoin sold off and alts are down double digits.

BTC trade updates

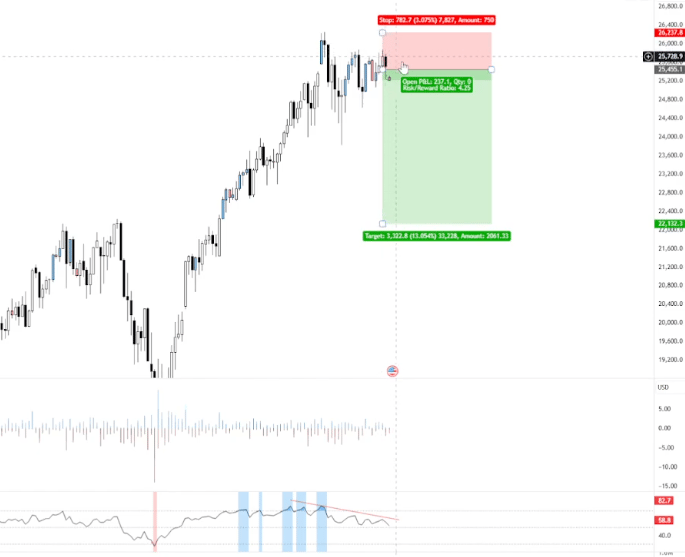

I'm still in my BTC long from that breakout attempt.

The thesis was simple—breakout runs, creates the next trending move. Obviously that was wrong.

The ideal place to exit was at breakeven when we came back into 94k, but I was asleep by then. Now I’m just going to let it play out.

TradFi & stocks

Every push up has been weaker and weaker, which we can see on the 3-day RSI.

Now I’m not saying the stock market is going to zero, but we’re seeing some weakness and momentum loss, so I wouldn’t be surprised by a correction followed by continuation up.

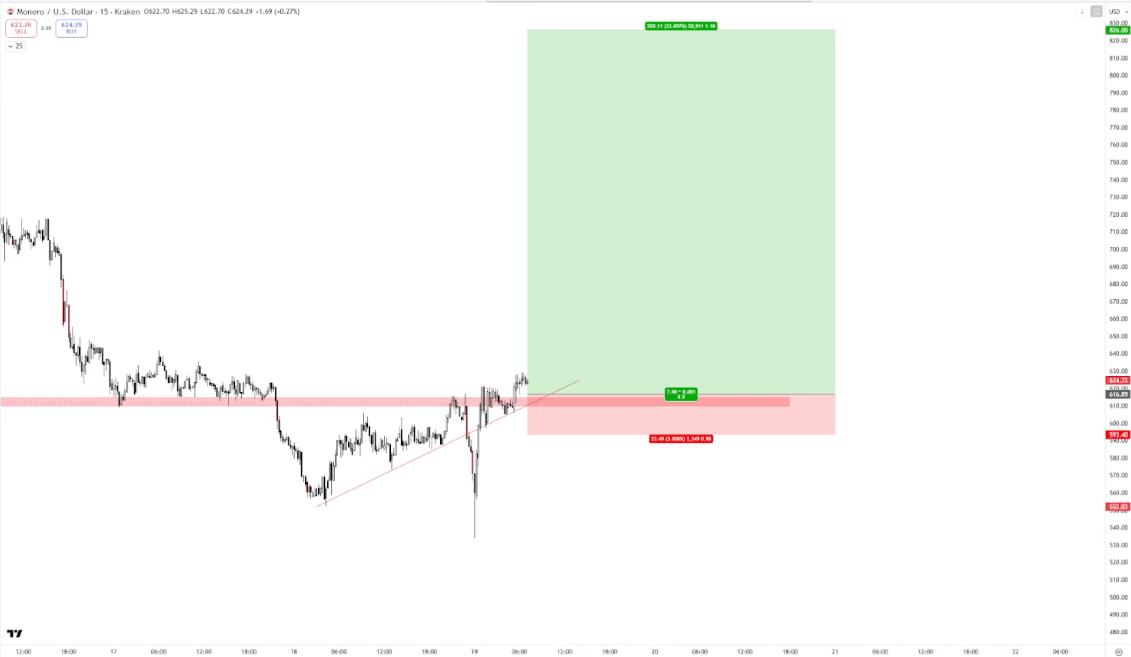

XMR screams relative strength

The play I like right now is Monero.

It's green while everything else is caned. When you've got that kind of behavior, it screams relative strength.

Not super strong alt season vibes (it literally just dipped and got bought up). But we saw from ZEC that outlier coins can remain strong for months even while the market is dying.

Looking to grab a spot bag around $216.

The best move

Sit on your hands until we get obvious capitulation or strength.

This market is going to be choppier for longer than 99% of people can handle.

Then everyone gives up as we break down, doomers claim clout, then we'll reclaim and go for the next leg.

Sort your taxes out. Review and test new strategies. Play Arc Raiders.

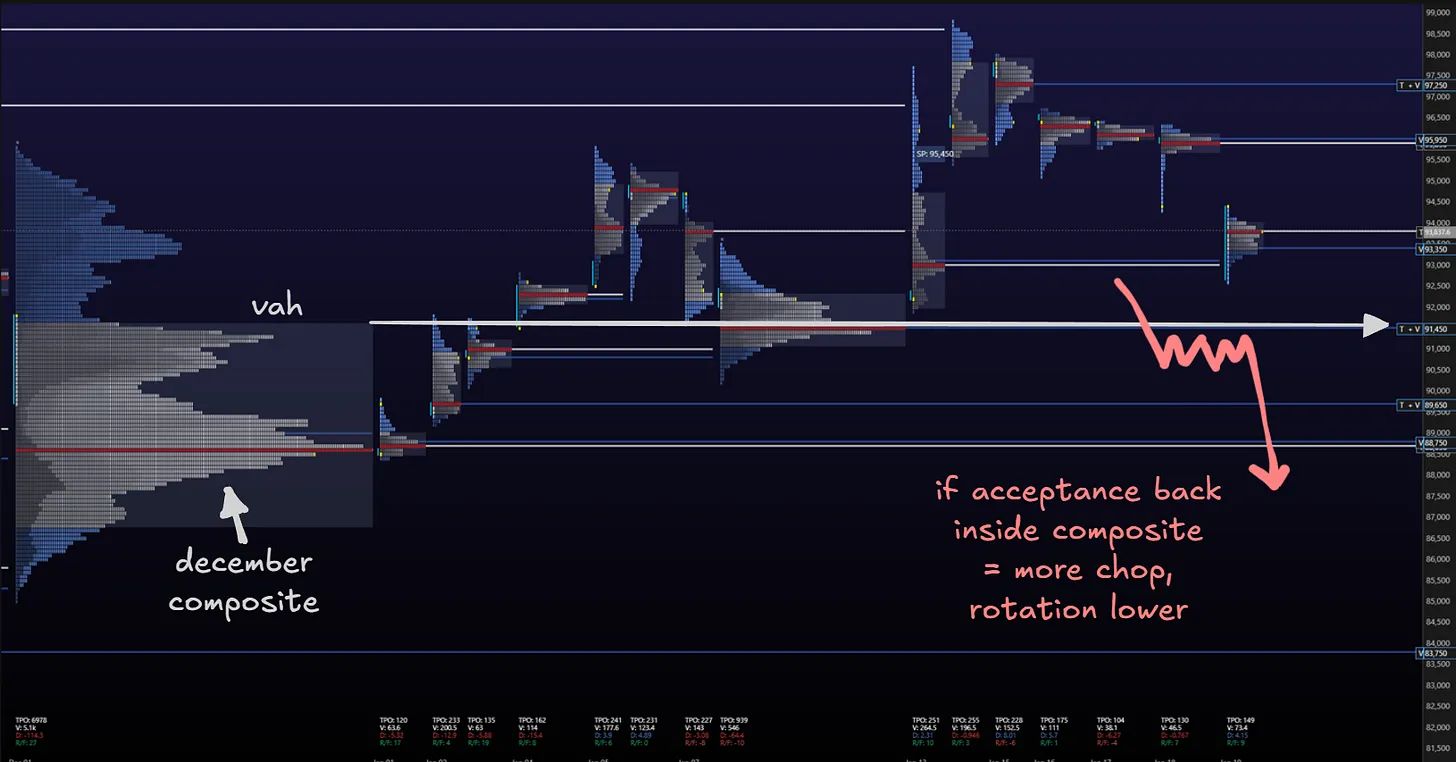

Stoic | The 2 levels I’m watching |

Keeping things simple.

BTC is trading back inside the 7D and 30D RVWAP band. That points toward more chop unless it flips ~94.5k with spot strength.

BTC rolling VWAPs

The low 90s are a key region.

December was a balanced month, so I'm using the high side of the value area as a pivot point.

Above that with constructive flow means we have potential for a rotation higher. Acceptance below means more weakness.

TLDR; Watch for reactions in the low 90s. For upside, 94s is a pivot for further continuation higher into the 100s.

Mercury | 3 charts shaping my view |

Bitcoin is still holding the 4H 200MAs + mid-range inflection point, the same level that made us think this rally would happen in the first place.

But it's doing so after testing the ~100k region and failing.

The simple assumption is that higher timeframes will take priority, now that price has worked its way back inside the local range and lost the range highs as support.

BTC 2D 200MAs

As it stands, "chop" seems to be the most optimistic scenario, and I feel that perspective stems from hope more than an objective stance on the market.

When this 4H inflection point is definitively lost, the bearish context on higher timeframes will have trumped the short-term bullishness we've seen.

To be clear, that's my bias today regardless.

Altcoins

I’ll use BONK for a general read on altcoins.

We discussed watching for multi-month trend reversal signals, and that proved fruitful. But the fun is over.

BONK 3H chart

The HTF inflection point (previous range highs plus the HTF trend) has been lost again after Sunday's sharp selloff.

Similar to Bitcoin, "chop" is hopeful.

It makes more sense to assume the downtrend simply resumes across the board, same as the argument we made back in September.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.