- CookBook

- Posts

- make your plans

make your plans

this is it

In today’s edition we have:

Magus on his positioning

Doc on his HYPE and ETH plans

Charlie diving into alts

Stoic trading the chop

Mercury on ENA and a hard-earned lesson

Magus | Bullish but playing it safe |

Obviously we’ve had a shakeup, so I’ve adjusted my risk exposure by putting a hedge on and selling most of my alts into BTC.

But I’m still bullish that we trade up Q4.

This highlights something key to my trading style: thesis vs positional invalidation. I can be bullish on a higher timeframe and not be balls deep in alts.

My expectation is that summertime chop seasonality plays out and optimism returns in September.

BTC probably builds out a choppy range in the low volume node (LVN) between the previous two ranges 110k-117k.

That said, I’m remaining flexible with what the market gives me. If we reclaim the previous range around 117k, I’m going to send it. If we lose 110k, I’m looking for reactions in the 90s.

This is when you separate yourself from all the whiners and win. Make your plans:

What am I going to buy?

Where am I looking to buy?

What does it look like if I’m right?

If I’m wrong?

Where am I looking to sell?

TLDR; chop people up for a few weeks, higher in Q4. Make your plans. Remain flexible.

Doc | Q3 is for accumulating |

I’m bullish high-timeframe and looking for spots to accumulate alts in Q3 for (hopefully) a bullish Q4.

ETH

Final boss resistance at $4k did final boss things and rejected.

As long as ETH holds its local range low around $3500 it looks good. Definitive breaks above $4k with big clearance and I’m looking to long shallow retraces.

But I think there’s a decent chance ETH can still trade down a bit lower toward the quarterly VWAP just below $3300, and that’s where I’d be looking to play longs for $4k break move.

HYPE

We’re getting the first tag of the weekly trend (D1 100 EMA). This could be the bottom.

Or we could get another stab lower confluent with the lower part of the weekly trend (D1 200 EMA) and previous swing lows on the daily chart.

That would likely be a great opportunity for a swing to send to range high around $42 or new all-time highs.

Charlie | Alts I’m watching 👀 |

Most alts, even the “good” ones, got obliterated on the move down.

We’ve since had a rotation on them Sunday going into Monday on the BTC bounce, but it’s hard to get excited about most alts right now, except for…

FARTCOIN

If we look at the last three months of FART as a range, we’re at a significant high-timeframe (HTF) level.

If it can break the local downtrend, and we can get some momentum on memes, I’d look for a swing toward the range highs. But those are big ifs.

BONK

We’re coming back to major pivot on BONK and it looks great on a very HTF perspective.

But I’m cautious because we have little to no relative strength on it or memes in general.

So I’d have BONK (and FART) high on your watchlist and observe how they behave during rotations on Spaghetti: Are they showing relative strength?

These two are in locations where swings with bigger targets could make sense, if they show strength.

PUMP

Prime candidate for a hated rally.

Watching…

Stoic | BTC: How I play the chop |

One scenario to consider after decisively losing an area of balance is turbulent chop due to a lack of value development between two established areas of balance.

The example below shows a loss of balance and consequent price action. But this didn’t eliminate opportunities — there were clear rotations toward the underside of the upper balance.

Comparing to the current environment, price has filled in some single prints (imbalance created on the way up) and we’re seeing some reversion after heavy one-sided sell aggression.

When we zoom into the H4 we can see a key pivot point around 116.5k.

I’m long (as of Mon morning) watching perps and spot aggression. If passive spot buyers step in higher on dips that’ll tell me there could be more juice in this move.

I'm maintaining a flexible mindset in this area, trading both sides depending on price action: cautiously if momentum starts to fail, or playing for rotation higher if price accepts back inside composite value above 116.5k.

Mercury | BTC, ENA and a lesson |

BTC

Throughout this cycle, I've been using 12H 200MAs to gauge the environment for Bitcoin.

As long as price is trending above them (now around 110k), I will continue to lean bullishly on a very high-timeframe outlook.

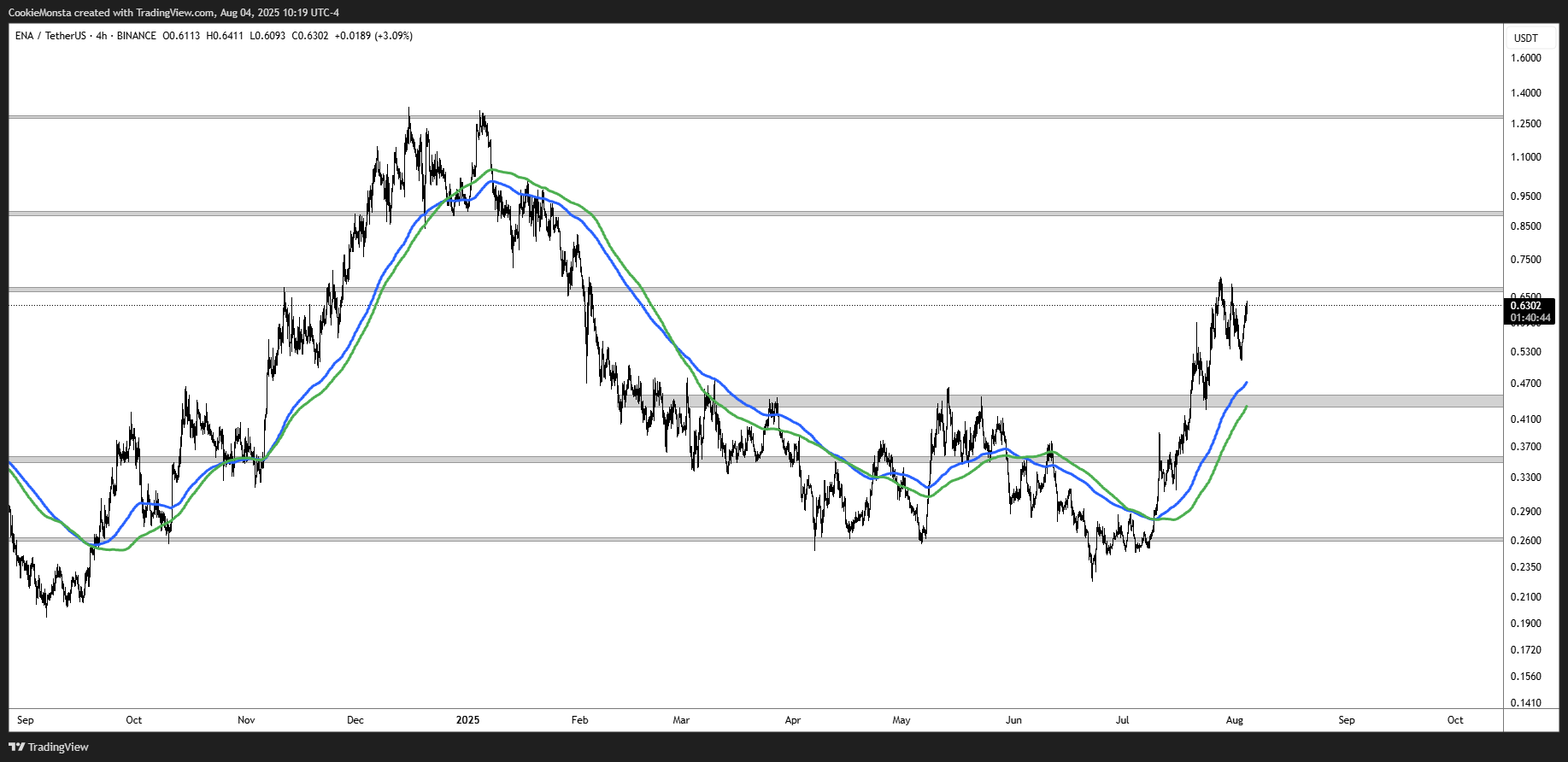

ENA

One of the stronger coins in the market as of recent.

I like H4 200 MAs as a HTF trend portrayal. Any deeper pullbacks in that region may present a solid swing long opportunity.

In the meantime, reclaiming the local H1 200 MA trend that recently allowed for a 100% rally implies we may be ready rally sooner.

A lesson

On May 6th, as ETH traded around $1700, I posted about how my biggest regret this cycle was not taking any profit on my long-term investment ETH bags.

Now, at $3600, my regret is that I didn't buy more.

There are certain things that are inescapable in markets:

when you lose on a trade, you bet too much

when you win on a trade, you didn't bet enough

Trading is pain. How you deal with it is what separates you.

Remember perfection isn’t possible.

Progress is.

There’s always another trade.

What'd you think of today's edition? Hit 'reply' to this email and let us know!

P.S. We cook up more sauce like this daily in The Paragon.