- CookBook

- Posts

- end-of-year focus

end-of-year focus

plus, how to build a strategy

In today’s edition we have:

Magus — My next swing long setup

Doc — What happens after the range

Charlie — A simple level

Stoic — How to build a strategy

Mercury — Key shift in relative strength

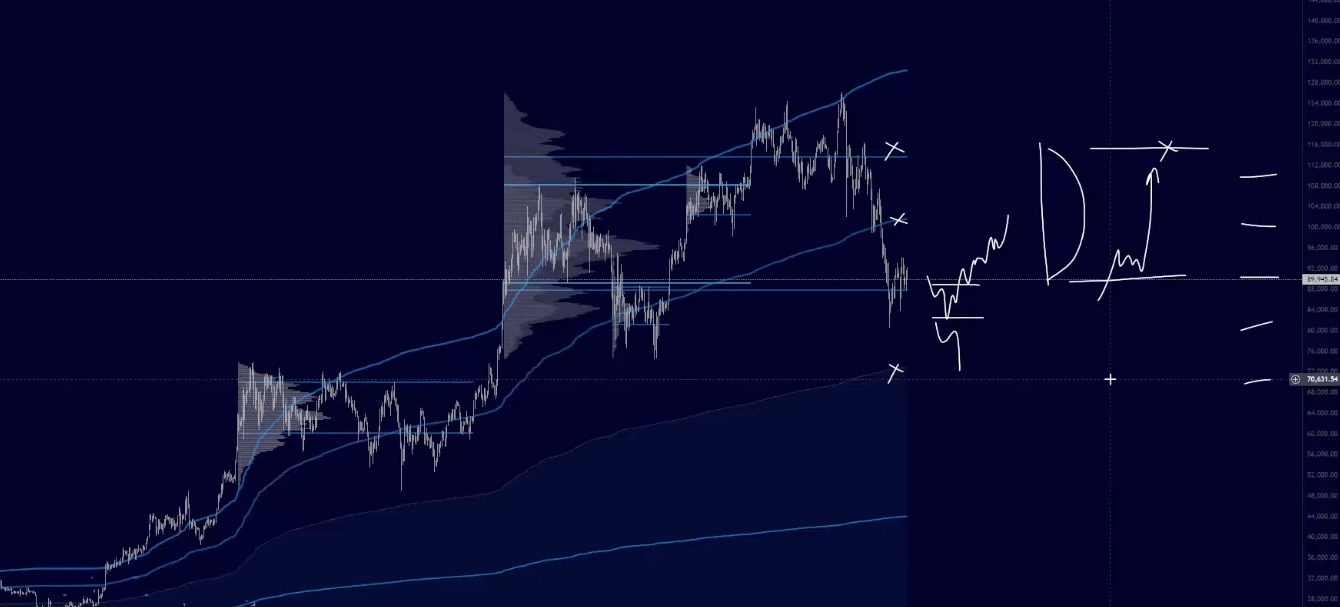

Magus | My next swing long setup |

2025 is wrapping up.

I'm planning to trade actively this week, then wind down for the last two weeks to focus on end-of-year review, tax prep, and time with friends & family.

Intraday volatility has been great lately but I expect it to die down going into the holidays.

Don't take this time for granted. It gives you a chance to refuel for the next year.

Quick FOMC note

Wednesday we have the FOMC.

I expect de-risking Tuesday and volatility Wednesday, which should be good trading days before things quiet down for the holidays.

High timeframe range thesis

Still operating off the same plan: composite range low 88k, range high 113k.

The longer we spend inside this range, the more likely we oscillate to the other side. Small deviations outside are normal.

Conservatively targeting the midpoint around 100k.

My main thesis: Risk isn't cooked. We're going to see risk markets continue higher, we just need to see the medium timeframe structure shift.

Medium timeframe: What I'm watching

We need to hold above the 7-day rolling VWAP. Then the 30-day rolling.

Until those flip, it doesn't make sense to be too optimistic.

Right now this looks more like a dead cat bounce structure than clear momentum loss to the downside.

I need to see a structural shift by flipping these VWAPs.

Higher timeframe long setups

Two scenarios where I'd look to get swing long:

Trade back down to 84-80k (wide bid zone) with clear exhaustion & absorption

Accept over 92k

88k is important short-term resistance-turned-support. 92k is your significant resistance to flip.

If we get over 92k, I think we trade to 100k-105k.

Sentiment is so bad that the slightest bullishness could put us at 105k in a day or two.

TLDR

Probably the last active trading week for me this year

Holding in HTF range: 80k and 100k are key HTF levels

Need to flip 7-day and 30-day rolling VWAPs to confirm structure shift on medium timeframe

Swing long setups: 84-80k bid zone or break over 92k

Over 92k = quick move to 100-105k

Wind down trading, do your end-of-year review, recover

Look at your mistakes head on, that's how you improve. Review the good, the bad, and the ugly.

Good luck out there. Cheers.

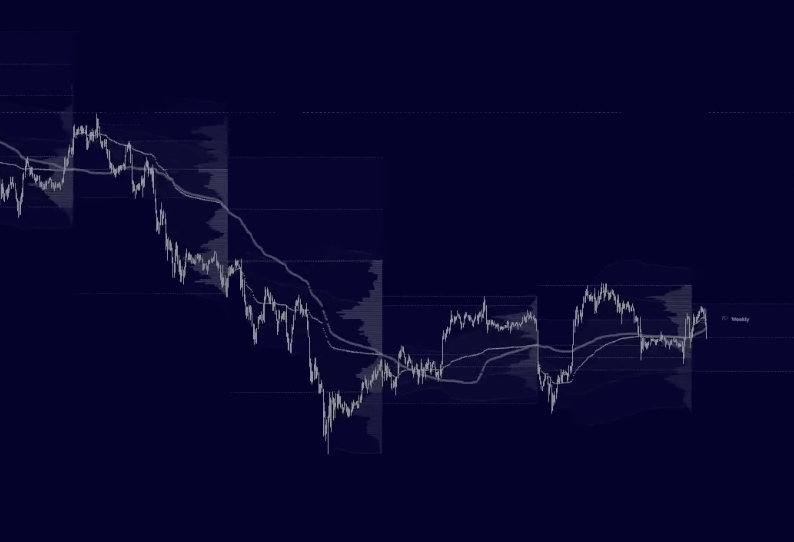

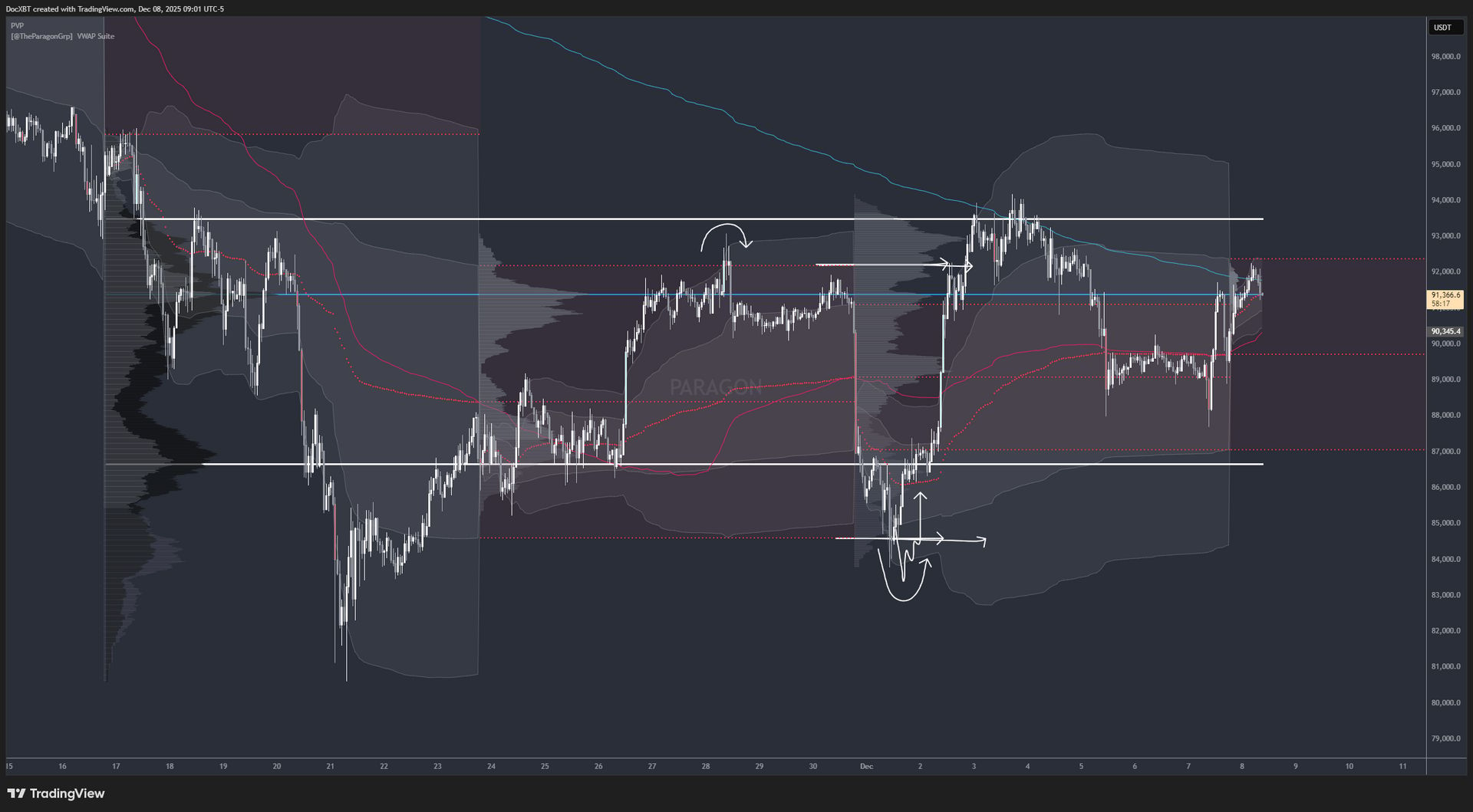

Doc | What happens after the range |

Between travel and the holidays, I won't be as locked for the next three weeks.

So here's everything you need to get through December.

High timeframe

The HTF uptrend is dead until proven otherwise.

BTC broke the weekly trend on the CME chart, which has been the cleanest trend representation for years.

The same thing happened last cycle.

I think we get a push back toward 100k sometime in the next few months, it baits people back to being bulls just in time for a complacency shoulder, then another expansion below 80k.

How to win in these conditions

This cycle trades in brief bouts of volatility followed by long ranges. Most people refuse to accept this, so they get chopped.

We just came out of extreme volatility, so I'm expecting range, maybe with little shakeouts on either side.

Trade it like a range. Avoid taking swings from the middle of it.

This week's levels

We tagged 30-day rolling at 91.8k, which has been pretty clean lately.

Previous week's value area high and composite value high are just above. If we break through, we could expand above.

The composite value low around 86k is my first area of interest for MTF longs.

Below that, I’m being careful, watching for absorption vs expansion signals. The order books and momentum loss patterns we teach matter a lot outside of value.

The CME is going 24/7 soon, so this could be the final CME gap of the year, which sits at 89.1-89.5k.

TLDR

High timeframe downtrend

Medium timeframe range

Then a bull trap rally toward 100k

If we accept below 80k, that brings the next expansion lower

Maintain awareness of context (range vs trend) and take the highest EV setups based on repeating patterns.

Keep improving. Enjoy the holidays. Peace out.

Charlie | Simple level |

Away from the desk, so no detailed setups today.

If you’re in an alt rotations keep an eye on BTC. Below $88.5k and they could unwind.

Back clicking soon.

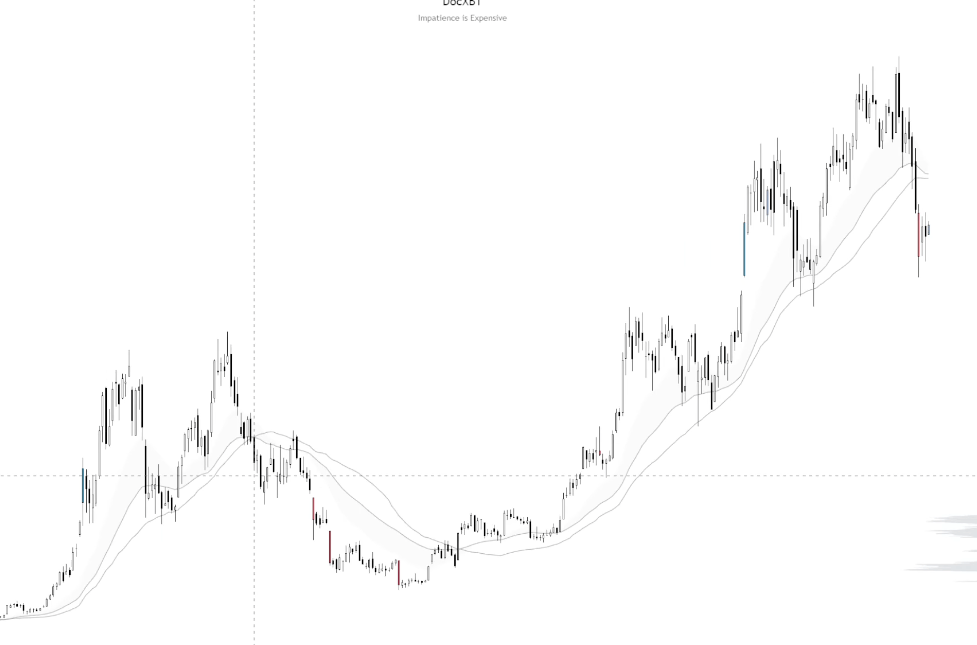

Stoic | How to build a strategy |

BTC continues to develop a sideways range (16-day composite) with key levels at:

VAH (value area high) ~92.1k

VAL & 30d rolling VWAP ~85.6k.

On LTF, I'm looking for reactions when BTC trades outside of value.

If spot carries through, I'll go with the move (continuation).

If we see weak squeezes leading into supply, I’ll look for mean reversion opportunities.

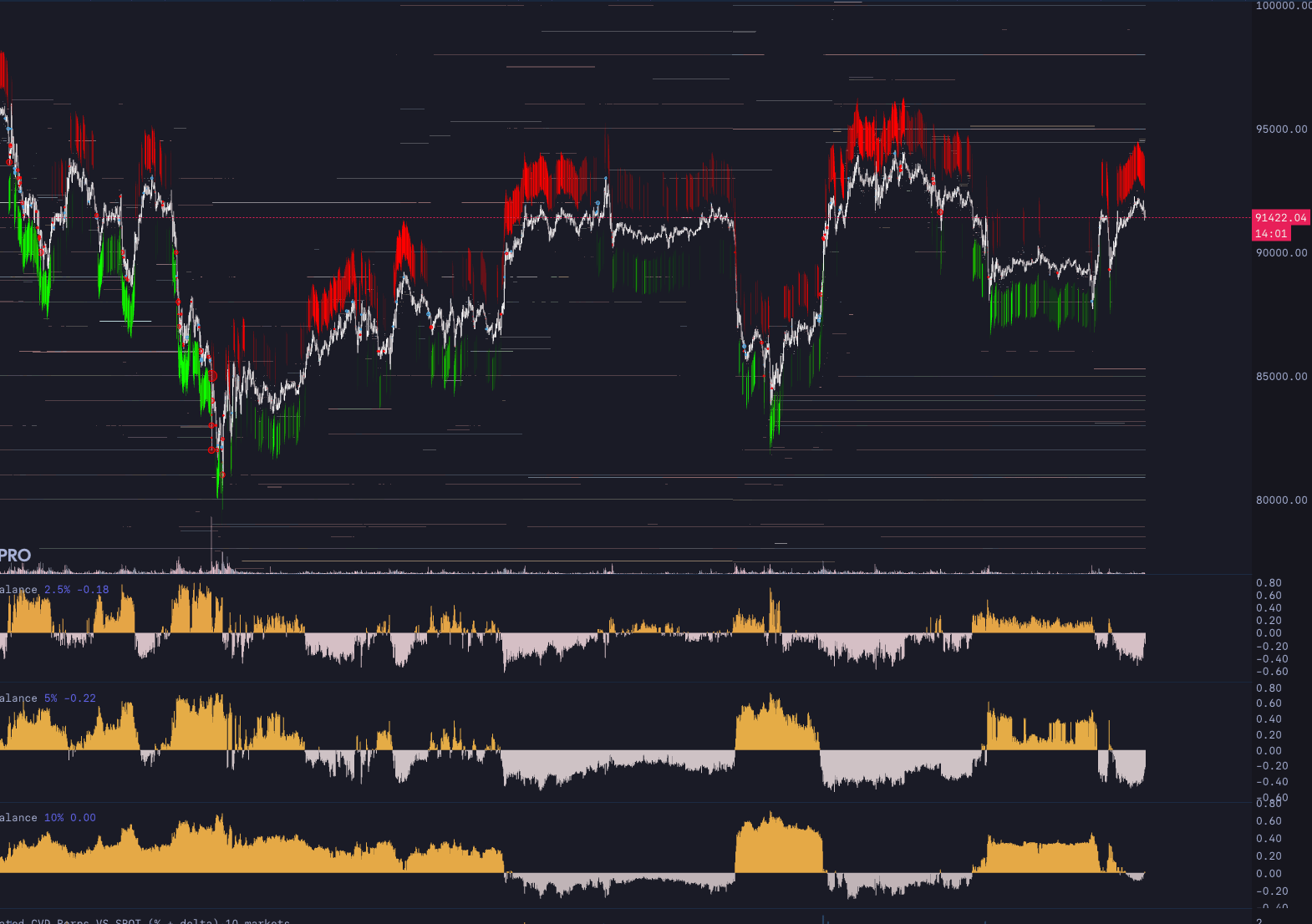

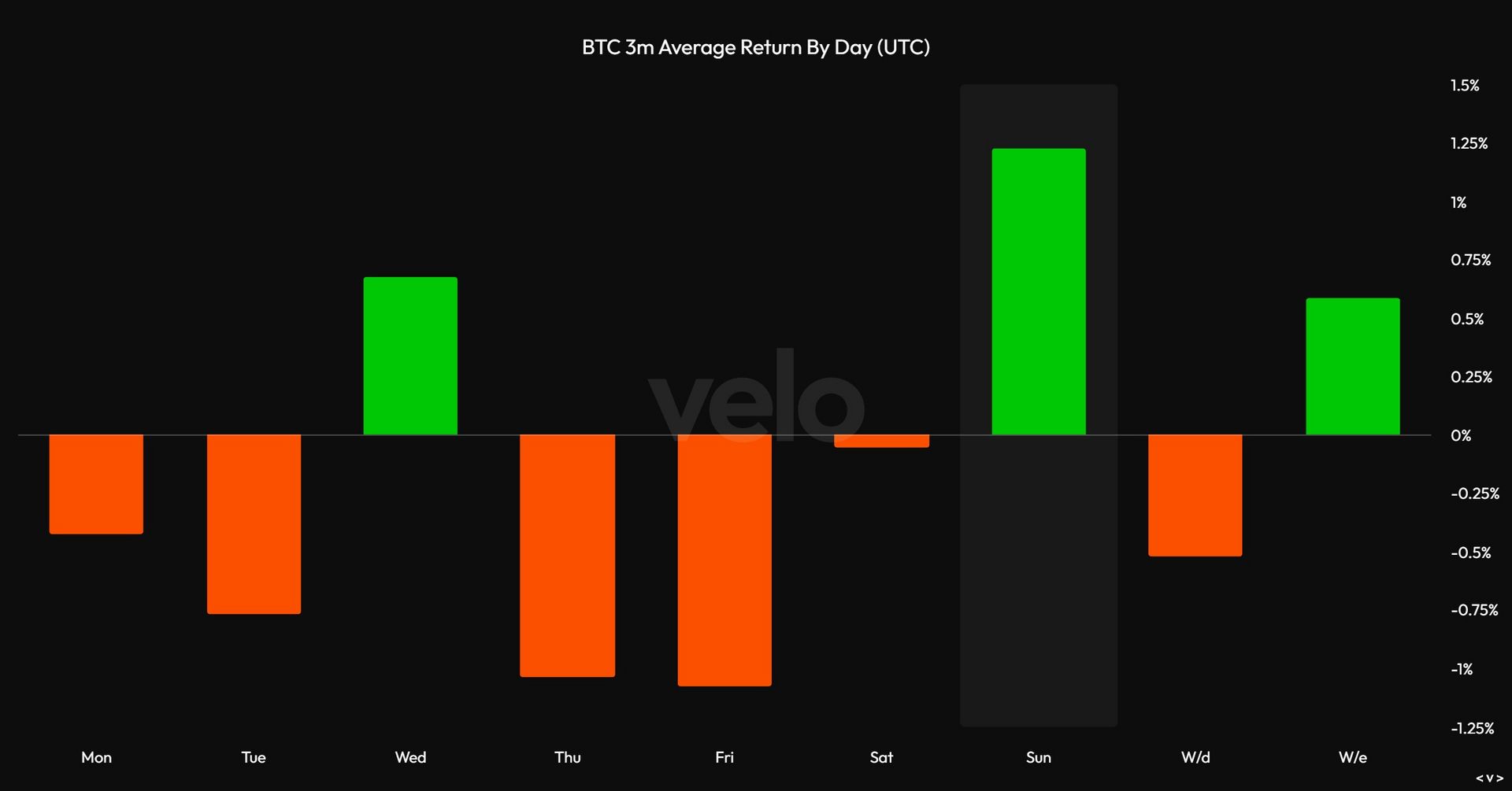

Building a strategy: recent weekend pattern

This is hindsight now, but worth mentioning as an example of how to think about opportunities.

Saturday to Sunday reversion and short-term squeezes to the upside have been a common theme for weeks.

You can use repeating patterns like this to create a strategy.

I'm not suggesting to use this blindly. Unpack what exactly happened: what type of flow and participant behavior was exhibited on Saturday, leading into the squeeze, and then the aftermath.

That's how you turn observations into actionable strategies.

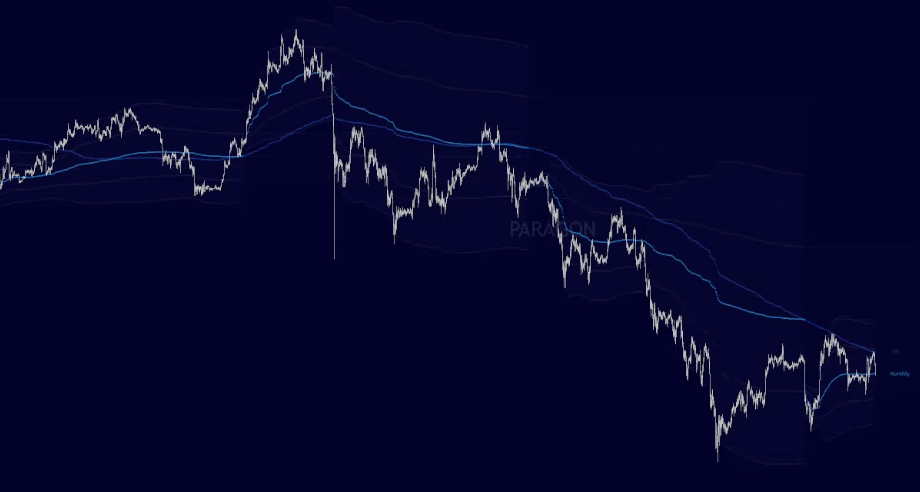

Mercury | Key shift in relative strength |

As Bitcoin chops sideways in a range, Ethereum has seen enough strength to rally into a bearish retest of HTF trend, the 4H 200 MAs.

This trend has been incredibly clean all year, representing the larger trending moves for ETH in either direction.

For now we're just coiling around it with consistent lower highs.

But if ETH reclaims the trend plus local resistance around $3250, there's an increased likelihood for a larger rally to follow.

ETHBTC

This relative strength shows up clearly on the ETHBTC chart.

The 2D 200 MAs have held as major support.

And ETHBTC has reclaimed the 4H 200 MAs, which had been bearish since September.

ETHBTC’s 4H 200 MAs are a key inflection point, signaling that if the market rallies from here, ETH (and likely alts) will be the place to watch for outsized returns.

The next step is breaking local resistance above, which would likely coincide with ETHUSD reclaiming its 4H 200MAs.

That's when we'd see higher-velocity moves.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.