- CookBook

- Posts

- Is the low in?

Is the low in?

Stay ready

In today’s edition we have:

Magus — Is the low in?

Doc — 3 setups and the one I want

Charlie — BTC dying, still watching 4 alts

Stoic — 2 scenarios

Mercury — Stay ready

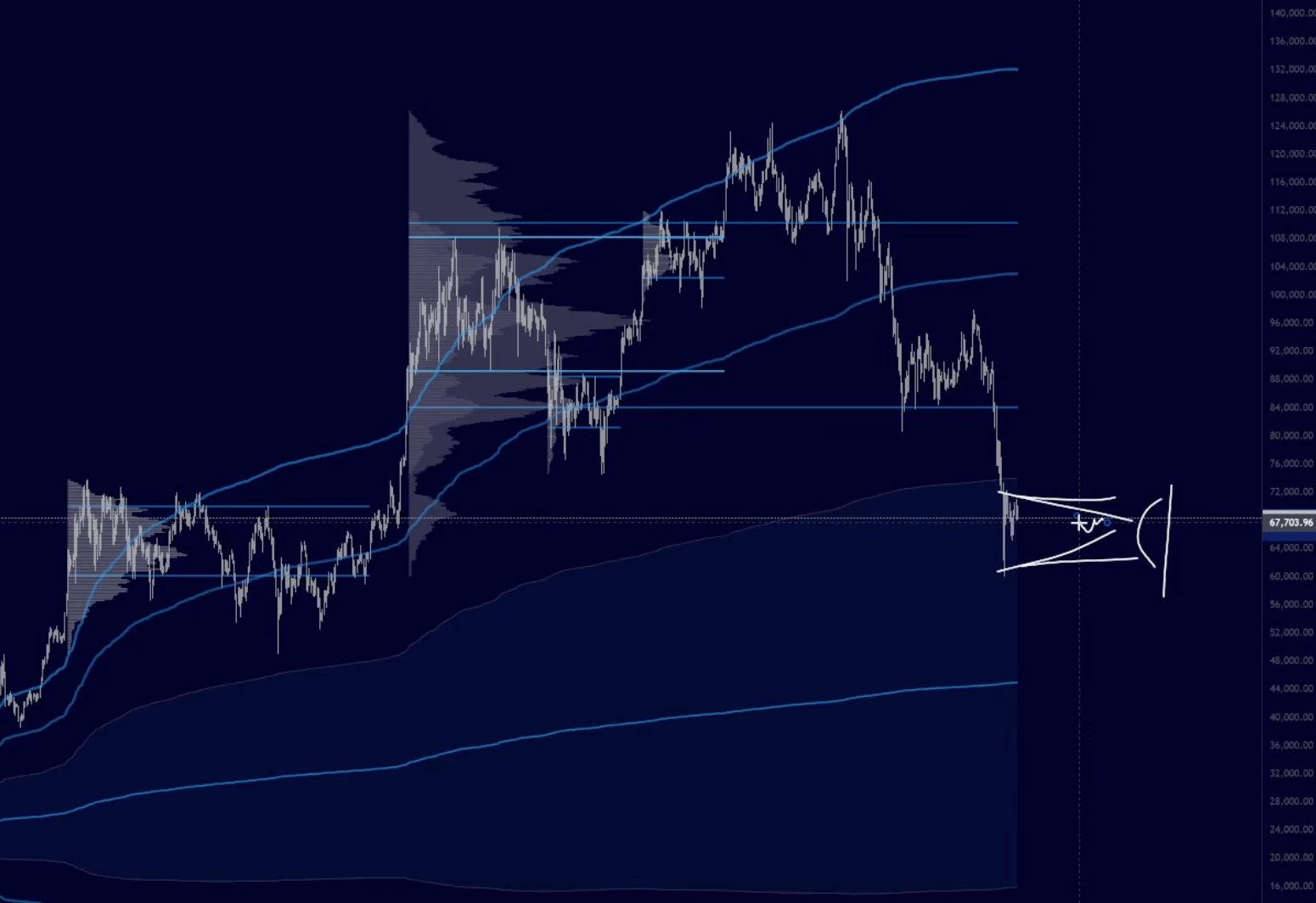

Magus | Is the low in? |

Almost certainly not, but this 60 to 70k region is where I expect the next macro composite to build out.

Same vibes as the 80k low except this time around it has a much better chance of actually being the macro bottom. If it's not, we probably see one more leg into the 40k range.

The thing to watch for is volatility shrinkage, which will make trading very boring. But if you're looking to build a spot bag for the next macro uptrend, this is what you want to see.

BTC VWAPs and the medium timeframe

VWAPs across the board are bearish, yearly and quarterly both pointing down. Monthly is fighting for its first chance to flip bullish, but we're so extended from the 30-day rolling that mean reversion upward is really the only argument right now.

On medium timeframe I slapped an anchored VWAP with standard deviation bands from the low. Upside deviation into the mid-70s, downside into the mid-60. I think attacking the lower 60s is likely.

The only medium timeframe trades (i.e. swings) I'm interested in are extreme range deviation fades, with a bias toward shorts. I'd need a really strong downside deviation with orderflow confluence for a classic long setup. Otherwise I'm sitting out and day trading.

TLDR on BTC

Looking for structural shifts, fading extremes, leaning into downside momentum with my directional plays.

This range will probably play out similarly to 80k where it just builds for a while regardless of which way it resolves.

TradFi and positioning

No dramatic changes.

S&P and NASDAQ showing some momentum loss but I have zero intention of selling.

If tariffs or anything else gifts me a dip, I'm buying it. DCA'ing dips on rare earth and energy index funds has been working well.

I'd much rather be late to buying more Bitcoin than be early to it. I want to see it bounce and form a new uptrend before I close the hedge and add to spot.

That's pretty much it. Cheers.

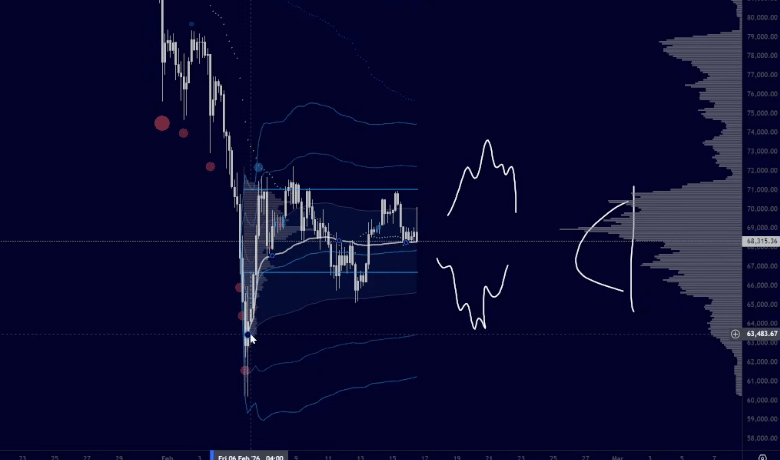

Doc | 3 setups and the one I want |

Simple one this week.

We're back inside this range (aka value) we've been building out for the past few weeks, which means I'm looking for entries at the extremes (highs or lows) of the range.

How to trade with orderflow: This morning's squeeze

This morning we got a clean short squeeze.

Key level + spot ask + spot buy exhaustion + perp shorts closing = de-risk or short trigger

Level: the 8-month composite value area high from 2024, monthly VWAP, yearly value area low, previous week's value area high.

Orderflow: We flipped to heavy spot asks at the highs, and the buying effort was all short closing, not real spot demand.

When the shorts were done covering, the whole thing reverted. Classic bart pattern. Stock market was closed for President's Day too, so there wasn't a lot of flow to support it.

3 setups and the one I want

Number one, if the anchored VWAP holds into tomorrow and we get some sell absorption in this region, I think we could see another short squeeze. A lot of people are probably front-running what they hope is spot selling, and if it doesn't come, someone takes advantage of that.

Number two, de-risking around the composite value area high. As we've seen, that's where the resistance is.

Number three, and this is my preferred trade, if we puke down to last week's lows and clean up the CME gap at 65.8, I think that's a beautiful trigger for a long all the way up to 73.

Peace.

Charlie | BTC dying, still watching 4 alts |

I was AFK over the weekend for the best rotation we've had in weeks. As is standard.

Friday to Saturday was really, really good on the alts we've been watching. FARTCOIN popped, PUMP popped, MORPH ran beautifully. And I missed all of it.

Daddy BTC and the lower highs

Now we're back to reality.

Bitcoin is printing lower highs on the daily, and even if you squint at the wicks, the structure just isn't great.

I've got little faith in this market randomly running hard that I can't bring myself to long these rotations unless something obvious jumps out.

TradFi looks particularly shite with its own lower highs.

It's all a bit weak in terms of trying to change the trend, but we'll see how the week goes.

4 alts on the radar

PIPPEN is absolutely flying.

We were talking about it around the 28s and now it's consolidating after what would've been a 100% rotation.

Whether this is distribution or a pause before another leg, I don't know. I either play reclaim of range lows or breakouts of the range highs with relative strength confluence and tight stops.

FARTCOIN I want another crack at.

Maybe the selloff back into the previous range is just the fakeout and we get another consolidation into a run.

HYPE was disappointing, but if it does reclaim $31 I'll be more aggressive longing that as a swing.

Spaghetti is telling me there's a really good rotation happening on MOODENG right now.

When this coin breaks out it really breaks out, these monstrous candles, not some weak little move.

But I can't buy in the middle of a consolidation, that's just dumb. I need a selloff and then a reclaim or a breakout on relative strength before I enter. Size is limited too because if it goes -10% in a single candle you'll get absolutely caned.

TLDR

Actively looking at PIPPEN, MOODENG, and FARTCOIN for intraday rotational longs. Not shorting.

If Bitcoin breaks out of this low timeframe range we could get a decent risk-on rotation, but any loss of this local trend means alt rotations are donezo for a bit.

Stoic | 2 scenarios |

We had another illiquid weekend of spot unloading on Binance.

The 4-day composite gives us two scenarios from here.

Scenario one, follow through above the composite. Rotate up toward the poor high and naked VPOC above 72k.

Scenario two, trade back toward the lows and excess below 65k.

Everything in between is noise unless you're trading intraday.

Trade the range.

Note: NYSE closed Monday for President's Day. FOMC minutes Wednesday, PCE Friday.

Mercury | Stay ready |

Bitcoin

After nailing the bottom of that high-volatility move, I discussed the idea that we'd be capped in a range around 72-64k.

That analysis has developed nicely. We haven't gotten any major moves in this market, and the 72k level that refused to act as support is suddenly eager to be resistance. As we imagined.

The only real update is we now have a range developing as opposed to assuming it would. The message is the same regardless: survive the chop until the next opportunity presents itself.

Whether that comes from sporadic rotations in alts or sharp volatility on Bitcoin is yet to be seen, but at some point we’ll get both. We simply stay ready.

"Stocks have reached what looks like a permanently high plateau"

The infamous quote made by a Yale economist just before the 1929 crash.

This isn't me comparing today's market to 1929, but in markets the same principles prevail regardless of what year it is.

Stocks have gone parabolic for over a decade now, and the end of that parabola is nowhere in sight, as of now.

But all good things come to an end eventually, so it's important to be prepared for weakness as it makes it easier to accept at face-value when it finally manages to show.

For SPY, we'll look for the first meaningful sign of weakness upon breaking down below our local range and losing the 4H 200 MAs trend.

Breaking down from here likely creates more pain for crypto, but that was already our assumption from when Bitcoin was still 6-digits anyways.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.