- CookBook

- Posts

- bulls need to prove themselves soon

bulls need to prove themselves soon

plus, execution areas & alts we're watching

In today’s edition we have:

Magus — Bulls need to prove themselves soon

Doc — Where I’m looking to execute

Charlie — The few alts I’m watching

Stoic — Going with the flow

Mercury — How I determine if we’re in a “bear market"

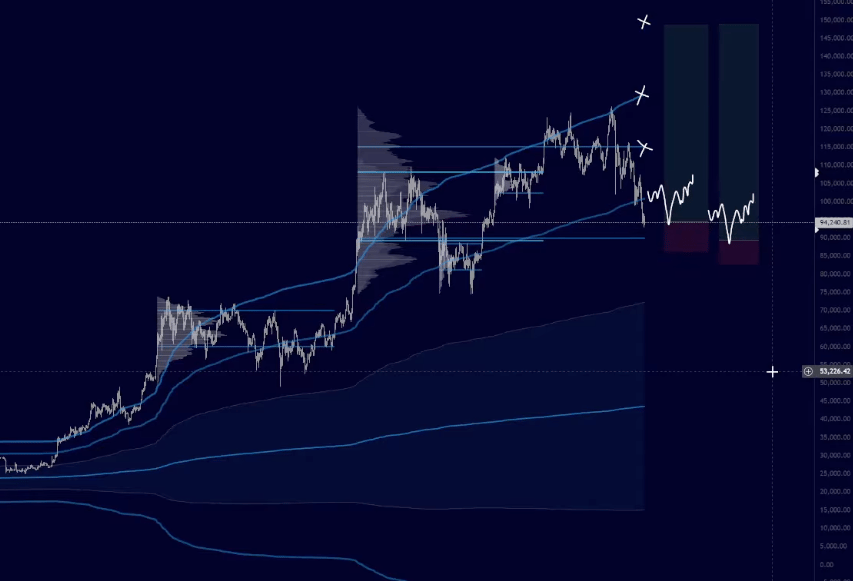

Magus | Bulls need to prove themselves soon |

I’m still confident that the macro uptrend on BTC is intact, but we're getting to the point now where bulls have to prove themselves.

Levels

Bitcoin is trading within this larger range that it's been in for a year.

The big levels are 100k and the yearly value area low around 89k.

89k is the long I’m looking for.

After that I’m looking for reclaims of 100k and 110k.

Failure at 100k sets up continuation lower.

A reclaim of 110k means bulls are back in control.

I originally called 94k as one of the areas I wanted to look for the bottom, but I think we're going to that 89k level for the next swing long instead.

Medium timeframe

Structure favors the downside and bears are in control.

I’m watching if the bulls can start to fight off this selling and create a rounded bottom.

Then do we see a dead cat or a reclaim?

Until I see a rounded out structure and some sort of aggressive move back up, I expect prices to continue to move down.

Right now it looks like we're developing a range between 97k and 94k.

Beyond that, bulls have this ridiculous 105-110k resistance block. I’m confident that eventually we get through it, but right now we don’t have the bottoming structure I’m looking for.

TLDR

As far as positioning goes, no dramatic changes. I’m boomered up in benchmarks, playing it safe and waiting.

We accumulate more poker chips via intraday and we put those into our long-term portfolio while we wait for better times.

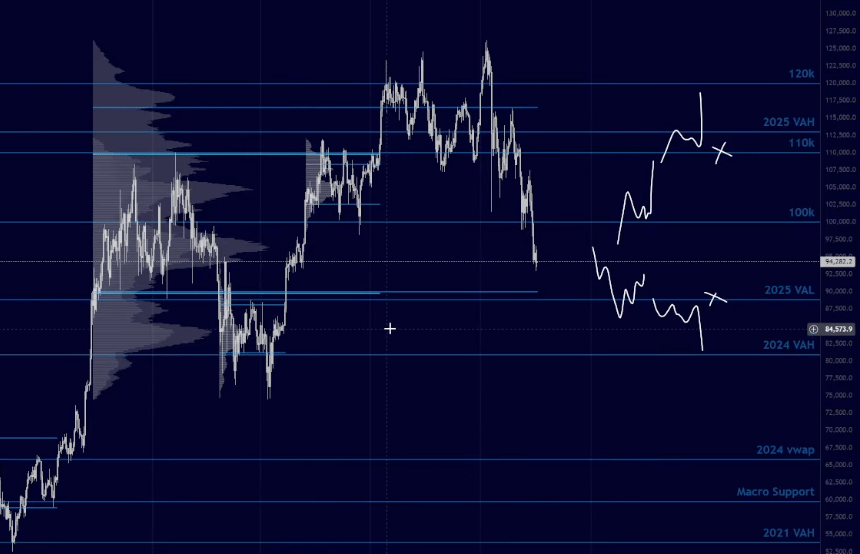

Doc | Where I’m looking to execute |

We're down 25% from the all-time high and pretty much straight down 20% in the last 20 days.

But we’re not yet at my highest interest levels.

So, for me, we’re kind of in a no man’s land.

TLDR; I’m looking for higher to short and lower long for swings.

In the meantime, I’m taking intraday trades as we’ve had some great volatility to send on the lower timeframes.

Levels & plans

88k yearly value area low

91k CME gap

95.8k local level to break for bulls

99k prev week VWAP

102k daily trend

95.8k is our local line in the sand and last week's value area low, which needs to break if we're getting relief.

Above that, 101-102k is where yearly VWAP and the daily trend converge, which could be a good region for a short if we spike up.

A little lower at 88k is the yearly value area low and all that March/April demand.

That's where I'd be much more comfortable stacking chips for a bigger relief rally into year-end. But even then I’d most likely be looking to sell a macro lower high.

Charlie | The few charts I’m watching |

Bitcoin's starting to show a bullish divergence on the 4-hour, but we're still in a strong downtrend.

Moves up aren't being sustained, and I’d much rather look to play long rotations on alts rather than BTC.

Here are the few I’m watching…

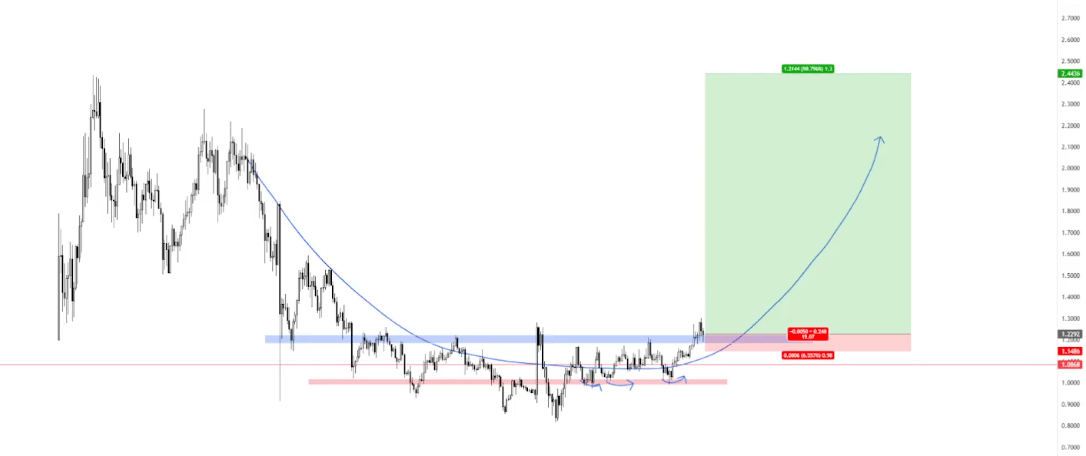

ASTER

We’re breaking above a pivot while showing relative strength so I could see something like this for a spot play.

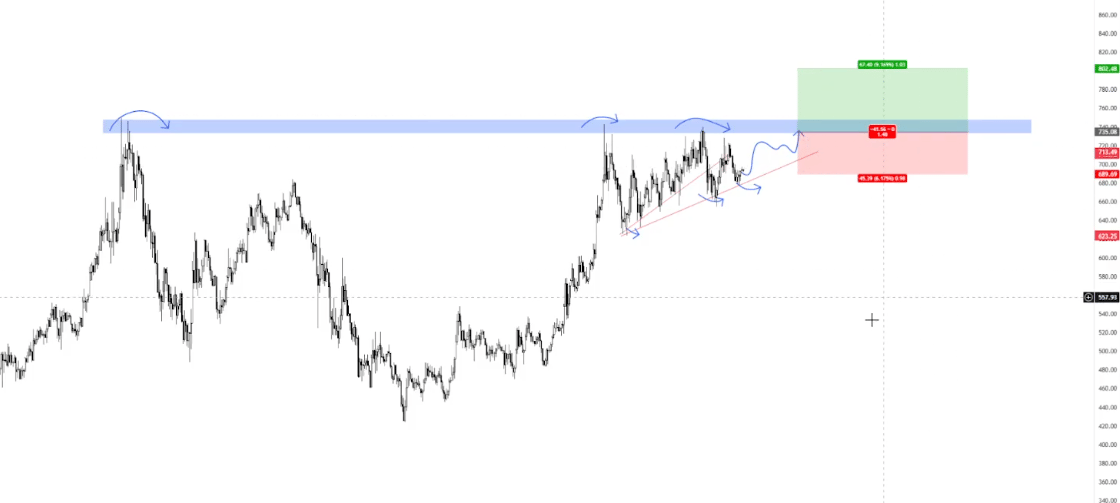

ZEC

One of the only decent charts, and it’s making higher lows on the LTF.

But we also have some lower highs, which means we have the meme compression triangle that could break either way. I’d need to see relative strength to long.

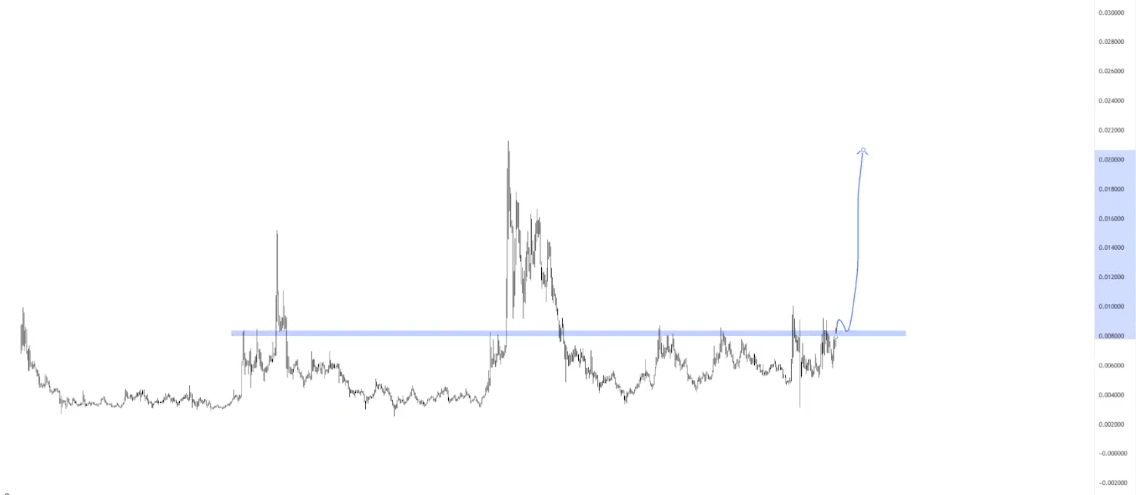

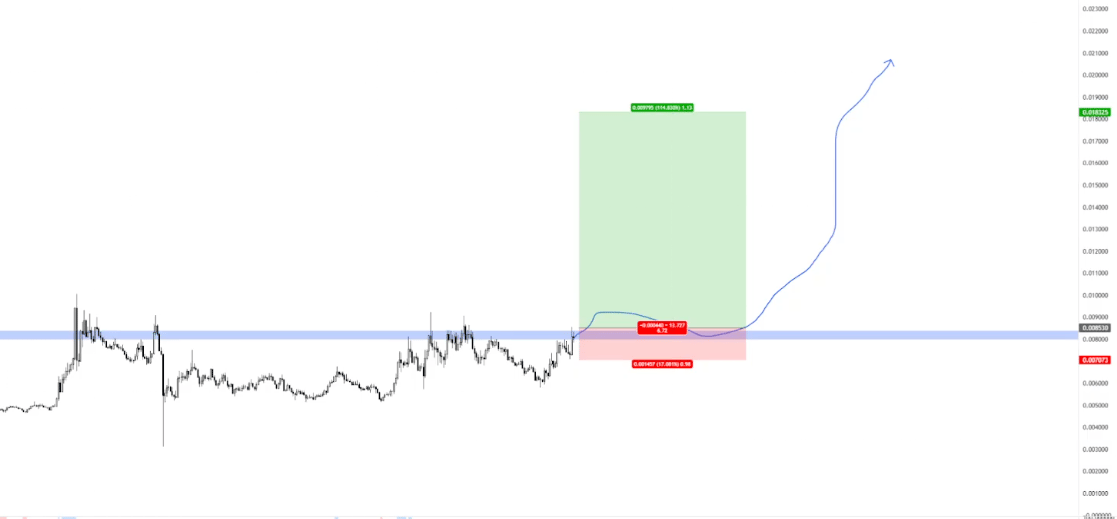

XVG

Part of the privacy meta and at a very pivot HTF level.

I’m looking to take a breakout like this if I see relative strength on spaghetti. I don’t want to get involved in the chop below without relative strength.

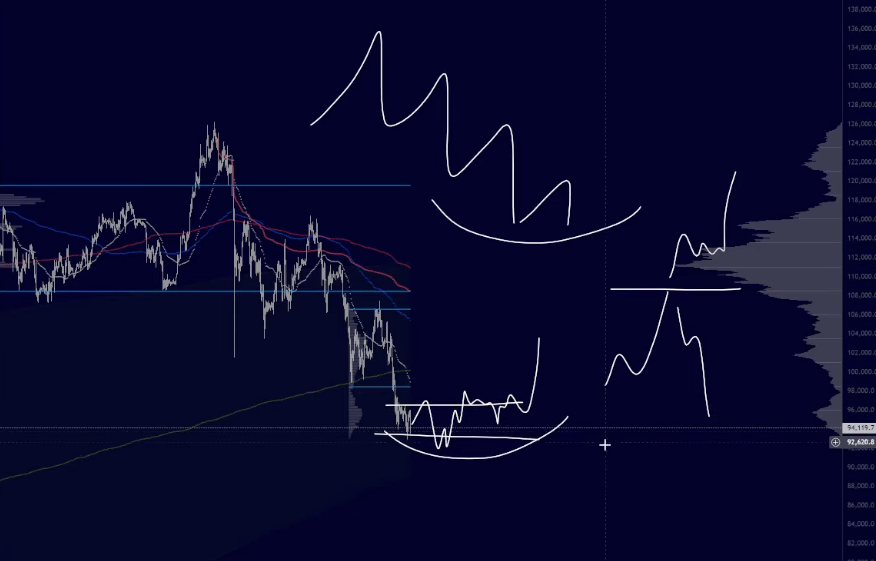

Stoic | Going with the flow |

We’ve been in a traders market since the 10/10 flush.

Very high timeframe

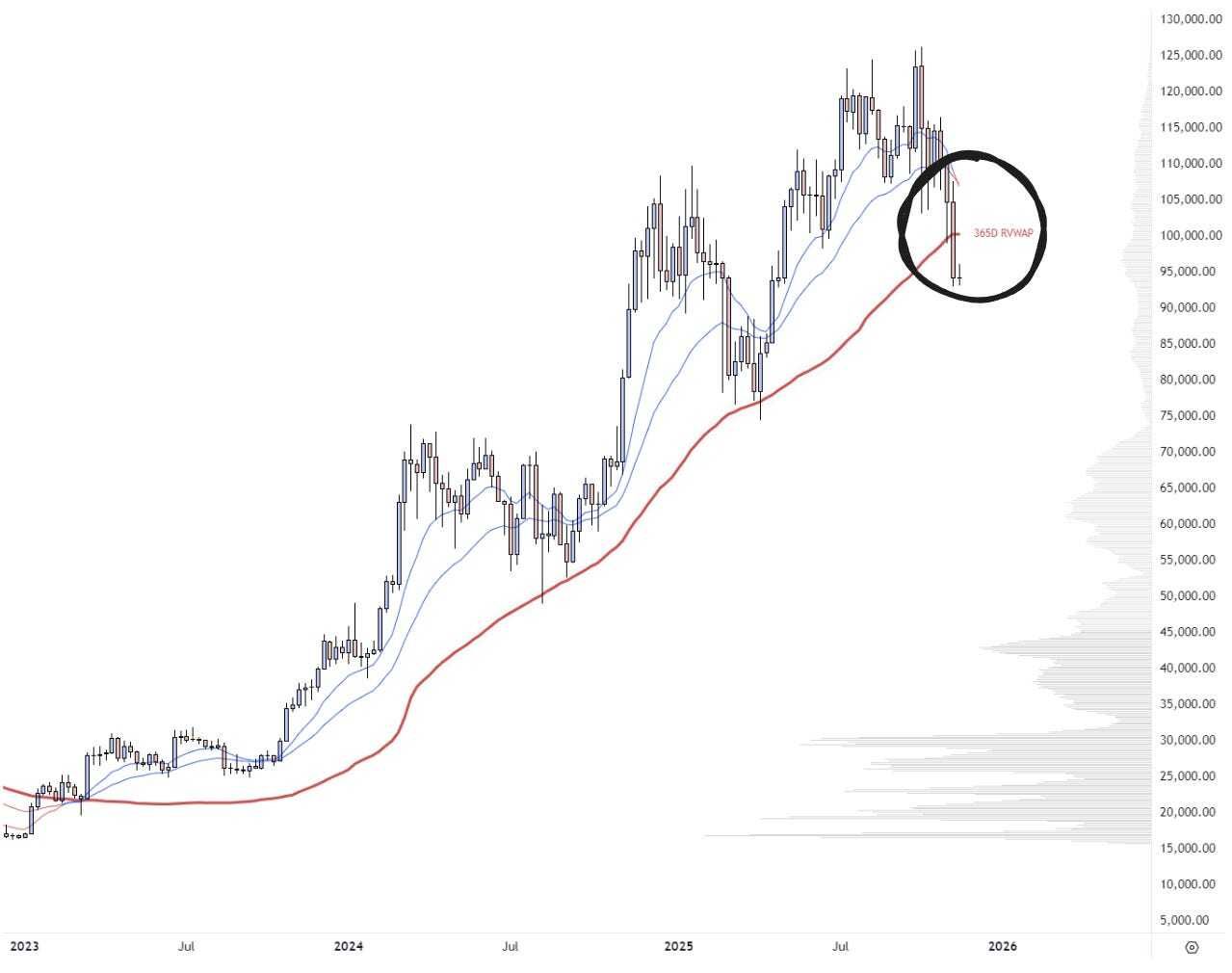

Loss of the 365d rolling VWAP and the 100k psychological level combined with the weekly trend starting to shift red points towards being defensive to say the least.

BTC has been rotational where any bounces have been met with heavy spot selling.

I plan to go with the flow, which means short-term trades and playing two-sided rotations with a skew to the short side.

I would consider shifting my short bias if key pivots like 100k are reclaimed and momentum turns.

High timeframe

We’re currently trading into the low side of value of the extended consolidation from late 2024.

Personally, I don’t give this much relevance since this value was developed a year ago, but it has the additional confluence of the yearly open.

Medium timeframe

If BTC bounces from here, I will be observing how flow develops around the previous composite value area low in the 100-102 area (which has additional confluence of the 7D RVWAP and previous month low).

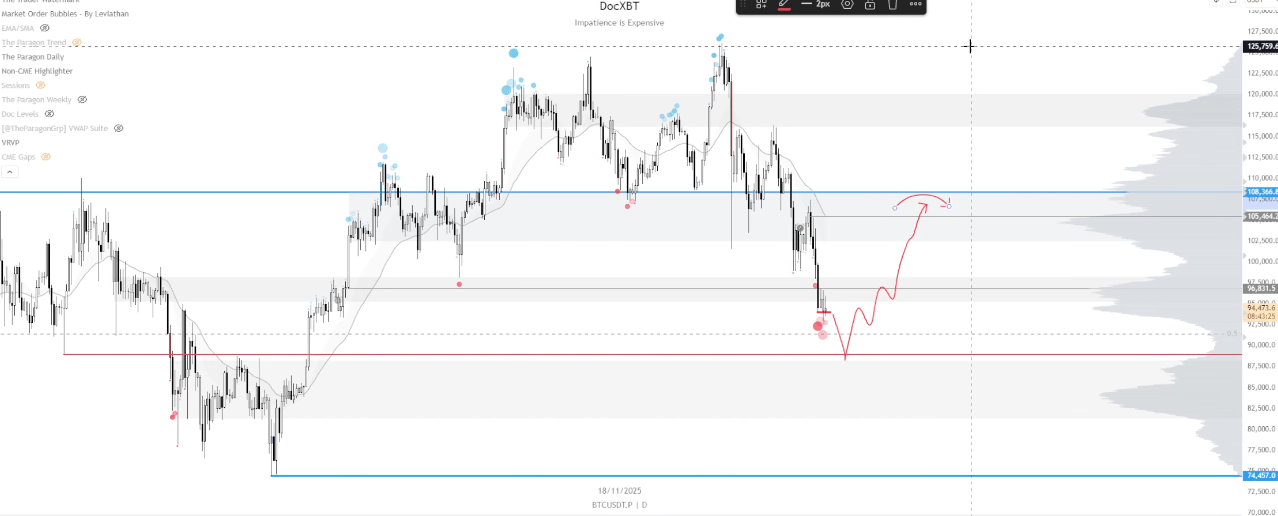

Mercury | How I determine if we’re in a “bear market" |

Bitcoin is showing greater weakness than anything we've seen before in the past 3 years, portrayed by losing the D2 200 MAs.

It's my job to take this into account with a high degree of merit. If a “bear market” were ever going to happen, this is exactly how it would start.

So if I were to neglect this event, that means I'm a trader who navigates a multi-year bull run, just to inevitably give it all back when the environment shifts.

We acknowledged this weakness via loss of H12 200 MAs several weeks ago. That weakness compounded when we broke down below the 3-month range.

Although we are now testing a level of support at ~$92k, and could very well see a relief bounce, the bearish arguments are supported by both HTF trends.

Hope for another major rally starts with reclaiming the D2 200 MAs, and is vindicated fully when we reclaim the H12 200 MAs, along with deviating back inside the previous range.

Otherwise, the conservative principles from previous weeks apply.

Hit 'reply' to this email and let us know what you liked, disliked, or if you have any questions.

P.S. Magus, Doc and Charlie cook up more sauce like this daily in The Paragon.